Understanding Your Credit Score

Once you have a basic understanding of what credit score is needed for each type of loan, its time to take your own score into consideration. That means looking at your credit report.

Your credit report is an essential part of understanding your credit score, as it details your credit history. Any mistake on this report could lower your score, so you should get in the habit of checking your credit report at least once a year and report any errors to the credit reporting agency as soon as you find them. Youre entitled to a free credit report from all three major credit reporting agencies once a year.

If youd like to check your credit score, Rocket Homes, a sister company to Rocket Mortgage, can help. Rocket Homes helps you track and understand your credit profile. Rocket Homes allows you to view your TransUnion® credit report, which is conveniently updated every 7 days to ensure you get the most up-to-date information, as well as your VantageScore® 3.0 credit score.

Once you know your score, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Supercharge Your Future & Credit Score Today

Reclaim your financial freedom and speak with a live credit specialist for your free consultation, right now

Copyright © 2022 Credit Glory LLC. All rights reserved. 1887 Whitney Mesa Dr Ste 2089, Henderson, NV 89014. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Credit Glory does not provide legal advice and is not a substitute for legal services. If you are dealing with credit and debt issues, you should contact a local attorney regardless of your use of our service. Credit Glory does not guarantee the permanent removal of verifiable tradelines or make promise of any particular outcome whatsoever. Credit Glory requires active participation from its clientele regarding requested documents and information, including investigation results, for the sought-after outcome of a healthy, accurate credit report. Individual results may vary.

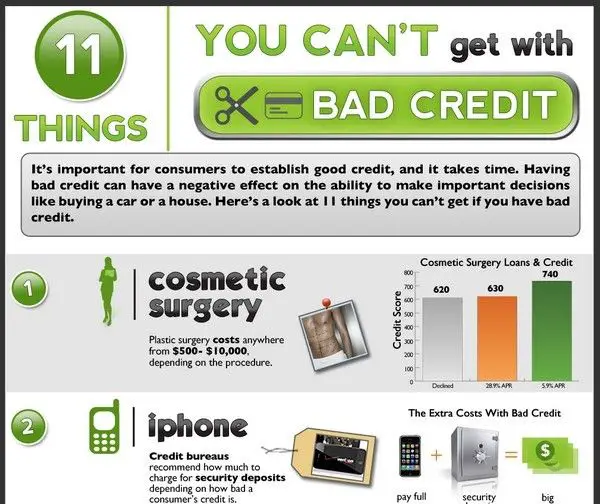

How Long Does It Take To Get A 630 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Recommended Reading: Can I Apply Personal Loan In Two Banks

Mortgage Rates For Someone With A 650 Credit Score

Youll usually need to have a FICO score of at least 760 to get the best mortgage rates, and having anything below 680 puts you at risk of receiving an unsustainable one.

Unfortunately, that means that with a relatively low credit score of 650, you fall into a zone where youre often just qualified enough to get financing but not quite qualified for a loan worth taking.

In most cases, youd be better off waiting to apply for a mortgage until youve built up your credit score, as you stand to save thousands of dollars in interest.

Heres a demonstration of the interest costs of a mortgage at each credit score range:

