Is Ida Focused On The Right Countries

The original rationale for IDAfocusing on the poorest countries who cant get finance elsewherestill makes sense. One implication is that, as they develop, IDA recipients should graduate .

Between IDAs founding and 2020, 37 countries graduated. Another 9 graduated but suffered development reverses and re-entered. Eighty-two countries were recipients in 2019, some of whom received no new money, just disbursements from previously approved allocations. There are 30 fragile and conflict-affected states among the current recipients.

Formally, the World Banks graduation threshold for IDA is an annual per capita income of $1,205, but it is not applied. Of the 74 countries in principle eligible for new IDA resources, at least 49 have per capita incomes above the threshold.

There may be an argument for countries with per capita incomes above the threshold retaining access to IDA if they cant get resources elsewhere. But for a good number, thats not the case. A glance at data from credit ratings agencies suggests that some 25 IDA recipients have credit ratings in the B- to BB- rangecomparable, in other words, with the likes of Brazil, South Africa, Turkey, Oman, and Bosnia.

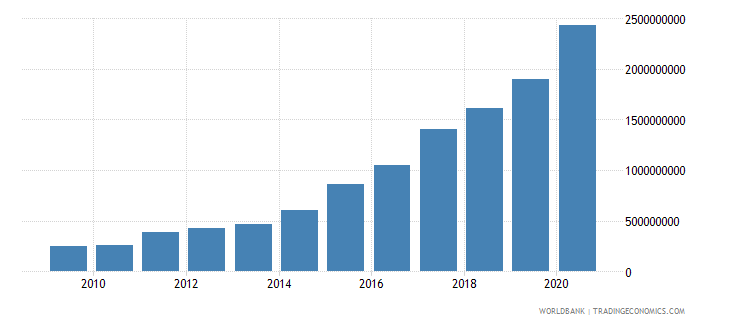

Time lags in the IDA system reinforce the issue. Countries moving beyond IDA still get disbursements for years after graduation. India, for example, which graduated in 2014, received more than $1 billion in 2019. Substantial disbursements five years after graduation is common.

Figure 1 Regional Distribution Of The Poverty

Source: World Bank Regional aggregation using 2011 PPP and $1.9 a day poverty line, data accessed online on June 28, 2017

IDA countries lag behind the world in terms of other key development outcomes. Figure 2 compares some key development achievements in IDA countries compared with the world in 2015 or the latest year for which data are available. The development indicators presented in the figure are described in Appendix A.

Does It Prioritise The Most Salient Issues

IDAs country-driven operating model means that sectoral priorities within each countrys allocation are significantly determined by the authorities in the recipient country. It would be undesirable to move too far from that approach.

In the immediate future, the top priority should be to contain the damage from the pandemic and then to support recovery. But as we have said, there are important questions as to which countries IDA should focus these efforts on.

As others from CGD have argued , there is a good case for IDA to play a stronger role on global public goods, in particular health and climate. That could include a substantial and over time growing ring-fenced window, which could also earmark more resources for regional projects. That might, however, be more an issue for IDA21 than IDA20.

Conversely, as Charles Kenny has argued, recent experiments in using IDA resources to subsidize the International Finance Corporation should be dropped for the time being.

Read Also: Bayview Loan Servicing Lawsuit

Increasing The Scale Of Resources

Most immediately, the longer than expected downturn of the economy and the front-loading of IDA19 grants and loans in 2020 and 2021 call for an increased funding envelope. This is to ensure that IDA operations do not fall in 2022 and 2023 when they will be most needed. There are three potential options to increase the scale of resources available to IDA to support the Covid-19 recovery.

International Centre For Settlement Of Investment Disputes

ICSID engages in international investment dispute settlement.

- It settles disputes between investors and governments.

- It also settles state-state disputes under investment treaties and free trade agreements and acts as an administrative registry.

- The Centre provides for settlement of disputes by arbitration, conciliation, or fact-finding.

- It also disseminates information on international law on foreign investment.

- India is not a member of the ICSID because it claims that the ICSIDs functioning and structure are biased towards the developed countries.

