Things You Should Know About The Citizens Bank Student Loan Refinance Option

- 8 Things You Should Know About the Citizens Bank Student Loan Refinance Option

Are you looking to refinance your student loans? If youre considering Citizens Banks student loan refinancing, read on as we explore everything you need to know about this option.

Citizens Bank is part of the Citizens Financial Group, one of the nations oldest and largest financial institutions. The company was founded in 1828 and is headquartered in Providence, Rhode Island. The institution offers a broad range of retail and commercial banking products and services to individuals, small businesses, and companies in almost every industry.

Citizens Banks reliability and trust status earned from almost 200 years of service is one of its most attractive features. The bank has approximately 1,000 branches in 11 states in the New England, Mid-Atlantic, and Midwest regions. Citizens also provides an integrated experience that includes mobile and online banking.

Student Loans For International Students

Citizens Bank student loans reviews often mention that they are the best option for international students and non-U.S. residents.

Theyre consistently rated a top option because they offer private student loans to international students as long as they apply with a qualifying cosigner. This cosigner needs to have good credit, income, and be either a U.S. citizen or permanent resident. This is a unique feature of Citizens Bank which many other lenders do not offer.

Citizens Bank Student Loans Review: Better Than Loans 2022

Do you have a great handle on personal finance but no credit history to back it up? With Citizens Bank student loans, its possible to refinance your student loans to a more affordable interest rate.

Citizens Bank provides qualified borrowers with a unique student loan product at competitive interest rates. When it comes to private student loans, Citizens Bank is far and away the most innovative option.

What follows are the essentials for understanding Citizens Banks student loan refinancing options.

Variable APR: 4.40% to 12.72%

Fixed Rates: 4.74% to 12.18%

Loan Amounts: $1,000 minimum

Citizens Bank, now shortened to Citizens, is among the largest commercial banks in the United States. The Providence, Rhode Island-based company has over 900 locations nationwide and provides student loans to students from coast to coast.

Students at all levels of education can benefit from Citizens Banks student loan services, as the bank originates both private and federal student loans and facilitates refinancing. Citizens are one of the only refinancing lenders that will work with borrowers who have left school without a degree.

No up-front costs are associated with a Citizens Loan, including application processing, underwriting, or funding.

You May Like: Phone Number For Caliber Home Loans

Noteworthy Perks And Features

Citizens has several standout features:

- Loyalty discount: If you or your co-signer are a Citizens Bank customer with an existing checking, savings or loan account, you can qualify for a 0.25% interest rate discount. However, Citizens Bank checking and savings accounts are only available to residents of Connecticut, Delaware, Florida, Massachusetts, Maryland, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Virginia and Vermont.

- Autopay discount: When you sign up for automatic payments, you receive a 0.25% interest rate discount. This discount can be combined with the loyalty discount, reducing your interest rate by up to 0.50%.

- Multiyear approval: When you apply, Citizens Bank will determine your eligibility for future loans. If you qualify, you can request additional funding during your next academic year without having to fill out another application.

- Hardship forbearance: If you or your co-signer is dealing with financial issues, you can request a hardship forbearance from Citizens. If your request is approved, you can temporarily pause your payments.

Citizens Bank Student Loan Refinance Review

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Student Loan Refinance: Earnest, Credible, SoFi, Citizens Bank, College Ave Student Loans, ELFI Education Loan Finance, Laurel Road, Splash Financial, PenFed Student Loan Refinancing , and Lend-Grow-Inc.

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

For example, when company ranking is subjective our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don’t click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process,

Recommended Reading: How Can I Get An Auto Loan

Are Citizens Bank Student Loans Right For You

The best private student loans carry the lowest interest rates but dont stop there. They also provide additional support and rewards that you might find useful in the short term or years into repayment.

Citizens Bank student loans carry attractive APRs, few fees and a pair of valuable rate discounts. The lender also stands out for its multiyear approval benefit as well as a nice variety of in-school repayment plans.

On the downside, Citizens Bank could improve by clearly outlining its repayment protections and shorten the time required to release a cosigner.

