Pay Private Student Loans First

Private student loans come from commercial lenders, not the federal government. These loans generally have fewer repayment options or opportunities for forgiveness than federal loans and higher interest rates.

You’ll likely want to get any private loans off your plate first. Consider doing the following to help with this:

-

Refinance at a lower interest rate. There’s little downside to refinancing private student loans if you can qualify for a better interest rate. Refinancing can reduce your monthly payments, saving you money and helping you pay off private loans faster.

-

Pay the minimum on federal loans. If you’re going to make extra student loan payments, put them toward your private loans. To increase the amount you can overpay, consider enrolling in an income-driven repayment plan to decrease your federal loan bills. More interest will accrue on those loans if you do that, so calculate your total costs.

Always pay at least the minimum on all your student loans.

» MORE:3 ways to lower your student loan interest rate

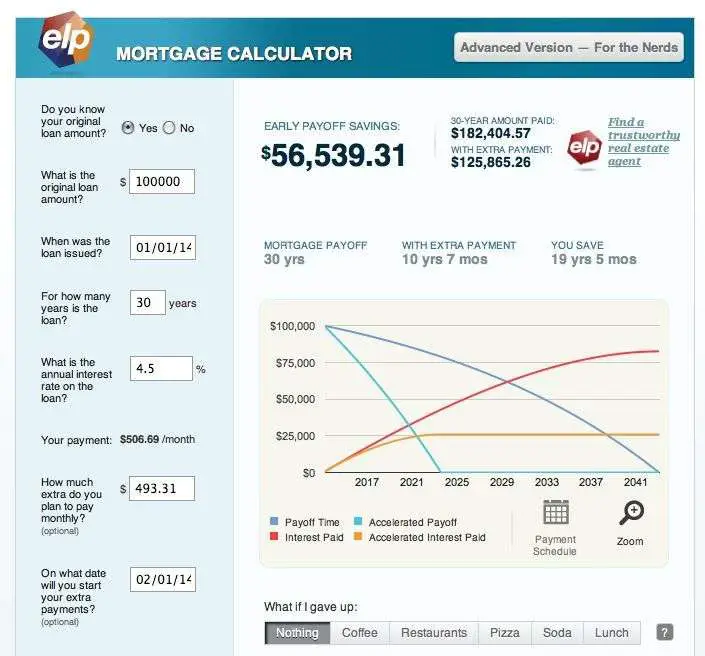

Using The Auto Loan Calculator

- This calculator uses your original loan amount, length of the loan and interest rate to calculate your current monthly payments. From there, enter the number of months left on the loan, then enter how much extra you’d like to pay each month to see how much sooner you’d pay it off.

You can adjust that figure using the slide bar to experiment with how varying the additional payment would affect how early you can pay off the loan and how much interest you’d save. Your results appear instantly at in the blue field at the top of the calculator and just below it at right as you adjust the extra payment figure.

- FAQ: Arm yourself with various scenarios that fit your budget goals

Start by entering the number of months remaining on your car loan, than enter the full length of the loan, in months. If you want to see the effect of making extra payments over the entire length of the loan, just enter the full length of the loan in both places. Next, enter the amount of the loan and the interest rate. The calculator will immediately display your regular monthly payment for the loan in the place indicated. Next, enter any additional amount you’d like to pay each month. The number of months you’ll shorten your loan by and your interest savings will appear at the top of the page.

Loan Early Repayment Analysis

Based on the figures entered into the Loan early Repayment Calculator:

- If you continue to make monthly payment of you will repay your loan months quicker than if you just paid the standard monthly installment of

- You will reduce the total amount of interest paid on the loan, reducing from to which is a saving of in interest payments

Recommended Reading: Does Va Loan Work For Manufactured Homes

Early Auto Loan Payoff Calculator

Have an auto loan that you want to pay off sooner? Wondering how much faster you could pay it off by paying a bit more each month? And how much interest you could save in the process?

This Early Auto Loan Payoff Calculator has the answers.

Enter how much extra you want to pay each month, and the calculator will immediately tell you how many months you’ll shave off your loan and your total savings in interest. It can also show how quickly you’re paying down the loan, with the balance remaining for each month until the vehicle is paid off.

