Relation Between Lender & Customer:

Capital One personal loans were designed to meet the financial needs of all individuals, including consumers who have bad credit history and have difficulty finding a loan from traditional sources. Capital One is a direct lender, which means that it purchases assets from other banks and then resells them to customers. This direct relationship between lenders and customers has made Capital One of the largest direct lenders in the United States. However, Capital One is not the only direct lender several other banks offer personal loans. So before applying for a loan from Capital One or another direct lender, it is a good idea to do some comparison shopping among different banks.

Lets Get Personal: Understanding How To Get A Personal Loan

The rise of personal loans

Sue is driving her daughter to a follow-up doctorâs visit for a broken leg, thinking about paying her recent medical bills. She asks Siri, “How do I get a personal loan?”

Jack has recently started a small food truck business that sells tacos. Sales are booming, but so are his credit card balances. He wants to take out a personal loan to pay off those looming bills and consolidate his debt but isnât sure where to start.

If you, like Sue and Jack, have heard of personal loans but find yourself Googling “how to get a personal loan from a bank,” youâre not alone. Many Americans have researched and taken out personal loans recently.1 The number of personal loans rose from 16.9 million to 19.2 million from 2017 to 2018.1 If you think thatâs a lot of dollars floating around, youâre right. The total balance for all personal loans grew from $102 billion at the beginning of 2017 to $120 billion at the beginning of 2018.1

What is an installment loan?

Sometimes personal loans are referred to as an installment loan, but the two terms really mean the same thing. Personal loans can be used for a lot of different thingsâthatâs part of the beauty.

To get a personal loan, youâll first need to apply for one from a bank or online financial company. Not everyone who applies will qualify, but if you do, the institution may lend you a certain amount, such as $10,000. Then you pay it back during a set amount of time.

Collateral and personal loans

Determine How Much Car You Can Afford

When figuring out how much car you can afford, it might be tempting to think only about the monthly loan payment.

But a car is a large, potentially long-lasting purchase. So itâs a good idea to think about other costs, too, such as taxes and fees. Learning how to avoid monthly payment mistakes could help as well.

Debt-to-income ratio could also affect loan offers. The Consumer Financial Protection Bureau has more information, including quick lessons on how to calculate your debt-to-income ratio and why 43% is an important figure to remember.

There are online tools and auto loan calculators that can help you estimate monthly payments. And donât forget things like gas, maintenance and insurance. Considering everything could provide a better idea of the total costs of owning a car.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Travel And Retail Benefits

- No Capital One cards charge foreign transaction fees, giving you a savings of 3% to 5% per foreign transaction.

- Capital One will automatically monitor your transactions for suspicious activity, like excessive tips or duplicate charges. Also, you can lock and unlock your card instantly through the app.

Replies To Capital One Auto Loan Application Status

Register your Lasting Power of Attorney with NationwideLasting power of attorney MyLawyer

House /Flat / Apartment No. or Name Repairs and Renovation Please note that insurance cover is optional for the purpose of the loan application andRental Reference Letter Home Loan Experts

The All New Powerful Windows 8 Task Manager How To Disable Annoying Adobe Auto-Update. Go to Control Panel -> Add/Remove Programs 2. Uninstall Adobe Reader 3.Remove Adobe Application Manager Start Up from Native

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Applying For Private Student Loans

Applying for a private student loan can be similar to the process of applying for a car loan or a personal loan. But remember, sometimes a co-signer is required.

While federal student loans might be based on financial need, private loans are different. Theyâre based on credit history. Having a co-signer who has good credit may increase your chances for approval. It may also help get you a better interest rate.

There are numerous variables to consider when shopping for a private loanâinterest rates, loan protection, payment plans and lender reputations. Comparing loan offers and talking to an expert can help you figure out whatâs best for you.

Getting Into The Details

Hereâs what to expect with these Capital One small business loans.