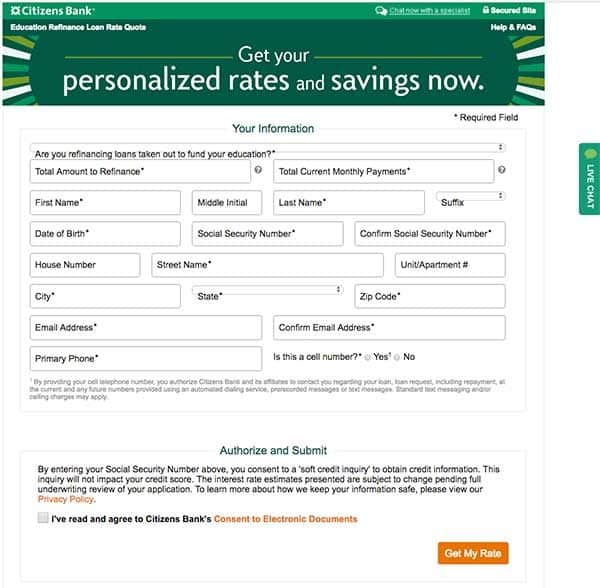

Because Citizens Bank also lacks a prequalification process, its wise to revisit the lender once youve already shopped around and are ready to submit to a hard credit check. If youre not yet at that point, visit our private student loan marketplace to learn about more borrowing options.

Citizens Bank Student Loan Review: Low Rates Many Repayment Options

Edited byHow Student Loan Hero Gets Paid

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Bottom line: Were here for you. So please learn all you can, email us with any questions, and feel free to visit or not visit any of the loan providers on our site. Read less

Don’t Miss: Can I Refinance My Parent Plus Loan

Tips For Comparing Student Loan Refinance Lenders

Since the goal of refinancing is to save money on interest, youll likely want to choose the lender that offers you the lowest rate you qualify for. Variable rates tend to be lower than fixed rates, but they could go up in the future only opt for a variable rate if you plan to pay off your loan quickly.

Similar to private student loans for those attending school, refinance loans arent required to offer the same consumer protections that federal loans do, such as income-driven repayment plans or forgiveness. But some refinance lenders provide more than the standard 12 months of forbearance throughout the loan term, and/or additional loan modification options for borrowers having difficulty making payments.

Refinancing is typically best for those with strong incomes and job stability. But life is unpredictable. If you think you might need to take a pause from payments or to lower your monthly bill, consider choosing a lender with a more generous forbearance policy.

Also, if you choose to refinance with the help of a co-signer, go with a lender that offers a co-signer release policy so you can take on the full repayment obligation when possible. That will protect your co-signers credit from the negative marks that could occur if you fall behind on payments.

Before Refinancing With Citizens Bank

Before deciding on a student loan refinance lender, compare multiple student loan refinance options to make sure youre getting the best rate you qualify for. In addition to interest rates, compare lenders repayment options and the flexibility they offer borrowers who are struggling to make payments.

Also Check: How Soon Can I Refinance Fha Loan To Conventional

About Citizens Bank Student Loan Refinancing

If you went to college, you likely walked away with student loans. In fact, according to The Institute of College Access and Success, the average graduate left school in 2017 with $28,650 in student loan debt.

Along with that hefty balance, high interest rates on student loans can cause your balance to balloon over time. You could end up owing far more than you originally borrowed.

If youre struggling with student loans, refinancing can help you save money and pay off your debt ahead of schedule. Comparing rates from the best lenders is the number one way to get the best deal. Citizens offers student loan refinancing and can be a smart choice if you want to take charge of your loans. Learn more in our Citizens Bank student loan refinancing review.

Is Refinancing Student Loans With Citizens Bank Right For You

If student loan refinancing is the right measure for your education debt, its wise to shop around for the right bank, credit union or online lender.

And thanks to its low rates and easy-to-use platform, Citizens Bank should be among your options. It could be worthwhile to consider if youre a nongraduate or a noncitizen who hasnt found a refinancing lender elsewhere, or if youve graduated with six figures of student loans.

As you compare Citizens Bank with competitors, however, keep in mind that you must have a strong credit profile or a cosigner with one to qualify. Citizens Bank also might not meet your needs if youre attracted to online lenders with more perks or stronger repayment protections.

To make a thorough comparison, review our recommended lenders in the student loan refinancing marketplace.

| Best student loan refinancing options for |

| Consolidating six figures of student loan debt |

Recommended Reading: How To Find My Mortgage Loan Servicer

How Citizens Bank Student Loans Compare

| citizens bank |

Citizens Bank and Sallie Mae both have five, 10, and 15-year repayment term lengths to choose from. On top of that, Ascent also offers seven, 12, and 20-year repayment lengths.

Of these three lenders, only Citizens Bank offers student loan refinancing.

Each lender has a unique perk designed to entice borrowers to choose them. With Sallie Mae, you get four months of the study service Chegg for free. Chegg offers expert Q& A, and students can submit up to 20 questions per month. You may qualify for a 1% cash-back reward from Ascent that will be paid to you after graduation. Citizens Bank allows multi-year approval, which is detailed above.