This is good information to have if you’re thinking of trading in the vehicle before it’s paid off and wondering how much to knock off the anticipated trade-in value.

Why You Should Pay More Than The Minimum On A Credit Card

You’ll Pay Less in Interest. Unless you’re carrying a balance on a credit card with an introductory 0% APR, most of your minimum payment goes toward interest charges, while reducing your balance only by a fraction. You’ll owe less interest in the long run by paying more than the minimum payment, and you’ll avoid interest charges altogether if you pay the balance in full by the due date every month.

Your Credit Will Improve. Paying more than the minimum amount due will reduce your , which is good for your credit score and will make it easier to get credit in the future. Plus, a low credit utilization ratio frees up more of your available credit for emergency use. It’s best to maintain a utilization ratio below 30% for these reasons.

You’ll Pay off Your Balance in Less Time. When you only make the minimum payment, it can take a long time to pay off your balance in full. New interest charges accumulate daily, and minimum payments only cover a very small percentage of the principal balance.

You can use WalletHub’s minimum payment calculator to see how long it will take you to pay off your debt solely with minimum monthly payments. You’ll also see how expensive that would be.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Amortization Table And Interest

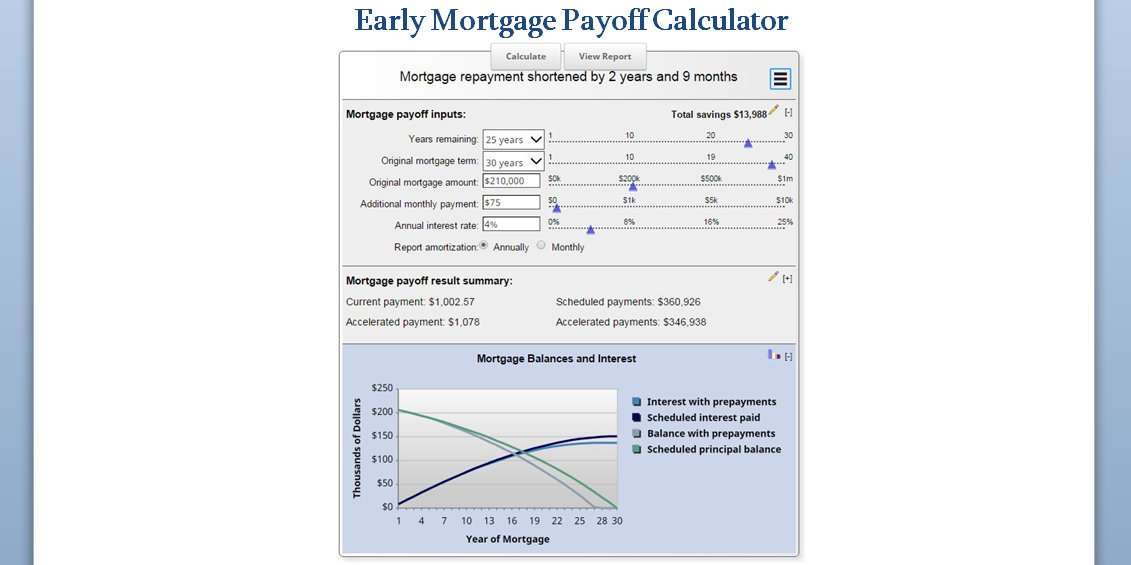

- Expanding the “Auto Loan Balances and Interest” section below the Auto Loan Payoff Calculator will display a graph illustrating the rate you will pay down your loan with and without any additional payments, plus your accumulated interest charges over time.

For the full amortization schedule, choose whether you want to see monthly or annual amortization then click “View Report” at the top of the page. You’ll then see a page showing how much you’ll shorten your loan by, the graph illustrating your amortization, a summary of the loan and a line-by-line table showing the amortization of the loan over time and comparing regular vs. accelerated payments.

- FAQ: Great tool to make positive decisions on budget planning and goals

If you’re looking to trade in your car at some point in the future, the amortization schedule is useful in that it lets you know exactly how much you’ll still owe on the loan at any point in time. You can then use this information, combined with the vehicle’s depreciation, to estimate what your trade-in value would be.