- India set up the BRICS Arbitration Centre to address and reinforce international arbitrations with foreign investors. Although this is limited to the BRICS countries, it will be available for all developing countries in the future.

| Related Links |

Don’t Miss: Fha Refinance Mortgage Calculator

Covid Economic Injury Disaster Loan Program Enhancements

In September 2021, SBA Administrator Isabella Casillas Guzman announced major enhancements to the COVID Economic Injury Disaster Loan program.

Key changes announced

- Increasing the COVID EIDL Cap. The SBA will lift the COVID EIDL cap from $500,000 to $2 million. Loan funds can be used for any normal operating expenses and working capital, including payroll, purchasing equipment, and paying debt.

- Implementation of a Deferred Payment Period. The SBA will ensure small business owners will not have to begin COVID EIDL repayment until two years after loan origination so that they can get through the pandemic without having to worry about making ends meet.

- Establishment of a 30-Day Exclusivity Window. To ensure Main Street businesses have additional time to access these funds, the SBA will implement a 30-day exclusivity window of approving and disbursing funds for loans of $500,000 or less. Approval and disbursement of loans over $500,000 will begin after the 30-day period.

- Expansion of Eligible Use of Funds. COVID EIDL funds will now be eligible to prepay commercial debt and make payments on federal business debt.

- Simplification of affiliation requirements. To ease the COVID EIDL application process for small businesses, the SBA has established more simplified affiliation requirements to model those of the Restaurant Revitalization Fund.

Navigator Hurricane Ida Relief Loan

Who is eligible to apply for a Navigator Hurricane Ida Relief Loan?The Hurricane Ida Relief Loan is available to current Navigator Members in good standing who meet lending criteria. Members can submit an individual or a joint application. Hurricane Ida Relief Loans are limited to one per household.

How can I request a Hurricane Ida Relief Loan?Visit Navigators dedicated Hurricane Ida Relief Loan web page for a link to apply online. You can apply for a Hurricane Ida Relief Loan online in just a few minutes. You can also apply during our regular business hours by calling 800-344-3281 and choosing option 3, or by visiting any Navigator Branch to apply in person.

Are there any requirements for the Hurricane Ida Relief Loan?Yes, the loan approval and terms are subject to creditworthiness. Employment and income criteria are not considered, but we will conduct a basic credit review which requires us to check your credit. Members who do not meet the criteria for the Hurricane Ida Relief Loan may qualify for another type of loan and will be given every consideration. The terms and conditions for loans other than Hurricane Ida Relief Loans vary.

How much can I borrow with the Hurricane Ida Relief Loan?Hurricane Ida Relief Loans are offered in amounts up to $1,500, with terms from five to 15 months. Based on the credit review, approved loans amounts are $500 with a 5-month loan term $1,000 with a 10-month loan term and $1,500 with a 15-month loan term.

Recommended Reading: Nerdwallet Loan Calculator

Expand The Share Of Ida Assistance Disbursed As Development Policy Loans

Using DPLs means funding is channelled directly through governments. Financing through national budgets is estimated to have a greater local economic impact, and would therefore likely have higher short-term fiscal multipliers. DPLs also usually come with conditions on policy reforms . At the time of the 2008-2009 global financial crisis, the share of DPLs surprisingly declined. But data for 2020 shows a rise in the use of DPL compared to 2019 . This trend should continue and expand in 2021 and 2022.

Increase Idas Own Resources

New donor pledges in 2021 of sufficient scale, or an early replenishment, could enable IDA grants and loans to maintain current levels of financing in to 2022.

As of 2018, IDA had $163 billion worth of paid-in shareholder capital. Given the severity of the crisis, there is an argument to be made on drawing upon the capital to expand financing . However, this would reduce IDAs financing capacity over the longer-term.

Also Check: Usaa Auto Loan Credit Requirements

How Ida Should Support Recovery From The Covid

IDAs core ambitions are to boost economic growth, reduce inequality and improve livelihoods in the poorest and most vulnerable countries. But as a result of the Covid-19 crisis, achieving these aims has become significantly more difficult. There are also short-term challenges to contend with. These include greater risks of macroeconomic instability and quickly recovering some of the economic activity that has been lost. How can IDA balance these short-term challenges and long-term development needs?

