What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers;and real estate agents;would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors;found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Be Prepared For Closing Costs

A long list of small closing costs can add up quickly. But dont despair. Your mortgage loan officer can help you figure out the best way to cover these costs. You may even be able to roll them into your mortgage.

Early in the loan process, youll get an itemized list of these costs. It will include standard expenses such as appraisal fees, title fees and the first year of your home insurance premium payments. Depending on your specific loan and state requirements, there will be other costs as well.

How Much House Can I Afford Rule Of Thumb

When deciding how much house you can afford, the general rule of thumb is known as the 28/36% rule. This rule dictates that individuals should avoid spending beyond 28% of their gross monthly income on housing expenses and 36% on their total monthly debt payments.

The highest possible front-end ratio, represented by the 28%, is the largest percentage of your income that should be allotted to mortgage payments. And 36% represents the highest possible back-end ratio, also referred to as the debt-to-income ratio, which you now know is the percentage of your income thats set aside to pay off debt.

Before asking how much house can I afford, its necessary to have a firm grasp of what falls into the category of housing expenses, the real cost of buying a home. These costs are the various components of your monthly mortgage payment, which are often referred to as the PITIA:

- Principal: This portion of the payment goes toward paying off the money that was borrowed to purchase the house.

- Interest: This portion is the fee that the lender charges you for borrowing the money to purchase the house.

- Taxes: This portion is the property taxes you pay to the local government based on the value of your house. These real estate taxes are used to pay for local infrastructure, improvements, municipal salaries, etc.

/ 100 = Maximum Total Monthly Debt Payments

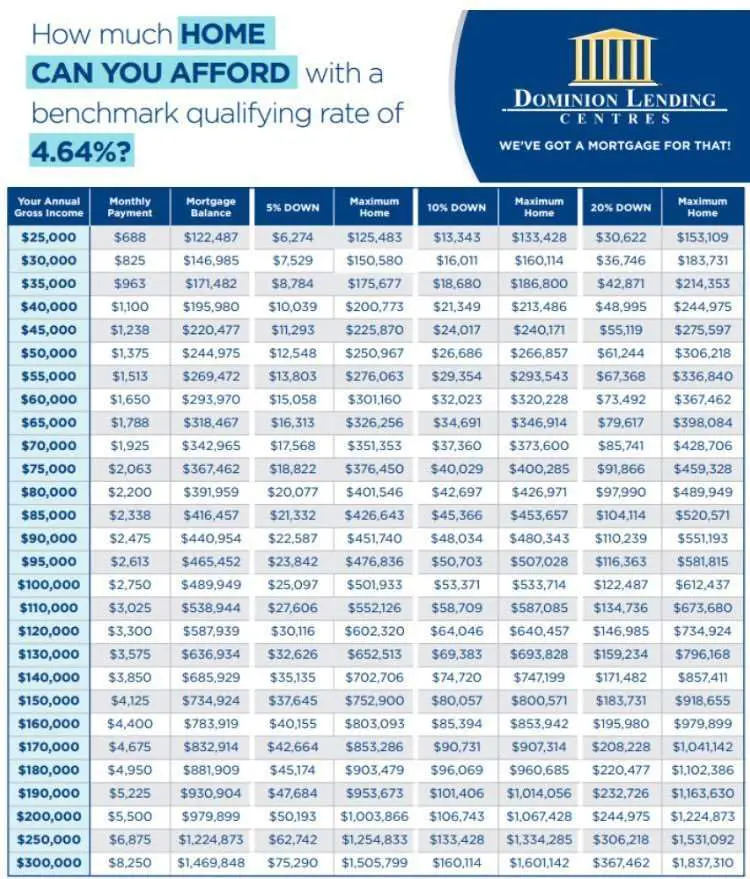

The chart below illustrates the maximum monthly mortgage payment you could afford based on different income levels.

Recommended Reading: What Is Fha And Conventional Loan

How Big A Mortgage Can I Get

Currency

Use this calculator to determine how much you could borrow for your mortgage. Intended as a guide only, other costs will likely be involved.

