Why Federal Student Aid Is A Great First Stop

If you have student loan debt, its important to know just how much you owe. Knowledge is power, and your Federal Student Aid account can show you exactly what youre dealing with.

Once you understand how much you have to pay back, youll be one step closer to becoming debt-free. You should log in to your Federal Student Aid account every once in a while to see an accurate picture of your student loan debt.

When you start paying your loans off, log in frequently to see your balance drop. Visiting the student loan database will keep you motivated and allow you to track your progress.

Where Can I Find Information About My Private Loans

The NSLDS only tracks federal student aid. Contact your private lender directly for information about your private student loans. Interest rates, disbursement dates, monthly payment amounts, and term-length are all important numbers for you to ask about. Your colleges financial aid department will have this information too.

How To Access Your Student Loan Data

Here are the steps. You can also download our instructive PDF here.

Also Check: How Much Do I Pay For Student Loan

Requests The Transfer Student Monitoring File

Student Financial Planning automatically submits the student to the Transfer Student Monitoring list once the Student Demographic Information message is received in combination with the students Social Security Number.

Once Student Financial Planning requests the student be added to the TSM list, the file is generated with the proper TSM flag. The file is sent to the NSLDS transmission queue via the SAIG Process NSLDS. When the file is received from NSLDS it be matched to the student record and displayed in the NSLDS screen of the user interface.

For all requests of the NSLDS , Student Financial Planning provides the institution’s school code in both the Header and the Detail Batch Records,per student.

Nslds Professional Access Upcoming January Enrollment Roster Dissemination

As we informed the financial aid community in earlier announcements, we resumed National Student Loan Data System Enrollment Roster processing in December 2022 however, we disseminated only some December Enrollment Rosters on schedule due to our identification of an issue. We resolved the issue and disseminated the remaining December Enrollment Rosters the first week of January 2023. To allow schools time to respond to the delayed December rosters, we explained that January Enrollment Rosters scheduled for dissemination during the period Jan. 115, 2023 would be held until mid-month.

We want to again acknowledge our appreciation of schools patience and understanding as we worked through issues. We are ready to disseminate all January Enrollment Rosters.

Don’t Miss: How To Apply For Fha 203k Loan

Update: Enrollment Status Reporting To Nslds

The following is an update to our November 15, 2022, Compliance Central blog post, Update: Enrollment Status Reporting to NSLDS Restored.

The National Student Clearinghouse continues to collaborate with Federal Student Aid and National Student Loan Data System on outstanding issues related to NSLDSs roster process, which resumed on November 16, 2022, following the July 25, 2022, NSLDS site modernization.

We strongly encourage your school to rely on the guidance provided in the FSA/NSLDS Professional Access Electronic Announcements. This includes the audit exception language related to instances where student enrollment status updates may not appear in the NSLDS system. For more information, please see the and the January 6, 2023, Note section that FSA added to the .

The Clearinghouse will continue to keep our institutions informed of updates and new information via our Compliance Central Blog. Please subscribe to ensure you receive notifications when new information is added.

Please note: Any data processed by the Clearinghouse is immediately available for our other services, including EnrollmentVerify, DegreeVerify, StudentTracker, the Postsecondary Data Partnership, Myhub, Reverse Transfer, and any other service in which your school participates that utilizes your enrollment data. The Clearinghouse continues to process any new enrollment and degree data we receive in chronological order.

National Student Loan Data System

The National Student Loan Data System is the national database of information about loans and grants awarded to students under Title IV of the Higher Education Act of 1965. NSLDS provides a centralized, integrated view of Title IV loans and grants during their complete life cycle, from aid approval through disbursement, repayment, deferment, delinquency, and closure.

Recommended Reading: Does Va Home Loan Cover Closing Costs

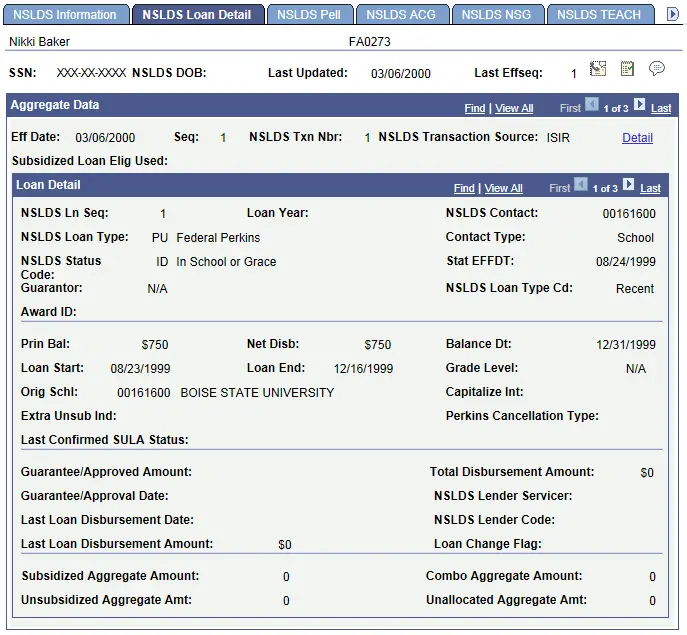

What Information Is Available In Nslds

The data within the NSLDS file is a collection of information from the schools you attended, your activity under the Direct Loan Program and other Dept of Education Programs , and the agencies that guaranty and service your federal student loans.