IDA funding should prioritise government spending policies that support IDAs long-term core objectives. In addition, projects that get cash to businesses and citizens will raise demand in the economy and help to maximise the short-term fiscal multiplier . Such policies should be timely, targeted and temporary.

In the current context, timelywould mean interventions should be adapted depending on the progress of vaccination programmes and the reopening of economies. Instruments and programmes that are quick to implement and get money flowing to service provision, businesses and households should be chosen.Targeted policies would require a larger crisis response window to be allocated to countries and sectors most adversely affected by Covid-19, to achieve high multipliers in the short run through greater use of local content. The additional intervention should also be temporary, without loading spending pressures onto the national budget once IDA funds are withdrawn.

What Are The Covid

The law states that IDAs may provide grants or in-kind donations of a maximum of $10,000 to businesses and nonprofits. These grants can be used for the purchase of Personal Protective Equipment and other fixtures needed to help prevent the spread of COVID-19. The law doesnt specifically state what those other fixtures could be, but they might include the plexiglass guards or social distancing markers that many businesses are installing.

IDAs can also provide loans under the new legislation. The loans are capped at $25,000. The law doesnt specify exactly what the loans are for, but it does require that businesses submit a proposal for their use of the loan for consideration. Long Island, NY-based Newsday states that the loans are to pay employee salaries, rent, utilities, and other expenses during the pandemic. The loans will be interest-free and will have a grace period of 60 days following the end of the state of emergency in New York. They will have to be paid back in full a year after the end of the grace period there is no penalty for early repayment.

You May Like: Loan Officer License Ca

What Is A New York Ida

IDAs were established in New York in 1969 to attract, retain and expand businesses within their jurisdictions through the provision of financial incentives to private entities,according to a state review from 2006. IDAs are legally empowered to buy, sell, or lease property and to provide tax-exempt financing for approved projects.

Every county in New York has an IDA, as do numerous municipalities.

International Bank For Reconstruction And Development

The IBRD calls itself a global development cooperative. It has a membership of 189 countries.

- It is the worlds largest development bank.

- It provides loans, guarantees, advisory services, and risk management products to middle-income and creditworthy low-income countries.

- Middle-income countries represent more than 60% of the IBRDs portfolio.

- IBRD finances investments across all sectors and offers technical support and expertise at every stage of a project.

- IBRD deals only with sovereign governments and not private players.

- It also assists governments in augmenting the investment climate of countries, removing service delivery bottlenecks, and strengthening institutions and policies.

- IBRD sources most of its funds from the worlds financial markets.

IBRD and India

- India is a founding member of IBRD.

- It started lending to India in 1949, the first project being undertaken for the Indian Railways.

- Since the 1960s, the IBRD is an important source of long-term funding for India.

- India is the largest IBRD client of the World Bank.

- India is a blend country, which means it is transitioning from a lower-middle-income to a middle-income country.

- India is eligible for loans from both the IBRD and the IDA.

Also Check: Usaa Used Auto Rates

Management Response And Action Plan

| Recommendations |

|---|

| Female enrolment in schools as a percentage of male enrolment | |

| Employment rate | Employment-to-population ratio for people aged 15 and over, as a percentage of the relevant group |

|---|---|

| Female-male labour force participation | Female labour force participation as a percentage of male participation, modelled on the International Labour Organization estimate |

Icipating In The Program

The program serves refugees and other ORR-eligible populations who have been in the United States for less than five years. Refugees who wish to save for a car for transportation to school or work must have been in the country for three years or less when enrolling.

To enroll in the program, participants must:

- Have a paying job

- Earn less than 200% of the federal poverty level

- Not have more than $10,000 worth of assets, excluding one car and one home

The Individual Development Accounts program provides participants with:

- Financial literacy training .

- Asset-specific training .

- A match of $1 for every $1 saved by the client. Matches are allowed up to $2,000 for individuals and $4,000 for households.

