How To Get Low

4 minute read July 27, 2022

Interest rates can be the deciding factor when youre choosing a loan. When you borrow money and later begin making loan payments, youll also be paying interest a percentage of your initial loan amount. Getting a higher interest rate will cost you more in the long run, so a lower rate is the preferable loan option.

Lets explore the variables that affect your loans interest rate, then consider some tips for getting a low-interest personal loan.

What Are The Hsbc Personal Loan Fees

Your HSBC personal loan comes with fees and other charges based on the terms and conditions set by HSBC in compliance with the BSP:

- Processing fee: PHP 1,500

- Late payment fee: 36% per annum

- Amendment fee: PHP 500 for any changes in loan details

- Breaking cost: computed upon application or loan pre-termination

- Documentary stamp tax : 0.75% of the loan amount deducted from the loan proceeds

Which Bank Has The Lowest Interest Rate On A Personal Loan

If you have a strong credit score, you can receive the lowest interest rate through LightStream. LightStream has rates as low as 2.49% if you enroll in autopay. Other lenders, like SoFi, PenFed, Wells Fargo, Marcus and U.S. Bank, offer rates as low as 5.99%. Although not as low as LightStream, rates that low still beat out other methods of financing, including credit cards.

You May Like: Sunrise Bank Credit Builder Loan

Comparing Low Interest Loan Options

When you’re weighing up different finance options to make a major purchase like a new car, or your dream holiday, you’ll want to find the most affordable option for your budget and lifestyle. As a lower interest rate means smaller repayments, a low interest personal loan could be one of the cheapest financing options for you.

So that you’re across all the info you’ll need to consider when comparing loans and lenders, we’ve answered all the most common questions we are asked here at Mozo about cheap loans in one easy-to-read guide below, allowing you can make an informed personal loan choice.

What Are Ofw Loans

OFW loans are personal loans specific to the qualifications of Overseas Filipino Workers . Unlike regular loans, it usually provides a bigger loan amount and the requirements are more suited for OFWs.

There are various types of personal loans for OFWs. The products are branded according to the OFW’s profession and current location. These OFW loans are as follows:

- OFW Personal Loan

Also Check: What Loan Can I Afford Calculator

How Can I Use A Personal Loan

You may want to borrow money to pay for a much-needed vacation or a big-ticket life event. With few exceptions, such as using the money to invest or gamble, you can use your personal loan however you see fit.

Many folks take a personal loan to consolidate other debts. The benefits include:

- Lowering your interest expense: A consolidation loan works best when its interest rate is less than that of your other debt.

- Simplifying your finances: Youll reduce the number of monthly payments by consolidating your loans and credit card debt. Youll spend less time making payments and juggling your budget.

- Improving your credit score: Your CUR will improve if you transfer debt from your credit cards to a loan. You should see your credit score improve if you aggressively pay down your consolidated loan balance.

Whatever your reasons for borrowing, its crucial to repay your loan on time and in full. Otherwise, your credit score will decline and make future borrowing more difficult.

What Is A Good Personal Loan Interest Rate

At the time of writing, personal loan rates varied from about 6% to 36%. The range is wide because it must accommodate consumers with every type of credit. Its often a good idea to raise your credit score before applying for a personal loan.

The two most effective ways to boost your credit are to pay your bills on time and reduce your debt. FICO bases 35% of your credit score on your payment history, and payments more than 30 days late can cause significant harm.

Another 30% of your credit score stems from your debt level. While FICO uses credit utilization ratio , lenders also look at your debt-to-income ratio. Reducing debt improves these measures and increases your odds of landing the loan you want.

CUR levels above 30% hurt your score. Paying off your credit card debt enough to get your CUR below 30% can quickly improve your credit score.

The following example shows the CUR computation for a consumer with three credit cards:

Lenders use DTI to evaluate whether you can repay a loan. Here is an example of how the calculation works:

Lenders get nervous when your DTI approaches 43%, but the reviewed personal loan networks may harbor lenders that can tolerate a higher ratio.

Recommended Reading: What Are The Different Types Of Loan

Kotak Mahindra Bank Personal Loan Interest Rates

If you are looking for a quick loan approval with 100% digitized process then Kotak Mahindra Personal Loan can be the right fit for you. With interest rates starting from 10.75% that can go upto a full blown 24%, Kotak Mahindra bank offers a credible way out to sort out your financial requirement. For a period of 5 yrs, a Rs 1 lakh loan can give you an EMI of Rs 2162

How Are Mortgage Rates Determined

There are seven primary factors that determine your mortgage rate, including:

What is a mortgage?

A mortgage is a loan from a bank or another lending institution that helps you refinance or buy a home. The lender provides funds on your behalf secured by a lien on your home, and you agree to repay the loan plus interest. If you stop making monthly payments, your lender can repossess your home through the foreclosure process and sell it to recover their money.

How does the Federal Reserve impact mortgage rates?

