See Your Updated Amortization Schedule

As you make extra payments, your student loan amortization will change over time. This is because, as you pay down the principal of your loan, there will be less of an outstanding balance available to accrue interest as the months and years go on.

Student debt, like cars, mortgages, and other types of debt, has amortization that changes over time, since you’re paying a different amount in interest and principal each month.

And since student loans carry the same payments month after month, year after year, you’ll be able to project how the loan’s amortization will change when you pay down a little extra principal each month.

Luckily, our calculator is dynamic and will update automatically based on the inputs that you give it.

Do Student Loans Carry Prepayment Penalties

These days, it is highly unlikely for any student loans to carry anything in the way of prepayment fees, money that you’ll have to come up if you eliminate your loan before the end of its term. But to make sure you benefit as much as possible, make sure that any extra money that you are paying in any given month is going towards your outstanding principal balance.

Enter The Current Balance Of Your Student Loan

If you already have a student loan, the next step is to enter the current balance of your student loan. This is important, because it will show you how much more money you need to pay off before your debt is paid off completely. Be sure to include any fees and interest that have accrued since taking out the loan!

Don’t Miss: When Do I Pay Back Student Loan

Dont Forget The Origination Fees

Before applying for a new loan, theres one other factor you should be aware of: Some personal loan lenders charge origination fees equal to between 1% and 6% of the amount you borrow. That means you may pay between $100 and $600 on a $10,000 loan.

But an origination fee shouldnt automatically discourage you from considering a personal loan. For example, lets say you have $10,000 in credit card debt with an average interest rate of 23%. That means youre paying $2,300 per year in interest.

If you have an opportunity to get a personal refinancing loan at, say, 12% APR over 60 months with a 6% origination fee, then even though youll pay $600 for the origination fee, youll still save quite a bit of money compared to your current credit card debt.

The personal loan, with an interest rate of 12%, will cost you $3,346.4 in interest charges over the 60-month term. Even if you add the $600 origination fee to that, the combined cost is still dwarfed by the $6,914 youd pay in interest by keeping the balance on the credit card and gradually repaying it over the same 60-month period.

Translation: Dont let an origination fee scare you away from taking out a personal loan. Crunch the numbers, compare them with what youre paying on your current debt, and go forward if it will save you money.

Refinancing Can Save You Money

You could save even more by using this student loan calculator to estimate your savings from refinancing your student loans.

Using the same scenario, lets say youre able to refinance your $75,000 debt down to a new 4.5% interest rate and continue paying $1,000 each month.

Youd pay off your total debt within 88 months and only pay a total amount of interest of $13,229. In that scenario, youd yield a savings of $11,674 in interest over the life of the loan alone due to a lower refinancing rate and higher monthly loan payment.

Plug in your own student loan numbers and see how much you can save in different scenarios.

