What Is The Paycheck Protection Program

In March 2020, the Coronavirus Aid, Relief, and Economic Security Act established the Paycheck Protection Program to provide economic relief to small businesses nationwide adversely impacted by the COVID-19. The PPP is administered by the Small Business Administration with support from the Department of the Treasury. The PPP provides significant financial incentives for small businesses to hold on to current employees and bring back workers who had been laid off or furloughed, even before their business was fully back up to speed.

Designed to provide quick access to loans from the SBA for companies with 500 or fewer employees, the PPPs intention was to help with payroll and operating costs during short-term business disruption caused by the COVID-19 pandemic. The PPP loan application period, which had been extended from July to August and most recently to December and then March 31, 2021, has now been extended to May 31, 2021.

Eligible businesses are eligible for up to $10 million in loans, which can be used for covered payroll and other expenses, such as insurance premiums, mortgage interest, rent, or utilities. Loan payments are also deferred for six months. No collateral or personal guarantees are required. Neither the government nor lenders charge small businesses lending fees.

Forgiveness is based on the employer maintaining or quickly rehiring employees and

What Banks Can You Use To Receive Your Ppp Loan

If you want to receive your PPP loan from one of the many major banks in the country, here are some options for you. SunTrust Banks and Branch Banking & Trust have both merged recently, and they both are SBA lenders. Truist Financial Corporation is the eighth largest bank in the country, and it has branches in 15 states. If you are currently a client of the bank, you can apply for a PPP loan through the online portal.

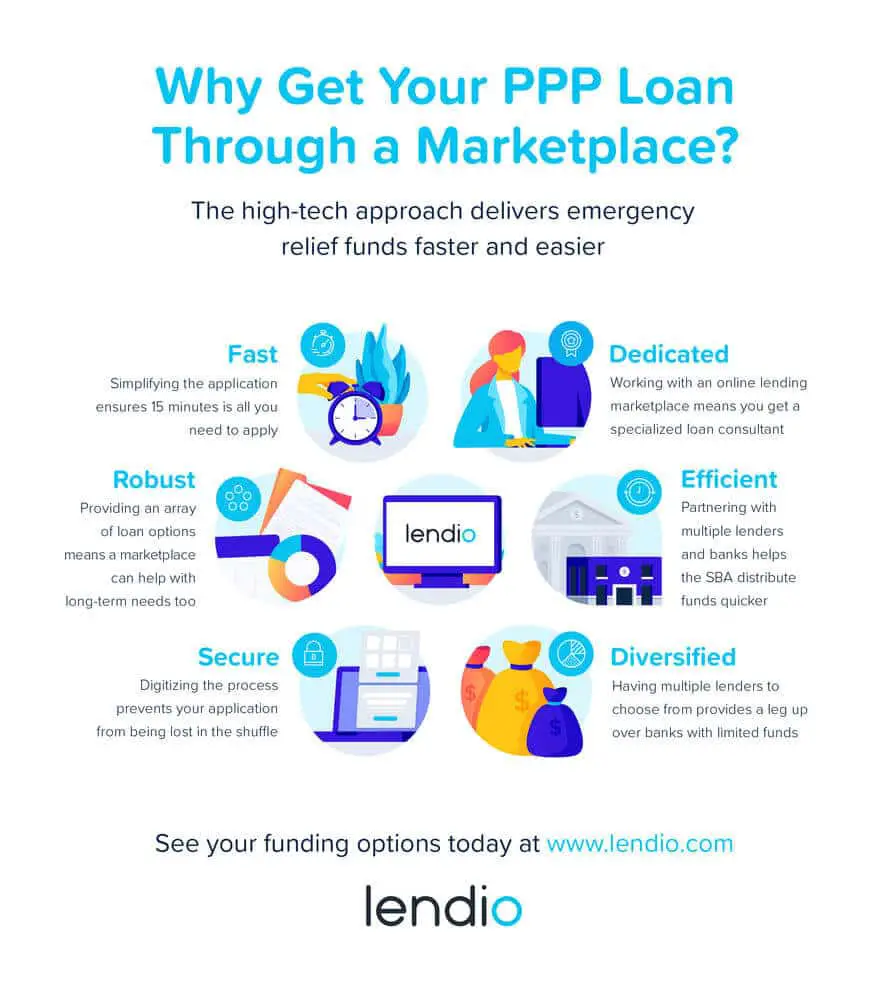

Key Point Credit Union accepts Paycheck Protection Program loan applications from existing business customers. Navy Federal Credit Union is another bank that accepts applications from current business customers. Lendio, a small business loan marketplace, connects applicants with approved capital providers. Newtek Small Business Finance is another business development company that accepts PPP loan applications. Kabbage is a fintech platform for direct funding.

