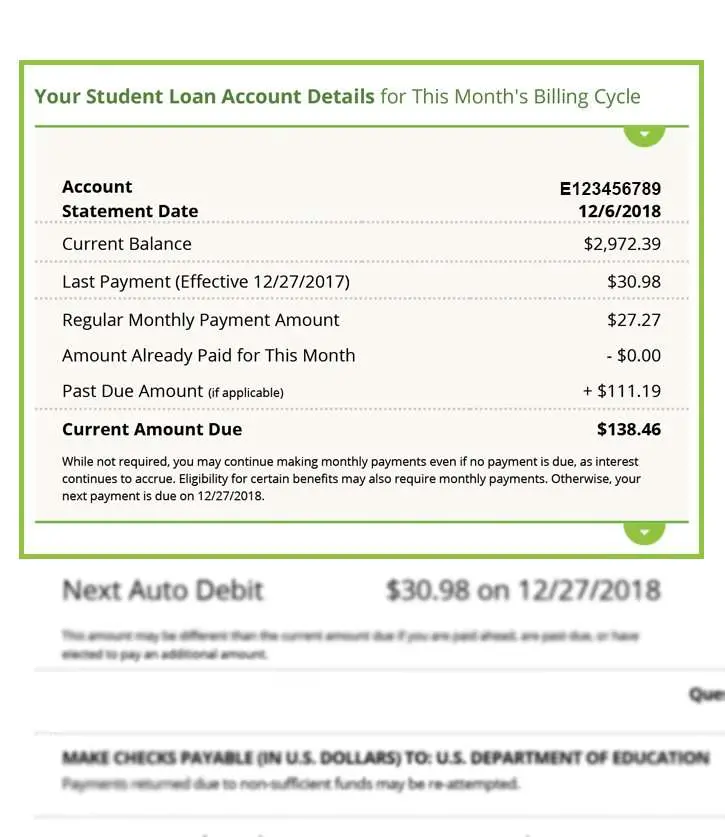

Student Loan Billing Statement

Every month that you owe a payment, youll receive an official billing statement to repay your student loan.

Your account number will be plainly listed as account number, on your billing statement.

Think of a credit card billing statement. Your account number is plainly identifiable on it.

Your student loan account number should be plainly noticeable near the top of your billing statement.

Corporate lending and facilitation services like Fannie Mae and various other federal student loan services feature plainly distinguishable account numbers on their billing statements.

Here’s How To Find The Holder Or Servicer For Your Loans

By , Attorney

Student loans that the federal government provides or guarantees usually fall into two categories: Federal Direct Loans and Federal Family Education Loans . The Department of Education makes Federal Direct Loans. Before July 1, 2010, the federal government also guaranteed loans that private lenders made. These loansFFELsare also considered federal student loans. Perkins Loans, another kind of federal student loans, were previously available toundergraduate, graduate, and professional students who had exceptional financial need.

No matter what type of federal student loans you have, you might need to know, and deal with, the loan holder or loan servicer.

What Should I Do After Finding My Loan Servicer

Once you know who your loan servicer is, you can create an account on their site. Youll usually create a username and password and then share relevant information like your full name, address and Social Security number. Youll also likely be asked to create several security questions and answers for your account as well.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well.

Typically, youll get a 0.25% interest rate deduction if you sign up for automatic payments. If youre not interested in autopay, find out if you can sign up for online alerts to be reminded when a payment is due.

Knowing your student loan servicer is more than just knowing who to pay each month its knowing who to turn to if you need to change your repayment terms or apply for deferment or forbearance.

But since student loan servicers dont always give the best guidance, its important to do your own research so you can make the best student loan decisions for you.

Rebecca Safier and Dillon Thompson contributed to this report.

Preparing For The Fafsa:

The 2021 – 2022 FAFSA is now available at . Listed below is an outline of the process students will need to complete in order to have;an aid offer made for the 2021 – 2022 academic year.;

1.; Get Organized:

- Apply for admission at University of South Alabama .; Students must be accepted before aid eligibility can be determined.

- Create a Federal Student Aid ID username and password at . FSA IDs are used for electronic signatures. Parents of dependent students must also create a FSA ID.