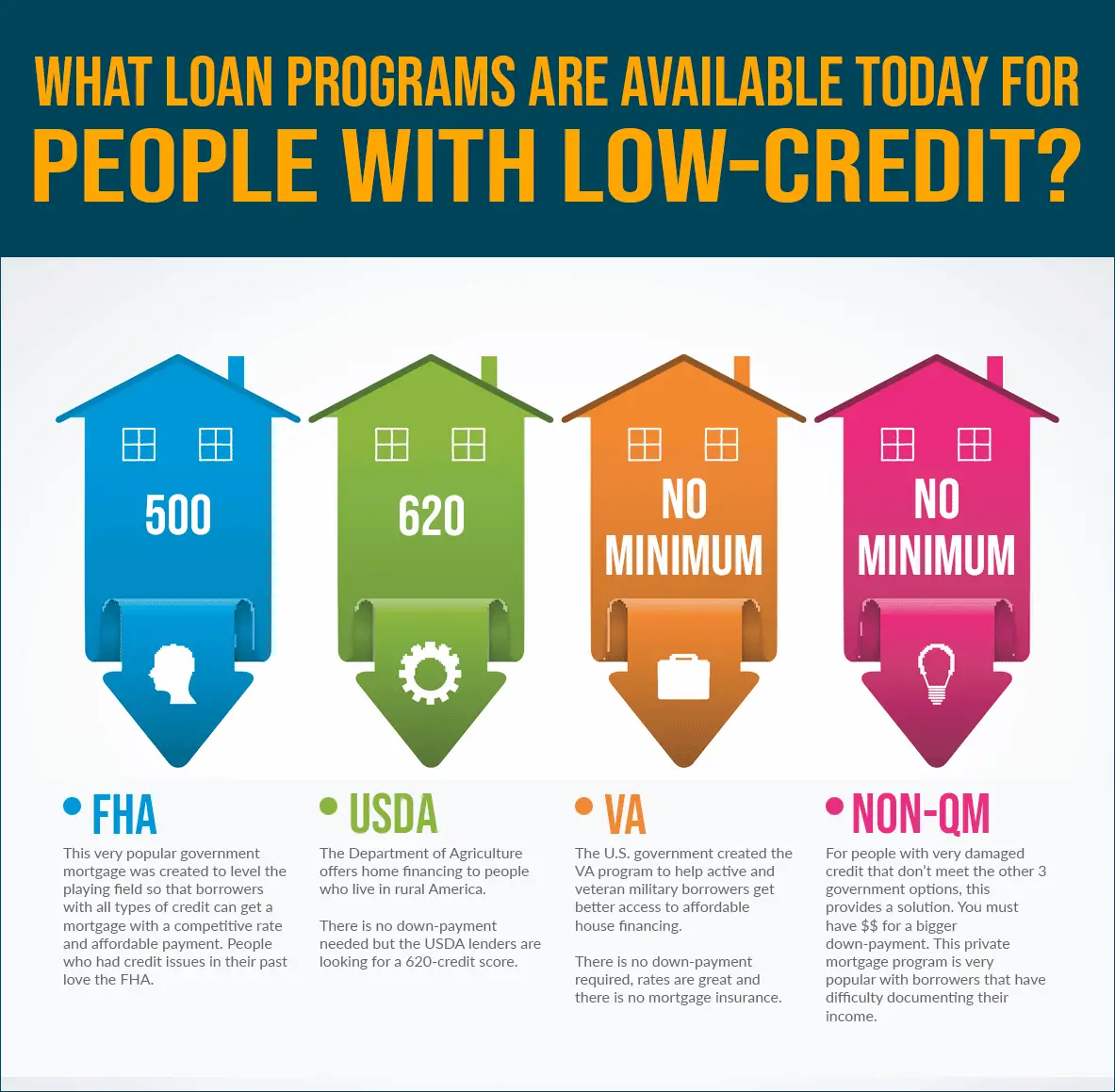

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Don’t Miss: How To Calculate Car Loan Interest

Minimum Credit Score For Fha Loans

The minimum credit score to qualify for an FHA loan is 580 with a down payment of 3.5 percent. If you can bump up your down payment to at least 10 percent, you can have a credit score as low as 500 and still qualify.

However, each mortgage lender has the flexibility to decide what loans they wish to offer and the lowest credit scores theyre willing to accept. Even though the FHA has requirements, FHA-approved lenders can also impose their own standards, a practice known as overlaying, depending on the level of risk theyre willing to tolerate. Thats why you might see different FHA credit score requirements with different lenders.

If your score is below 600, be prepared to find a lender who can put your application through manual underwriting, since getting approved can get more challenging the lower your credit score, says Robert E. Tait of Motto Mortgage Elite Services in Bucks County, Pennsylvania.

If youre planning to purchase a home within the next year, Tait recommends taking steps to boost your score now to increase your approval odds: getting your credit pulled, finding out what is on your credit report and align yourself with a lender who will help you improve your credit.

When you check your credit report, make sure its correct. If theres anything listed there you dont recognize, work with the credit bureau to remove incorrect items.

Sample Scorecard For Someone With A 630 Credit Score

Below, you can get a feel for how your might look as well as what your other top credit-improvement priorities might be.

- Payment History: D = Less than 98% on-time payments

- : C = 10% – 29% utilization

- Debt Load: B = 0.36 – 0.42 debt-to-income ratio

- Account Age: B = Average loan / line of credit is 7 – 9 years old

- Account Diversity: C = 2 account types or fewer than 5 total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: B = 1 collections account / public record

Also Check: How To Find Out How Much Student Loan I Owe

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial health.

