What Is Considered Adverse Credit History

- you have one or more debts with a total combined outstanding balance greater than $2,085 that are 90 or more days delinquent as of the date of the credit report, or that have been placed in collection or

- charged off during the two years preceding the date of the credit report or

- during the five years preceding the date of the credit report, you have been subject to a

- default determination,

- discharge of debts in bankruptcy,

- foreclosure,

- write-off of a federal student aid debt.

Why Was My Parent Plus Loan Denied

An applicant can be disqualified and denied a PLUS loan for credit problems like recent bankruptcies, large debts more than 90 days delinquent, a recent wage garnishment or a tax lien. READ: 4 Things Borrowers Dont Always Know About Parent PLUS Loans. ] Being denied a PLUS loan does not mean you are out of options.

Parent Plus Loan Limits

You can borrow up to your childs full cost of attendance each school year, minus all other student aid. Your childs school sets the cost of attendance, which is a sum of all education-related expenses.

Student aid such as scholarships, grants, or your childs student loans are applied to this total cost. The difference between student aid granted and remaining costs is how much you can borrow with parent PLUS loans.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Plus Loan Application Instructions

Application Tips

To avoid rebate check delays: Under , choose “The Student” .

Loan Amount: Choose your loan amount for this whole school year . This amount will be evenly split between the fall and spring semesters. Review your estimated costs and expenses.

Loan Period: For Fall 2021 & Spring 2022 loans, use 8/2021 to 5/2022.

Parent Master Promissory Note

Annual Student Loan Acknowledgement

The Annual Student Loan Acknowledgment is available at studentaid.gov. Who should complete the ASLA? Borrowers accepting a subsidized/unsubsidized loan, a PLUS loan for graduate/professional students, or a PLUS loan for parents. Borrowers are acknowledging that they understand their responsibility to repay the loan and that they understand how much they owe and how much more they can borrow.

Master Promissory Note

If you have not already completed a Master Promissory Note for a parent loan for your son/daughter, there are an additional 4 steps to complete the MPN. The parent borrower will log into the Direct Loans website using his or her own social security number and his or her own federal FSA Id. To log in: click SIGN IN, then:

| Select: |

Read Also: Rv Loan 600 Credit Score

Let The Government Know About Extenuating Circumstances

If you dont have someone who can cosign for you, you can still have the government reconsider your application if there are outside circumstances that affect the decision.

The primary parent plus loan denial reasons are related to adverse credit history. You can try to explain the adverse credit history in a way that will allow you to qualify for the loan instead.

Here are some examples of extenuating circumstances that qualify for reconsideration:

- The adverse action is related to debt from a Chapter 13 bankruptcy

- Youve consolidated a defaulted federal student loan and the consolidation is current

- The detrimental events happened more than five years ago

- You have a divorce decree that absolves you from paying the debt related to the adverse action

- Youve made satisfactory repayment arrangements for a tax lien and can show six months of on-time payments

- The adverse action is the result of an error

If you can show that there are mitigating circumstances, you may be able to get approval after an appeal.

Parent Plus Loan Eligibility Denials And Limits

Many parents want to help fund their childs college education. One common way to do this is through the Federal Parent PLUS Loan. Like with other student loans, the Parent PLUS Loan offers advantages to private student loans, including safer repayment terms and the option to enroll in repayment programs. As the name suggests, this loan goes to the parent of a dependent college student and limits how much debt the student will have to take on. But, parents with bad credit may not qualify. Parents should be aware of Parent PLUS Loan eligibility requirements, because a denial can impact their childs ability to finish college and can create more debt for the child. Parents and students also need to evaluate the cost of higher education carefully, because PLUS Loan amounts can be dangerously high at some schools.

You May Like: Does Collateral Have To Equal Loan Amount

Apply For Additional Direct Unsubsidized Loans

If obtaining a Parent PLUS loan isnt an option, but your student still needs extra money for college, they may be able to qualify for additional federal student loans.

Dependent students whose parents dont qualify for a Parent PLUS Loan may qualify for additional unsubsidized Federal Direct Stafford Loans, the same limits as are available to independent students.

While you arent the borrower, your child is still able to receive the additional funds that they need to pay for their education.

