Special Auto Financing For Bad Credit

Many automobile repair shops offer special auto repair financing options. For example, mechanics may partner with local lenders to provide their own auto financing for repairs, sometimes with an interest-free or interest-deferred loan option.

Large brand-name repair shops frequently offer cobranded credit cards as a financing option for purchases and auto repairs.

For instance, Firestone offers a card you can use to finance repairs of $149 or more with a deferred APR of 28.8%, and Midas International has a similar card with a $199 minimum purchase requirement.

Many shops provide special discounts and promotions to save you money on repairs. Meineke Car Care Centers frequently offer discount coupons for auto repairs and service.

Independent mechanics tend to give the best deals to help them compete against national brands. Costco members enjoy a 15% discount on repairs at a nationwide network of automotive service shops.

Almost all new-car automobile dealerships have their own repair operations that offer expert service. Dealerships tend to charge the most for vehicle repair, but many provide myriad discounts and warranty plans to save you money.

Your dealership may offer you an auto repair loan but may require you to secure the loan with the vehicles title. A title loan is risky because you could lose your vehicle. When you fail to repay a title loan on time, the lender can repossess it without going to court.

Why Get An Auto Repair Loan

Since there are no limits on how your personal installment loan can be used, your cash can take you further

Repair after a breakdown

Dont let bumps and breaks get you down, with loans that let you pay off repairs with ease

Preventative maintenance

Install season-appropriate tires, treat impending issues, and upgrade car features

Pay off a car loan

Avoid late fees and overdue bills by refinancing your vehicle loans

How To Get Emergency Car Repair Loans Best Available Options

If you are in need of emergency car repair and dont have the money to cover the cost, you may be wondering how to get a loan. There are a few different ways you can go about getting car repair loans, and each option comes with its benefits. In this article, we will discuss options to get a loan for emergency car repairs. So, whether you are in need of a quick fix or want to take your time shopping around for the best deal, we have you covered!

Read Also: Is It To Late For Ppp Loan

Dont Be Afraid To Walk Away

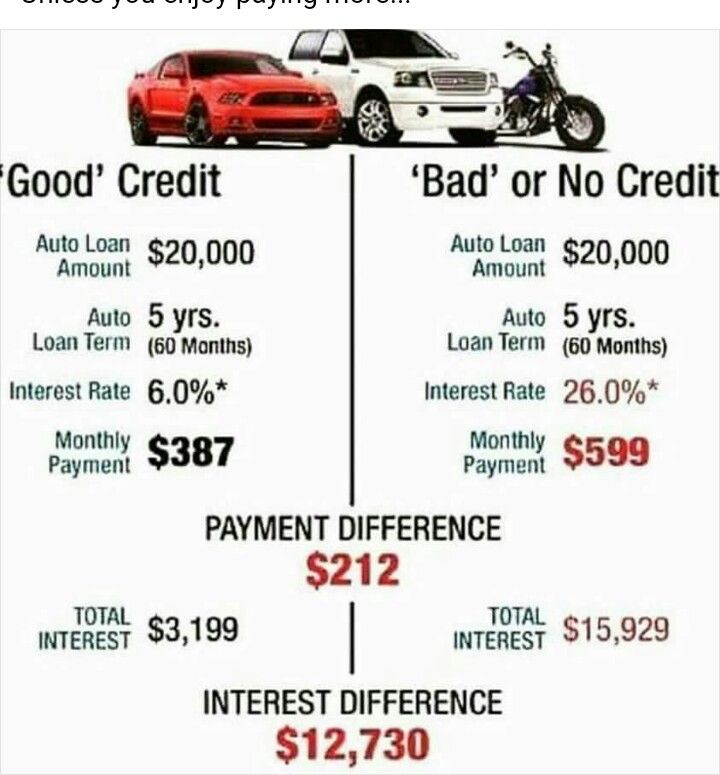

Buying a car is often a very high-pressure sale that can impact your credit score significantly, either in a good way or bad. Thats why it is so important to do your homework and take your time, regardless of how much you want a car.

If you like a vehicle that costs more than what you can afford, dont accept a longer loan term to achieve cheaper monthly payments. If you accept longer terms on a car loan, you will pay more in interest over the life of the loan and may pay more for the car than its actually worth over time.

Cars do not appreciate in value like houses. Its often said they depreciate the moment you drive it off the lot. Keep in mind that if you do get a longer term loan and are forced to sell the car before you have finished paying off that loan, you still have to pay back the balance on the loan.

Your best bet is to walk away from a car you know you cant afford and find a comparable vehicle that costs less.

Get Yourself A Secured Credit Card

You May Like: Is Refinancing Car Loan Worth It

Car Repair Loans For Bad Credit

Your credit plays a prominent role in your eligibility for traditional loans like bank loans. Bad credit can be a major barrier in securing a loan for a car repair from most financial institutions. In these cases, short-term auto repair loans for bad credit can be helpful to get your car fixed and back on the road fast.