At first glance, this file will look horrendous Let me help point you toward what to look for.

The first section of this file has your basic contact information. Make sure the information is current.

Next, youll see your overall financial aid details. This overview will outline information about your grants, enrollment status, and total loan balances. Each line item will include specific loan types with their respective outstanding principal and interest.

Then the NSLDS file will go on to further break down each individual loan you borrowed from each enrollment period. This gives you details on what school the loans went toward, how much was disbursed and when, the current balance, interest rate, repayment plan youre on, your next payment due date, how much that payment will be, a timeline of your repayment history, and contact information about your loan servicer:

This file can be long, especially if youve had many years of schooling.

If youre an SLP client, we give you a cleaned-up version of your NSLDS file via our Magic Macro converter thats much prettier to look at!

What Is An Fsa Id And How Do I Get One

Youll need your FSA ID to log into StudentAid.gov, so well go over what that is and how to get one.

Your FSA ID is a username and password that controls your online access to federal student aid services, including FAFSA and StudentAid.gov. In addition to granting you access to these websites, your FSA ID can also be used to electronically sign any necessary loan paperwork.

FSA ID took the place of the Federal Student Aid PIN on May 10, 2015, so if you havent logged into any federal student aid websites since then, you may need to create a new ID.

You can do so here but most people who have filled out a FAFSA recently will already have one.

The process of setting up a new FSA ID includes choosing your unique username and password, as well as providing personal details such as your name, date of birth, and social security number.

You can also provide your mobile number or email address and select a language preference, and youll be asked to set up some security questions in case you lose your login information.

If youre just now setting up your FSA ID, it can take between one and three days to verify your information with the Social Security Administration, and you wont be able to use it until then.

Don’t Miss: How To Calculate Fha Loan Amount

Privacy And What Else To Know About The Nslds

Information included on the NSLDS is protected by federal privacy laws, and only those who have access to NSLDS can access the information. This includes student users as well as professional users who have been authorized to access the information contained in a specific user account.

If you currently are utilizing a federal aid program, including loans and grants, the National Student Loan Data System is an invaluable resource you can use from the beginning of your post-secondary career to the final loan payment.

This database is also incredibly useful if youre unsure of your total federal debt, or if you need to obtain information about loan servicers. it can be a helpful way to keep up with student loan payments and by always making your monthly payment on time, youll build a strong credit history.

Also, by logging into the NSLDS, you can utilize important information about your student debt to make educated decisions regarding your future, including those that will govern your academic career and your long-term financial health.

Login National Students Loan Data System

For the NSLDS FAP website, terminate your session by clicking the logout link. For all other systems, click the X at the top right of your browser window and close all browser windows. This will terminate your login session.

preview

This system is LIMITED to approved use by AUTHORIZED personnel. Access by others is prohibited and unauthorized.

preview

The National Student Loan Data System is the U.S. Department of Educations central database for student aid. NSLDS receives data from schools, guaranty agencies, the Direct Loan program, and other Department of ED programs. NSLDS Student Access provides a centralized, integrated view of Title IV loans and grants so that

preview

We have resources for parents looking to save for college and learn about financial aid. We also make loans to eligible parents to help pay for their childs undergraduate education expenses. Well help you manage the repayment process. Federal student loans offer flexible repayment plans, loan consolidation, forgiveness programs, and more.

preview

Don’t Miss: How To Calculate Student Loan Interest Paid

How To Handle Incorrect Information On Your Nslds File

Finding errors on your NSLDS file can happen. If the inaccuracy is in your basic contact information , you can update this through Studentaid.gov and your servicer.

Otherwise, a numerical or loan detail inaccuracy reflected on your NSLDS file will most likely originate from one of the places the information was gathered, such as a school or servicer.

Graduating Or Leaving Gateway

When students graduate, withdraw from school or drop below half-time enrollment status they have six months before the first payment is due on their subsidized and unsubsidized loans. This is called a grace period. This time can allow students to get financially settled, select a repayment plan and determine the amount of income needed to put toward student loans each month. Learn more about the options available to students after graduating or leaving Gateway below and everything you need to know about repayment. If you have any questions please call 800-247-7122 to start working with our Student Finance Specialist via phone, email or in person at a Student Support Center. You can also find more information on the Federal Student Aid website.

Grace Periods

Your loan may have a grace period. Most federal student loans dont require repayment until after a student leaves college or drops below half-time enrollment. However, PLUS loans enter repayment once the loan is fully disbursed . Loan servicers or lenders must provide you with a loan repayment schedule that states when your first payment is due, the number and frequency of payments, and the amount of each payment.

Learn more about grace periods.

Loan Exit Counseling

National Student Loan Data System

Stay on top of all your Student Loans with NSLDS.