Note that since the financial crisis most mortgage providers require a minimum 10% deposit. For the most competitive rates a deposit of 20% is usually required, making it extremely difficult for first home buyers to access the best mortgage rates.

Javascript is required.

2. monthly payments on car loans, personal loans and credit card debt.

What Kind Of Mortgage Is Right For Me

The answer to this question is totally dependent on your present situation. To determine what kind of mortgage is right for you, you would need to realistically consider your financial situation. Some important questions you would need to answer include whether you are able to make a down payment, the length of time you would spend in the house, the state of things with your annual salary for the period of the mortgage as well as your credit history.

Don’t Miss: What Is The Commitment Fee On Mortgage Loan

How Much Home You Can Afford With Different Loan Types

As mentioned, the examples above are based on a conventional loan with a 20% down payment and an excellent credit score. However, to obtain a conventional loan, you must have the ability to make a substantial down payment if less than 20%, you usually must pay for PMI and a credit score of at least 620. Depending on your circumstances, you may find that a conventional loan isnt right for you due to limited savings or mediocre credit.

If this is the case, you should consider a government-backed mortgage. Government-backed loans, such as FHA and VA loans, are good alternatives, as they provide borrowers with lower eligibility requirements and some relief when it comes to down payments. However, you must be eligible for these loans to reap the benefits.

How Does The Down Payment Affect How Much House I Can Afford

Its crucial to consider your down payment before determining how much house you can afford because the money you put down will drain a considerable amount of your savings. If you use up your savings on a down payment and have earmarked too much of your income for paying off your mortgage and other debts, youll find yourself in serious financial trouble should any emergencies or unforeseen expenses occur.

The higher the down payment you can make, the more equity youll have in your home after you purchase it. Lets take a look at how the size of your down payment would impact your home equity if you were purchasing a home for $450,000.

Although down payments can be lower than 20% of the purchasing price, you should really try to stay as close to that number as possible, especially if youre in the market for a conventional loan. You dont want to get stuck paying PMI fees. But more importantly, you need to remember that the less you put down now, the more youll have to spend each month on your mortgage payments and the less equity youll have in your home.

You May Like: Is Student Loan Refinancing Worth It

How Much House Can I Afford With An Fha Loan

are available to homebuyers with credit scores of 500 or more, and can help you get into a home with less money down. If your credit score is below 580, youll need to put down 10 percent of the purchase price. If your score is 580 or higher, you can put down as little as 3.5 percent.

Youll still need to crunch all the other numbers, but these lower downpayment thresholds should be a shot in the arm for your budget.

Mortgage Qualification Benchmarks Plus A Third Ratio Most Home Buyers Fail To Consider

Mortgage Qualifying Benchmarks

If you’ve used a mortgage qualifier calculator on another website, you have probably seen the two standard benchmarks used to determine how much of a mortgage you qualify for. They are the PITI to income ratio and the debt to income ratio. In case you’re not familiar with how these ratios are arrived at, or how they impact your home loan qualification, let’s discuss each of them separately.

PITI to Income Ratio

The PITI to income ratio is one of two common formulas used to determine how much a lender is willing to borrow to a home buyer. PITI stands for Principal, Interest, Tax, and Insurance, which are the four parts that make up the typical mortgage payment. A fifth part, Private Mortgage Insurance may also be included in the PITI figure where it applies .

The PITI to income ratio is calculated by dividing the total mortgage payment by your gross monthly income. Since most home lenders only allow a maximum PITI to income ratio of 28% , you can determine your maximum PITI mortgage payment by multiplying your gross monthly household income by 28%. So if your gross monthly household income is $4,000, the most your monthly PITI mortgage payment can be is $1,120 .

Debt to Income Ratio

The Lesser of Two “Ratios”

A Third Ratio to Consider

Recommended Reading: Which Credit Union Is Best For Home Loan

My Result Came Out Higher Than The Amount I Wish To Borrow What Now

Now that you have ascertained that you are in a strong enough financial situation to sustain the purchase of your desired property, you need to set about getting in touch with some mortgage providers.

