Why A 5% Down Conventional Loan Can Be A Smart Choice

- You can choose between an adjustable-rate mortgage or a fixed-rate mortgage

- This slightly larger down payment may prompt lenders to offer you a lower interest rate

- Instead of spending all your cash on a down payment, you may be able to keep some for emergencies

If you owned a home within the last 3 years, the lowest down payment you can make for a conventional loan is 5%. A key benefit of making a 5% down payment is that youll qualify for an adjustable-rate mortgage . These types of mortgages can help you save money in the long run if you plan to sell the home within 10 years. You see, the first 5-, 7-, or 10-years of an ARM has a low introductory fixed interest rate. When this introductory period ends, the interest rate adjusts twice a yearsometimes it goes up, sometimes down.

Often the introductory fixed interest rate of an ARM is lower than the interest rates offered for traditional fixed-rate mortgages. If you plan to buy a starter home, then buy a larger one before the ARM introductory fixed interest rate ends an ARM can be a smart choice for you.

Homebuyers with 5% down can qualify for fixed-rate mortgages and adjustable-rate mortgages for single-family homes, condos, townhouses, and planned unit developments . As the down payment is less than 20%, youll likely need to pay PMI until your home equity reaches at least 20%.

Conventional Loans: Requirements Types And Rates

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

You might be surprised at the many choices you have when searching for a mortgage loan to help finance the purchase of a home.

You can choose from loans insured by the federal government, such as FHA or VA loans. You can select a mortgage with an interest rate that never changes or one with a rate that rises and falls throughout your loan’s term. You can choose a loan that you pay off in 30 years or one that you’ll pay down in just 10 or 15 years of regular monthly payments.

Here well go over the different types of mortgages so you can make the right decision.

Pmi On Conventional Loan Faqs

How much is PMI on a conventional loan?

PMI on a conventional loan varies based on the loan amount, down payment, and your credit score. Typically, PMI rates range between 0.5-1.5% of the loan balance, and premiums adjust every year to reflect the update balance.

Can you get rid of PMI on a conventional loan?

Yes, you can, once you reach 20% equity. But you have to request either verbally or in writing that your lender remove the PMI on your conventional loan. Once you hit 22% equity according to the lenders calculations, the lender removes PMI automatically.

Do you pay PMI with a conventional loan?

Private mortgage insurance is required by most lenders when the borrower makes a down payment of less than 20% on a conventional loan.

Also Check: Usaa Car Loans Review

Heres What You Need To Get A Conventional Loan

Conventional loans have to meet certain baseline requirements set by Fannie Mae and Freddie Mac and can be harder to qualify for than a government-backed loan.

Edited byChris JenningsUpdated January 4, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Conventional loans are one of the most popular types of mortgages: almost all lenders offer them. In August 2020, 82% of all closed mortgages were conventional loans, according to a report by Ellie Mae, making them far more popular than FHA, VA, or other home loans.

Conventional loans tend to have stricter requirements than government-backed mortgages. But with so many homeowners meeting these requirements, a conventional loan might be more accessible than you think.

Heres what you should know about conventional loans before you apply:

Conventional Mortgage Down Payment

Keep in mind, that the more you put down, the lower your overall loan costs. Your down payment amount helps determine your PMI rate and interest rate, which affects your monthly payment amount and overall interest costs.

Bottom line: The higher your down payment, the less youll spend monthly and over the life of the loan.

You may also use gift funds from a parent or eligible non-profit agency to pay for your entire down payment and loan closing costs. Learn more about gift funds here.

Recommended Reading: Usaa Personal Loan Calculator

How Can I Save Money For A Down Payment

Down payment assistance programs help first-time and low-income buyers afford a home. Each program has specific eligibility requirements.

Some loans are flexible and accept down payments entirely funded through gifts, grants, and loans. You may not have to contribute your own savings. This includes DPA funds and assistance from family or friends.

Otherwise, the best way to save is with a comfortable budget and savings plan. Determine which loans youre eligible for and their down payment requirements to set a goal. Consider how much you can save each month to determine your home-buying timeline.