How Do I Calculate The Maximum Amount For My Ppp Loan

For first-time PPP loans, businesses and nonprofits generally can request a maximum loan amount of 2.5 times the average monthly 2019 payroll. Insurance payments can also be included in payroll costs. The SBA has also that outlines calculations for different types of businesses.

For second-draw PPP loans, the maximum loan amount is calculated as 2.5 times average monthly 2019 or 2020 payroll costs for a maximum of $2 million. For borrowers in the accommodation and food sectors, they may qualify to use a higher calculation of 3.5 times average monthly 2019 or 2020 payroll costs, but the maximum amount remains at $2 million. Work with an accountant or financial advisor to make sure you calculate the loan amount correctly.

Notably, in March 2021, the SBA changed the maximum loan size sole proprietors and independent contractors can apply for, basing it on gross income instead of net income. This means if you are self-employed or run a business solo, you should use the new formula if applying for a new PPP loan. If you have a loan already, you should check with your lender to see exactly how much your PPP loan is for and if you can increase the size of it to match the new formula.

Recommended Reading: First Time Home Buyers Loans

Why Cant I Borrow Money From Cash App

Although Cash App offers short-term loans, a personal loan is a better choice if you need more money and want to pay it off quickly. Unlike payday loans, there is no revolving fee to worry about. The lender will notify you if you miss an EMI, which could mean more debt and a lower credit score. A missed EMI may also result in a penalty imposed by the lender.

This service was previously available to 1,000 customers, but this feature has been unavailable since February 2021. The Cash App does allow you to borrow money multiple times if you need it, but you must pay off the first loan before you can apply for another one. You can take out additional loans for the rest of the loan amount. However, you should remember that if you miss a payment or skip a payment, you will have to pay non-compounding interest. You can find a better deal online, but you must read the terms and conditions carefully before you borrow money from Cash App.

If you have a Square account, it is unlikely that youll be able to borrow money from the Cash App. However, you can use your Square account to make purchases on Cash App. However, because youre using Squares peer-to-peer payment service, it is important to remember that Square is not responsible for the security of your account. Youll need to keep your security password safe and update it on a regular basis.

Do: Apply With More Than One Lender

You dont want to spam lenders with loan applications, but you do want to have a Plan B and Plan C in case a lender rejects your application.

Alozie recommends working with a lender you know. If thats not an option, look for lenders accepting PPP applications from new clients .

Accepting multiple PPP loans will land you in hot water fast, so withdraw any applications with other lenders as soon as you’re approved for a PPP loan.

Don’t Miss: Bank Of America Payday Loan

Can I Send My Ppp Loan To My Bank Account

Before you apply for a PPP loan, you should review the information on the program to make sure that all of the required documents are present. These documents can include payroll documents, tax statements, bank statements, purchase orders, and canceled checks. Also, make sure that your signature is present on all of these documents. If you fail to provide your signature on the necessary documents, your application may be delayed or even rejected.

The amount received refers to the amount received on the date that the funds were deposited into the borrowers bank account. If there are more than one disbursement, enter the date of the first disbursement. The number of employees is also important, as you must list all of them both at the time of loan application and when the loan was canceled. Lastly, make sure that your business is properly registered to receive the PPP funds.

In order to receive a PPP loan, you must apply through a lender. You can try your luck with a nonbank lender. American Lending Center accepts PPP loan applications. In some states, you need to have a business bank account to qualify. In Kansas City, AltCap, a community development financial institution, is also a lender that accepts PPP loan applications.

Who Is Eligible To Apply For A Ppp Loan

The SBA has some guidelines on who can apply for a PPP loan. In terms of who may qualify for a First Draw PPP loan, the list includes:

- Sole proprietors, independent contractors, and self-employed persons

- Any small business concern that meets SBAs size standards

- Any business, 501 non-profit organization, 501 veterans organization, or tribal business concern of the Small Business Act) with the greater of:

- 500 employees, or

- That meets the SBA industry size standard if more than 500

For Second Draw PPP loans, you may qualify if:

- You previously received a First Draw PPP loan and will or have used the full amount only for authorized purposes

- Your business has no more than 300 employees

- You can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020

Your business has to have been affected by the COVID-19 pandemic in some way. And you must have been operational before February 15, 2020.

You May Like: How To Loan Money For Profit

Who Is Eligible For A Paycheck Protection Program Loan

To receive the loan, the lender must confirm that the borrower was in operation as of Feb. 15, 2020, had employees, and determine the maximum amount of the loan.

