Usaa Personal Loans: 2021 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

How To Apply For Financing At Usaa

Once youve joined USAA, you can begin the process of applying for an auto loan. You can apply for a new auto loan, used auto loan or USAA auto refinance loan online by logging into your USAA account. If youre already at the dealer, you can apply by phone via the USAA mobile app.

Youll need to provide some basic information for a purchase loan, including:

- Proof of identity and residency

- Amount of loan and year of car, make and model

- Social Security number

For USAA auto refinancing, youll need to have this information ready when you apply:

- Cars model year and mileage

- 10-day payoff amount

- Loan annual percentage rate

- Loan account number

- Your employer and income

The application takes just a few minutes to complete and once approved, your loan offer is good for up to 45 days. That gives you time to shop around and compare auto loan financing terms and rates from other lenders. Remember, the best way to get the best rate for you is to get several auto loan offers, ideally before you arrive at the dealership.

About Usaa Car Insurance

USAA sells insurance for a wide variety of vehicles: cars, motorcycles, recreational vehicles, boats and classic cars. For members with their pilots license, USAA offers aviation insurance.

Optional insurance coverage types like roadside assistance and rental reimbursement are also available from USAA.

Worried about a rate increase after a car accident? USAA offers accident forgiveness so you wont have to worry about your insurance rate going up after a first-time accident where youre at-fault. To qualify, youll need to be accident-free for five years.

For members who are also Uber or Lyft drivers, USAA provides rideshare insurance coverage.

Don’t Miss: What Is My Monthly Loan Payment

Best For The Most Options: Autopay

- Starting interest rate: 1.99%

AutoPay offers flexible auto loan refinancing with plenty of options for all borrowers and an average savings of $95 per month.

-

Average savings of $95 per month

-

Compare loans from over 20 different lenders

-

Minimum monthly income requirements

AutoPay specializes in auto loan refinancing, so itâs no wonder they offer great deals for many individuals. They often cater to clients who have improved their credit score in the time since they took out their original auto loan, and because of this, they are usually able to offer steeply discounted loans. On their site, you can compare offers for loans from many different lenders without having to fill out more than one application. They also pull your credit with a soft check, which is easy on your credit score and a great option if you are not seriously considering refinancing your loan right this second . AutoPay makes it easy to shop around and often partners with credit unions. The lowest rate offered by AutoPay is 1.99% but this is only available if you have a top-tier credit score. The average rate at Autopay is 5.49%. Knowing your credit score ahead of time makes a big difference in estimating what your APR will be on refinancing a car loan.

Does Usaa Give Auto Loans Bad Credit

Should you apply? USAA offers competitive starting rates with no minimum credit score or income requirements. USAA doesnt offer car loan preapprovals nor does it publicly disclose its maximum loan rates, though you might be able to get an estimate for your rate and monthly payment using the USAA car loan calculator.