- For more information regarding the criteria the Department of Education uses to determine if a student is considered to be dependent, visit;.

2.; Complete and Submit the FAFSA Online:;

- Complete the FAFSA at or by using the myStudentAid app for iOS and Android. The FAFSA is available every October 1 so apply early!

- Avoid common errors by verifying personal information is entered correctly .

- Use the IRS Data Retrieval Tool to transfer tax information to the FAFSA.

- List USA in Step 6 of the FAFSA.; USAs school code is 001057.

- Both the student and parent must sign the FAFSA using their FSA IDs if the student is dependent.

- Print a copy of the submitted information for future reference.;

3.;;After Filing the FAFSA:

4.;;Finalize Aid Offers:

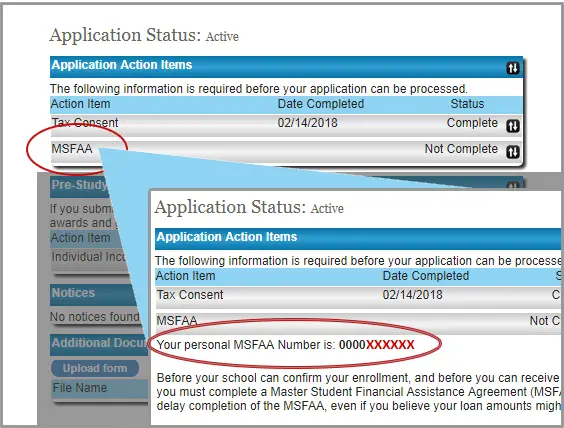

Option 3: Assistance With Login To Myloan Or Loan Repayment

Choose Option 3 if you need help with:

- Your;username and/or password for;your MyLoan online account.

- Your current loan balance.

- Accessing Repayment Assistance Programs if you are having difficulty repaying your loans.

- Updating your address if you are in repayment status.

- If you will be returning to school, you should also update your address in your Alberta Student Aid account:

|

7th Floor, 9940 106 StreetEdmonton, Alberta T5K 2V1 |

When submitting a form,;please follow the instructions given on the form.Notice:;Alberta Student Aid;no longer accepts;student loan and scholarship;applications dropped off in person.

The National Student Loan Data System

The Department of Education’s central database for student aidthe National Student Loan Data Systemprovides information about what kind of loan you have, as well as loan or grant amounts, outstanding balances, loan status, and disbursements. Identification information is required to access the database. You’ll need a user ID and password to get into the system, which you can get online. You can also access the database by calling the Federal Student Aid Information Center.

Determine Whether Youre A Full

Student aid is calculated differently for full-time and part-time students. Also, the process of applying for student aid is different.

Your school determines whether youre full-time or part-time based on your course load, not Student Aid. At many schools, its possible to take fewer than the maximum amount of courses and still be considered a full-time student.

|

Dependent students, provide your parents or guardians name, Line 15000, family size, number of children in family attending post-secondary |

|

, provide your spouses or partners name, birthdate, Social Insurance Number, Line 15000, expected reduced yearly income |

|

|

Students with dependent children, provide your childs name, birthdate, monthly childcare costs |

|

|

Students enrolled at multiple schools or doing an exchange/field study, provide name of your primary school, name of your additional school, airfare costs |

|

|

Students with permanent disabilities, provide proof of your permanent disability, copies of a medical letter, a learning disability assessment or documentation proving you are receiving disability assistance such as AISH, an estimate of equipment costs and an assessment fee |

Understand What Student Aid Is

Student Aid is a government service that provides student loans, grants, scholarships, and awards to help you pay for your post-secondary education. Student aid may not cover all of your costs, so youll need to plan to make up the difference.

You only have to submit one application to be considered for loans and grants from both Albertas government and Canadas government. Most students get money from both, which means you may get two smaller loans instead of one big one. Learn more about scholarships and awards.

You should:

- Apply early. The only way to know for sure how much money youll get is to apply and wait for your award letter. You should apply at least 60 days before your classes start so that you have time to figure out your finances.

