Sls Llc Mortgage Foreclosure

f you have received a foreclosure notice or phone calls from Specialized Loan Servicing threatening foreclosure of your 1st or 2nd mortgage, then it is possible that SLS LLC purchased your loan and has legal right to your property.

However it is important to remember that SLS LLC must provide proof of ownership regarding your 1st or 2nd mortgage or assignment of the servicing rights to service your 1st or 2nd mortgage. It is not uncommon for a bank failure to provide such documentation.

Specialized Loan Servicing Q& a

Information on this page is provided ‘as is’ and solely for informational purposes, not for any other purpose or advice. In addition, this information does not originate from us and thus, we do not guarantee its accuracy.

You can check the profile page of each professional or company to determine whether they are a paying advertiser . Regardless of advertiser status, none of the listings, reviews, or other information on Wallet Hub constitutes, in any way, a referral or endorsement by us of the respective financial company or professional, or vice versa. Furthermore, it is important to note that the inclusion of a financial company or professional on Wallet Hub does not necessarily indicate their involvement with the site or control over the information that we display. Information is displayed first and foremost for the benefit of consumers.

Editorial and user-generated content on this page is not reviewed or otherwise endorsed by any financial institution. In addition, it is not the financial institutionâs responsibility to ensure all posts and questions are answered.

What Should I Watch Out For

There are a host of things to watch out for but it is important to review your monthly mortgage statements We have noticed that at times they fail to send required monthly mortgage statements and suddenly show up at the time of a refinance or sale of the property to claim the full amount owed with additional late fees, interest, and penalties.

Watch Out For Initial Correspondence

Keep an eye out for any initial correspondence when Specialized Loan Servicing either takes over or is assigned the servicing rights on your existing second mortgage. They are required to notify you in writing and a lot of times they do not so within the required time periods and we always ask for this information when we are retained to take action against them.

Sudden Increases In The Total 2nd Loan Amount

Also keep an eye out for sudden increases in the total amount of the mortgage loan on any given mortgage statement, especially on a payoff demand submitted by SLS LLC at the time of a refinance or sale of your property.

Watch Out For Notice Of Intent To Accelerate Debt and Foreclosure

Also Check: What Is A Student Loan Account Number

Be Proactive With 2nd Lien Holders

This is one of the main reasons why it is important to be proactive in how you approach these second lien mortgages and evaluate and identify servicing errors and other issues early enough to put you in a position to negotiate down or address your second lien rather than being surprised at an unexpected time.

We have seen clients who have not heard from their second lien holder for 10 years and when they start the process to sell or refinance their property they are surprised by Specialized Loan Servicing suddenly showing up and submitting a payoff request with an inflated mortgage balance with unaccounted late fees, charges, interest and penalties. This can ruin any refinance attempt or makes the sale of the property not feasible.

F Appellant’s Motion For Reconsideration

In December 2018, after learning that the Legislature had reenacted section 2923.55 and 2923.6 in September and that they were set to take effect on January 1, 2019, appellant moved for reconsideration. He argued this legislation constituted new law that required the trial court to reevaluate its ruling.

The trial court denied appellant’s motion for reconsideration, concluding, inter alia, that the new legislation would not have affected its ruling. The court entered judgment for respondent, and appellant timely appealed.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

What Our Clients Are Saying

I was almost going nuts receiving calls every afternoon from a person using profane language to push me to pay debts I dont owe. Someone I trust referred me to Lemberg Law, and I dont regret having contacted them. The attorneys were very kind and always available when I needed them.

Thank you for standing with me Lemberg Law. I was so afraid I could lose my job because of a caller who called my job number 4 hours straight back to back. He not only harassed and threatened me but also abused workmates who received the call when I wasnt around. Since I solicited for your services, Ive had a peace of mind, and Im happy because of the few dollars I got as a settlement.

I just called in to thank you for the incredible help you offered to my sickly father who was bothered with frequent calls from scammers. At a point, he just wanted to pay them to get rid of all the annoyance, but because of Lemberg Laws assistance, he got free help, and the bothering calls ended immediately.