Recommended Reading: How To Pay Home Loan Faster

What Does That Mean For You

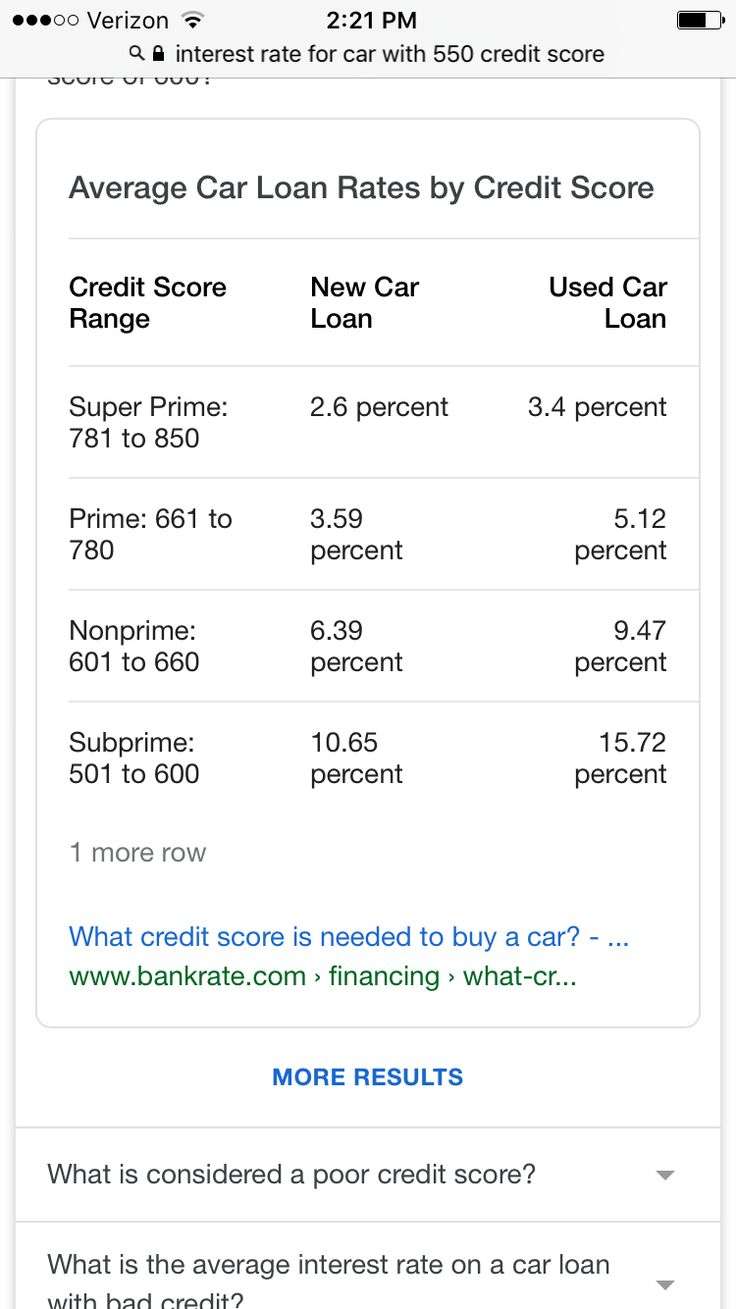

In general, it means that although different lenders use different measures, people with exceptional credit scores may qualify for the lowest rates, while people with lower credit scores will often qualify only for loans with higher rates.

High Credit Score Low Interest Rate Lower Credit Score Higher Interest Rate

Usaas Grade From Collision Repair Professionals: C+

In a survey of collision repair professionals by CRASH Network, USAA earned a C+ grade.

The opinions of auto body professionals are insightful because they see how insurers compare in the use of lower-quality repair parts, whether insurers encourage the use of repair procedures recommended by car makers, and whether insurers have claims processes that lead to quick and satisfactory claims for customers.

You May Like: How Much Do I Pay For Student Loan

Best For Members Of The Military: Usaa

USAA

USAA is a great choice for auto loan refinancing for members of the military and their families, with competitive rates and the option to take your car overseas when deployed, moving, or travelling.