Direct Loan Consolidation

Don’t Miss: How Does An Equity Loan Work

What You Need To Access The Nslds

To access your federal student loans and higher education grants through the NSLDS, you must have a Federal Student Aid ID. If you do not have an FSA ID, you can create one on the Federal Student Aid website as long as you have your Social Security number and a valid email address. After youve set up your FSA account, you can log into the NSLDS at any time to access the following information:

Exit Counseling For Federal Student Loans Explained

Most students who have taken out federal student loans are required to complete exit counseling once they graduate, leave school, or drop below half-time enrollment. This applies to anyone who has taken out a subsidized, unsubsidized, or PLUS loan via the Direct Loan Program or the FFEL Program.

Exit counseling can help you understand how much you owe and how long it will take to pay it off, as well as explain the differences between your loan types and some basic lending terminology. Its important to know what the benefits of consolidating your loans can be for the amount of interest youll pay over time.

Youll need to log into StudentLoans.gov with your FSA ID to complete exit counseling, as well as notify your school that youve completed counseling. Most people complete exit counseling in 20-30 minutes, so its not a huge time commitment, and can help to kickstart your knowledge about paying off your loans.

Napala Pratini contributed to the reporting for this article.

Jerry Brown is a personal finance writer, owner of the Peerless Money Mentor blog, and a contributor to Credible. He has written for major publications such as Forbes Advisor, Business Insider, and Rocket Mortgage.

Recommended Reading: How Much To Put Down For Conventional Loan

Student Loan Planner Disclosures

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

National Student Loan Data System : Why You Should Use It

So, youre finally ready to get a handle on your student loans. But, where do you start? Finding out who owns your loans, how much you actually owe, and what type of loans you have can get complicated. Thankfully, sites like the National Student Loan Data System make finding this information easy. Well break down how to use the NSLDS and why you should use it below.

Don’t Miss: Usda Home Loans South Carolina

Where Does The Information In The Nslds Come From

The information, including student loan debt, is collected by and listed on the NSLDS is provided by numerous sources, including federal loan servicers, colleges and universities, and the U.S. Department of Education.

Typically, the institution or organization that authorized the aid is responsible for reporting it to the NSLDS. For example, if a federal loan is serviced by AES, then AES is responsible for reporting accurate and up to date information to the NSDLS.

Information You Can Find At The Nslds

The NSLDS contains all records of your active federal student loans, as well as the federal student loans youve already paid off or consolidated.

This is the information you will find when you access the NSLDS database:

- The total amount of your Title IV loans and grants

- The types of federal loans youve takendirect, consolidated, subsidized, or unsubsidized

- The date each loan was approved

- The disbursement history of each loan

- The type of interest rate on each loanfixed or variable

- The outstanding principal of each loan

- The outstanding interest amount on each loan

- The repayment start date for each loan

- The status of each loanwhether it is paid in full, still in repayment, or in default

- Name and contact information of the loan servicer assigned to your loan

Read Also: What Is Down Payment Required For Conventional Loan

How To Use The National Student Loan Data System

When it comes to student loans, information is power. Having the details of your loans readily available for you not only saves you time but also acts as a very useful first stop when you are trying to figure out your finances after graduation. It helps you determine how much you owe, how much you need to pay back every month, and when you will finally be debt-free.

Use this big-picture view of your loans to help you map out a financial plan that works for you. Taking into account your income and your outgoings.

Use College Raptor to discover personalized college matches, cost estimates, acceptance odds, and potential financial aid for schools around the USfor FREE!

Do You Have Information Thats Incorrect With Both Your Servicers Records And Your Nslds File

If so, you might need to straighten it out with the schools financial aid office or the Dept of Educations Student Loan Support Center at 1-800-557-7394.

Here are some additional resources to refer to if you find inaccurate information on your NSLDS file:

Don’t Miss: Does Student Loans Affect Credit Score

Review The Satisfactory Academic Progress Policy

Penn State’s SAP Policy outlines the federal regulations we must follow to monitor student progression toward completion of degree and certificate programs at the undergraduate, graduate, and professional degree levels.

Refer to Appendix E Financial Aid Satisfactory Academic Progress Policy on the University Faculty Senate website.

Why Is The Nslds Important

The NSLDS can quickly confirm certain information that youre unsure of:

- Which company service your loans and their contact information.

- The types of loans you have .

- What repayment plan youre on.

- When you entered repayment, and when you were in forbearance, deferment or a grace period, and for how long.

- Your interest rate .

This file is important for record-keeping purposes. Student loan servicing companies are contractors for the Department of Education. This means that their contracts can expire from time to time, or your servicer can be replaced or fired.

A change of your loan servicer is naturally going to be a disruption. Having a centralized database for your loan details ensures that, even if a servicing company exits the business, they arent solely responsible for storing your loan information and repayment history.

We recommend downloading this file once a year or more to keep an active record of your loan details over time.

The NSLDS file is static information, meaning its accurate as of the date of your download. There is also sometimes a slight lag in information reflecting on the NSLDS from the loan servicer depending on their systems and processes. This delay shouldnt be more than a month or two from what weve seen.

You May Like: Best Loan For Small Business