Don’t Miss: Where Do I Apply For Ppp Loan

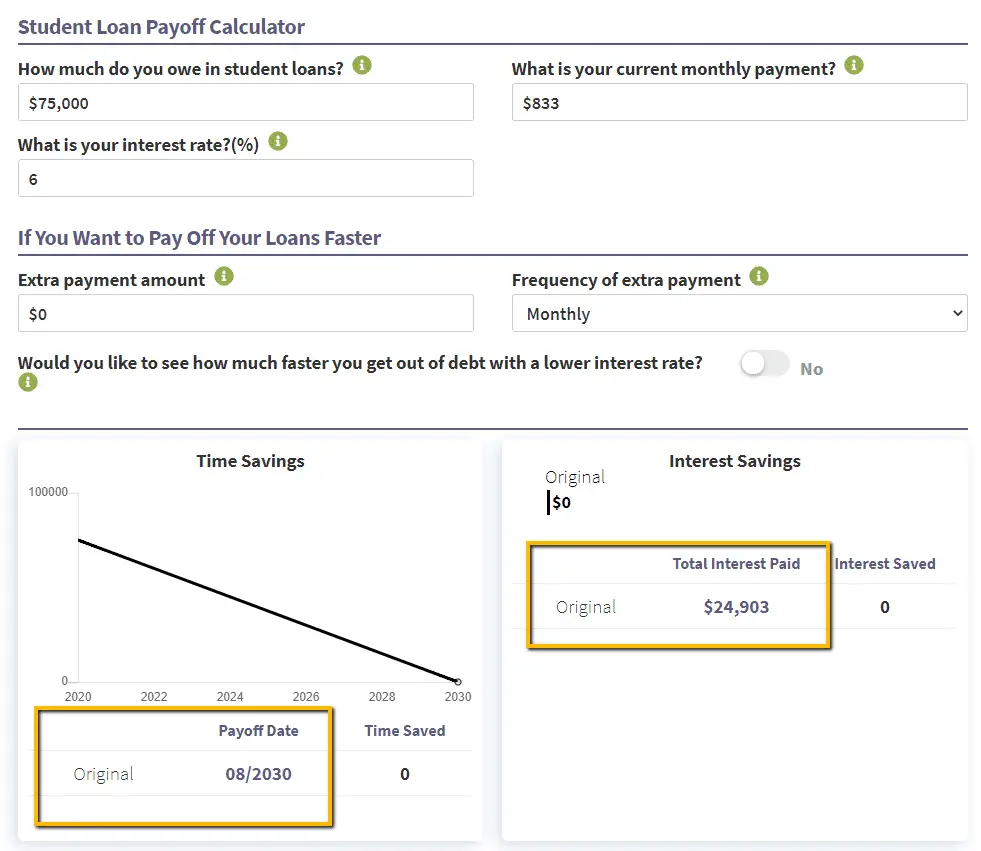

Student Loan Payoff Calculator

Looking to pay off your student loans faster? With our Student Loan Payoff Calculator, you can see how quickly you can be student debt-free!

This calculator also serves as a student loan extra-payment calculator so you can see how long it will take to pay off your student loans by adding extra payments, refinancing your student loans, or doing both!

Can You Claim Student Loans On Taxes

If you made payments toward interest on your student loans, you might be able to claim the student loan interest tax deduction. You can deduct $2,500 or the amount of interest you paid during the tax year, whichever is less.

Tip:

If you decide to refinance, remember to research and compare as many lenders as possible. This way, you can find a loan that best suits your needs. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Kat Tretina is a freelance writer who covers everything from student loans to personal loans to mortgages. Her work has appeared in publications like the Huffington Post, Money Magazine, MarketWatch, Business Insider, and more.

Also Check: How To Calculate Dti For Mortgage Loan

How To Calculate Student Loan Interest

The price of a loan, putting aside any extra fees, is the interest you pay. In other words, you need to repay the loan you received, plus the accumulated interest.

The main factors that drive your total payment are the following:

- borrowed money: the higher your loan balance, the more interest is charged

- interest rate: the higher the rate, the more expensive it is to borrow and

- the time frame over which you repay the loan: the longer the loan term, the more periods there are where your lender can charge interest on the balance of the loan.

As you can see, the interest that will accumulate on your loan’s balance is usually your primary concern when borrowing money. For this reason, it’s essential to know how to calculate student loan interest. Through the following simple example, you can easily learn the process of interest computation. Let’s assume that you borrow $10,000 at a 6% annual interest rate. On a 10-year standard repayment plan, your monthly payment would be about $111:

interest rate / number of days in a year = 0.06 / 365 = 0.000164 = 0.019%

loan balance / interest rate factor = $10,000 * 0.000164 = $1.64

daily interest * number of days in a month = $1.64 x 31 = $50.84

Early Payoff Calculator Student Loan

If youre trying to pay off your student loans or other debt, an early payoff calculator can help you figure out how much money youll save by paying off your debt ahead of schedule. The tool is easy to use and lets you see exactly how much interest youll save by making extra payments on your student loans each month.

Recommended Reading: When Can I Sell My House Fha Loan

Pros And Cons Of Paying Off Student Loans Early

While paying off student loans saves you money in the long run, are there any drawbacks in the short term? Following are the pros and cons of paying off student loans early.Pros and cons of paying off student loans early

- Save on interest payments – borrowers may save thousands of dollars in interest payments when they pay off their student loans faster.

- Shorten loan terms – isn’t it nice to pay off your student loan many years earlier? The feeling of being loan-free is something to celebrate.

- Lowers your debt-to-income ratio – if the borrower is thinking of buying a house and needs to get a mortgage. The debt to income ratio or LTV is something that the bank reviews when processing your mortgage application. The lower the LTV, the better. A lower LTV might even get you better mortgage rates.

Cons of paying off student loans early

Whether it is worth paying off your student loan earlier is a personal choice and depends on your situation. Evaluate all the inputs and make a decision. If you can’t afford to make a meaningful extra payment each month, but still want to give it a try. You can always start small, and it may have a bigger impact than you might think.

How Do You Change Student Loan Repayment Plans

There are several federal student loan repayment options in addition to the standard repayment plan, including graduated repayment plans, extended repayment plans, and IDR plans.