You can apply for a Capital One installment loan starting at $10,000 for a loan amount. Your business installment loan will come with a term of up to 5 years in length. And again, Capital One doesnât set a range of interest rates on their installment loan. The rate you get depends on the loan amount, the loan term, your creditworthiness, and your established relationship with the bank.

Capital One considers their small business installment loan the perfect fit for business owners who want to make big capital investments. So if you need to consolidate debt, significantly expand your operations, or purchase long-term assets, these Capital One business loans might work for you.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Capital One Auto Loan Requirements

Capital One auto loans are only available at dealerships, and only certain dealerships. While this lender does have a wide array of dealers available, there’s no option for other financing for private party purchases, and could limit your ability to purchase from some independent dealerships. Information on dealers that work with this lender is available on Capital One’s website, and is worth checking out in advance if you want to work with a specific dealership or find a specific vehicle.

Other requirements include:

- A minimum income between $1,500 and $1,800 a month, depending on credit

- A minimum financing amount of $4,000

- Residency in a US state other than Alaska or Hawaii

- Used vehicles must be model year 2011 or newer and have less than 120,000 miles. However, Capital One states that financing may be available for vehicles model year 2009 or newer and with 150,000 miles.

How Much Do I Need

The first step in choosing a personal loan is knowing how much you need. The smallest personal loan sizes begin at around $500, but most lenders offer a minimum of $1,000 to $2,000. If you need less than $500, it might be easier to save up extra cash in advance, or borrow the money from a friend or family member if you’re in a pinch.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

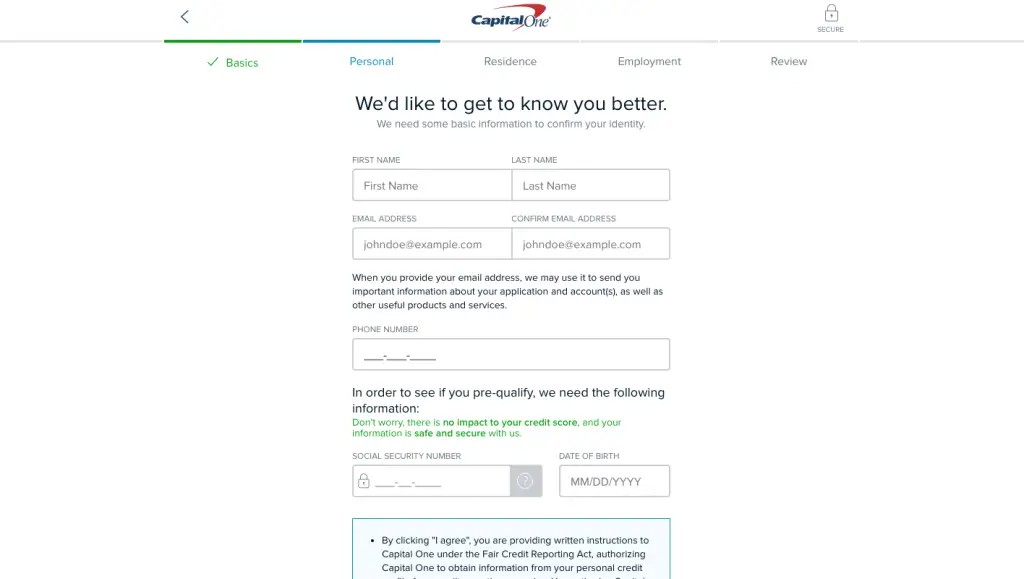

Qualifying For A Personal Loan

Letâs say you want to apply for a personal loan. How does a lender decide whether you qualify?

Keep in mind that every lenderâs process may be slightly different. But here are a few things that might be part of a personal loan application:

- Remember, the CFPB says a higher credit score usually makes it easier to get a loan and could also help you get a better interest rate. Factors that can affect your credit scores include your credit history, , credit mix, credit age, new credit applications and total debt.

- Proof of employment: Lenders may want to verify that youâre employed. They might request your length of time on the job as well.

- Proof of income: Lenders may want to verify how much income you make by requesting your pay stubs or bank statements.