Whats The Maximum Loan To Value Ratio In Georgia

Maximum LTV Ratio: The maximum financing loan-to-value ratio for conventional mortgages is 80% 97% of the appraised value of the home or its selling price, whichever is lower. Learn how to calculate loan-to-value. Maximum Loan Amount: Conventional loan limits in Georgia are set at the floor amount of $424,100 across the entire state.

Read Also: Refinancing A Fha Loan To A Conventional Loan

What Is Private Mortgage Insurance

PMI on a conventional loan protects your mortgage lender if you default on your home loan. The annual premium on your private mortgage insurance adjusts every year based on your loan balance.

Your PMI rate is charged as a percentage of your loan, and private mortgage insurance rates typically vary between 0.5-1.5% of the annual loan balance. Rates are calculated based on your credit score and your loan-to-value ratio , which just means how much youre putting down vs how much youre borrowing.

If you put down 3%, your LTV is 97%, since you are borrowing the remaining 97%. If you put down 5%, the LTV is 95%, and so on.

Its incredibly common for homebuyers to put just 3-5% down on a conventional loan.

Heres the good news: You only owe PMI if your down payment is less than 20%. And if you put less than 20% down, you only have to pay PMI until you achieve 20% home equity.

You only owe PMI if your down payment is less than 20%. And if you put less than 20% down, you only have to pay PMI until you achieve 20% home equity.

At that point, you can request that your lender remove the PMI obligation. Once you reach 22%, the lender removes PMI automatically. However, it is important that you ensure this happens. If it doesnt happen automatically, submit a written request to your lender to remove PMI.

Having to pay PMI might seem like a drawback to conventional loans. But the benefit to buyers is that they can buy homes with less money up front.

How Does A 5% Down Conventional Loan Work

A conventional loan is classified as any loan that is not guaranteed through a government agency, but rather, is insured through private lenders or a government-sponsored enterprise, . Most conventional mortgages are conforming loans, which means that they meet the requirements to be sold by government-sponsored enterprises, such as Freddie Mac or Fannie Mae. These GSEs set conforming loan limits and set the guidelines for credit score and down payments. Because these loans are not insured through the federal government, they pose a certain risk to lenders since they arent guaranteed payment in the event of a borrower default. Therefore, the eligibility requirements for conventional loans tend to be stricter than non-conventional loans.

Recommended Reading: How To Get Leads As A Loan Officer

What Type Of Down Payment Is Required For A Conventional Loan

Conventional loans offer a variety of down payment options. Ultimately your interest rate and any additional mortgage insurance fee will be based on the size of your down payment. A 20% down payment will eliminate the need for private mortgage insurance, but there are lower down payment options. Your down payment for a conventional loan can be as low as 3%.

How Much Should You Put Down When Buying A Home

Your down payment plays an important role when youre buying a home. A down payment is a percentage of your homes purchase price that you pay up front when you close your home loan. Lenders often look at the down payment amount as your investment in the home. Not only will it affect how much youll need to borrow, it can also influence:

- Whether your lender will require you to pay for private mortgage insurance . Typically, youll need PMI if you put down less than 20% of the homes purchase price.

- Your interest rate. Because your down payment represents your investment in the home, your lender will often offer you a lower rate if you can make a higher down payment.

So how much of a down payment will you need to make? That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%.

Also Check: Usaa Auto Loan Approval

How Much Money Do I Need To Put Down On A Mortgage

When you buy a home, one of the biggest up-front expenses is the down payment. Not to be confused with closing costs, the down payment is the portion of the purchase price that you pay upfront at closing. Generally, if you put less money down on a home at closing, youll pay more in fees and interest over the loans lifetime .

How Much House Can You Afford

When you are pre-approved for a mortgage, a lender will tell you the maximum loan amount for which you qualify, based on responses in your application. Your mortgage application asks about your estimated down payment amount, income, employment, debts, and assets. A lender also pulls your credit report and credit score. All of these factors influence a lenders decision about whether to lend you money for a home purchase, how much money, and under what terms and conditions.