The Federal Reserves monetary policy directly affects adjustable-rate mortgages, as they are tied to an index that moves up and down with the broader economy. The Feds policy indirectly impacts fixed-rate mortgages, which typically correlate with the 10-year U.S. Treasury bond yield.

What are the different types of mortgages?

Read Also: What Is An All In One Loan

Who Has The Lowest Interest Rates On A Personal Loan

Here are our best picks, organized from the lowest to highest starting rates on personal loans.

Whats the difference between my interest rate and APR?

Best For Smaller Loans

Who’s this for? PenFed is a federal credit union that offers membership to the general public and provides a number of personal loan options for debt consolidation, home improvement, medical expenses, auto financing and more.

While most lenders have a $1,000 minimum for loans, you can get a $600 loan from PenFed with terms ranging from one to five years. You don’t need to be a member to apply, but you will need to sign up for a PenFed membership and keep $5 in a qualifying savings account to receive your funds.

While PenFed loans are a good option for smaller amounts, one drawback is that funds come in the form of a paper check. If there is a PenFed location near you, you can pick up your check directly from the bank. However, if you don’t live close to a branch, you have to pay for expedited shipping to get your check the next day.

Also Check: How Do I Find Who Has My Student Loan

Faqs On Personal Loan

A Personal loan is a type of unsecured loan that you can borrow from a bank or financial institution if you require funds to pay for your financial needs.

You borrow a loan when you require credit. Once you submit your loan application to a lender for a personal loan, the lender verifies and approves it. Post this, the loan amount is disbursed into your bank account. Once you receive the loan amount, you will need to repay the lender via EMIs for the loan repayment tenure.

The maximum amount of loan depends on your monthly income. In India, there are lenders who offer up to Rs.40 lakh.

If you happen to get some extra money, you can pay it towards your loan even before the EMIs are due. This is called a prepayment. Every prepayment you make goes towards reducing the outstanding principal component of your loan. And since the principal reduces, your interest cost will also reduce. Also, your tenure gets shortened this way, helping you pay off the loan ahead of time.

Usually, banks will require your CIBIL score to be above 720 to provide a personal loan. In case your credit score is less, your application may be rejected or the personal loan will be provided with high interest rates.

Is There A Catch With Cheap Low Rate Personal Loans

When you compare low interest rate personal loans its important to look at the loan as a whole product package, rather than just the interest rate. Comparing your options by the effective interest rate rather than the advertised rate can also give you a better idea of the true cost of the loan, as this incorporates fees and charges.

You can also use a personal loan calculator to see if your repayments will be manageable on your budget.

Recommended Reading: Can I Refinance An Upside Down Car Loan

What Is The Average Apr Of A Personal Loan With Low Interest Rates

According to the most current Federal Reserve System data, the average interest rate for personal loans in the United States is 9.41%. However, this is an average rate, not the lowest in the country. You may be eligible for loans with interest rates as low as 2.49%, but only if you have a good credit score.

Best For People Without A Credit History

Who’s this for? Upstart can be a solid option for those with no credit history. The company considers factors beyond your credit when evaluating your application, such as your work experience and education history.

You can borrow as little as $1,000, which also makes Upstart a good choice if you need a smaller loan.

Upstart lets you check the interest rate you’ll get before applying without any impact to your credit score. According to Upstart, 99% of personal loan funds are sent one business day after signing. Note, however, that the origination fees could get somewhat expensive, depending on the terms of your loan.

You May Like: How To Get Federal Student Loans

What Do People Think About Lendingtree

Shereen Cantu

Super quick and easy. I signed up and applied for a loan Friday and money was in my account Tuesday morning. Probably wouldve been sooner if not for the weekend. This will help me so much in consolidating a few bills while being a lower payment per month.

Gary Morris

I was very apprehensive at first going online to search for a loan. But with LendingTree everything went smoothly and all the paperwork was very simple to fill out. Thank you very much for helping us out!

Jean Conroy

This was the most enjoyable loan application and finalization I have ever been exposed to. Great company. I was in a bind and they came thru with flying colors and extremely quickly. Website was easy to follow as were the instructions and emails.

Vince Hawkins

I was able to close the deal at home on my cellphone. I felt comfortable and my shopping was guided for me. So easy. Thanks

Lavone Dickson

It was quick and easy. The loan person was clear and very informative. Everything went exactly the way she said it would. THANK YOU!

How Can I Get A Low Interest Rate Personal Loan

The easiest way to obtain a low interest personal loan is through a lender-finding network such as those in this review. These networks are efficient because you can get multiple loan offers through a single request.

The lender-finding services prequalify you for a loan without a credit check, which means loan requests wont affect your credit score. But direct lenders on the loan networks customarily perform hard credit checks unless they explicitly state otherwise. A hard credit check can reduce your credit score by a few points and remain on your credit reports for two years.