- Debt-to-income ratio: Simply put, this is how much debt you haveâwhat you oweâcompared with how much income you haveâwhat you earn. Your total debt might include things like student loans and car loans in addition to credit card balances.

To keep an eye on where your credit stands, you may want to check your credit report regularly. Doing so could give you an idea about your potential creditworthiness.

Find Out What To Expect When Shopping And Applying For An Auto Loan

Buying a car is a big decision. And it can be an exciting one, too. But figuring out how youâre going to finance a car and how to get an auto loan can feel complicated for anyoneâespecially if youâre a first-time buyer.

Here are a few things to know about how to get a loan for a car and what you should do before you apply.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Who Should Get A Personal Loan

One of the great things about personal loans is that they can be used for lots of different expenses. Here are some common reasons why people might consider getting a personal loan:

- Fast cash for financial emergencies: A personal loan can be helpful when you have unexpected medical expenses, for example.

- Consolidating high-interest debt: You might be able to consolidate some debt by combining high-interest loans into a single personal loan with a lower interest rate. The added bonus is that youâll only need to make one monthly payment rather than multiple ones.

- Big-ticket purchases: If you want a boat or a big-screen TV, a personal loan may be an option. A second option is to save for the item and buy it with cash. It might help to ask yourself, âIs this a need or a want?â and then make your decision from there.

- Home upgrades: Need to make improvements to your homeâs electrical or plumbing system? A personal loan might be one way to fund those and other home upgrades.

If you apply for a personal loan, be sure you understand your interest rate and loan terms before you accept an offer. Itâs also a good idea to pay attention to how much you borrowâand have a plan for paying back the loan. Talking to a financial expert for their advice can be helpful, too.

Capital One Personal Loans

A Capital One personal loan is an unsecured loan that offers fixed payments and a fixed payment schedule. The money can be used for just about any purpose, such as consolidating other debts, home improvements, paying for tuition, etc. A capital one personal loan offers many benefits, and possibly the most attractive of these is the fact that there are no applications fees, no origination fees, and no closing costs.

However, it is especially important to note that an individual will only ever be considered for a Capital One personal loan if they have received an offer through the mail, have not applied for a Capital One personal loan within the last 90 days, and are not currently delinquent or have defaulted on any Capital One account in the previous year.

A potential borrower will not need to provide any collateral to be approved for a Capital One personal loan, but they will need to be of good credit standing, and therefore applicants with bad credit or a history of missed and late payments are unlikely to qualify. Therefore, it is advisable for an applicant to check their FICO credit score prior to applying for a loan.

If for any reason, an applicant changes their mind once they have been approved, they simply need to refrain from cashing their loan check. No Capital One personal loan account will be activated unless the loan check is cashed within a 30 day period of approval.

Recommended Reading: Usaa Car Loan Reviews

Is Capital One Good For Car Loans

In addition to credit cards, Capital One is also a great source of funding for a new or used automobile purchase. Capital One will also refinance an existing auto loan in some states. And all this business can be quickly and easily conducted through the Auto Navigator system, available on the Capital One website.

Benefits of using Capital One for your car loan include:

- Prequalification through a soft credit check that wont show up on your credit history

- Co-applicants allowed

Typical auto-related loan amounts from Capital One are in the range of $7.5K to $50K, with minimum monthly payments ranging somewhere between $1,500 and $1800 depending on credit.

The vehicle in question must be no more than seven years old, however, and Capital One doesnt disclose maximum vehicle mileage, nor do they disclose the maximum loan-to-value ratio.

$10000 Personal Loans: How To Qualify For $10k Fast

There are a few types of lenders that offer $10,000 personal loans, including online lenders, banks, and credit unions.

Whether you need to consolidate credit card debt, remodel your bathroom, or cover another large expense, a personal loan might be a good choice. If you decide to take out a loan such as a $10,000 personal loan be sure to carefully consider your lender options to find a loan that best suits your needs.

Heres what you should know before getting a $10,000 personal loan.

