Refinancing Parent Plus & Private Student Loans

Whether youve taken out a Parent PLUS Loan or a private student loan, one of the best ways to ensure financial success for both you and your student is to make a post-graduation financial plan.

After graduation, you may choose to consider student loan refinancing. This option could both lower your interest rate and enable you to transition responsibility for the loan to the student.

Explore the Parent PLUS Loan refinancing options available to you with ELFI.* With competitive interest rates and top-quality Personal Loan Advisors, refinancing may offer a faster route to financial freedom.

Can Parent Plus Loans Be Written Off On Your Taxes

As of September 2021, the federal government allows parent PLUS loan borrowers to deduct up to $2,500 of interest payments annually. Borrowers who paid more than $600 in interest payments receive Form 1098-E at the end of the tax year. This form reports interest payments. Borrowers input this information when filing their taxes.

This deduction applies to all qualified student loans. The IRS defines a qualified student loan as one in which the borrower made all mandatory payments in the prior tax year. Other requirements include not filing separate tax returns, if married. These borrowers must also not qualify as a dependent on someone else’s tax return.

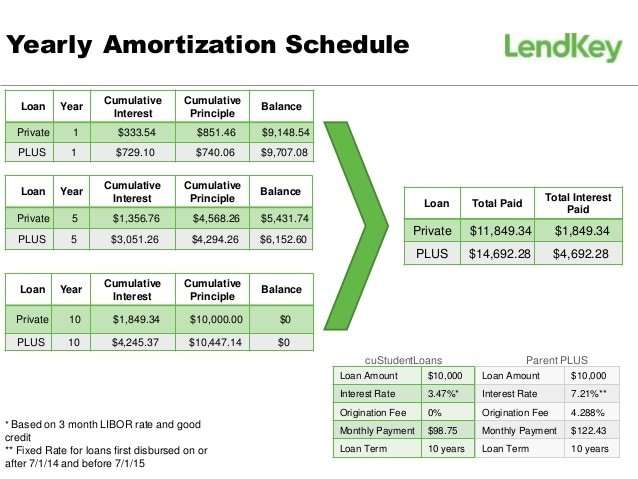

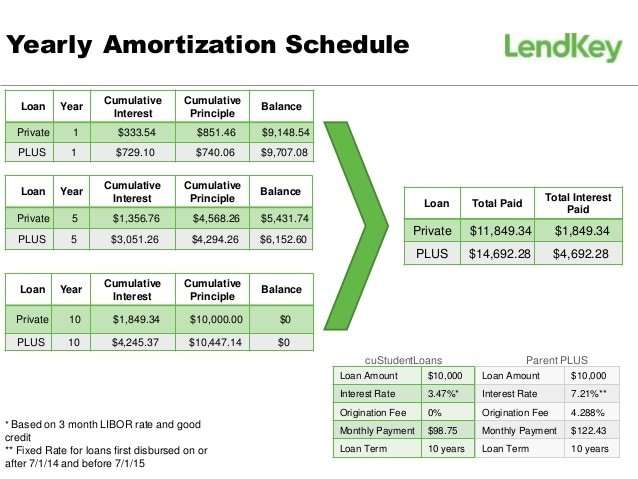

Private Student Loan Vs Parent Plus Loans: Interest Rates

Parents may opt for a private student loan because the interest rates could be much lower than what they would be on a Parent PLUS loan.

Congress sets Parent PLUS Loan rates. They have the highest interest rate of all federal student loans. The private student loan rate will depend upon credit score, income, and the lender chosen. If you have a good credit score and income, lenders get competitive. Borrowers can find low rates with minimal research.

Procedurally, the private loan is actually in your childs name, but it will appear on both credit reports because you will have to co-sign the loan. If you wanted to avoid the student loan appearing on your childs credit report, a Parent PLUS loan would accomplish this goal.

Ultimately, the decision comes down to limited federal perks vs. lower interest rates. If you are sure of your ability to pay off the loan in a short period, the private loan is probably the better option. If you are desperate to find the money to pay for your childs education and unsure of how you will repay the debt, the Parent PLUS loan might be a better option.

Both the government and private lenders are guilty if lending more money than borrowers can afford to repay. Borrow as little as possible and be sure to evaluate all other options before being forced with this choice.

Don’t Miss: Usaa Used Car Loan Interest Rates

Factors To Consider When Comparing Loans

As a parent, you can choose which type of loan to apply for. So, is it better to get a parent PLUS loan or a private loan? As with any financial product, youll need to shop around and compare the loans key features.

Here are some of the factors to consider as you compare federal PLUS loans and private loans:

Situation Two: If Your Monthly Budget Is Tight

Youll want to take into account more than the total cost of borrowing when youre evaluating student loans. The monthly payment makes a difference, too. Because of the different term lengths and interest rates, either a private loan or a federal parent PLUS loan may offer a lower monthly payment depending on your financial situation. Its worth running the numbers to see.