Reasons Parents Are Denied Plus Loans

You’ll be ineligible for a parent PLUS loan if you have adverse credit history on your credit report. Adverse credit history is a negative mark on your credit report, such as a tax lien or debt payment that’s more than 90 days late.

You may also be denied if you or your child doesn’t meet other parent PLUS loan eligibility requirements. For example, your child must be an eligible undergraduate student and you must be a U.S. citizen.

» MORE:Federal direct parent PLUS loan review

Read Also: How To Transfer Car Loan To Another Person

Calculate Your Loan Amount

Funds Needed: You can borrrow loan funds to pay your TU charges and your other living and personal expenses. To calculate how much you need to borrow for this academic year , compare your total grants/scholarships to your estimated costs. Use our estimated Cost of Attendance Budgets or review our current rates for tuition, room, and board.

Maximum Loan: Your maximum PLUS loan amount = your Cost of Attendance Budget minus all your other financial aid.

Loan Fees: For loans with first disbursements between 10/1/20 and 9/30/22, before they disburse your loan funds, the federal government will deduct a 4.228% loan fee from the amount you borrow.

Final Loan Amount: After you calculate the total loan funds you need to receive, adjust the amounts you request to compensate for the loan fees that they will deduct from your loan disbursements.

The Problem With Parent Plus Loans

PLUS loans are the only federal student loans that come with some creditworthiness requirements. Basically, the government will deny an application if the parent is considered delinquent for 90 days or more on the repayment of a debt or has been the subject of a default determination, bankruptcy discharge, foreclosure, repossession, tax lien, wage garnishment, or write-off of a student loan in the past 5 years. Parents can appeal denials based on extenuating circumstances.

In 2011, the Department tightened the credit standards for parent PLUS loans by deciding to go back five years instead of just 90 days in looking at a borrowers delinquent accounts and charge-offs. The decision stemmed at least in part from concerns about increased PLUS loan borrowing, very high PLUS loan acceptance rates and increased default rates. .

The fact that so many PLUS loan borrowers are struggling should not be all that surprising given the rough economic conditions in our country, combined with the relatively high cost of PLUS loans and the limited number of repayment options. Most Direct PLUS loans have fixed interest rates of 7.9%. Going forward, the new fixed rate is 6.41% with origination fees of just over 4%. Most distressing of all, parent PLUS borrowers are not eligible to repay through the income-based repayment programs.