Pros And Cons Of The Debt Snowball Method

It’s not easy to get excited about paying off what you owe, and it’s even harder if you dont seem to be making a dent in your debt without a sense of progress, you can become prone to throw in the towel early on.

It’s our hunger for instant gratification that makes the snowball method so effective, says personal finance author and talk-show host Dave Ramsey, an advocate of the technique. The math seems to lean more toward paying the highest-interest debts first,” he allows. “But what I have learned is that personal finance is 20% head knowledge and 80% behavior. You need some quick wins in order to stay pumped enough to get out of debt completely.

The debt snowball method’s big advantage is that it helps build motivation. Because you see fast resultseliminating some outstanding balances completely in only a few monthsit encourages you to stick with the plan. That mountain of debt doesn’t seem so unscalable after all. Plus, it’s easy to implementno need to compare interest rates or APRs just look at each sum you owe.

The big drawback of the debt snowball is that it can be more expensive overall. Because you’re prioritizing balances over APRs, you could end up paying more money in interest. Getting completely free and clear could take more time, too, depending on the nature of the debts, and how frequently the interest on them compounds.

-

Incurs more interestmore expensive overall

-

Can take longer to become completely debt-free

Don’t Miss: Does Va Finance Manufactured Homes

Why Cash Flow Is Top Priority

Many people think that the best way to pay off loans is to start with the high-interest loans first because their goal is to pay the least interest. While ideally, you want to have low-interest loans, this strategy can have you chasing your tail if the high-interest loans are the largest loans, because it will take forever to reach that first milestone.

Another common strategy people use is to get a quick win by paying off the smallest loan first. In this way, they hope to build up traction to pay off the next loan.

But, when it comes down to a nuts and bolts strategy for paying off debt, the most important thing to remember is that cash flow is your top priority. You want to ask yourself this question before any financial decision: how does this increase my cash flow?

You can think of paying off debt the same way that you think about investing. What is the rate of return on making this financial move? For the dollars I commit, how does it improve my cash flow?

Some Other Important Things To Know

- This credit card payoff calculator is intended solely for general informational and educational purposes.

- The accuracy of this debt payoff calculator and its applicability to your personal financial circumstances is not guaranteed or warranted.

- To learn more on paying off your balance, read about our favorite balance transfer credit cards from our partners.

See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. However, all credit card information is presented without warranty. When you click on the “Apply Now” button, you can review the credit card terms and conditions on the issuer’s web site.

As seen on:

Read Also: Usaa Auto Loans Rates

Refinancing And Loan Consolidation

Sometimes it makes sense to refinance loans to lower payments and increase cash flow. One strategy could be to refinance a mortgage, roll in the lowest Cash Flow Index non-deductible debt to reduce your total interest and payments. More of your interest will become tax deductible, additionally increasing your cash flow.

Pay Off Your Mortgage Or Grow Your Wealth: Which Is Best

The choice often comes down to whether you have retirement savings or not. The younger you are, the more you should focus on retirement savings.

Later, when compound interest has grown your wealth, you could make extra payments toward your home loan principal to build equity quickly.

If your retirement portfolio is in good shape, try to make extra mortgage payments early to reduce the principal youre paying interest on.

You May Like: Ussa Car Loans

How Each Debt Repayment Strategy Works

To help you understand these four different options, here is an example of what your debts could look like.

| Debt |

|---|

How snowball debt repayment works

Need some help with the math? Tiller offers an automated debt snowball spreadsheet that can help you.

How avalanche debt repayment works

Using Our Calculator To Start Your Plan

To see how much interest you are wasting on loans and credit cards use the calculator above. Simply enter your loan amount and interest rate and choose the date you would like to see the debt eliminated. Then click the compute button. The calculator will populate the three lower spaces to show your monthly payment, number of months needed to pay off the debt, and the interest you are spending to have this debt. No need to enter dollar signs, commas or percent symbols. It’s a smart calculator.

After you decide on your debt payment plan, remember to reward yourself a little with each credit card or loan you eliminate. Dinner at a restaurant will taste so much better knowing you are well on your way to being debt free.