To prequalify for a network loan, you must meet specific requirements:

- Be 18+ years old

- Be a US citizen or permanent resident

- Have regular income

- Have an active online banking or credit union account in your name

- Provide a valid email address and phone number

Using the online loan-finding services is easy:

Don’t Miss: Can You Refinance Your Car Loan With The Same Company

Understand Your Interest Rate

Your interest rate just might be the most important factor on your small business loan. The lower the rate, the better. Your interest rate is a percentage of your loan that’s charged over your loan’s life. Lenders charge an interest rate to make a profit and to offset the risk of loaning the money in the first place.

How To Get A Personal Loan With Low Interest Rates

While the process varies by lender, follow these general steps to apply for a personal loan:

1. Check your credit score.Check your credit score for free through your credit card issuer or another website that offers free scores. This will give you an understanding of your creditworthiness and your qualification chances. While you can qualify for a low-interest personal loan with a credit score as low as 650, you wont receive the lowest possible rates a score of at least 720 will yield the most favorable terms.

2. If necessary, take steps to improve your credit score. If your score falls below 650 or you want to boost your score to receive the best terms possible, take time to improve your score before applying, such as lowering your credit usage or paying off unpaid debts.

3. Determine how much you need to borrow. Once you check your credit score, calculate how much money you want to borrow. Remember, though, youll receive your money as a lump sum, and youll have to pay interest on the entire amountso only borrow what you need.

4. Shop around for the best terms and interest rates. Many lenders will let you prequalify prior to submitting your application, which lets you see the terms you would receive with just a soft credit inquiry. Prequalifying lets you shop around for the best rates without hurting your credit score.

| $13,563.02 |

You May Like: What Is An Ida Loan

How To Get A Personal Loan With A Low Interest Rate In The Philippines

A personal loan with a low interest rate is useful for funding any emergency expenses or projects. It can also help you consolidate your debt or fund your childs education. However, do your research and thoroughly evaluate your own finances before getting one.

Here are a few steps to consider when getting a personal loan at a low interest rate:

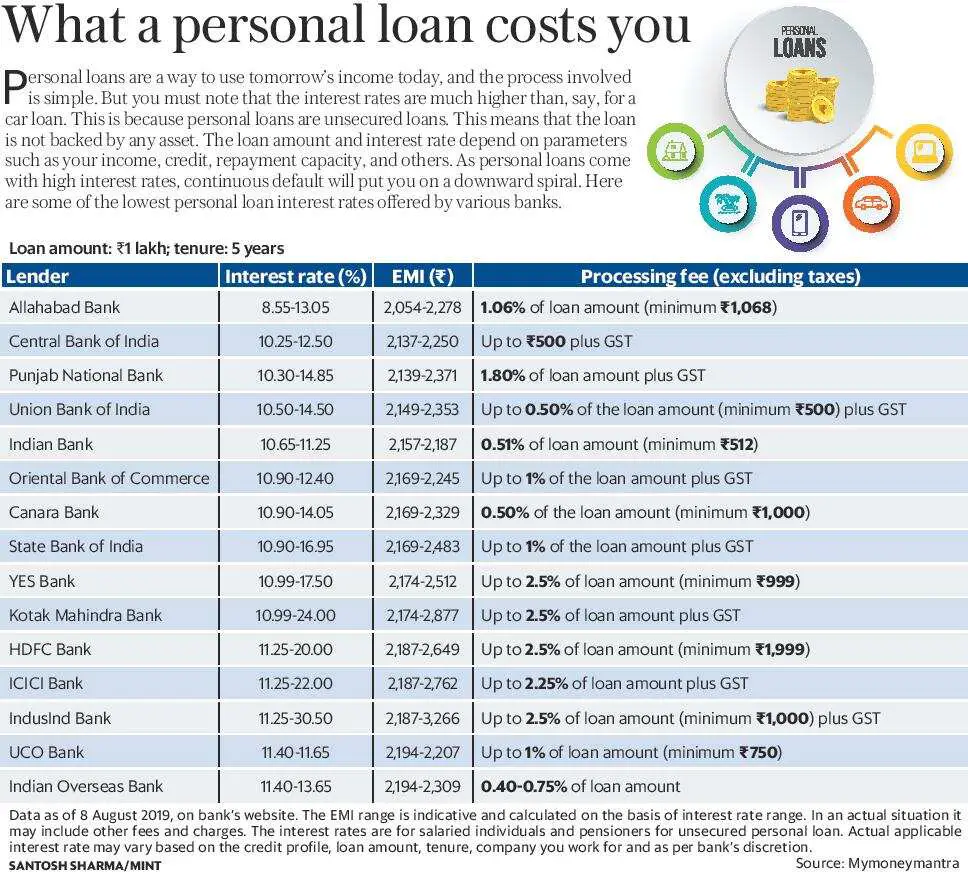

Which Is The Best Bank To Get Better Personal Loan Interest Rates

When you are going for a Personal Loan then the most important thing that keeps running through your mind is whether you will get a decent interest or how much the EMI for a 5 year term is going to be. To answer this question, let’s take a look at some of the banks who are offering personal loans at very low interest rates.

Also Check: How Much Business Loan I Can Get