Specialized Loan Servicing Llc

On May 11 2020, the Consumer Financial Protection Bureau issued a consent order against Specialized Loan Servicing, LLC , a mortgage-loan servicer in Colorado. As of February 29, 2020, SLS serviced a portfolio of mortgage loans worth about $112.69 billion. The Bureaus investigation found that since January 2014, SLS violated the Real Estate Settlement Procedures Act , its implementing regulation, Regulation X, and the Consumer Financial Protection Act of 2010 by taking prohibited foreclosure actions against mortgage borrowers who were entitled to protection from foreclosure, and by failing to send or to timely send evaluation notices to mortgage borrowers who were entitled to them. In some cases, SLS obtained foreclosure judgments and conducted foreclosure sales on borrowers homes when Regulation X would have entitled the borrowers to protection from foreclosure had SLS complied with that rule. The consent order requires SLS to pay $775,000 in monetary relief to consumers, waive $500,000 in borrower deficiencies, pay a $250,000 civil money penalty, and implement procedures to ensure compliance with RESPA and Regulation X.

Related documents

Recommended Reading: Autosmart Becu

Who Owns Sls Mortgage

Who owns SLS mortgage?

Is SLS net legit? Is Specialized Loan Servicing Legit

Who is the CEO of Specialized Loan Servicing? Tom Millon is CEO of Computershare Loan Services US, including Specialized Loan Servicing, Capital Markets Cooperative, and CMC Funding. Tom founded Capital Markets Cooperative in 2003.

Where is SLS mortgage located? Specialized Loan Servicing LLC. P.

B Appellant’s Lawsuit And Subsequent Application For A Loan Modification

In August 2016, days before the scheduled foreclosure sale, appellant filed a complaint against respondent, asserting violations of the HBOR and seeking injunctive relief. On appellant’s application, the trial court issued a temporary restraining order to enjoin the foreclosure sale and ordered respondent to show cause why it should not issue a preliminary injunction.

Around the same time, appellant’s counsel sent respondent a written request to review appellant for a loan modification. In response, respondent assigned a service representative to serve as appellant’s “single point of contact,” and advised the court that it was willing to review appellant for a loan modification. In September 2016, appellant submitted a loan-modification application to respondent, and over the next month, provided additional documents at respondent’s request, until his application was complete. Because his application was under review, appellant took the scheduled hearing on his request for a preliminary injunction off calendar. In November 2016, respondent denied appellant’s application for a loan modification, but informed him he could apply for a second, independent review to determine his eligibility. Appellant took advantage of this option and appealed respondent’s initial denial of his application.

Read Also: What Is The Commitment Fee On Mortgage Loan

What Do Mortgage Servicers Do

Mortgage servicers collect homeowners mortgage payments and pass on those payments to investors, tax authorities, and insurers, often through escrow accounts. Servicers also work to protect investors interests in mortgaged properties, for example, by ensuring homeowners maintain proper insurance coverage.

Better Business Bureau Complaints

At the time of this writing, the Better Business Bureau reports that SLS LLC has a total of 737 complaints closed in the last 3 years, with 419 complaints closed in the last 12 months. BBB evaluates Specialized Loan Servicing at a 1 star out of 5 with 195 customer reviews.

One such review is as follows

SLS LLC Payoff Requests May Be More Than What You Owe

They are charging more then what I owe. They are using an old tax from 2018 to make it look like I owe more. When I call they keep hanging up on me and they never even tried to call back. Im a single mom and Ive had to work hard for everything that I own. I dont trust specialized loan servicing. I NEED HELP…………PLEASE CAN SOMEONE HELP ME!

Ketty J

Don’t Miss: Usaa Classic Car Loan

Company Profile: Specialized Loan Servicing

If you are being called by Specialized Loan Servicing, here is a broader overview of the agency and its background.

Specialized Loan Servicing, which also does business as the Terwin Group, is a debt collection agency in Highlands Ranch, Colorado. It was founded in 2003, has 375 employees, and is managed by Dolores Gilden. The company has a C rating with the Better Business Bureau.

Archived records at the PACER website indicate that consumers who believed that they were being harassed by Specialized Loan Servicing chose to fight back.

Is Sls Llc A Debt Collector

In May 11, 2020 the Consumer Financial Protection Bureau settled with Specialized Loan Servicing LLC and ordered SLS to pay millions in monetary relief to consumers. However, SLS LLC is not a collection agency. SLS claims to be an asset management company and has purchased many of the loans it now owns from Bank of America. They process delinquent debt, try to collect on this debt , and if they are unsuccessful with their efforts, will initiate a foreclosure against the homeowner.