Best Student Loan Refinancing Rates

Student loan refinancing rates vary quite a bit. You’ll likely see a rate quoted, but that doesn’t necessarily mean you’ll qualify for the top rate.

To get the best rate, you typically have to have a credit score over 800, a great debt-to-income ratio, and looking to refinance a loan for a period of time of 3 years. Some other requirements may include signing up for autopay , and taking out a variable rate loans.

Right now, the best student loan refinancing rates are 3.99% – 11.87% APR.

Read Also: How Much Interest On House Loan

What To Keep In Mind About Citizens Bank Refinance For Student Loans

Low rates, flexible eligibility requirements and ease of use are all benefits of Citizens Bank student loan refinancing. However, you should also keep the following drawbacks in mind as you shop around.

Relatively high minimum borrowing amount

Citizens Bank student loan refinancing allows you to privately consolidate your federal and/or private education debt but it also requires you have at least five figures of it.

If you have less than $10,000 in student loans to refinance, keep in mind that many top-rated lenders set their minimum borrowing requirement at $5,000. And if your balance is especially low, consider refinancing with LendKey, which sets its threshold at $2,000.

Few student loan refinancing perks

The 16th largest retail bank in the U.S., Citizens Bank has been around since 1828. It allows you to potentially house your personal finances under one roof, offering savings accounts and credit cards as well as personal loans, mortgages and more. If you live close to one of its nearly 1,000 branches, you have the option to hash out your financial plan with a banker.

If those features arent relevant to you, however, you might find competitors more modern perks to be more enticing:

- SoFi offers unemployment protection and career guidance during repayment.

- CommonBond funds the education of an underserved student abroad when you refinance.

- Earnest lets you choose from as many as 180 repayment term options, spanning five to 20 years.

Limited repayment protections

Citizens Bank Student Loan Interest Rates And Fees

Citizens Bank student loans offers both fixed and variable interest rate loans. Fixed rates stay the same for the length of your repayment, so your minimum monthly payment never changes. With variable interest rate loans, the interest rate tends to start out lower than fixed interest rate loans, but the rate will fluctuate over time.

The rate you receive is dependent on a number of factors, such as your creditworthiness and the repayment term you choose. In general, the longer the repayment term, the higher the interest rate.

You can get a lower interest rate through incentive programs. You can qualify for an additional 0.25 percentage point discount by signing up for automatic payments. And, Citizens Bank offers another 0.25 percentage point discount if you already have a checking, savings, money market account, auto loan, or home loan with the company. Please note that youll have to have this account set up before you apply for a student loan, to get the discount. With these two initiatives, you can lower your interest rate by 0.50 percentage points, allowing you to save money.

Citizens Bank student loans have no origination, application, or disbursement fees.

Also Check: How Long To Get Pre Approved For Car Loan

Lender And Bonus Disclosure

All rates listed represent APR range. Commonbond: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

CommonBond Disclosures: Refinancing

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

CommonBond Disclosures: Private, In-School Loans

Student Loan Planner® Disclosures

Refinancing Options For Parents

Citizens Bank also has a refinancing program for parents who are paying for their childrens education. So if you have Parent PLUS loans, you qualify. You need to have been part of the original loan, either as a primary borrower or cosigner, to be eligible to refinance with Citizens Bank student loans.

Also Check: What Is Immediate Repayment Student Loan

How To Qualify For A Citizens Bank Student Loan

To get a loan from Citizens, you must be enrolled with an eligible institution as a full- or half-time student. Loans are available to U.S. residents, permanent citizens and international students that have a friend or family member that is a U.S. citizen or permanent resident and is willing to co-sign the student loan application.

Refinancing Your Student Loans

If you want to tackle your student loans head on, refinancing can be a smart strategy. By refinancing your debt, you can qualify for a lower interest rate, so more of your monthly payment goes toward the principal rather than interest. Over time, you can save thousands of dollars thanks to the lower rate.

While Citizens Bank offers many benefits, theyre not the only lender out there. Its important to take Citizens Bank student loan refi reviews into consideration prior to deciding on your favorite lender. Before submitting your application, make sure you compare offers from multiple student loan refinancing lenders to make sure you get the lowest rates.

Recommended Reading: Loan Agency For Bad Credit

Before Applying For A Citizens Bank Student Loan

Before taking out a Citizens Bank student loan or any other private student loan, exhaust your federal student loan options first. Submit the Free Application for Federal Student Aid, known as the FAFSA, to apply.

Compare your private student loan options to make sure youre getting the best rate you qualify for. In addition to interest rates, look at lenders repayment alternatives and the flexibility they offer to borrowers who struggle to make payments.