- Apply every year. You can apply for student aid for up to 12 months at a time. If your period of study is longer, you need to submit another application.

| Student loans are interest-free while you study. You dont make any payments while youre a student, and they wont acquire interest until 6 months after you leave school. |

How To Find Student Loan Account Number

The only surefire way to stay current with your student loan information is to know your student loan account number.

When you apply for a student loan, your account number will be issued to you. Finding it out wont be a difficult process.

After you apply for student aid via the federal website Studentaid.gov, youll go through an application process to find qualifying loans.

Youll receive an official letter detailing your imminent student loan and future repayment processes after approval.

Your student account number should be highlighted, boldfaced, or plainly identifiable in such a letter.

There are several ways for you to find your 10-digit student loan account number.

Explore Your Student Loan Repayment Options

You will receive a package in the mail from the National Student Loans Service Centre that details how much you owe, your proposed monthly payment, and the confirmed interest rate on your loan. It is your responsibility to set up a repayment schedule. Otherwise, your loan repayments will be automatically withdrawn from the account in which your loan was deposited.

What Is A Student Loan Servicer

The loan holder may choose to employ a loan servicer to manage the day-to-day activities of handling your loan account. The servicer takes care of billing, processing payments, providing repayment options, and sending communications to borrowers. If you want to set up a repayment plan, postpone payments, cancel a loan, or apply for some other government program, you need to know who services your federal student loan. Basically, the servicer is a third party that acts as a liaison between you and the holder of the loan.

You don’t get to choose your loan servicer. The loan holder assigns one. So, if you have federal student loans, the Department of Education picks your loan servicer.

What Is a Servicing Transfer?

Sometimes, a loan is transferred from one servicer to another. The holder, like the Department of Education, is still the holder. But the new servicer will handle the management of the loan.

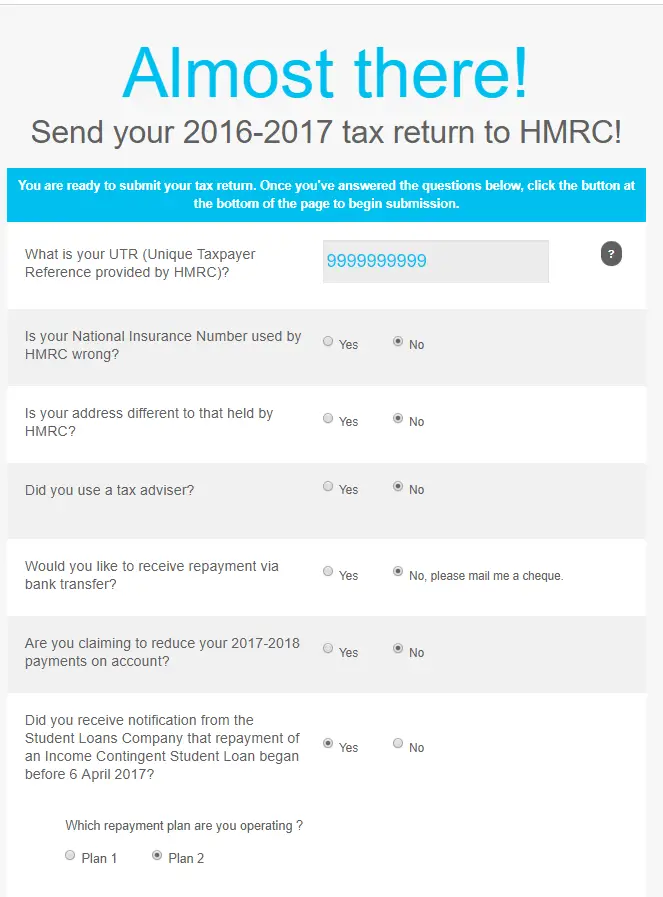

New Students From England

Most full-time and part-time students can apply online to Student Finance England.

Set up a student finance online account.

Log in and complete the online application.

Include your household income if needed. Your parent or partner will be asked to confirm these details.

Send in proof of identity, if needed.

If you cannot apply online, use the form finder to get the forms you need. You can if you want to apply online but you cannot use a computer without help.