Also Check: Usaa Refinance Rates Auto

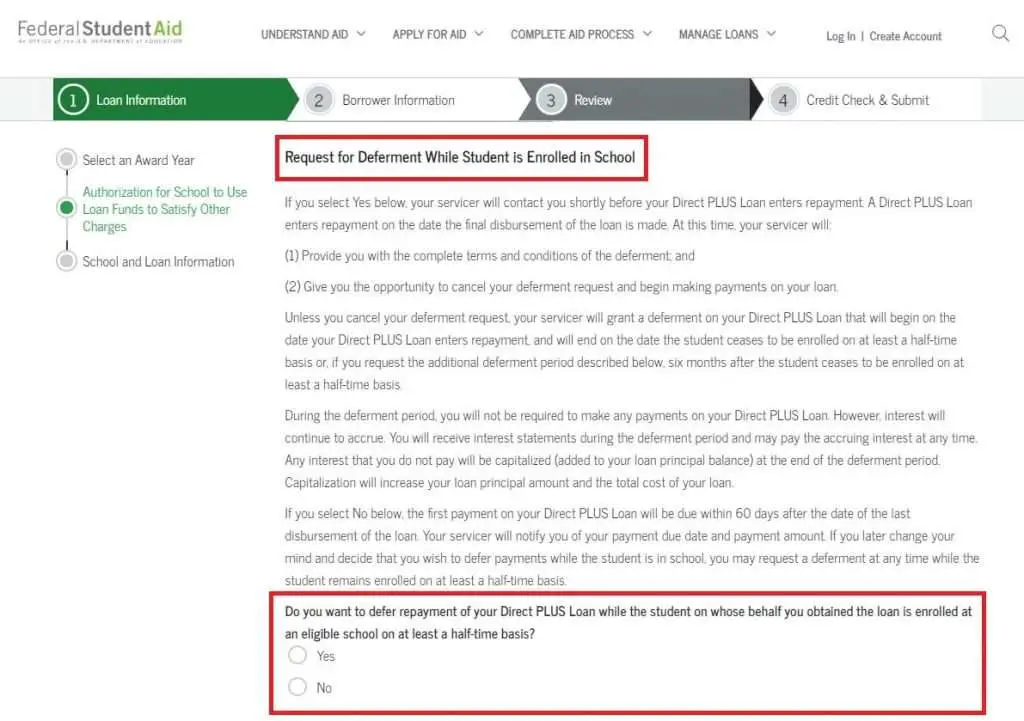

Complete A Parent Plus Loan Application

You can complete a parent PLUS loan application online using the FSA ID and account you created to file a FAFSA, or through your financial aid office. Youll provide basic info on yourself as the parent, your child, their school, and your loan. You can also indicate how you want loan funds disbursed and whether you want to defer payments while your child is in college.

Your Parent Plus Loan Was Denied Now What

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If youre helping your college-bound child pay for school, you may have considered taking out loans in your name. If so, one of the options available are Parent PLUS loans, also known as Direct PLUS Loans for Parents, offered through the federal government. If your Parent PLUS Loan application is denied, you might try to appeal the decision, find an endorser for the application, or look into other funding options.

Read Also: Does Va Loan Cover Manufactured Homes

Appealing The Parent Plus Loan Denial

When your child applies for financial aid for college, they should focus on getting scholarships and grants first, using any money in savings for college, and applying for subsidized federal student loans. Then, unsubsidized federal loans can be beneficial. After these options have been exhausted, you and your child can look at parent PLUS loans or private loans to make up any financial gaps. After considering other funding sources, these loans may be small. If you need to apply for a parent PLUS loan for your child and you are denied due to adverse credit history, you have some options for recourse.

- Obtain a loan endorser who does not have an adverse credit history. This could be your childs other parent, another family member, or close family friend. If your parent PLUS loan is then approved with an endorser, you need to obtain a new master promissory note for each endorsed loan.

- Document, to the satisfaction of the U.S. Department of Education, the extenuating circumstances related to your credit history. This is an appeal process offered through the Department of Education. Youll state that the reported adverse credit history is incorrect or that there are extenuating circumstances.

In both scenarios, you must also complete the Department of Educations PLUS credit counseling within 30 days of the denial of your PLUS loan. It is not a lengthy, multi-session form of counseling and typically takes just 15 to 20 minutes to complete.

Why A Parent Plus Loan Might Be Denied

Unfortunately, some Parent PLUS loans are denied. If youve found yourself in that camp, now what do you do?

Parent PLUS loans have credit-related requirements to qualify. If your PLUS loan was rejected, it could be because of something found within your credit history or some other inability to meet eligibility requirements.

According to the Federal Student Aid website , PLUS borrowers cannot have an adverse credit history, such as having a debt payment 90 days overdue or having completed bankruptcy in the last five years.

Was your Parent PLUS loan denied? Dont lose hope yet because you still have options to consider: You could appeal the decision, get an endorser, maybe consider taking out a private loan, have your child request more aid, and search for more scholarships or other educational options with your student.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

You Dont Have Enough Employment Or Income History

Lenders not only want to make sure you arent borrowing too much debt relative to your income but also that your income is reliable so youre likely to continue making on-time payments. If you have no employment or income history to speak of, private lenders may have no reason to believe youll be able to pay off the money they lend to you.

Why Are Parent Plus Loans Denied

Parent PLUS Loans are based on the assumption that parents, rather than their soon-to-be-undergraduate children, will have more stable incomes, better credit scores, or less debt. However, this is not always the case. Parents are more likely to have car loans, mortgages, credit card debt, and their own student loans listed on their credit history, which can make it harder for them to qualify for a parent PLUS loan. There are many reasons why you may be denied a parent PLUS loan. These include:

These events on your credit report show lending agencies, including the Department of Education, that you may be unable to repay the debt.