If you want to change your federal student loan repayment plan, contact your loan servicer. You might also be able to apply for a new repayment plan online.

There are generally fewer private student loan repayment options, and available repayment plans will depend on your lender. You can typically only change your repayment plan by refinancing your private student loans.

You May Like: What Loan Amount Can I Get Approved For

How To Calculate How Much Interest Youll Save By Paying Off Your Student Loans Early

Calculating how much interest you will save by paying off your student loans early is simple:

- Add up the total amount of interest you owe. This can be found on either your monthly student loan statement or through an online calculator.

- Subtract the amount youve already paid. If youve been making payments for 12 months, this should be $0 otherwise, add up all the monthly payments made so far and subtract that from the total amount owed to get a number representing how much interest has been paid out thus far.

- Divide by how much is left to pay on your student loans . This gives us a percentage value which represents how much money were saving by paying off our debt early rather than simply making regular payments throughout our repayment period. For example: $10K owed at 6% APR would cost $600/month in interest alone over 10 years . But if we were able to cut down those 10 years into 5 years by making extra payments toward principal instead of just interest over those 5 years, then our savings would look like this :

Monthly Payment Interest Paid Total Paid Savings Monthly Savings Yearly Savings

Be Careful With Repayment Plans

Federal student loans allow most borrowers to access income-driven repayment plans, which help reduce your minimum monthly payment requirement by extending the term and limiting your payment based on discretionary income. There are also extended repayment options that reduce your monthly payment by stretching repayment over a longer amount of time.

While these are beneficial from a cash flow perspective, they do not necessarily help you pay off your loan balances early. This is because the minimum payment due may not cover your full interest payments, and you will likely owe far more than you started with by following this strategy.

Don’t Miss: How Do I Know If My Ppp Loan Is Approved

What If I Dont Know My Student Loan Information

No sweatwe know keeping track of your student loans can be confusing. If you have federal student loans, you can log into your studentaid.gov account to see who your loan servicer is, your current loan balance, your interest rate and more. If you have private student loans, youll need to contact your specific lender to get your loan information. If you dont know what private student loans you have, you can request a free credit report to find out.

How To Pay Student Loans Off Early

Interest is a beast. If it goes unmanaged, interest will eat away a good portion of the money you put towards paying off your student loans. One of the most common ways to eliminate debt faster is by making more than the monthly minimum.

Someone who makes additional monthly payments uses a very similar tactic as someone that pays more toward their monthly payment. This payoff strategy consists of paying multiple times per month rather than the one assigned monthly due date. Its very common for someone using this tactic to make a goal to pay bi-weekly rather than monthly.

Recommended Reading: How Much Is The Maximum Student Loan

How Can I Pay Off $200k In Student Loans

If youre looking to pay off $200,000 in student loans, the optimal way to repay the debt mainly depends on the type of loans you have.

- If you have federal student loans, be sure to consider all of your repayment options. For example, you could be eligible for an IDR plan to help you manage your payments. Or you might qualify to have some or all of your student loans forgiven through programs like Public Service Loan Forgiveness. Your loan servicer can help you explore what options are available to you.

- If you have private student loans, you could consider refinancing, especially if you can reduce the interest rate on any of your loans. You can use our student loan refinancing calculator below to see how much you can save by refinancing your student loans.

Step 1. Enter your loan balance

What Repayment Plan Qualifies For Student Loan Forgiveness

Some federal student loan forgiveness programs require you to make payments under an eligible repayment plan.

For example, to potentially qualify for Public Service Loan Forgiveness, youll need to work for 10 years at a government or nonprofit agency while making qualifying payments under an IDR plan.

You could also qualify for loan forgiveness under an IDR plan itself. Depending on the plan, your loans could be forgiven after 20 to 25 years of payments. There are four plans to choose from:

Keep in mind:

