Commitment Fee Vs Interest

Legally, a commitment fee is different from interest, although the two often are confused. The key distinction between the two is that a commitment fee is calculated on the undisbursed loan amount while interest charges are calculated by applying an interest rate on the amount of the loan that has been disbursed and not yet repaid.

Interest also is charged, and paid, periodically. A commitment fee, on the other hand, often is paid as a one-time fee at the closing of the financing transaction. A further commitment fee may be charged by a lender at the renewal of credit facilities. In the case of open lines of credit, a periodic;commitment fee may be charged on the unused portion of the available funds.

Average Mortgage Lender Fees

Lender fees amount to an average of $1,387 based on our results from the four largest banks. These include the origination fee and the cost of any discount points required on your mortgage rate, which moves down according to the number of points you purchase. Not all banks provided estimates for all fees.

| Bank of America | |

|---|---|

| $995 | $1,387 |

Since the amount you spend on discount points mostly depends on your individual preference, we focused on the differences in origination fee among the banks we surveyed. Most of these large institutions charge a flat fee of $1,000 or more for their origination services, although Chase charged a much lower $595. While these lenders all used a flat fee for origination, other lenders sometimes set this fee at 1% of the total loan amount.

What Is A Mortgage Origination Fee

A mortgage origination fee is a fee charged by the lender in exchange for processing a loan. It is typically between 0.5% and 1% of the total loan amount.;You’ll also see other origination charges on your;Loan Estimate and Closing Disclosure in the event that there are prepaid interest points associated with getting a particular interest rate.

Also called mortgage points or discount points, prepaid interest points are points paid in exchange for getting a lower interest rate. One point is equal to 1% of the loan amount, but you can buy the points in increments down to 0.125%.If you’re trying to keep closing costs at bay, you can also take a lender credit, which amounts to negative points. Here, you get a slightly higher rate in exchange for lower closing costs. Rather than paying up front, you effectively build some or all costs into the life of the loan.

The origination fee;itself can cover a variety of things, some of which may be broken out in your Loan Estimate. It covers things like processing your loan collecting all the documentation, scheduling appointments and filling out all necessary paperwork as well as underwriting the loan.

Don’t Miss: When Do I Pay Back Student Loan

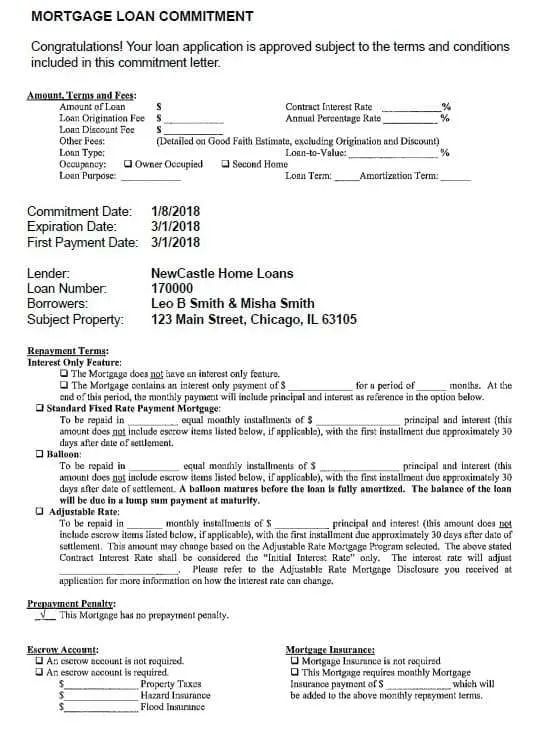

Whats Included In A Mortgage Commitment Letter

Mortgage commitment letters include specifics about your loan. Whats exactly included will depend on the lender. However, most will typically include such information as the loan amount, loan purpose, length of your loan term and whether youre getting an FHA or conventional loan or other type of mortgage. The letter will also feature your lenders information, your loan number, and the date your commitment letter will expire. Youll also find the terms of you loan listed in the letter. These may include the amount of money youll pay each month and the number of monthly payments youll make until the loan is paid off. If youre going to have an escrow account, youll find information on that as well.

There are two main kinds of commitment letter: conditional commitment and final commitment.

Average Prepaid Mortgage Costs

Prepaid costs cover insurance, property taxes and prepaid interest on your mortgage. Although we saw an average of $3,021 for prepaid mortgage costs, these can vary a great deal depending on your particular closing date. Some of these funds will be held in an escrow account to ensure that your monthly tax and insurance payments are made on time.

| Bank of America | |

|---|---|

| $3,227 | $3,021 |

Your closing date affects both your prepaid interest and your property taxes. Prepaid mortgage interest is calculated for each day between closing and the date of your first monthly payment, while property taxes are collected at various dates depending on your jurisdiction. Pushing your closing date to the end of the month reduces prepaid interest, but reducing your upfront tax bill is harder to manage. If you close a mortgage just one or two months before property taxes come due, your lender may require you to put the entire amount in escrow ahead of time.