As a general guideline, many prospective homeowners can afford to mortgage a property that costs between 2 and 2.5 times their gross income. For example, if you earn $100,000 per year, you can afford a house between $200,000 and $250,000.

Rather than simply borrowing the maximum loan amount a lender approves, youre better served by evaluating your estimated monthly mortgage payment. Say you get approved for a $300,000 loan. If your monthly mortgage payment and other monthly debts exceed 43% of your gross monthly income you might have trouble repaying your loan if times get tight. In other words, be cautious about buying more house than you can reasonably afford.

Beyond buying a house, you may also want to contribute to other financial goals such as saving for retirement, starting a family, shoring up an emergency savings fund, and paying down debt. Taking on a too-high monthly mortgage payment will eat up cash that could otherwise go toward some of these important goals.

Don’t Miss: Usaa Auto Loan Pre Approval

Homebuyer Down Payment Assistance

Down payment assistance can help you buy a home without immediate cash. This includes several federal, state, and non-profit programs for first-time home buyers.

At Homebuyer, we partner with the Chenoa Fund to make homeownership possible without paying anything out of pocket.

Through our partnerships, Homebuyer.com provides DPA for buyers purchasing a home with an FHA loan, offering an affordable and user-friendly path to homeownership.

Buyers have two choices a 3.5 percent second loan to cover your down payment, or a 5 percent second loan to cover down payment and closing costs

If youre a middle-income earner, or lower, the second loan has zero interest and no monthly payments. Plus, its a forgivable second mortgage. If you make your housing payments on time, the loan is forgiven and you never have to pay it back.

The 3.5 percent option is forgiven after you make your first 36 mortgage payments on time.

The 5 percent option is forgiven after you make 10 years of payments without falling 60 or more days behind. If you do fall behind, there is still no interest and no payments youll just have to pay back the second lien when you sell or refinance the house.

If youre a higher-income earner, the second loan has a monthly payment. Buyers can choose a 10-year loan with no interest, or a 30-year loan with 5 percent interest.

These down payment assistance options are available now and you can apply here.

How Much Money Do I Need To Buy A House For The First Time

As of October 2021, the median home price in the U.S. is around $404,700. Assuming a 20% down payment, you would need $80,940 for a down payment, plus several thousand more for closing costs and fees to your lender, realtor, lawyer, and title company. Still, no set amount is required and home prices vary state-to-state and city-to-city. It’s all dependent on what you’re looking for in terms of size and type of property, neighborhood, amenities, and any other details specific to your situation.

You May Like: Classic Car Loans Usaa

I Can Afford A Monthly Mortgage Payment But I Dont Have 3% To Put Down Can I Still Get A Conventional Mortgage Loan

Lower down payments make home buying with a conventional mortgage loan a lot easier than the old 20% requirement. But what happens if you struggle to save up 3% down in cash?

After all, 3% of a $300,000 home is still $9,000 a sizable sum, especially if youre paying rent, making student loan payments, and dealing with credit cards and other debts.

If you simply cant get together the minimum down payment, you dont have to delay your homebuying timeline for another few years.

You may be able to get conventional loan down payment assistance from:

- Down payment assistance programs: You could apply to a conventional loan down payment program offered by nonprofit organizations in your community

- Gifts: You could ask family members or close friends to help you make a down payment. Some homebuyers ask for down payment help in lieu of wedding or graduation gifts, for example

However, if you are looking into obtaining a gift for your down payment, it is important to reach out to your Loan Officer first to ensure the documentation is done properly and the person who is gifting the funds is an approved person within the guideline requirements.

Using gifts and assistance programs for conventional loans isnt always possible. Some lenders and loan programs require you, as the homebuyer, to put a minimum amount of your own money toward the loan.

Be sure to check with your loan officer up front about your minimum contribution so youll know where you stand.

Benefits Of A Conventional Home Loan

Conventional loans are themost popular typeof mortgage.After that come government-backed mortgages, including FHA, VA, and USDAloans.