Home buyers with lower credit scores are typically assigned a higher interest rate.

There is no way to get around a credit check. It is one of the things you need to buy a home during the mortgage pre-approval stage so be sure to learn more about how a mortgage pre-approval affects your credit score.

Get pre-approved for a mortgage today.

What Documents Do I Need For An Fha Loan

If youre applying for an FHA loan, youll need documentation. These documents include a state-issued identification, proof of a Social Security number and 2 years worth of pay stubs, W-2 forms or tax returns. FHA lenders can provide you with a specific list of what youll need, and they can walk you through the process.

Read Also: Veteran United Home Loans Reviews

How To Improve Your 630 Credit Score

Think of your FICO® Score of 630 as a springboard to higher scores. Raising your credit score is a gradual process, but it’s one you can begin right away.

74% of U.S. consumers’ FICO® Scores are higher than 630.

You share a 630 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Can You Get A Personal Loan With A 630 Credit Score

Yes, you can get a personal loan with a 630 credit score. The best personal loans for a 630 credit score are from FreedomPlus, Upgrade and Avant, as they offer the most competitive APRs and fees. Furthermore, the best way to see what loans you’re likely to get with a 630 credit score is to read full answercheck for pre-qualification.

Best Places to Get a Personal Loan With a 630 Credit Score

- FreedomPlus: 620 credit score required

- Upgrade: 620 credit score required

- Avant: 600 credit score required

- LendingPoint: 580 credit score required

- Upstart: 620 credit score required

Note: Scores are from the lender or multiple third-party sources.

In general, your personal loan choices are limited with a credit score of 630, as it’s in the bad credit range. Personal loan credit score requirements tend to be anywhere from 580 to 700+, with many of the best loans overall requiring a credit score of 660+.

Ways to Get a Personal Loan With a 630 Credit Score

See if you get pre-qualified

The best way to see if you’re likely to qualify for an unsecured personal loan with a 630 credit score is to check for pre-qualification. WalletHub’s free pre-qualification tool will let you know your approval odds and potential interest rates with multiple lenders at once, with no impact on your credit score.

Apply with a cosigner

Try credit unions

Friends and family

Secured personal loans

Don’t Miss: Is Direct Plus Loan Good

Conventional Loan With 630 Credit Score

The minimum credit score requirement to get a conventional loan is 630. In order to qualify for a conventional loan, you will need to meet all other loan requirements. This includes having at least 2 years of steady employment, a down payment of at least 3-5%, and no recent major credit events .

Would you like to find out if you qualify for a conventional loan? We can help match you with a mortgage lender that offers conventional loans in your location.

How To Solve Common Credit Issues When Buying A House

If your credit score or credit history is standing in the way of your home buying plans, youll need to take steps to improve them.

Some issues like errors on your credit report can be a relatively quick fix and have an immediate impact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally six to 12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Also Check: How To Calculate Your Auto Loan Interest Rate

Fha Credit Score Requirements May Vary

The credit scores and qualifying ratios weve mentioned in this article so far are either the minimums required by Rocket Mortgage or the FHA itself. Other lenders may have their own requirements, such as a higher FICO® Score or a larger down payment.

Read More: Mortgage Payment Breakdown: Whats Included In Your Payments

What Credit Score Is Needed For A Mortgage Faqs

What credit score do you need to buy a house in 2022? Credit score requirements vary by the type of mortgage you want to use. The minimum credit score for a conventional loan is 620. For an FHA loan, itâs 580. Lenders often look for a credit score of 580 or higher for a VA loan, and the USDAâs suggested minimum is 640. However, the VA and USDA give lenders discretion to approve borrowers who are otherwise creditworthy but whose scores are lower than the standard requirements.

Can I buy a home with a 630 credit score? You can qualify for a mortgage with a 630 credit score. The minimum credit score for a conventional loan is 620 for FHA loans, itâs 580 and for VA loans, the minimum is typically set by the lender. However, the higher you can get your score before you apply for a mortgage loan, the greater your chances of approval and of getting competitive mortgage rates. In addition to meeting minimum credit score requirements, youâll also need to meet other eligibility criteria, including sufficient income to make your monthly payments, proof of employment, and having a qualifying debt-to-income ratio.