Read Also: Loan Originator License California

Comparing Parent Plus Loans And Private Student Loans

Despite college costs skyrocketing in recent years, borrowing limits on most federal loans like Direct Subsidized and Unsubsidized Loans havent increased in over a decade. As a result, more parents and graduate students are turning to PLUS loans because they can borrow up to the total cost of attendance, filling the gap left by the strict borrowing limits.

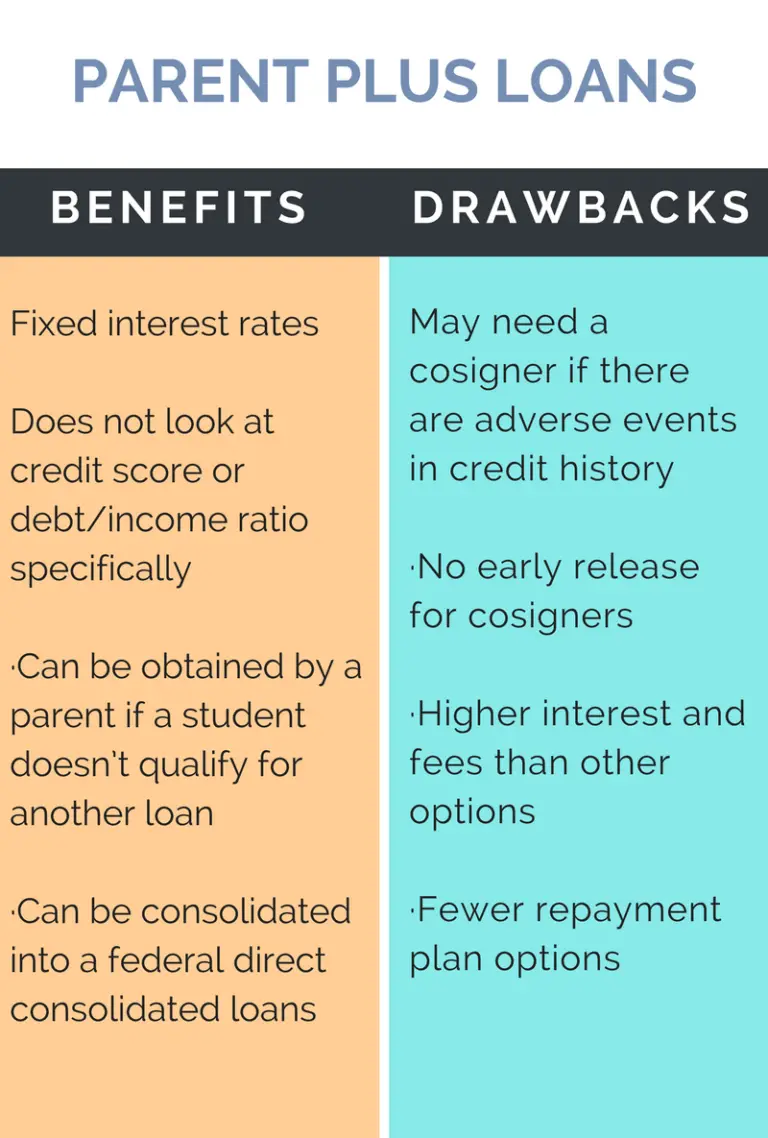

However, Parent PLUS Loans have significant downsides which can make private student loans a viable alternative:

Check Out:

Federal Vs Private Student Loans

There are two types of : federal student loans and private student loans. If youre trying to figure out how youre going to pay for school, youve likely thought about both. Federal and private student loans are not the same and its important to know the difference.

Federal student loans are made and funded directly by the federal government. To apply, you need to complete the Free Application for Federal Student Aid .

Sometimes referred to as non-federal or , private student loans are made and funded by private lenders, such as banks and online lenders.

But when it comes to paying for college no matter if youre an undergraduate student, a graduate student, or a parent theres more to know about federal vs. private student loans. Lets look at each one in more detail.

Don’t Miss: Usaa Car Loans Reviews

Types Of Federal Student Loans

- Direct Subsidized Loans are available to undergraduate students with financial need and recipients are not responsible for paying the interest charges on the loan while in school.

- Direct Unsubsidized Loans are available to undergraduate and graduate students who meet the eligibility requirements, but there is no requirement to demonstrate financial need.

- Perkins Loans are available to undergraduate and graduate students with exceptional financial need.

- Direct PLUS Loans are available to eligible graduate students and parents.

Direct Subsidized and Direct Unsubsidized Loans are the most common type of federal student loans for undergrad and graduate students. Direct PLUS Loans have higher interest rates and disbursement fees than Stafford Loans.