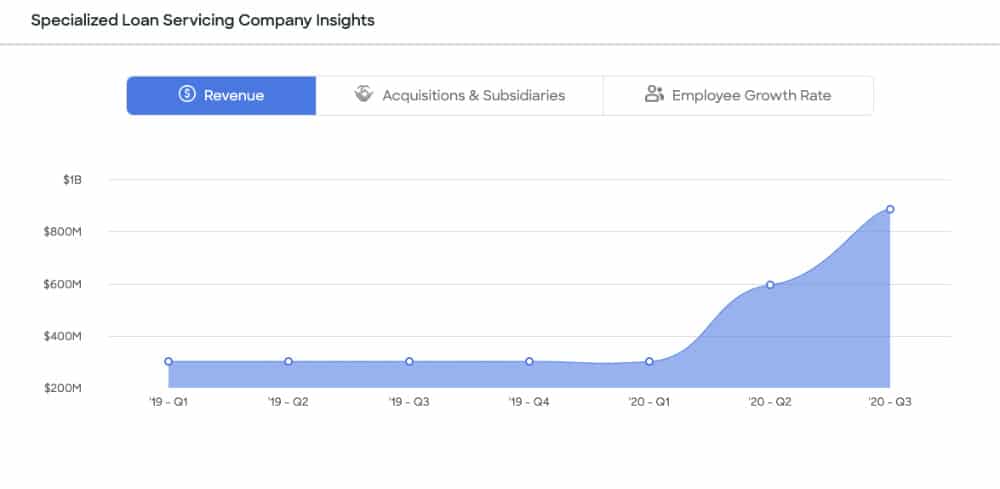

Currently, Zoom Info estimates their revenue to be > than $800,000,000 dollars per year relating to their business activities.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Frequently Asked Questions Regarding Specialized Loan Servicing

Where are Specialized Loan Servicings headquarters?

Specialized Loan Servicings headquarters are in 6200 S Quebec St, Greenwood Village, Colorado, 80111, United States

What is Specialized Loan Servicings phone number?

Specialized Loan Servicings phone number is 241-7200

What is Specialized Loan Servicings official website?

Specialized Loan Servicings official website is www.sls.net

What is Specialized Loan Servicings Revenue?

Specialized Loan Servicings revenue is $887 Million

What is Specialized Loan Servicings SIC code?

Specialized Loan Servicings SIC: 60,609

What is Specialized Loan Servicings NAICS code?

Specialized Loan Servicings NAICS: 52231,523130

How many employees are working in Specialized Loan Servicing?

Specialized Loan Servicing has 4,000 employees

What is Specialized Loan Servicings industry?

Specialized Loan Servicing is in the industry of: Banking, Brokerage, Finance

Who are Specialized Loan Servicings main competitors?

What companies has Specialized Loan Servicing acquired?

Specialized Loan Servicing has acquired the companies: Servizio Titoli SpA, Equatex, Altavera Mortgage Services, Verbatim

What is Specialized Loan Servicing’s tech stack?

The technologies that are used by Specialized Loan Servicing are: Google Analytics, Google Dynamic Remarketing, Sentry, Citrix ADC

Who is Specialized Loan Servicing’s CFO?

Specialized Loan Servicing’s CFO is Sue Schneider

Is Sls A Debt Collector

4.9/5debt collectordebtDebt Collection

Herein, who owns SLS mortgage?

SLS bought our Mortgage from Wells Fargo, we had been with Wells for 17 years!

Likewise, what is SLS company? Specialized Loan Servicing is an independent, third-party mortgage servicer with a proven record of delivering superior portfolio performance across a wide range of residential mortgage products.

Besides, is SLS a mortgage company?

Specialized Loan Servicing, LLC or SLS is a residential mortgage servicing corporation based in Colorado which receives a lot of consumer complaints to our law firm for debt harassment.

What is an SLS loan?

Prior to 1994, borrowers could also receive loans under the Supplemental Loans for Students program. The borrower is responsible for paying interest on the loan during the grace period and periods of deferment, but the interest may be capitalized by the lender.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Can Sls Llc The 2nd Lien Holder Foreclose On My Property

A second mortgage lien holder has the right to foreclose on your property even if the 1st mortgage holder is current on their payments. However, the 2nd lien holder must receive approval from the 1st lien holder to approve the foreclosure proceedings.

If a 2nd lien holder is unable to receive approval for their foreclosure request in court, they still have the right to recover losses. This is known as a deficiency judgement.

D Subsequent Communications Between The Parties And The Foreclosure Sale

On January 9, 2017, appellant’s counsel contacted appellant’s assigned single point of contact, sought information about the loan balance, expressed that the amount of the offered trial-period payments was too high, and advocated for a lower payment amount. Counsel did not seek an extension of the deadline for acceptance of respondent’s offer. The representative informed counsel that a loan modification was a means to bring a loan out of default and did not guarantee a lower payment. She then told counsel she needed to look into the matter in order to provide additional information. After counsel did not hear back from the representative, counsel attempted to contact both respondent and its attorney in the litigation below, Tanya McCullah, without success. By the end of January 25, 2017, appellant had not made the initial payment under the offered trial-period modification plan. Thus, by its terms, respondent’s offer was rescinded.