Also Check: Usaa Auto Refinance

Somerset County New Jersey Disaster Assistance From Fema

If your home or business was impacted by Hurricane Ida 2021, and is located in one of the communities approved for individual assistance from FEMA , you can apply for disaster assistance.

Check to see if Somerset County, New Jersey is approved by FEMA by visiting DisasterAssistance.gov or by calling 1-800-621-3362 between the hours of 7am to 11pm Eastern Standard Time seven days a week.

For other possible Somerset County, New Jersey disaster assistance resources, or to apply for assistance from FEMA, visit the official Hurricane Ida FEMA website.

Summary Of Hurricane Ida Disaster Loan Relief For Somerset County Nj

To apply for financial assistance and relief due to your Somerset County, New Jersey home or business being damaged by Hurricane Ida, it is important to do so in a timely manner. There are deadlines for when you need to submit your application.

This is something you can do yourself by visiting the official government Hurricane Ida FEMA and Hurricane Ida SBA websites.

Also Check: Usaa Car Loan Credit Score

New Jersey Included Hurricane Ida 2021 Caused Damage In 12 States And 134 Counties

New Jersey was not the only state that suffered disastrous damage from Hurricane Ida.

With New Jersey, 12 states were affected, including: Alabama, Connecticut, Delaware, Georgia, Louisiana, Maryland, Massachusetts, Mississippi, New Jersey, New York, Pennsylvania, and Virginia.

Hurricane Ida formed as a tropical depression in the Caribbean Sea on August 26, 2021. It increased to a hurricane the next day. Hurricane Ida was a deadly and destructive Category 4 Somerset Ocean hurricane that became the second-most damaging and intense hurricane to make landfall in the United States on record behind Hurricane Katrina in 2005.

Hurricane Ida made landfall in the State of Louisiana on August 29, 2021, the 16th anniversary of Hurricane Katrina. Hurricane Ida made landfall near Port Fourchon, Louisiana, devastating the town of Grand Isle. Ida weakened steadily over land, becoming a tropical depression on August 30th, 2021. It then turned northeast causing damage across multiple states.

Sba Disaster Loan Eidl Options To Overcome Being Denied

Disaster Loan Advisors was featured on Yahoo! Finance and other news media with this original press coverage of this story.

The Small Business Administration deadline to submit new Economic Injury Disaster Loan applications is fast approaching. Surprisingly, there are still small businesses who have never applied for the EIDL disaster loan program. December 31, 2021 will be the last day for new SBA loan applications to be accepted. For the millions of small business owners who have applied for EIDLs previously, and have been denied, there are several important, yet often unknown, options available to them that surpass the end-of-year deadline.

“For the past several months, we’ve received hundreds of calls from small business owners and entrepreneurs who fall into one of three categories. First, those who applied for an EIDL, and were denied. Second, those businesses who received an initial EIDL loan, and were turned down for an increase. And third, those who have been approved for a 2nd round EIDL fund increase, yet want to do an increase request upwards of the $2 million maximum.”

DLA is a strategic advisory firm that specializes in assisting small businesses and companies with SBA loan consulting for EIDL loan reconsideration requests and SBA EIDL loan increase requests.

Recommended Reading: How To Get A Mortgage License In California

Figure : Ida Project Approvals Dssi Savings And Imf Emergency Lending Us Billions

World Bank project approvals , DSSI webpage and IMF Covid-19 Financial Assistance and Debt Service Relief .

This expansion of IDA grants and credits in 2020 and 2021 comes at a price though. Unless shareholders pledge additional contributions in 2021 the current IDA19 cycle is due to end in June 2023 or if lending policies change, IDA operations are expected to fall by 35% in 2022. This would mean a drop from $35 billion in 2021 to $22.5 billion in 2022. If more countries are assessed to be at greater risk of debt distress as a result of the crisis, then the sum of IDA funding will fall even further. This is because a greater proportion of the overall IDA envelope will be paid out as grants.

This note explores:

- the implications of a potential sharp fall in IDA resources in 2022 and what this could mean for the prospects of economic recovery in lower-income countries

- how the financing, allocation and use of future IDA resources could best support recovery in lower-income countries.