Pritzker Signs Legislation To Cap High

Apr 3, 2021 J.B. Pritzker signed the Illinois Predatory Lending Prevention Act late last month, which caps annual interest rates on short-term loans at;

Jul 22, 2021 Learn everything about auto title loans in Arizona. Apply for a title loan online or visit What are the interest rates for title loans?

Aug 25, 2017 Auto title loan lenders charge an average of 25% per month in interest on the loan. Thats an annual percentage rate of 300%! Even;

Whats The Best Motorcycle Loan Term

Loan term affects both your interest rate and monthly payment when the term is longer, monthly payment is lower. Plus, certain terms will have certain rates available. The best Motorcycle loan term is the one with the right balance of time, rate, and budget for you! Our most commonly used loan terms are between 36 72 months.

How To Get The Best Motorcycle Loan Rates

If youre in the market for a motorcycle loan, youll want to do what you can to make yourself more attractive to a lender before you apply for one.

Because bikes can be expensive, small differences in the interest rate they offer you can make a huge difference in how much youll pay in interest over the life of your loan.

Here are a few things your lender will look at when you apply. If you take steps to improve them, you can get the best motorcycle;loan;rates.

*Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% points higher. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice.

**Payment example: Monthly payments for a $10,000 loan at 5.95% APR with a term of three years would result in 36 monthly payments of $303.99.

2 Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will qualify for the full amount. Loans are not available in West Virginia or Iowa. The minimum loan amount in MA is $7,000. The minimum loan amount in Ohio is $6,000. The minimum loan amount in NM is $5100. The minimum loan amount in GA is $3,100.

You May Like: Are Quicken Loan Rates Competitive

What To Consider For Motorcycle Payments And Affordability

When you’re in the market for new or used motorcycles, it can get rather daunting when you have no idea where to start. One of the keys to a successful motorcycle purchase is knowing what you can afford. This motorcycle payment calculator takes all the hard work out of making a sound financial decision. Simply enter in your desired monthly payment or vehicle price and it will return your results.

Who Should Get A Motorcycle Loan

Financing a motorcycle for a secondary mode of transportation isnt usually a good idea. These luxury purchases are often best paid for with cash to avoid interest charges.;

However, buying a motorcycle as your primary way to get around town could make sense. Even though motorcycles cost less than most cars initially, you should consider the additional costs of motorcycle ownership including riding gear, more frequent tire changes, and more costly maintenance. To get the best rates on your motorcycle loan, you need excellent credit, a reasonable debt-to-income ratio, and a stable source of income.;