You May Like: Classic Car Loans Usaa

Smart Debt Repayment Strategies

Now that you have all of your loan information together, the next step is to decide what to pay off first.

If you only make the minimum payments on each loan or card every month, this would be your debt payoff schedule:

- Auto loan: Paid in five years with $4,332 in interest.

- Paid in 6.4 years with $1,737 in interest.

- Student loan: Paid in 10 years with $4,092 in interest.

- Mortgage: Paid in 30 years with $164,813 in interest.

Overall, itd take you 30 years to become entirely debt-free, and youd pay $174,974 in interest. But if you want to pay it all off sooner and with less interest, there are a few approaches you can take.

Common strategies include focusing first on the highest interest rate, the lowest balance, or the somewhere in between.

Does It Matter Which Loans I Pay Off First

The debt payoff process can be tricky. If you still cant decide which loan to pay off first, any plan is better than no plan. At the very least, you should categorize your debt according to the characteristics mentioned above.

If you have a mix of good and bad debt, consider targeting bad debt first. This means high interest debt with loose repayment structures or unfavorable terms. That way, you can maximize interest savings and can continue receiving the ancillary benefits of good debt.

Ready to refinance your car loan?

Also Check: Can You Refinance An Fha Loan

How Does Credit Card Debt Consolidation Work

If your credit score is in good shape, debt consolidation may be an excellent way to pay off your debt faster and save money along the way.

Consolidating credit card debt involves paying off your existing debt with a new credit card or personal loan, preferably with better terms. Heres a breakdown of how each debt consolidation option works:

- Balance transfer credit cards: With a balance transfer credit card, you can transfer debt from one or more existing cards to a new one. Many balance transfer cards offer an introductory 0% APR promotion, which means you can pay off your debt interest-free during the promotional period. Some of these cards charge an upfront fee of up to 5% of the transfer amount, but that may be worth it for the interest savings.

- Personal loans: You can use personal loans for just about anything, including debt consolidation. On average, personal loans charge lower interest rates than credit cards, and you may be able to get a rate in the single digits if your credit is excellent. Personal loans also offer the benefit of set repayment terms instead of just giving you a minimum payment.

Regardless of which option you choose, its important to avoid racking up balances on your paid-off credit cardsotherwise, you could end up in an even more difficult financial situation.

Debt By Balances And Terms

While the debt avalanche method might save you more money, you may be better off using the “debt snowball” method. Rather than focusing on interest rates, you pay off your smallest debt first while making minimum payments on your other debt. Once you pay off the smallest debt, use that cash to make larger payments on the next smallest debt. Continue until all your debt is paid off.

The debt snowball method is a good strategy if you respond well to little victories and dont have the patience to tackle big balances first.

If you have a small debt, like a few hundred dollars, you might be able to pay this off in a few weeks or a couple of months. This first win may be the motivation you need to stay the course and pay off your remaining debt.

Don’t Miss: Usaa Auto Loan Interest Rates

How Long Will It Take To Pay Off My Loan

When you repay a loan, you pay back the principal or capital as well as interest . Interest growing over time is the really important part: the faster you pay back the principal, the lower the interest amount will be.

E.g. You borrow $40,000 with an interest rate of 4%. The loan is for 15 years. Your monthly payment would be $295.88, meaning that your total interest comes to $13,258.40. But paying an extra $100 a month could mean you repay your loan a whole five years earlier, and only pay $8,855.67 interest. Thats a saving of $4,402!

Play around with our Loan Payoff Calculator, above, to see how overpayments can shorten the length of your loan.

The following guide focuses particularly on student loans, but the tips and advice can apply to all types of loans. So read on to learn how to shorten and shrink your loan.

How Can You Pay Off Student Loans Faster

Here are a few ways that might help you pay off your loans faster:

- Pay extra on your loans. If you can afford it, make extra payments toward your loans. This could save you money on interest and cut down your repayment time.

- Refinance your loans. This could get you a lower interest rate. If you also choose to shorten your loan term, you could pay off your loans more quickly with fewer interest charges.

Read Also: What Credit Score Is Needed For Usaa Auto Loan