Fortunately, we have made this process very easy for you. Simply click the Get FREE Quote button and you will be taken through a very brief set of questions. We will then ask our carefully selected lenders to contact you directly with the very best quotations they can provide. By reaching out to lenders this way, you get the best deal possible and are saved the effort of contacting them yourself it couldnt be simpler!

Using The Mortgage Qualifying Calculator

The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory.; Just fill in the various fields with the information requested.; Start by choosing if you want to base the calculation on your annual income, the purchase price of the home you’re looking at or the monthly payment you can afford.;; Then work down the page entering your other information and the calculator will figure out the other two values for you and display them in gray.

For example:

- Enter your annual income and the Mortgage Qualifying Calculator will determine the maximum purchase price you can afford and the associated monthly payment.

- Enter the purchase price and the calculator will tell you the income you need and the monthly payment required. Or,

- Enter the monthly payment you’re thinking of and the Mortgage Qualifying Calculator will tell you the income needed to qualify and the home purchase price that will cover.

Then go down the rest of the page entering the information requested.; Your answers will be displayed in gray at the top of the page. Click “View report” for a detailed breakdown and an amortization report.

Also Check: How Do I Get My Student Loan Number

What Can I Afford Calculator

Includes mortgage default insurance premium of $

A maximum purchase price that is over $1,000,000 will use 20% minimum down payment for illustrative purposes, however a higher percentage may be required by your lender. Speak to your lender for exact amount.

Must be a valid email.

Must be a valid 10-digit phone number.

Community Banks And Credit Unions

The community bank is the safe choice. You probably have an account there, or had one in the past. There should be more of a personal touch because the community banker makes his money in your neighborhood and needs you as a customer. He can make some concessions on things like credit score and maybe even size of the down payment. Unfortunately, local banks often operate a little short-handed so it may take time to get an appointment or solve a crisis, if you have one.

Read Also: When Do I Pay Back Student Loan

How To Calculate A Down Payment

The down payment;is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

What Income Do I Need To Qualify

The most surprising aspect of how to get a mortgage is the importance lenders place on debt-to-income ratio. Fair Isaac Corporation , the industry leader in credit scores, surveyed lenders who said that a poor debt-to-income ratio is the No. 1 reason mortgage applications are denied.

The unsurprising news is that most people dont know what a debt-to-income ratio is. It is the ratio of our monthly debt payments divided by your gross income. Lenders use it to measure your ability to handle mortgage payments.

For example, if your make $4,000 a month and pay $1,500 for credit cards, $300 for car loan and $200 for student loan, your debt-to-income ratio would be 50% .

A good consumer debt-to-income ratio is 36%, but conventional mortgage lenders like to see that number under 30%. The national average for conventional home loan applicants in July of 2017 was 25%. Note that the ratio includes your projected monthly mortgage payment.

Things are a little looser with FHA where the debt-to-income ratio limit is 28%, but that is still far less than the suggested figures for mortgage hopefuls. The federal government says the highest ratio you can have for a qualified conventional mortgage is 43%. Most lenders put the suggested debt-to-income ratio at 36% or less.

Refinancing is another option. It is important that you not add any additional debt during the home-buying process.

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

When Do Consumers Choose An Arm

Adjustable-rate mortgages , on the other hand, have interest rates that change depending on market conditions. ARMs usually start with a low introductory rate or teaser period, after which the rate changes annually for the remaining term.

ARMs come in 30-year terms that can be taken as a straight adjustable-rate mortgage with rates that change annually right after the first year. However, borrowers usually take them as a hybrid ARM, which come in 3/1, 5/1, 7/1, and 10/1 terms. For example, if you get a 5/1 ARM, your rate remains fixed for the first 5 years of the loan. After the 5-year introductory period, your rate adjusts every year for the rest of the payment term.

When does taking an ARM make sense? ARMs are usually chosen by consumers who plan to sell their house in a few years or refinance their loan. If you need to move every couple of years because of your career, this type of loan might work for you. ARMs usually have a low introductory rate which allows you to make affordable monthly payments, at least during the teaser period. Before this period ends, you can sell your home, allowing you to avoid higher monthly payments once market rates start to increase.