Homeowner’s insurance and mortgage insurance premiums also go into your prepaid costs. Lenders typically require up to 1 year of homeowner’s insurance premiums upfront in order to guarantee continuous coverage. Mortgage insurance usually comes into play if your down payment is under 20%. In most cases, the first month of mortgage insurance must be paid for as part of your closing costs.

Recommended Reading: Is Student Loan Refinancing Worth It

When Do You Have To Pay The Origination Fee

Mortgage origination fees are usually paid as part of closing costs. In addition to your down payment, closing costs may include the following, although they can vary depending on whether the transaction is a purchase or refinance.

It varies widely depending on the details of the transaction, but closing costs typically range anywhere from 3% 6% of your loan amount.

Find out what you can afford.

Use Rocket Mortgage® to see your maximum home price and get an online approval decision.

Ways To Make A Title Commitment Work For You

Normally, a title commitment is time-sensitive. You may have just a few days to review the document and consult with your loan officer, attorney, or realtor, if necessary.

Because easy is better. Download our free LoanFly app for the complete mortgage experience.

Consider these helpful tips before you sign:

1. Know what youre looking for.

A title commitment is categorized into five different portions. Who is being insured, the amount of insurance, what is being insured, what is required to insure the title, and what is not insured. The parties being insured may include you as the buyer and your lender. The amount of insurance should cover your mortgage loan amount and the property owners sales price.

2. Separate Schedule A and Schedule B.

A title commitment is broken down further into two subsections. Schedule A is what has been submitted to the title company by the escrow officer, containing the commitment date, buyer and seller information, property price, and loan amount. Youll find the exceptions in Schedule B, including the Covenants, Conditions, and Restrictions that well explain more about below. Schedule B is the part of the title commitment that youll really want to read.

3. Take a look at the exceptions.

5. Check the numbers.

6. Get it all in writing.

Now that you understand your title commitment, check out our full mortgage glossary. You can find a list of the most commonly used mortgage terms here.

,Aug 28, 2021

You May Like: How Do I Get My Student Loan Number

How Commitment Fees Work

Lenders typically must disclose commitment fees up front. Often, they will provide a commitment letter specifying the amount of future funding they’ve agreed to provide as well as the commitment fee that will be charged.;

Depending on the lender, commitment fees may be paid at different points in the process. They can be paid when the borrower agrees to take the future loan; when the lender agrees to provide the funds; or at the time when the loan money is actually disbursed.

Most states impose specific regulations on commitment fees. For example, New Jersey requires that the amount of a commitment fee be “reasonably related to its purpose, often based on a percentage of the amount of the loan.

There are also some cases where lenders will provide a refund of commitment fees. Virginia, for example, specifies circumstances in which lenders must provide a refund of commitment fees, including:

- If the commitment period was too short to be reasonable, given market conditions.

- If the lender decides not to move forward with the loan because the property intended to secure the loan doesn’t appraise for enough money.

- If the lender decides not to move forward with the loan because of the applicants lack of .