Read Also: Usaa Used Car Interest Rates

Youre Asking For Too Much

Trying to borrow more than your school-certified cost of attendance or more than the lenders maximum loan balance could also result in a loan denial.

Each school specifies the amount of money that they believe it should cost a student to attend for the yearincluding tuition, room and board, and other expenses. Youre typically not allowed to borrow more than the school says it should cost you to attend. If you already have borrowed for school or have received scholarships or grants, these other sources of funding will reduce the amount youre eligible to borrow.

> > Read More: Federal Student Loan Limits

What To Do When A Parent Is Denied A Plus Loan

With college tuition rising each year, finding the funds to cover the cost can be a challenge for many families. Even with savings and financial aid like scholarships, grants and federal student loans, students and their parents are sometimes faced with a gap between college costs and available resources.

In these cases, colleges may offer parents a federal Parent PLUS loan. This is a loan made to the parent of a qualifying student. The terms and borrower benefits differ from the federal direct loan, which is offered to students and has a lower interest rate and more flexible repayment options.

Another difference between the PLUS loan and the direct loan is that the PLUS loan requires an application to verify that the borrower — the parent — has no adverse credit history. An applicant can be disqualified and denied a PLUS loan for credit problems like recent bankruptcies, large debts more than 90 days delinquent, a recent wage garnishment or a tax lien.

Being denied a PLUS loan does not mean you are out of options. There are other steps that families can consider, but be sure to weigh the pros and cons of each to make the right decision for your situation. Here are four options that families can consider after a Parent PLUS loan denial:

— Borrow additional unsubsidized loans.

— Consider alternatives to taking on additional debt.

— Enlist an endorser or co-signer.

Borrow Additional Unsubsidized Loans

File an Appeal

Consider Alternatives to Taking on Additional Debt

You May Like: Does Va Loan Work For Manufactured Homes

The Basics Of Plus Loans

To be eligible for a Parent PLUS loan, your child must be enrolled at a qualifying school and take at least a half-time course load. You and your child must also meet the basic eligibility criteria, such as demonstrating financial need and being a U.S. citizen or eligible noncitizen.

Youll also have to fill out and submit the Free Application for Federal Student Aid, or FAFSA, which you can now fill out and submit as early as October 1.

Schools have different application processes for Parent PLUS loans. Youll either be able to request the loan from StudentLoans.gov, or you may have to check with the schools financial aid office for information on their process.

As with private student loans, Parent PLUS loans require a credit check. Your application might be denied if you have an adverse credit history as defined by the Department of Education. For example, you cant have charged-off accounts, accounts in collections or a 90-plus-day delinquent account with a combined balance of $2,085 or more.

You may be able to appeal the denial if your negative credit history is based on extenuating circumstances and you complete PLUS .

You could also get approved if you have an endorser who doesnt have an adverse credit history and youve completed PLUS credit counseling. The endorser takes a similar role to that of a cosigner and will be responsible for repaying the loan if the borrower doesnt.

Problem #: Parent Plus Loans Have No Limit

So far, we have discussed the problems surrounding Parent PLUS Loan denials. But, there is actually a big problem facing parents who qualify for the loan:

The Parent PLUS Loan has no limit.

This loan is designed to cover the difference between the total cost of attendance and the amount of aid that has been awarded to the student. If the student has chosen to go to an expensive school that offers very little financial aid, the Parent PLUS Loan will be for a larger amount, burdening the parents with more debt.

Essentially, this is a matter of financial literacyAre parents and students evaluating colleges based on finances?

Students and parents should carefully review financial aid offers from different schools. They should consider grant amounts and look for low-interest rate loans in their package. Any remaining amount, which can be covered by the PLUS loan, should be considered carefully. Students and parents should want this amount to be as low as possible. Why? Because this amount will be covered by either a PLUS loan or private loans with more dangerous terms.

Lets take a closer look. Here, we assume a student is considering two public schools, one is in-state and one is out-of-state. The out-of-state school will require that the parents take out a larger PLUS Loan:

| Public In-State | ||

|---|---|---|

| Total PLUS Loan Repayment Amount | $32,556 | $65,111 |

Read Also: How Long For Sba Approval