Recommended Reading: How To Pay Home Loan Faster

What Is A Good Credit Score For A Motorcycle Loan

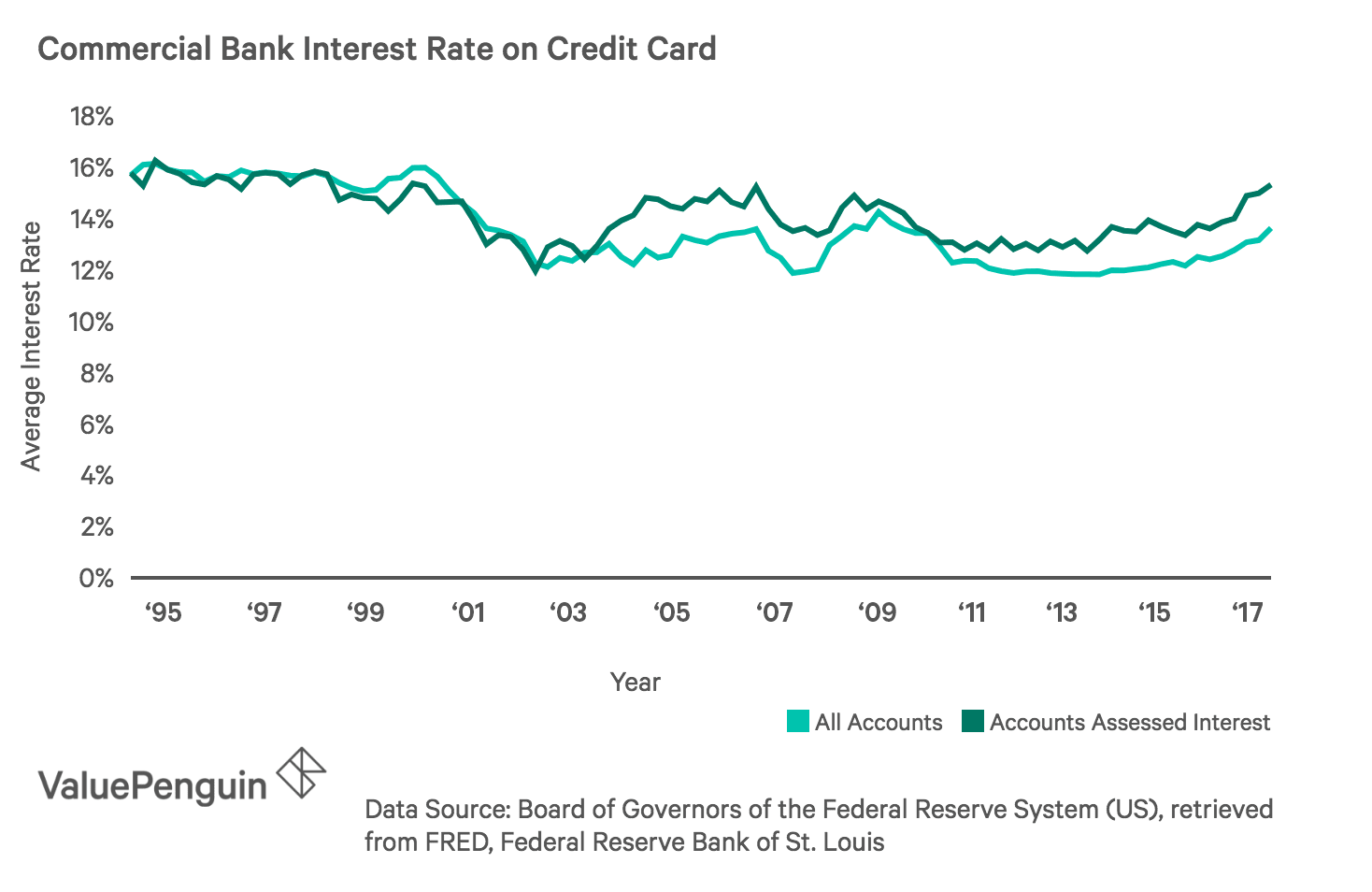

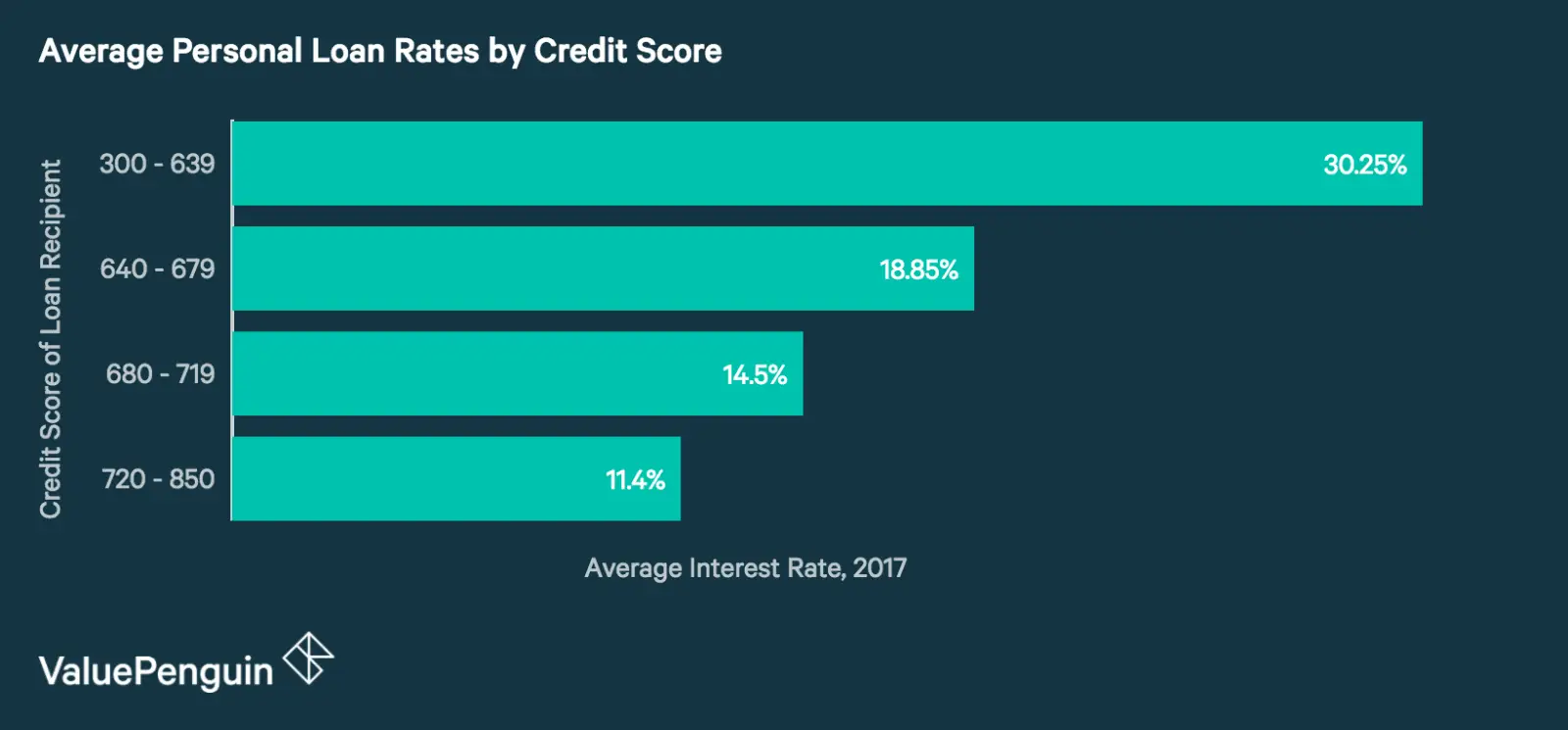

When you apply for a loan to purchase a motorcycle, lenders will evaluate your application based on your income, credit history, and credit score. Your credit score plays an important role in whether you get approved and what interest rate the lender will give you.;

You will typically need good to excellent credit to qualify for a motorcycle loan with competitive rates. According to Equifax, one of the three major credit bureaus, good credit scores range between 670 and 850. However, the lowest-advertised interest rates and most favorable loan terms will be reserved for people with very good to excellent credit.;

- 800 to 850: Excellent credit

- 740 to 799: Very good credit

- 670 to 739: Good credit

- 580 to 669: Fair credit

- 300 to 579: Poor credit

Some personal loan lenders will work with people with scores below 670. However, youll typically pay a higher interest rate than someone with a higher credit score.;

Buying The Motorcycle Of Your Dreams

Yes, the lure of the open road is hard to resist, but there’s more to buying a motorcycle than simply picking a cool looking model out of a trade magazine. Think about the kinds of riding you will be doing, and the type of motorcycle that fits your needs and your experience level. Carefully consider what you can afford, and how you will finance your purchase. Take the time to research a number of different lending paths, until you find the lender and the loan that works for you and your current financial situation. Once you find a loan that you are comfortable with you’ll be ready to finalize your purchase and start experiencing the magic that comes with seeing the world from the back of your new motorcycle.