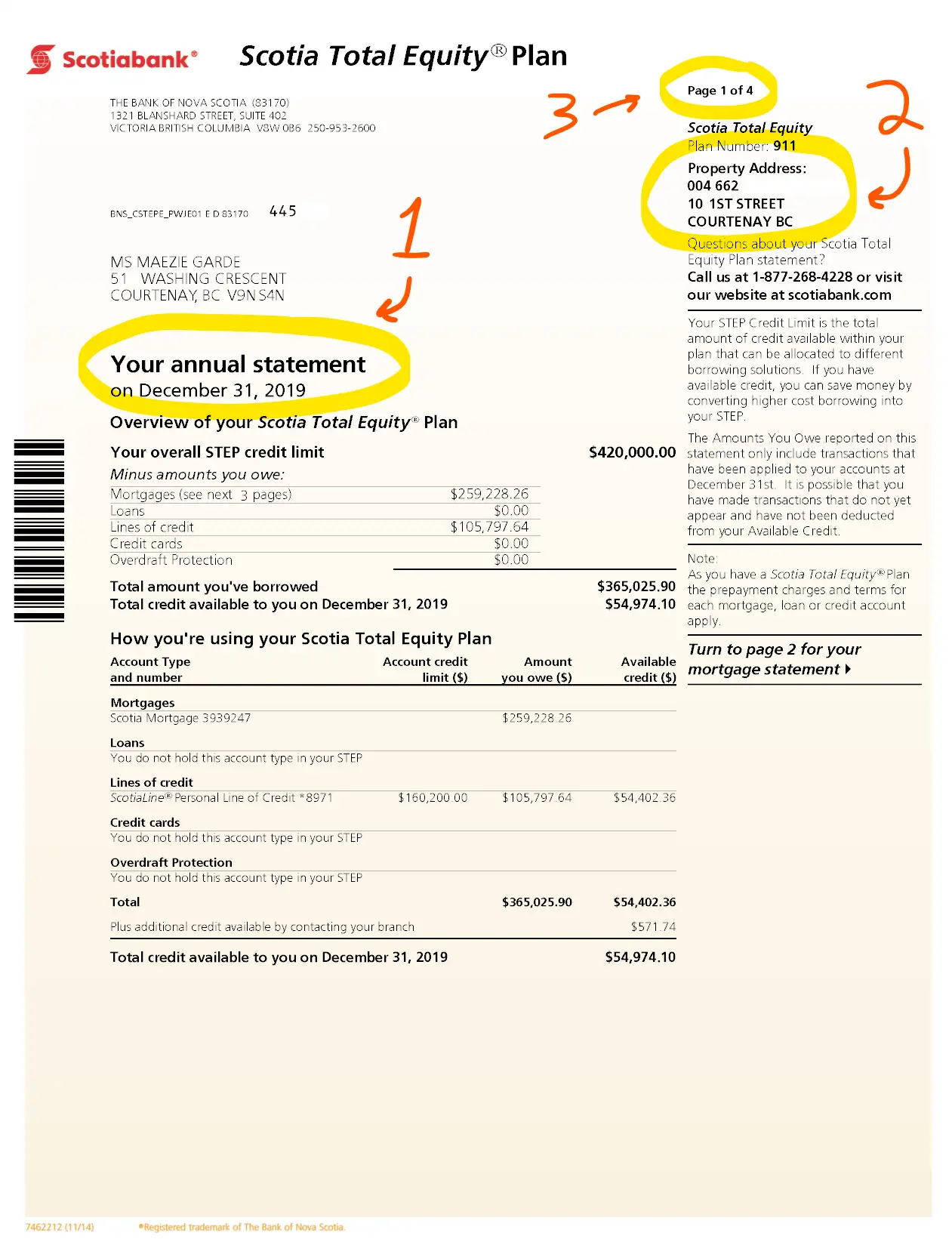

How Much Equity Do I Need To Refinance My Home Mortgage At A Low Interest Rate

A good rule of thumb for refinancing is that you should have at least 20% equity in your home. That means that you have paid down at least 20% of your original mortgage.

However, many lenders look at your loan-to-value ratio instead of your equity. Your loan-to-value ratio is the amount of debt you owe on your mortgage divided by your homes market value. Most lenders want you to have a loan-to-value ratio of less than 80% to refinance your mortgage.

Commitment Fees Vs Lock

In some cases, lenders are willing to provide not only a commitment to lend in the future, but also a commitment to lock in a specific interest rate. That means a borrower is guaranteed to borrow at the specified interest rate for a period of time, regardless of whether prevailing interest rates go up or down in the future.

A lock-in fee, or a fee to guarantee the future loan rate, may be charged as part of a commitment fee. Or in some cases, it may account for the entire commitment fee. Be sure to review the commitment agreement ahead of time to identify all costs involved.

What Closing Costs Are Negotiable

Closing costs are the fees and other costs that lenders and third-parties charge you for originating your mortgage and buying your home. Banks, real estate agents, lawyers, title research companies, credit reporting agencies and the government require various services during the closing process, including drafting and reviewing loan documents, checking and updating official records, reviewing your credit profile and brokering your loan and home sale.

Not every cost is negotiable. Any fee charged by the government is set in stone. Likewise, any service from a third-party provider will be difficult to negotiate with your lender. That means you wont have much room to negotiate your credit report fee, flood determination fee or appraisal costs. Lenders outline “services you cannot shop for” on page two of the loan estimate form.

| Fees you can negotiate | |

|---|---|

| Real estate commissions | Flood certification fees |

You have plenty of opportunities to negotiate for a better mortgage. Start by negotiating for lower interest rates, discount points and lower origination fees. Negotiating these fees may dramatically reduce the total cost of your loan.

What Mortgage Rates Can I Get

Mortgage interest rates vary widely based on several factors, including your credit score, the amount of debt you want to refinance, your homes value, and more. That said, interest rates for refinancing are typically very competitive among lenders, which is a good thing for you.

Source – YCharts

Keep in mind that the lowest rate isnt always the least expensive loan when it comes to refinancing. ;There are fees associated with the refinancing process that could run into thousands of dollars. These charges stem from the appraisal process, application fees, and title insurance. Its a good idea to compare the five-year cost of new mortgages when shopping around for lenders to get a sense of what youll end up paying.