Government-backed mortgages have some unique benefits,including small down payments and flexible credit guidelines. First-time home buyers oftenneed this kind of leeway.

But conventional loans can outshine mortgages subsidized bygovernment agencies in several ways.

For example, conventional mortgageshave diverse repayment plans, borrowers dont have to meet any specialcriteria to qualify, and theresno upfront mortgage insurance fee.

Flexible repayment plans

As with most mortgages, conventionalloans offer several repayment options.

Conventional loans come in15, 20, 25, and 30-year terms. Some lenderseven offer 10-year conventional loans.

The shorter your loan term,the higher your monthly payment.

Fortunately, a 30-year fixed-rate conventionalloan stillcomes with low fixed-interest payments that are accessible to the majority ofhome buyers and refinancers.

Adjustable rates available

Conventional loans are also a smart choice for those who know they wont remain in their house long and want a shorter-term, adjustable-rate mortgage. This option comes with a lower interest rate than that of a fixed-rate loan.

Adjustable rates are in factfixed, but only for a period of time usually 3, 5, or 7 years. During thatinitial teaser period, the homeowner pays ultra-low interest and can savethousands.

No special requirements to qualify

Don’t Miss: Average Motorcycle Apr

How Your Down Payment Impacts Your Offers

When youre on the hunt for the right home, time is of the essence. Homes at entry-level price ranges typically sell quickly, and you want to put your best foot forward when making an offer because youll probably have competition. When markets are competitive and sellers receive multiple offers, they want to see buyers best offers, including a sizable down payment. From a sellers viewpoint, buyers who have more money to put down are more attractive because they have more skin in the game.

A higher down payment can indicate to a seller that you have enough cash on hand and solid finances to get a final loan approval without a hitch. Also, a higher down payment could beat out other offers that ask for sellers to pay closing costs or offer below the asking price. Someone with a sizable down payment is unlikely to request such assistance, and sellers are more likely to work with a buyer who has the money and motivation to see the purchase through with minimal haggling.

Low Down Payment Home Loans: Conventional 97 & Fha Loans

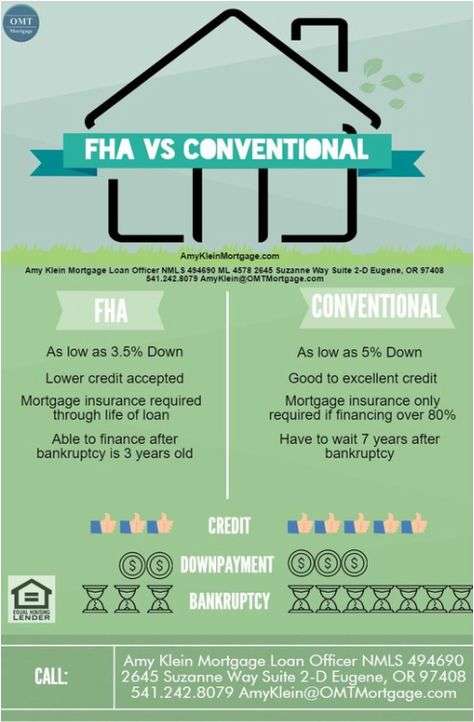

Choosing between a conventional mortgage or a loan backed by a government program like the Federal Housing Administration may seem a little ambiguous and confusing.

The FHA offers 3.5 percent down payment mortgage loans. That sounds great especially if you dont have a lot of money to spend upfront on homebuying. But conventional loan programs now give qualifying borrowers the opportunity to put just 3 percent down for a mortgage.

With so many loan options, how do you choose the right type of mortgage for your financial situation?

Its all about who you are talking to, says Susan Stevenson, president of the Ohio Mortgage Bankers Association. You really have to educate yourself on the different loans and get options. As a loan officer, I could take the same options and make them look different than someone else. There are a lot of variables in mortgages, and plus it also depends on what kind of house you buy and where you buy it.

Read Also: Co Applicant For Home Loan