Don’t Miss: Does Refinancing Car Loan Hurt Credit

The Difference Between Motorcycle & Auto Loans

When it comes to motorcycle loans, it is important to understand how they differ from standard auto loans. While there are some similarities , there are some key differences that can significantly impact interest rates, as well as determine whether or not you will be approved for financing. As a general rule, lenders are more hesitant to underwrite a motorcycle than a standard automobile, and this can be attributed to a few key factors.

Advantages Of Taking A Two Wheeler Loan From Bajaj Auto Finance

As is mentioned above, Bajaj Auto Finance offers the lowest rate of interest to its customers. Apart from that, there are several other advantages of taking a Two wheeler loan from us. These are:

- Hassle free documentation and speedy processing

- Quick disbursal of two-wheeler loans

- Low-interest rates and low-cost EMIs

- Convenient repayment schedule

You May Like: What Is The Housing Loan Interest Rate

Bank Or Credit Union Loans

You can save money at the dealership by securing financing on your own beforehand. Many banks and credit unions offer motorcycle loans and tend to have lower interest rates than dealerships.

If you have poor credit or dont have an established credit history, going through a credit union could be a smart choice. Unlike banks, credit unions are nonprofit organizations and might have more relaxed requirements for loans. If youre not a member of a credit union already, you can find one near you through MyCreditUnion.gov.

Finance A Car Chase Auto

The rate calculator provides estimated auto financing terms, APRs and of the cost of the credit, which will make the APR higher than the interest rate;

Jul 30, 2021 Low rates are driving rebound. The average rate on a five-year new car loan is 4.15%, down from 4.24% last year, according to Bankrate.com.