After The Seller Accepts Your Offer

While buyers pay most of the closing costs, you can attempt to negotiate for some concessions from the seller after they’ve accepted your offer on the house. For example, you may ask the seller to pay an appraisal fee or a title transfer fee. Its not common for sellers to pay closing costs, so ask your real estate agent about best practices in your area before you start asking for concessions.

Example: Standby Fee In Loan Agreements

Bank ABC requires all borrowers to pay a 0.25% standby fee on the amount of credit borrowed. Assume that Company XYZ, which deals with wine processing, wants to secure a loan of $1 million to facilitate the acquisition of Company EFG, which deals with the manufacturing of wine glasses.

Bank ABC will send a commitment letter to Company XYZ detailing the terms of the loan, the standby fee, and other fees related to the loan. If the borrower agrees with the terms of the loan, it will sign and return the commitment letter, along with a standby fee of $2,500.

Understanding Your Mortgage Commitment Letter

One commitment that everyone looks for is the mortgage commitment 😉 Dont get this confused with the three tiny words people love to hear when obtaining a mortgage for their new home: Clear to Close. A mortgage loan commitment is the lender’s firm approval on the loan. The lender will send a mortgage loan commitment letter that includes any terms or conditions the final approval is subject to.

Once your offer is accepted your mortgage contingency date will be set. You and the sellers will agree to the First Commitment Date which is a firm written mortgage commitment from your lender. Your lender will need to send you the commitment letter by that date or they will need to request an extension. If the lender doesnt meet the date, they will need to notify the buyer’s attorney, agent and/or buyer in writing. If a mortgage commitment hasnt been obtained by the contingency date, the seller has the right to either extend the contract closing date or cancel the contract and return all earnest money to the buyer.

NewCastle Home Loans commitment letter will have certain dates. The date of when the commitment was created, the expiration date, and the first payment date. The average time it takes a lender to close on mortgage is 53 days. At NewCastle, it takes us less than 30. In fact, we have been getting files Clear to Close in under 15 days!

Lets take a look at the details of the two sections of the mortgage commitment.

First Section of the mortgage commitment:

How Much Do Commitment Fees Cost

Commitment fees can vary by lender and type of loan. As mentioned, the commitment fee on a commercial loan typically ranges from .25% to 1% of the amount to be borrowed in the future.

Commitment fees are generally included when the annual percentage rate of a loan is calculated. APR is a broader measure of the cost of borrowing money than the interest rate alone. It reflects both the interest rate and other costs associated with borrowing, including any fees owed.;

Prequalification Vs Preapproval Vs Commitment

Prequalification is the most basic indication you can get from a lender of your eligibility for a mortgage. Itâs a rough estimate of what you might receive in terms of financing, and it requires you to provide very little information about your situation. You can likely get prequalified simply by providing details over the phone without any supporting documentation. Prequalification is helpful to have, but it doesnât offer much security for you or for a seller.

Preapproval is the next step up. Once youâve provided documents proving your income, credit history and other financial information, an underwriter will review your file and provide a conditional approval letter stating how much theyâre willing to lend you. This may put a seller more at ease because they know that you can probably pay for the property.

A loan commitment is even more official than a preapproval. It indicates that youâre good to go with financing and that your loan amount and interest rate are secure. This provides the ultimate assurance for the seller that you wonât have to back out of the deal due to loan issues.

What Is A Mortgage Commitment Fee

Mortgage companies lend money to credit worthy borrowers to purchase homes. In addition to the interest charged on the loan amount, the lender charges certain fees up front when the loan originates. These fees are generally lumped together in closing costs paid by borrowers on the date the loan closes. The mortgage commitment fee is generally a closing cost, but may not always be a necessary expense.

Give Yourself Extra Time

Negotiating with lenders and sellers takes time. Consider taking a vacation day to spend extra time on negotiations. If you cant take time off from work to negotiate, be sure to give yourself extra leeway between your offer and your targeted closing date. The extra long window of time will ensure that you have ample time to negotiate with lenders before you finalize the loan details.

Closing Costs And Credit Scores

How much your lender is willing to negotiate on closing costs will often depend on your credit score. Credit scores are a rating system lenders use to measure your reliability as a borrower. Your score is based on how regularly you pay your debts, how much you owe, past foreclosures or bankruptcies and other credit related events. Credit scores generally range from 350 to 850. The higher your credit score, the more attractive a customer you are, which will determine how willing lenders will be to negotiate closing costs.

References

What Is A Mortgage Commitment Letter

A mortgage commitment letter is an agreement between you and your lender stating that your home loan has been formally approved. This document usually outlines your loan type, the amount youâre borrowing, the agreed-upon interest rate, the loan terms and conditions and the offerâs expiration date. It also contains contact information for you and your lender, and it may list the purchased propertyâs address.