Choosing An Private Loan Lender

As with all borrowing, you must carefully consider the private loan terms before borrowing them.

Some of the questions you should ask include:

- How much may I borrow?

- What are the fees associated with the loan?

- What is the interest rate on the loan?

- How is the interest rate calculated?

- What are the terms of repayment?

- How much will my payments be if I borrow $x?

- Do I need a co-signer?

Many different lenders offer private student loans. To find lenders, check with your bank or lending institution, or search the Web for private student loans or alternative student loans.

Recommended Reading: What Is The Maximum Fha Loan Amount In Texas

Federal Student Loan Interest Rates

Federal student loan interest rates and fees are set at the start of each academic year and remain fixed for the life of the loan. Federal loans come with a standard repayment schedule and offer a wide range of repayment assistance options, including forgiveness for qualified borrowers, forbearance, deferments, and Income-Based Repayment or Pay As You Earn plans that tailor the monthly payments to your income level. For more details on eligibility criteria, repayment assistance, and current rates, visit the Federal Student Aid website.

To apply for federal student loans, you need to complete the .

Private Undergraduate Student Loans

Private student loans for undergraduate students function similarly to other types of private loans in that a credit and income review will be required to determine your ability to repay the loan. This review can also affect the interest rate on your loan. Since most undergraduate students have not yet established a credit history or have a steady income, it is often necessary to apply with a cosigner.

Learn more about .

Read Also: Apply For Avant Loan

Reasons To Avoid Parent Plus Loans

As of 2021, approximately 3.6 million people have outstanding Parent PLUS Loans, with an average balance of $28,778. With such a large balance, many parent borrowers will struggle to repay their loans because of the following issues:

With such significant drawbacks, its wise to consider other options besides Parent PLUS Loans to help your child with their college costs.

Private Student Loans Vs Federal Student Loans: What’s The Difference

When talking to families, especially around this time of year, I typically get a lot of questions about student loans. There are questions about interest rates, about how to apply, about where to apply, and even if loans are necessary in the first place. One of the most popular questions is what is the difference between a private student loan and a federal student loan?

In many cases, families take out both types of loans. That being said, we always recommend that a student borrow a federal student loan, officially called a Federal Direct Student Loan, first, and then potentially cover the remaining cost gap with a private loan. Below, I have laid out the key differences between the two.

Read Also: How Do I Refinance My Car With Bad Credit

Which Type Of Student Loan Is Best For My Family

Parents and students should sit down together and discuss how they plan to finance the childs higher education. Figure out how much you need to borrow and decide who is going to foot the bill. In most cases, its best for the child to take out the loan in his or her own name, both because loan terms for students are usually more flexible and because if the parent cannot keep up with the loan payments, it could make it difficult or impossible for them to save for their other financial goals.

Parents of college-age children usually have their eyes on retirement and its important that they prioritize saving for this first because if they run out of money in their old age, their child will have to support them, and this may cost the child more than a student loan would. So if the parent is behind on retirement savings or is unsure of his or her ability to pay back the loan on time, its better to let the student take responsibility for the debt.

If the parent isnt comfortable placing such a heavy burden on the child, the two may decide to split the loans. The child may take out what he or she can in federal student loans and then if thats not enough, the parent may make up the rest with a Direct PLUS loan.

You May Like: Does Va Loan Work For Manufactured Homes

Parent Plus Sofi Applications Each Have Pros And Cons

When comparing SoFi versus parent PLUS loans, you might also consider the qualification process. As a private lender, SoFis eligibility criteria is more stringent than the education departments.

When you apply for SoFi parent loans, SoFi reviews your credit history, income and other debts. Although it doesnt advertise a strict minimum, youll likely need a decent credit score and steady income to qualify for your best rates.

Parent PLUS loans, on the other hand, only state that you cant have an adverse credit history. In other words, you cant have derogatory marks on your credit report, such as unpaid debts or loan defaults. If you do, you could still qualify by applying with a creditworthy endorser.

Although it might be harder to qualify for a SoFi parent loan, the application process itself is easy. As an innovator in the online lending space, SoFi lives up to its reputation with a user-friendly website.

Its easy to get a rate quote, and filling out a full application is painless as well. Thats not to say applying for a parent PLUS loan is difficult, but the process can vary depending on where your child goes to college.

Read Also: Can I Refinance My Car Loan With The Same Lender

Parent Plus Vs Private Student Loans: 4 Factors To Help You Choose

Image Courtesy of Student Loan Hero

Student Loan Hero

Financial aid goes a long way toward helping you pay for college until it runs out.

If your childs financial aid package falls short, you might need other sources of funding. Many families take out Parent PLUS Loans from the federal government to fill the gap. In fact, over 3.4 million people have a total of $81.5 billion in Parent PLUS Loans.