-

No payments for up to 60 days

-

Easy application process

-

Only available to USAA members

-

Borrowers canât prequalify

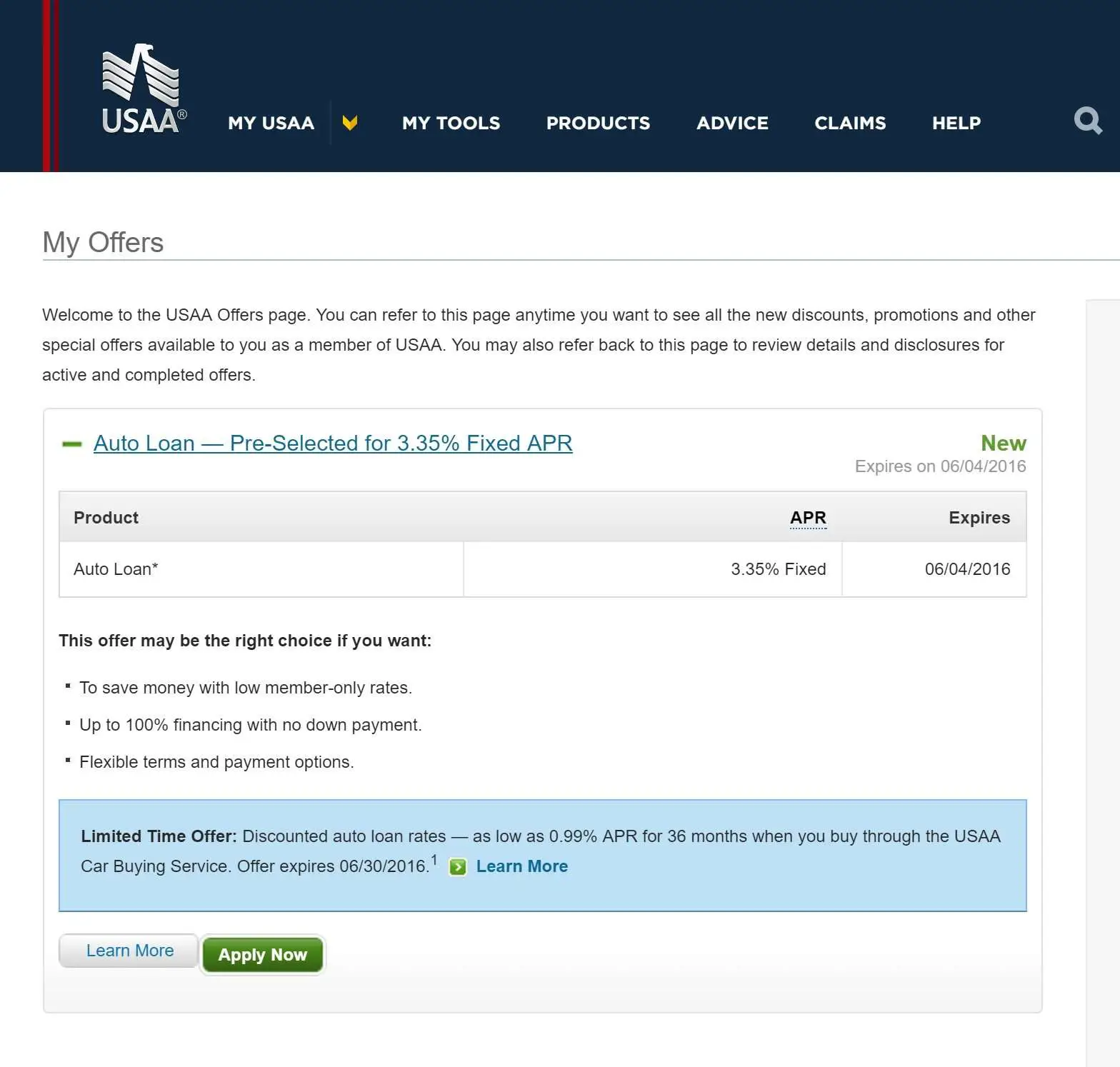

USAA only works with members of the military and their families, but for those who serve our country, this nearly 100-year-old organization offers rates and customer service that is often hard to beat. You wonât have to pay for up to 60 days after you start the loan, giving you time to catch up if you are behind. You can also choose from many of their vehicle protection plans if thatâs something youâd like to add on as well. USAA offers to refinance for up to 60 months, and longer terms are also available. USAA takes the hassle out of refinancing by working directly with your lender. Their rates are stated on their website as being as low as 3.04% APR which is noted as including a discount of .25% for automatic payments. Rates are subject to change without notice and vary based on approved credit and other factors, such as term, model year, and loan amount.

What Is The Lowest Credit Score To Buy A Car

Key Takeaways

- Your credit score is a major factor in whether youll be approved for a car loan.

- Some lenders use specialized credit scores, such as a FICO Auto Score.

- In general, youll need at least prime credit, meaning a credit score of 661 and up, to get a loan at a good interest rate.