Where to get a $10,000 personal loan

Here are a few types of lenders that offer $10,000 personal loans:

Online lenders

An online lender is one of the most convenient options when it comes to getting a personal loan. These types of lenders provide both large and small personal loans and often provide competitive rates to borrowers who qualify.

The time to fund for online loans is usually one week or less though some lenders will fund loans as soon as the same or next business day after approval. This could make online lenders one of the best options if you need a fast personal loan.

Before taking out a personal loan, make sure to consider as many lenders as you can to find the right loan for you. You can compare your prequalified rates from Credibles partner lenders in the table below in just two minutes.

Banks and credit unions

How to apply for a $10,000 personal loan

If youre ready to get a $10,000 personal loan, follow these three steps:

You May Like: Suntrust Car Loan Rates

Can I Afford The Monthly Payment

When you apply for a personal loan, you have the opportunity to choose which repayment plan works best for your income level and cash flow. Lenders will sometimes provide an incentive for using autopay, lowering your APR by 0.25% or 0.50%.

Some people prefer to make their monthly payments as low as possible, so they choose to pay back their loan over several months or years. Others prefer to pay their loan off as quickly as possible, so they choose the highest monthly payment.

Choosing a low monthly payment and a long repayment term often comes with the highest interest rates. It might not seem like it because your monthly payments are so much smaller, but you actually end up paying more for the loan over its lifetime.

As a general rule, borrowers should aim to spend no more than 35% to 43% on debt, including mortgages, car loans and personal loan payments. So if your monthly take home pay is $4,000, for instance, you should ideally keep all total debt obligations at, or under $1,720 each month.

Mortgage lenders in particular are known for denying loans to people with debt-to-income ratios higher than 43%, but personal loan lenders tend to be a bit more forgiving especially if you have a good credit score and proof of income. If you think you can temporarily handle higher payments in order to save a lot on interest, you may be able to stretch this ratio a bit to take on a higher monthly payment.

Benefits Of The Capital One Travel Rewards Program

The Capital One travel rewards program offers a decent amount of flexibility when it comes to earning miles. Capital One offers the Venture Rewards and VentureOne Rewards as travel card options. Seeing as they arent co-branded cards, or affiliated with certain hotels or airlines, you wont be limited to one brand. Plus, youll earn a flat rewards rate for every purchase no rotating bonus categories, no problem.

If you are interested in transferring your points, Capital One offers many miles transfer partners. Here is a list of some of the airline transfer partners:

- Aeromexico

- Singapore KrisFlyer

Here are a few other perks:

- You can redeem miles for travel, gift cards or as a statement credit for travel booked in the past 90 days on your Capital One card.

- Redemption also includes spending on Airbnb.

Lets break down Capital Ones travel cards, the Venture and the VentureOne using a few examples:

Also Check: Usaa Auto Loans

Capital First Personal Loan Faqs

1. What are my loan limits?

Your personal loan limit would be determined by your income and repayment capacity. Capital First offers two types of personal loans. They are Personal loan and Quick Loan.

2. Can my spouse income be included for calculating the loan amount?

Yes, your spouse’s income can be included provided he/she guarantees the loan or the loan is taken jointly.

3. Do I have to pledge some form of security?

In some cases, security is required.

4. What is the repayment schedule like?

The minimum amount that you are expected to pay every month is the EMI. You are allowed to pay more than the EMI if you wish to, and we do not charge any prepayment penalty.

5. What is EMI?

EMI stands for Equated Monthly Instalments. This instalment comprises both principal and interest components. Use the EMI calculator to find out your monthly payments based on the loan amount, the rate of interest and the repayment period. Choose the combination that best meets your financial resources and requirements.

6. What is the processing fee? Are there any other charges?

There is 1.5% processing fee for Personal loan.

7. Do I have the option of choosing a fixed or floating rate for the loan?

8. How does Capital First Personal loan compare with those offered by other banks?

9.How can I apply for the Capital First personal loan?

You can either apply online or visit the nearest Capital First loan centre for a personal loan.

There are no pre-payment charges levied towards the personal loan.