Recommended Reading: Caliber Home Loans Log In

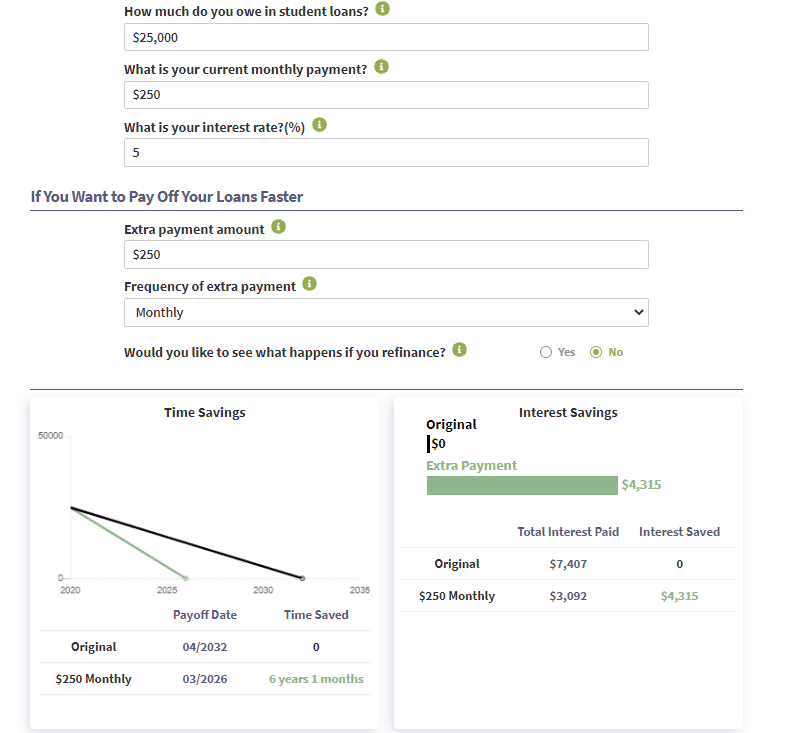

Student Loan Prepayment Calculator

Thinking about becoming debt-free faster? If you’re looking to make extra payments now, use this calculator to estimate how much time and money you will save in the long-run by doing so.

FAQs about loan prepayment calculator

Making extra payments towards your student loan debt can help you pay off your loan balance quicker. You can pay more than the minimum or make multiple payments during the month. However, you need to confirm with each lender how prepayment works, so your payment is applied as an extra payment to the principal balance of the right loan and not treated as an early payment of the next installment.

Benefits of prepaying on your student loans and paying more than the minimum required payment include: paying off your student loans faster, saving money on interest and improving your debt-to-income ratio. The faster you pay off your student loan debt, the quicker you will be able to contribute money into a savings account or retirement account.

If you are making extra student loan payments, you may not be prioritizing other important financial moves, such as having an emergency fund. If you don’t tell your lender how you want your extra payment applied, it may not go towards the loan it should. If you are seeking loan forgiveness, making extra payments may reduce the amount of loan forgiveness.

More Calculators

Loan Early Payoff Calculator Definitions

- Annual interest rate

- Annual interest rate. Maximum interest rate is 20%.

- Number of months remaining

- Total number of months remaining on your original loan.

- Loan term

- Total length, or term, of your original loan in months.

- Loan amount

- The original amount financed with your loan, not to be confused with the remaining balance or principal balance.

- Additional monthly payment

- Your proposed extra payment per month. This payment will be used to reduce your principal balance.

- Current payment

- Monthly principal and interest payment based on your original loan amount, term and interest rate.

- Monthly prepayment amount

Recommended Reading: How To Determine Home Loan Amount Based On Income

How Do You Calculate Monthly Payments On Student Loans

Your monthly payments depend on several factors, including the interest rate on your loans, your loan term, and your principal loan balance.

Some repayment plans also have fixed monthly payments for example, the minimum payment for most federal student loans on the standard repayment plan is typically $50 per month.

Keep in mind that if you sign up for an income-driven repayment plan, your monthly payments will also be based on your discretionary income.

Tip:

How Do I Pay Off My Student Loans Early

Kudos for asking this question! The fastest way to pay off your student loans is with the debt snowball. Heres how it works:

Step 1: List all your debts from smallest to largest, regardless of interest rate.

Step 2: Make minimum payments on all your debts except the smallest.

Step 3: Throw as much money as you can on your smallest debt .

Step 4: Repeat until each debt is paid in full and youre debt-free!

When you pay more than your minimum monthly payment, be sure to let your student loan servicer know that you want the extra payment to go toward the principal. Otherwise, they may just put it toward the next months interest.

Recommended Reading: Loans For Federal Employees Only

The Generic Loan Payoff Results Get Generated

Using the information provided in the form, the app calculates the following:

Monthly payment how much youre supposed to pay every month: $542.11

Total months remaining how many months youd have to make the payment to pay off the loan: 300

Total interest payable this is the sum of all interest payments you would pay to payoff the loan: $87,631.54

So effectively, youd pay $87,631 + $75,000 = $162,631 in total.

Till here, its the basic loan repayment math. Next we will explore the impact of two things

There are two fields below the calculated results for that.