Car Repair Loans For Bad Credit1 Up To $30000

Get your vehicle back on the road with a Money3 Car Repair Loan.

Whether it’s to pay for road accident repairs, service costs and repairs, body paint work or a breakdown, Money3 could help1. We can also assist with things like new tyres, car registration costs and many more vehicle issues and not just for cars. We offer car repair loans up to $30,000, and unlike other lenders, we also welcome applications from people on benefits1 or who may have a bad credit mark on their credit file.

Start the application process by completing the quick apply form above to register your interest. Once this short form is complete, you will be given the option to give us some more details straight away so that we can give you your loan approval decision quicker.

Money3 offer both unsecured personal loans and secured personal loans for car repairs, depending on your financial situation.

- Service Repairs

Car Repair Loans up to $30,000

1. Subject to verification, suitability and affordability

Personal Loans

Also Check: Direct Lender Loans For Bad Credit

Online Installment Loans Have Minimum Requirements

You dont need perfect credit to get an online tribal installment loan. When you apply for an easy tribal installment loan, youll be asked to provide basic required information, including being a U.S. resident who is at least 18 years old with a valid email address and phone number. You should also have an open bank account in good standing and a verifiable source of income.

The application process is fast and straightforward for personal installment loans.

Getting approved for an online installment loan is a relatively quick process and an excellent alternative to payday loans, especially for borrowers with bad credit. Simply fill out the online loan application, review your loan documentation, and meet the lenders underwriting requirements.

The lender will then verify your information, and if your loan is approved and you sign the loan documents, your funds can be deposited into your bank account as soon as the next business day.

Types Of Lenders That Offer Car Loans For Bad Credit

Many different types of lenders offer bad-credit auto loans. When you have bad credit, its especially important to apply to more than one lender. Lender requirements vary, and one may be more willing to work with you than another. Also, having multiple loan offers later enables you to take the lowest-rate one to the dealership and ask the finance office to try to beat it.

Banks and credit unions, known as direct lenders, are a good place to start. If you already have accounts in good standing there, they may be more willing to work with you. Direct lenders can be 100% online or have physical locations.

Online loan marketplaces that work with a network of lenders are another option. They provide the convenience of applying to multiple lenders with one loan application.

Online car retailers, such as Carvana, also offer financing for bad-credit borrowers.

Auto dealerships also offer access to bad-credit auto loans. This is where most people find their loans. Finance officers there often have long-standing relationships with banks and credit unions and make either a flat fee or a percentage of the amount borrowed. They also have the ability to adjust interest rates within a lender’s guidelines. That’s why its best to bring your lowest-rate offer from another lender to the table.

Don’t Miss: When Can I Refinance My Home Loan

Where Can I Get Emergency Car Repair Loans

To manage a financial crisis like an auto repair, many people may think about approaching banks or credit unions for support. However, you may not qualify for a loan and most of them cannot get you the cash you need right away. Short-term emergency car repair loans from an online payday loan referral service like Faaast Cash will help you get your car on the road in no time.

Consider A Down Payment Is Key

It might be difficult to have extra cash on hand when youre trying to pay bills to improve your score, but even having a few hundred dollars to put down for a car can help the lender approve you for financing and lower the upfront costs.

The ability to put a down paymentan upfront partial paymenton a vehicle signals to the dealer or seller that you are serious. Depending on how much you can put down, it can help reduce the overall size of the loan, upfront taxes and fees, your monthly payment, the length of the loan and/or the interest rate.

Recommended Reading: How Much To Pay Off Car Loan Early

Who Should Consider An Auto Repair Loan

Although loans for auto repairs can be convenient, these loans are not the right solution for everyone. They are a relatively quick and hassle-free way for small business owners that deal frequently with cars or car rentals, limousines, trucks, and so on.

Before applying for auto repair loans, business owners should ask themselves the following questions: Are you someone with a bad credit history or no credit? Have you ever filed for a bankruptcy? Could you potentially pay for your vehicle repair using a credit card or savings instead?

If you dont have a credit card and do not have enough money or savings to pay for auto repairs, then you may be a good candidate for an auto repair loan. Obtaining auto repair loans ensure that you have cash readily available to pay for any damage that might occur to your vehicle.

In a situation where you dont have cash in the bank, dont have access to other credit options, and need funds quickly in order to make an urgent repair, or otherwise respond to an emergency involving a damaged vehicle, auto repair loans could be a good financing option.

Can I Get A Car Repair Loan With Bad Credit

NetCredit personal loans and lines of credit provide alternatives for people who have difficulty getting approved for traditional bank loans or other forms of credit. This makes it possible for someone with less-than-perfect credit to qualify for car repair financing. Plus, NetCredit lending products are unsecured, which means you are not required to provide collateral such as a home or car title.