Respondent’s representative initially told appellant’s counsel she would have to speak with respondent’s attorney because appellant’s case was in litigation. However, after appellant’s counsel informed the representative that the attorney had directed her to contact respondent directly, the representative agreed to speak with her.

Also Check: What Is The Maximum Fha Loan Amount In Texas

Consumer Financial Protection Bureau Settles With Specialized Loan Servicing Llc

WASHINGTON, D.C. Today the Consumer Financial Protection Bureau settled with Specialized Loan Servicing, LLC , a mortgage-loan servicer in Colorado. As of February 29, 2020, SLS serviced a portfolio of mortgage loans worth about $112.69 billion. The consent order requires SLS to pay $1.275 million in monetary relief to consumers in the form of redress and waiver of borrower deficiencies, pay a $250,000 civil money penalty, which will be paid to the Bureau and deposited into the Bureaus Civil Penalty Fund, and implement procedures to ensure compliance with the Real Estate Settlement Procedures Act and its implementing regulation, Regulation X.

The Bureaus investigation found that since January 2014, SLS violated RESPA and Regulation X by taking prohibited foreclosure actions against mortgage borrowers who were entitled to protection from foreclosure, and by failing to send or to timely send evaluation notices to mortgage borrowers who were entitled to them. These violations also constitute violations of the Consumer Financial Protection Act of 2010. In some cases, SLSs violations of Regulation X short-circuited the protections against foreclosure for consumers whose homes were ultimately foreclosed upon.

A copy of the consent order filed with the Bureau is available at:

Specialized Loan Servicing Lawsuit How A Law Firm Can Help Protect You

A Law Firm that is familiar with second lien mortgages can really help you navigate and take action against SLS LLC for its common legal violations.

Unfortunately, we have seen issues with Specialized Loan Servicing not being responsive or taking requests from borrowers seriously until they retain legal counsel, and once you have an experienced law firm on your side you can take a proactive approach in first investigating how they came to acquire the servicing or ownership rights on your mortgage loan, whether they did so in compliance with applicable federal and state requirements, and if not, take the necessary action to assert the pressure needed to get them to respond.

Sometimes a Law Firm can successfully bring such issues to their attention and then utilize that to obtain a settlement of the second lien mortgage. In other instances, a Law Firm can properly set things up for a lawsuit against SLS LLC in situations where they fail to properly account for the total amount of the mortgage or blow off a Qualified Written Request.

The right Law Firm will know from evaluating the your specific circumstances and the underlying documents as to whether a lawsuit or a pre-lawsuit demand and negotiation is the best and most cost-effective option for you.

Recommended Reading: How To Refinance An Avant Loan

Specialized Loan Servicing Reviews

Mortgage company was fine. they sold my mortgage within a year and transition to new company had its issues. Not sure who’s fault that was, would have preferred to stay with SLS

I talked with Patrick and from the beginning, he sounded stressed and tried to cut me off without understanding my concern. I was seeking a resolution but the way he spoke with me was utterly disrespectful and when I confronted him for doing so, he became aggressive. If you want to stay in the business with these people, best of luck. I will be moving away from the company and the experience is horrible.

A The Loan And Respondent’s Initiation Of Foreclosure Proceedings

In 2006, appellant and his wife, Darlina E. Billesbach, took out a home equity line of credit secured by the couple’s home in Lancaster. Only Mrs. Billesbach signed the promissory note, but both she and appellant executed the deed of trust securing it. After Mrs. Billesbach’s death in 2008, appellant continued to make monthly payments on the loan. Respondent began servicing the loan in 2011.

“ections 2924 through 2924k provide a comprehensive framework for the regulation of a nonjudicial foreclosure sale pursuant to a power of sale contained in a deed of trust.” 25 Cal.App.4th 822, 830, 30 Cal.Rptr.2d 777 .) “The foreclosure process is commenced by the recording of a notice of default and election to sell by the trustee. After the notice of default is recorded, the trustee must wait three calendar months before proceeding with the sale. .) After the 3-month period has elapsed, a notice of sale must be published, posted and mailed 20 days before the sale and recorded 14 days before the sale. ”

As discussed more fully below, section 2923.55 requires mortgage servicers to contact the borrower in person or by phone, or diligently attempt to do so, before recording a notice of default. , & .)

Recommended Reading: How To Transfer Car Loan To Another Person