29.04.2021

Read Also: Is Jumbo Loan Rates Higher

Usaa Auto Approval Questions

Has anybody recently used USAA’s online application for an auto loan? It seems pretty straight forward but I had a few questions….

1) Assuming I am to be approved for “x” amount, how does that work in terms of shopping with various dealerships? Say I apply for $20,000 but only use $16,000 of that….how does that all work out? What do I take with me to the dealership after approval?

2) I would initially like to apply first without a down payment and hope I would be able to be approved with nothing down. If I am denied for whatever reason, would I be able to re-apply and attempt to put like 10% down or is the first denial pretty much it? Basically, Can I apply without anything down but then go back and put a down payment down if necessary?

3) Any good/bad experiences would be welcome. I’m not sure what to expect and so any information would be greatly appreciated. I plan on applying as soon as I close on my new home on March 19th. Just want to be prepared for everything in terms of applying online with USAA and whether or not that is the ideal move onmy part.

How To Get Approved For A Personal Loan

Once youve decided to apply for a personal loan, youll need to figure out how to get approved for a loan.

The first step towards getting approved is actually applying. When you apply for the loan youll probably do so online or in person. When you apply, youll have to provide identifying and financial information, such as:

- Name

- Proof of income, such as bank statements or pay stubs

- Verification of employment

USAA will use that information to decide whether to offer a loan.

Though it may be a daunting amount of information and paperwork to gather, its important to do it correctly. You want to give the lender a clear picture of your financial situation. The fewer questions the lender has, the better your odds of getting approved for the loan.

You May Like: What Form Is Student Loan Interest Reported On

Apply For A Loan With A Cosigner

If your score is in the nonprime to deep subprime range, you might consider applying for a car loan with a cosigner. A cosigner is someone, such as a family member, who is willing to apply for a loan with you and, ideally, has good to excellent credit. A cosigner shares responsibility for the loan, reducing the lenders risk. Youre more likely to qualify for a loan and get a lower interest rate than if you applied on your own. But if you’re unable to make the loan payments, your cosigner will be stuck with the bill.

What Is The Maximum Auto Loan Term You Can Get With Usaa Auto Loan

USAA auto loan has car loans with terms ranging from 12 to 84 months. Having the option of longer terms — terms can range up to 144 months — allows borrowers to take on larger auto loan amounts while keeping monthly payments more affordable. However, the longer the term of your auto loan, the more interest you will pay.

You May Like: Who Has The Best Student Loan Refinance Rates

Does Usaa Do Bad Credit Auto Loans

USAA offers competitive starting rates with no minimum credit score or income requirements. USAA doesnt offer car loan preapprovals nor does it publicly disclose its maximum loan rates, though you might be able to get an estimate for your rate and monthly payment using the USAA car loan calculator.

Highlights Of Usaa Rv Financing

The biggest advantage for service members seeking an RV loan from USAA is working with a financial organization thats solely military-focused. However, its not the only organization that focuses specifically on military families Navy Federal Credit Union and PenFed Credit Union are two other financial institutions that also focus on the military though USAA had lower starting RV loan rates, as of publication. You may be able to find even lower rates from an online lender such as Lightstream, which offered RV loans starting as low as 4.29%, as of publication.

Other pros of USAA RV financing include:

- No down payment for those who meet its credit requirements.

- Long loan terms, up to 20 years, which may be useful if youre considering a particularly expensive motorhome or other type of RV. This could also be considered a lowlight see below.

Also Check: How To Calculate Loan To Debt Ratio

Apply For Your Auto Loan Refinance

Before you apply for an auto loan refinance, you should make sure that your own finances are in order. You should try to establish a high credit score, low debt to income ratio, and a history of stable income before applying for an auto loan refinance.

In order to apply for an auto loan refinance, there are a few documents youâll need to have on hand. These include personal information like your name, address, and Social Security number, as well as proof of insurance, your current loan and lender information, and your vehicleâs make and model, age, and mileage.

Some lenders may allow you to prequalify and view your loan options before submitting an application. Once you decide on a lender, you can submit your application for an auto refinance loan. In some cases, you could receive funding in as little as one business day.