That amount far exceeds the $7.8 billion that students took out in private student loans between 2014 and 2015, reported NPR. But just because Parent PLUS Loans seem to be more popular than private student loans doesnt necessarily mean theyre the better fit for your family.

Before choosing which loan to take out for school a Parent PLUS Loan under the parents name or a private student loan made out to the student consider these four factors.

1. Who Will Be Responsible for the Debt?

One major difference between Parent PLUS Loans and private student loans is whose name goes on the debt. While Parent PLUS Loans go to parents, private student loans go to students.

However, many students dont have the credit score or income to qualify for a student loan on their own. A private lender might require students to add a co-signer to the loan and a co-signer is just as responsible for paying back the debt as the primary borrower.

In effect, parents might be on the hook for either loan type. But its up to your family to decide who will eventually be paying the bills.

Are You Ready To Find Your Fit

Parents can pay for their child’s college education in many ways, including loans. The federal government offers parents unsubsidized and subsidized parent PLUS loans. These loans apply only to undergraduate education. They cover education-related expenses, such as tuition, fees, and housing. Like other federal financial aid programs, parent PLUS student loans require the FAFSA results.

Banks and other private lenders also offer parent loans for college. These institutions may offer better interest rates than federal loans. These rates depend on borrowers’ financial histories. However, private loans’ variable interest rates may rise unexpectedly. This can increase out-of-pocket expenses. Most private lenders do not offer unsubsidized loans.

This page explains the differences between private and parent PLUS loans. Read on to learn how to apply for both. You can also review answers to typical questions. Click on the links in the final section for information from outside resources.

Also Check: Drb Student Loan Refi

Parent Plus Loans Vs Private Loans

Prospective borrowers should compare parent PLUS loans and private parent loans for college. Both loan types award only the funds learners need to cover attendance costs.

Parent PLUS loans and private loans have differences that may affect repayment. Private loans may offer a low introductory variable interest rate that rises over time. Federal loans require the FAFSA results annually. Fees and repayment options also vary. See the chart below for details. You can also visit the Federal Student Aid website to learn more.

Am I Eligible For Pslf

If you work for a nonprofit organization or government agency, take out Parent PLUS Loans.

- Parent PLUS Loans: If you have federal student loans and work for a nonprofit organization or government agency for 10 years and make 120 qualifying payments and payments made under an ICR plan count you can qualify for loan forgiveness under PSLF. Parent PLUS Loans can qualify for PSLF, but you do have to consolidate them with a Direct Consolidation Loan first and sign up for an ICR plan first. Once you do that, your monthly payments will count towards PSLF, helping you pursue loan forgiveness, which can be a substantial relief.

- Private student loans: Only federal loans are eligible for PSLF private student loans dont qualify.

Learn More: Public Service Loan Forgiveness

Also Check: Does Va Loan Work For Manufactured Homes

Sofi Parent Loans Could Have Lower Interest Rates

There are lots of factors that go into choosing a loan, including eligibility criteria and repayment options. But if your priority is saving money, take a close look at interest rates.

All parent PLUS loans come with a fixed rate of 5.3% in the 2020-21 year. This rate is significantly lower than past years rates, which were set around 7%. But it might still be higher than what youd get on a SoFi parent loan, which has fixed APRs starting from 2.74% and variable APRs starting at 2.25%.

Depending on your credit, income and other factors, you could snag a rate on a SoFi parent loan thats lower than what youd get with a parent PLUS loan. Reducing your interest could save you a good deal of money over the long run. That said, a variable rate, unlike a fixed rate, could potentially rise over time.

Since SoFi offers an easy pre-application online, its worth it to check your rates. This preliminary rate quote wont affect your credit score, and youll see what rate you could be eligible for.

If its lower than the one youd have on a parent PLUS loan, it could be worth going with SoFi.

Recommended Reading: Is Bayview Loan Servicing Legitimate

Alternatives To Parent Plus Loans

Since private loans are contingent on a strong credit history, your student will likely need a cosignerthats you!to take one out. Private student loans can have a fixed or variable interest rate, but the specific rate will always depend on the applicant and cosigners credit history. This means that parents with a strong financial profile may be able to qualify for an interest rate thats lower than a federal Parent PLUS loan by cosigning a private loan. Being a cosigner also means that you and your student are both responsible for repayment.

Loan fees vary by lender, but Earnests cosigned private loans, for example, do not come with a disbursement or origination fee. The total amount youre able to borrow will also depend on the lender and the student and cosigners credit profiles.

Private loans dont come with federal loan forgiveness and repayment options. Some private lenders will let you defer payments until after graduation others may require you to start making payments while your child is still in school, which can save you money in the long run.

Private loans can be consolidated or refinanced down the road, potentially lowering your interest rate and/or reducing your monthly payment depending on your financial situation at the time you refinance.

Don’t Miss: How To Refinance An Avant Loan