Get a new car loan from U.S. Bank and find great new car loan rates, convenience and flexible auto financing options. Apply for a new car loan today!

Below you can learn the average interest rate for a new and used car based on credit score. When youre ready to take the next step, chat with the finance;

Their State of the Automotive Finance Market report from the fourth quarter of 2020 found that the average interest rates for both new and used auto loans;

Don’t Miss: How To Get Loan Signing Jobs

Best For Manufacturers Financing: Harley

;Harley-Davidson

Harley-Davidson, an iconic motorcycle manufacturer, provides motorcycle financing through Eaglemark Savings Bank, a subsidiary of Harley-Davidson Credit Corp. We chose Harley-Davidson as the best motorcycle loan for manufacturers financing because they offer new and used motorcycle loans for purchases at their dealerships as well as private-party financing on used Harley-Davidson motorcycles.

The company often advertises special financing deals on their new motorcycles and APR discounts for rider training graduates. Depending on the loan you choose, terms can stretch as long as 84 months. APRs can be as low as 3.49% for rider training graduates that fall in the highest credit tier if the loan term is 60 months or less. Military members may also qualify for reduced rates, flexible term options, and a $0 down payment.

You dont need to pick out a motorcycle before applying for financing. A loan decision can be made in minutes, and all financing is facilitated by the dealership, even if you apply online. This includes private-party financing. If you dont have a dealership nearby, this could present issues, as both the buyer and seller must visit a Harley-Davidson location to finalize financing.;

Motorcycle Loan Frequently Asked Questions

Where can I get a motorcycle loan?

Motorcycle loans are offered through some motorcycle manufacturers, banks, credit unions and online lenders. Compare offers from multiple lenders to find the lowest rate.

How do I get a motorcycle loan?

Getting a motorcycle loan starts with comparing multiple loan offers. You’ll then;submit an application, typically with documentation like W-2s and pay stubs. The application will trigger a hard credit pull. Once approved, you’ll typically receive the loan within one to five business days.

What credit score do you need to get a motorcycle loan?

Minimum credit score requirements vary among lenders, but the higher your credit score, the more likely you’ll be approved for a low interest rate. Borrowers with good to excellent credit scores receive the lowest rates, though some lenders offer;bad-credit loans.

What are repayment terms on motorcycle loans?

Motorcycle loans typically have repayment terms between one and seven years. A longer term means lower monthly payments, but more interest.

What are motorcycle loan rates?

Rates on personal loans from online lenders range from 6% to 36%, while unsecured bank loans can have rates between 7% and 25%. Federal credit unions cap interest rates at 18%.

You can see what rate you qualify for on an unsecured personal loan by pre-qualifying. Doing so with NerdWallet lets you see potential rates and terms from multiple online lenders and doesnt affect your credit score.

You May Like: What Is The Commitment Fee On Mortgage Loan

Summary Of Best Motorcycle Loans Of 2021

Est. APR

Loan Amount

Key facts

LightStream targets strong-credit borrowers with no fees and low rates that vary based on loan purpose.

Pros

-

Competitive rates among online lenders.

-

Offers .5% rate discount for setting up autopay.

-

Special features including rate beat program and satisfaction guarantee.

Cons

-

No option to pre-qualify on its website.

-

Requires several years of credit history.

-

Does not offer direct payment to creditors with debt consolidation loans.

Qualifications

-

Minimum credit score: 660.

-

Several years of credit history.

-

Multiple account types within your credit history, like credit cards, a car loan or other installment loan and a mortgage.

-

Strong payment history with few or no delinquencies.

-

Investments, retirement savings or other evidence of an ability to save money.

-

Enough income to pay existing debts and a new LightStream loan.

Available Term Lengths

-

Late fee: None.

Disclaimer

Est. APR

Loan Amount

SoFi offers online personal loans with consumer-friendly features for good- and excellent-credit borrowers.

Pros

-

Offers co-sign and joint loan options.

-

Offers .25% rate discount for setting up autopay.

-

Offers unemployment protection.

-

Provides mobile app to manage your loan.

Cons

-

Must legally be an adult in your state.

-

Must be a U.S. citizen, permanent resident or visa holder.

-

Must be employed, have sufficient income or have an offer of employment to start within the next 90 days.

Available Term Lengths

-

Late fee: None.