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to:

Don’t Miss: How To Eliminate Student Loan Debt

What We Love About Usaa Auto Loans

USAA is a popular financial company that has a reputation for great customer service. That reputation holds true with its auto loans. Customers can expect an easy application and strong customer service throughout the borrowing process.

Loans are flexible, with terms as long as 84 months, and have highly competitive rates and fees so borrowers can feel confident that theyre getting a good deal.

Additionally, because USAA was founded by members of the military and is dedicated to serving the military, its also well-equipped for handling the unique circumstances servicemembers face.

One great perk of USAAs auto loans is that if you buy from a USAA certified dealer and find a better deal on a car right after you make your purchase, USAA will refund the difference, acting as a form of purchase protection.

What Else Do Auto Lenders Look At Besides My Credit Score

Auto lenders look at several factors in addition to your credit history and credit score. According to the Consumer Financial Protection Bureau , theyll also consider how much income you have, your existing debt load, the amount of the loan you are applying for, the loan term , your down payment as a percentage of the vehicle value and the type and age of the vehicle you are purchasing.

The most important things car lenders consider when you apply for a loan, however, are your credit score and credit history. You can even get a car loan when you are unemployed, provided you have a down payment and money in the bank, said Nishank Khanna, chief marketing officer at Clarify Capital, a business lending firm in New York City.

Don’t Miss: What Does It Mean To Refinance Your Car Loan

What Credit Score Do I Need To Qualify For A Used Car Loan

Financing a car can seem daunting considering there are different qualifications that you must meet in order to buy a car. Furthermore, different lenders will have different rates and your eligibility can even depend if youre buying a new or used car. But what kind of do you need to buy a used one?

Usaa Tips On How To Establish Credit

To get a USAA loan approval youll need a high credit score. But some people dont have the credit score they need to get a loan. Take a look at the following tips on how you can build credit to increase your score so you have more chances of getting approved for loans.

Become an Authorized User on a Relatives Account

Sometimes you may need help to build credit. If you have a family member that has an excellent , you can become an authorized user on their account if they let you. You dont have to spend money from the card or transfer any funds to be an .

As long as the USAA member pays the card on time and uses it regularly, it will improve your credit score if youre an authorized user on their card. But you have to make sure that the credit score and spending habits of the main cardholder are solid. Find out what the USAA pros and cons are in our review above before becoming a member on someone elses card.

Get a Secured Credit Card

Another easy way to build credit is by opting for a secured credit card. The credit limit on the secured card is equal to the amount of money you put into a savings account. This money is used as collateral in case you cant stick to the repayment terms.

The money cant be withdrawn from your savings account while your credit card is linked to it. With USAA, even if your credit score range is bad you can sign up for a secured credit card because there is no risk to the lender.

Repay Student Loans

Add a Co-Signer to Your Loan Application

Read Also: How To Calculate Mortgage Loan To Value

Usaa Personal Loan Reviews & Transparency

Category Rating: 3.3/5

- Better Business Bureau: USAA is not BBB accredited, and is not rated due to government actions against them. According to the BBB, USAA had to reach a settlement for failing to honor stop-payment requests and failing to complete error investigations. In addition, they had another action taken against them for failing to have an effective risk management program. Both of these cases were settled in January 2019.

- Consumer Financial Protection Bureau: USAA has around 80 complaints filed against their personal loans with the Consumer Financial Protection Bureau. Some reasons for personal loan complaints include USAA charging late fees when they should not have and people having fraudulent accounts opened in their name.

- WalletHub: USAA has an average rating of 3.7/5 from over 6,800 user reviews.

- Transparency: While USAA does openly disclose the terms of their personal loans online, their use of a simple calculator rather than a pre-qualification check makes it more difficult for customers to know the rates they might get. In addition, USAA isnt clear about their minimum credit score or income requirements.

USAA is highly rated by their members, and their personal loans have brought about very few complaints. However, USAA has failed to keep up with some government standards regarding how they operate, which has made its reputation fall with the Better Business Bureau.