Is 670 a good credit score? A credit score of 670 is considered good, based on the FICO score model that is used by mortgage lenders. But the higher your score, the greater your chances of qualifying for a loan and receiving competitive interest rates.

*Debt-to-income ratio is monthly debt/expenses divided by gross monthly income.

Also Check: How To Refinance An Auto Loan

Usda Loan With 630 Credit Score

The minimum credit score requirements for USDA loans is now a 640 for an automated approval. Fortunately, you can still get approved for a USDA loan with a 630 credit score, but it will require a manual approval by an underwriter. In order to get approved with a 630 credit score, expect to have strong compensating factors, such as conservative use of credit, 2 months mortgage payments in cash reserves , a low debt-to-income ratio, and/or long job history.

Other requirements for USDA loans are that you purchase a property in an eligible area. USDA loans are only available in rural areas, as well as on the outer areas of major cities. You can not get a USDA loan in cities or larger towns.

You also will need to show 2 years of consistent employment, and provide the necessary income documentation .

Get Personalized Advice From Wallethub

The best approach to improving a 630 credit score is to check the of your free WalletHub account. This will tell you what problem areas to focus on and how to correct them.

If your grades are similar to those earned by the average person with a 600 credit score, for example, improving your credit utilization and paying your bills by the due date every month should be among the first orders of business.

Read Also: How To Loan Money For Profit

Compensating Factors Can Help If You Have Bad Credit

You dont need perfect finances across the board to secure mortgage approval. You can often qualify if youre weak in one area like credit score but stronger in other parts of your financial life. These offsets are known as compensating factors.

If your credit score is weak but you have a stable income, a lot in savings, and a manageable debt load, youre more likely to get mortgage-approved.

Similarly, you have a good chance at loan approval if you have a higher credit score but youre only average in those other factors.

The key is to understand that lenders look at your personal finances as a whole not just your credit score.

How Does The Fico Credit Score Rating Work

If youve ever applied for credit or are thinking of applying for credit, you will probably have heard the term FICO score. Your FICO score can play a significant role in whether a lender will extend credit to you or not. If your score is low, you will probably have a more challenging time getting an approval for credit than if you have a high FICO score. Lets look at what a FICO score is, how it is calculated, and how it can impact credit decisions.

A FICO score is a three-digit number that gives lenders an indication of how borrowers have handled their credit. Using information taken from the three main credit bureaus , a number is generated, which is referred to as a FICO score.

The information used to make up the FICO score is:The borrowers payment history-this is the most essential piece of information, accounting for a 35% measure of the score.The amount of debt the borrower is carrying is another significant piece of data making up 30% of the FICO score.The length of time a borrower has had a credit history-the longer, the better. The amount of time a borrower has had a credit report makes up 15% of the score.The credit mix the borrower has accounts for 10% of the score.If there are any new accounts, it also accounts for 10% of the FICO score.

FICO scores range between 300-850 and fall into one of the following categories:300-579 -poor

Don’t Miss: How To Report Ppp Loan On Schedule C

Is 630 A Good Credit Score For A Car Loan

If you have a credit score in the 630 to 639 range, congratulations! Your score is considered Fair credit and you will have multiple auto loan options to choose from. Your auto loan options and the monthly payment could differ greatly based on whether you use a bank, credit union, or an online Lender.

You May Like: How Much Mortgage Would I Get

Dispute Negative Accounts On Your Credit Report

Its a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law. They can help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items from your credit report. They have over 18 years of experience and their clients saw over 6 million removals on their clients in 2021 alone.

They can help you with the following items:

Don’t Miss: Same Day Bad Credit Loan

How Mortgage Lenders Pull Credit

When you apply for a mortgage, lenders pull your credit report from all three major credit bureaus: Transunion, Equifax, and Experian.

Whether you get approved for the loan and the terms of your loan will depend on the result of those reports.

Lenders qualify you based on your middle credit score.

For example, if your scores are 720, 740, and 750, the lender will use 740 as your FICO. If your scores are 630, 690, and 690, the lender will use 690 as your FICO.

When you apply with a spouse or co-borrower, the lender will use the lower of the two applicants middle credit scores.

Expect each bureau to show a different FICO for you, since each will have slightly different information about you. And, expect your mortgage FICO score to be lower than the VantageScore youll see in most free credit reporting apps.

In all cases, you will need to show at least one account which has been reporting a payment history for at least six months in order for the bureaus to have enough data to calculate a score.