Disclaimer

Est. APR

Loan Amount

Key facts

Useful Tips For Choosing For A Motorcycle Loan

When looking for ways to finance a motorcycle, it is always advisable to follow these simple steps:

1. Go for a motorcycle window shopping. Check the type of motorcycle you want to buy thoroughly. Consider your options for buying an used motorcycle.

2. Research for motorcycle loans or big bike loans available online. Due to the pandemic, most of the financing companies provide online loan applications. Its now easier to research all types of loans, including; to get a big bike loan in the Philippines.

3. Select 3 loan programs that you think suit your financial needs. Make inquiries; their customer service if necessary. Weigh in the factors that can influence your decision, then choose the best among them. Find out if down payment is necessary and what interest rates are offered by different companies. Your chances increase if you have a good credit rating.

4. Complete the requirements. Take note of all essential information such as the interest rate, payment loan term, mode of payment, and the loan conditions. Finally, choose which motorbike you want to buy.

* Interest payments are approximate. The final loan amount and interest rate must be confirmed in your loan agreement after loan approval.

You May Like: How To Take Loan From 401k To Buy House

Best For Military And Veterans: Usaa

USAA;

USAA, founded in 1922, is a financial services and insurance company focused on meeting the needs of military members, veterans, and their families. We chose USAA as the best motorcycle loan for military and veterans because of their ability to handle unique situations military members face.

You must be a USAA member to apply for a USAA motorcycle loan. You can qualify if youre a U.S. military member, veteran, or a pre-commissioned officer. Spouses and children of USAA members also qualify.

USAA motorcycle loans can finance new and used motorcycles, scooters, and new off-road dirt bikes. They come with APRs as low as 5.99%, including a 0.25% autopay discount, and loan terms of up to 72 months. You must finance at least $5,000 to qualify for 12- to 48-month terms, $10,000 to $15,000 for 60-month terms, and $15,000 or more for 72-month terms. The maximum loan amount is $20,000. The loan-to-value ratio must be 90% or lower. They have no minimum credit score requirement and look at your entire financial picture before approving or denying your application.

Youll need a signed contract with a dealership or title information from a private party. USAA requires you to sign loan documents and sends a check to you or the previous owners lender by FedEx, which takes one to three business days.;

USAA customers cite a hassle-free loan experience and good customer service but strict credit standards in their reviews.

Loan Basics: What Factors Affect Your Financing Rates

There are a number of basic factors that will affect your interest rate. There are general factors associated with any type of loan, and then there are powersport and RV specific factors.;

;Your credit score is highly influential in determining your interest rate. Rates can fluctuate by dozens of percentage points, depending on where you fall on the credit spectrum. Credit scores range from 300 to 850, with a low score meaning its going to be harder to obtain a loan or it might come at a higher cost, and a high credit score meaning its going to be easier to get a loan and the cost of borrowing will be cheaper.Generally, your credit score is determined by the following factors:;

- Payment history for loans and credit cards

- Type, number and age of credit accounts

- How many new credit accounts you have recently opened

- Total debt

- Public records such as bankruptcy and foreclosures

- Number of inquiries on your credit report

Common Question: How Long are RV loans? RV loans typically last from 10 to 15 years. However, many credit unions, banks or other financial institutions will extend the repayment period to 20 years for loans greater than $50,000 with qualified collateral. Interest rates for RVs are currently ranging somewhere between 4% and;20%, depending on the size of the loan, length of the loan, down payment and your credit rating.

;RV loans are also usually longer than car loans. The average length for an RV loan is 10 to 15 years where it is usually 5 years for a car.;

Don’t Miss: How Long Does Student Loan Approval Take

What Are The Requirements Of Applying For A Motorcycle Loan

All banks with motorcycle loan programs in the Philippines have their own sets of requirements, but the most common ones for applicants are the following:

Qualifications to Apply for a Motorcycle Loan

Typical Requirements for a Motorcycle Loan Application

How We Chose The Best Motorcycle Loans

To find the best motorcycle loans, we researched 18 top lenders, including manufacturer financing options, motorcycle loans, and personal loans. To narrow down the list and identify the top choices, we looked at lenders interest rates, available loan amounts, repayment terms, down payment requirements, and necessary credit scores. Our selections for the best motorcycle lenders offered the lowest interest rates and had loan terms of five years or more, often on both new and used bikes.

Also Check: How Much Loan Can I Get With 800 Credit Score