Supports For Students Affected By Wildfires

Are you affected by the current wildfire situation? Do you need help with your student loan payments?

- If you have Canada loans, or Canada and Alberta loans, contact the National Student Loans Service Centre to fast track your application for the Repayment Assistance Plan.

- For Alberta Student Loans, call 1-855-606-2096

Currently in School

If your studies have been disrupted as a result of the wildfires, and you have:

- Extended your study period

- Withdrawn from studies, or

- Your financial circumstances have changed.

Notify the Alberta Student Aid Service Centre, or login to your;Student Aid Account and submit a Request for Reconsideration. Eligible students may receive up to $7,500 in Alberta Student loan funding to help cover unexpected costs relating to the wildfire. Supporting documentation may be required to verify the costs.

How Much Can You Get

The amount you can receive depends on several factors, including:

- your province or territory of residence

- your family income

- your tuition fees and living expenses

- if you have a disability

The amount you can receive in grants and loans is calculated when you apply with your province or territory.

To find out if you can receive Canada Student Grants or Loans, use the federal student aid estimator. Note that this estimator doesn’t take into account the provincial and territorial student grants and loans.

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

Who You Need To Repay

You may have loans or lines of credit that you need to repay to the government and/or your financial institution.

In some provinces and territories, Canada Student Loans are issued separately by the federal and provincial or territorial governments. This means that you could have more than one loan to pay back.

Verify your contracts to determine where your debt comes from and where you need to repay it.

Federal Student Aid Ombudsman Office

If you’ve tried all of these places and are still in need of help, consider contacting the Federal Student Aid Ombudsman office. The Department of Education’s student loan ombudsman helps borrowers with student loan problems. The ombudsman is a last resource; usually, it will help you only after you’ve tried to resolve your issue yourself. You can contact the student loan ombudsman office at 877-557-2575.

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

Is The Amount Of Interest Higher Than You Expected

Capitalized interest may be counted as interest paid on the 1098E. That capitalized interest and your origination fees may be tax deductible. If you have more questions on your 1098-E, please contact a tax advisor.

Please note: Because fewer loan payments were required and interest rates were at 0% for much of 2020, your interest paid was likely lower than in previous years.

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies,;loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

Granite State To Stop Servicing Federal Student Loans When Current Contract Ends

In the next few months, Granite State will be working closely with the U.S. Department of Education to transfer all federal student loans currently held by Granite State to Edfinancial Services.

Please note that this change will not affect the existing terms, programs, or available repayment plans on your loans, nor will it affect the temporary suspension of payments and 0% interest benefits applied for the COVID-19 emergency. Auto-debit information will be transferred to Edfinancial Services; however, borrowers should contact Edfinancial Services to verify information once the transfer is complete.

Affected borrowers can expect to receive more information about this transfer from ED and Granite State, and once the transfer is complete borrowers can expect to receive additional information from Edfinancial Services. Be sure to read these notices fully. You can also visit StudentAid.gov/granitestate for the latest updates and information on loan transfers.

You can check your current balance online, and if you have questions, please contact Granite State at 1-888-556-0022.

How To Find Your Student Loan Account Number

June 11, 2020 By Allen Francis

Its kind of ironic that naive and broke college students, completely unprepared for real life, are saddled with unmanageable debt before entering the real world after graduation. Did you know that 45 million borrowers now collectively owe $1.6 trillion in student loan debt in the United States? If youre a student, parent, or grandparent soon to begin repayments, you must know how to find student loan account number information.

Do you need to find the student loan account number information for repayment purposes?

Youll find it in official correspondence concerning repayment. Its a 10-digit number.

It should be clearly identifiable on a statement or online account.

Student loan account numbers are used as an identifying metric for borrowers in official correspondence.

Learning how to find the student loan account number information is vital.

Youll be paying off student loans for years or decades.

In a recent survey, college students guessed it would take 6 years to pay off their student loans. The average estimate is 20 years. Student loans are a major life investment, so you should know your account number.

Before I talk about the multiple ways you can find student loan account number information, lets look at some student loan statistics.

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.;

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.;

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.