Recommended Reading: Loan For 500 Bad Credit

Need A Car Repair Loan Bad Credit What Do You Do

There are quite a few high-interest options for people with bad credit, payday loans, title loans. The problem with loans is that they prey on bad credit. You end up paying back 1400% more back if you take the full term to pay it back, then something else goes wrong with the car and you have no options left to pay the repair. I have heard many people say I will just give the car back, which is a nice way of saying let it get repossessed. All of these options will make bad credit even worse. The Buy Here Pay Here lot will still sell you another car with high down payment and no warranty included, and then you have still stuck in the same situation all over again with a new car note.

The best thing to do if you need a car repair loan with bad credit or no credit is to keep the vehicle you have and make your payments on time, every time. Getting a warranty is a MUST to protect your budget and ensure that the high cost of repairs does not put you in financial hardship. When your car breaks down out of the blue and you mechanic hands you a bill, it will be a relief knowing you wont have to pay them yourself.

Dont wait until it is too late! Contact us online or call 1-800-986-3608 and we can help you figure out your loan situation today.

More to explorer

Dont Miss: Loans Online No Credit Check Instant Approval

What Can An Auto Repair Loan Cover

Auto repair loans can be used to pay for almost anything related to car repairs. For example, you might use an auto repair loan to cover new tires, a transmission replacement, or a broken windshield.

Be sure to borrow only what you need to keep your future costs low. While an auto repair loan could technically be used to pay for upgrades , keep in mind that youll have to pay back however much you borrow along with interest.

Read Also: Can You Add To Your Home Loan For Renovations

Assess Your Income And Debt

Even if you have a low credit score, lenders will also look at your monthly income against your monthly expenses to weigh your ability to repay a loan. They want to see that you can make the new monthly car payments in addition to your existing debt obligations.

This will help the lender determine whether to issue the loan and how much interest, additional fees or down payment might be required to secure the loan. The higher the risk, the more you will pay in loan fees.

So before you apply for a loan or go car shopping, total your monthly debt against how much income you receive to get a better idea of how much you really can afford to pay per month.

How Do Car Repair Loans Work

Along with our car loans, our personal loans for car repairs start at as little as £500 and extend to £5,000. As well as selecting your loan amount, you can also tell us how long you’d like to borrow it for, selecting your own repayment term. For quick loans to fix a car, our payment plans start at a period of 12 months and extend all the way to 36 months. This gives you flexibility when it comes to financing your auto repairs, and there’s no need to worry about bad credit.

Plus, you can apply for a car repair loan online. You’ll know whether you are eligible in minutes and know exactly how much you’ll pay. Our quotes come with no obligation and checking your eligibility won’t affect your credit score.

Recommended Reading: Loan Calculator By Monthly Payment

Don’t Sign Anything Without Reading And Understanding It Thoroughly

Read everything carefully before you sign a contract and walk away. Neglecting this could end up costing you thousands of dollars and/or making your credit even worse, depending on what is included in your contract.

Ask questions about anything you don’t understand and don’t be afraid to walk away and tell the F& I office that you need some time to think it over before you sign. They’ll want your business when you’re ready to give it to them, no matter how much of a fuss they make at the thought of you leaving.

Can I Get A Bad Credit Car Repair Loan

Yes, at Fair Go Finance we can offer car repair loans to customers with certain levels of bad credit. We understand events in the past may have impacted your credit, which is why we will take into account your recent conduct on your bank statements to give us a good understanding of your current financial situation.

If youd prefer to discuss your situation before you submit an application, youre always welcome to get in touch with our friendly staff.

And if you do currently have bad credit, dont forget it is possible to turn bad credit to good credit and you can begin to fix it starting today.

Don’t Miss: What Is The Difference Between Direct Loan Subsidized And Unsubsidized

How Can I Get My Car Fixed With No Money

It can be stressful to find out your car needs repairing, especially if you dont have the money to pay for it all at once. The good news is that you can fund an auto repair even if youre short on cash. One of the best ways to do so is by doing your research and finding lenders that offer auto repair loans.

Once you apply for auto repair loans and receive some offers, closely compare each loans interest rates and terms. Youll want to go with the offer that fits best with your budget and lifestyle needs.

For example, if you dont have much money, an auto repair loan with a three-month term may not make sense. You may feel more comfortable with a loan that offers a 72-month term so that you can take your time paying it back.

The interest rate is another important consideration. If you get two auto repair loan offers that both have 72-month terms, but one offers a lower interest rate than the other, opt for the one with the lower interest rate. With a lower interest rate, youll end up paying less for your car repair and can save a great deal of cash in the long run.

While you may not land a great interest rate if you have bad credit, its still a good idea to explore all the options available. Not all lenders are created equal, and you may find that one lender offers you more favorable terms or interest rates than another.