The following entities affected by COVID-19 may be eligible:

- Sole proprietors, independent contractors, and self-employed persons

- Any small business concern that meets SBAs size standards

- Any business, 501 non-profit organization, 501 veterans organization, or tribal business concern of the Small Business Act) with the greater of:

- 500 employees, or

- That meets the SBA industry size standard if more than 500

- Any business with a NAICS code that begins with 72 that has more than one physical location and employs less than 500 per location

You should check the Paycheck Protection Program site and work with a qualified lender if you think you might be eligible for, and want a PPP loan.

How To Apply For A Ppp Loan

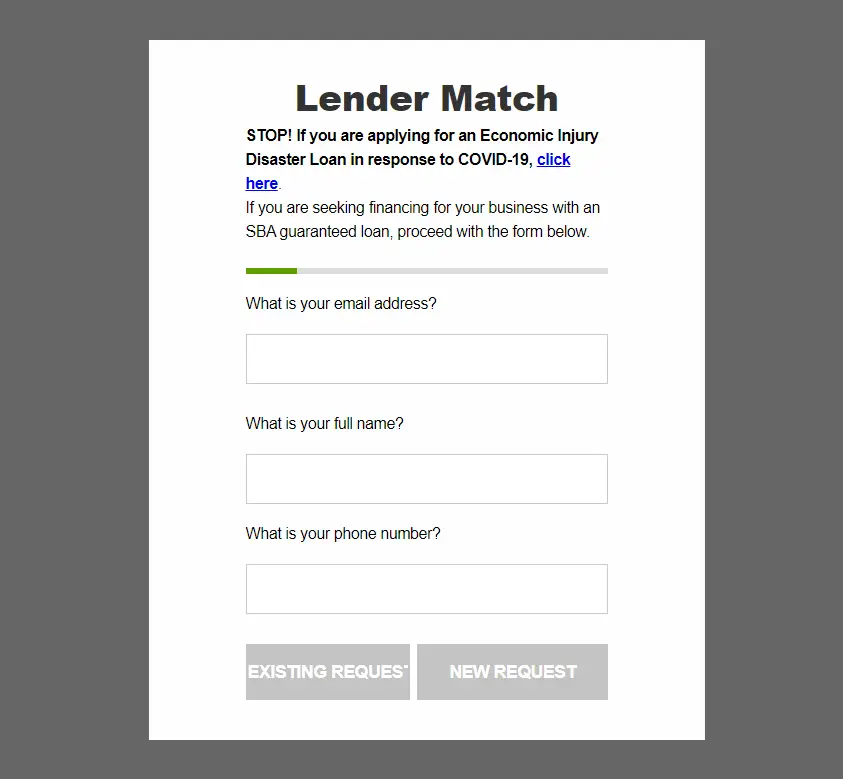

If you think you qualify for a PPP loan, the first step is finding a lender. You can use the SBAs lender lookup tool to find an approved lender near you. Or you can use the SBAs Lender Match service to get connected with a PPP loan lender. It can take a couple of business days to get matched this way.

Once you choose a lender, the next step is applying for a PPP loan. This means filling out a loan application and providing any supporting documentation the lender requests, which may include:

- Government-issued ID for all owners who have a 20%+ share in the business

- Proof that you were in business on or before February 15, 2020

- Copies of applicable tax forms, including a full business tax return

- Documentation of payroll costs, which may include W2s, IRS Form 944 or a third-party payroll processing report

- Bank statements

Youll also need to provide a bank account number and routing number for the account that youd like your funds deposited into. If youre applying for a Second Draw PPP loan, youll need to fill out a different application.

Once you submit your application and supporting documents, the lender will review them to determine if youre eligible and what amount of loan funding you qualify for. Youll have a chance to review the loan terms before signing any final paperwork to confirm that you want to move ahead with borrowing. SBA rules require lenders to disburse PPP loan funds no later than 10 calendar days of approving an application.

Recommended Reading: How To Estimate Pre Approval For Home Loan

How Does The Paycheck Protection Program Work

The PPP emergency loan program was created as part of the $2 trillion CARES Act in March 2020 and was authorized to distribute more than $600 billion in forgivable loans to small businesses. The program originally had just $350 billion allocated, but another $320 billion was added by Congress in April in order to help more businesses. Congress extended the PPP application deadline once more to August and then closed applications for the rest of 2020.

In late December 2020, Congress passed the $900 billion Coronavirus Response and Relief Supplemental Appropriations Act in order to help more businesses impacted by COVID-19. The CRRSAA fixed issues with PPP and put more money behind the program so businesses can apply for first-time and second-draw PPP loans. It also altered the criteria businesses needed to meet in order to be eligible for first-time and second-time loans and made forgiveness a little easier.

PPP loans are issued by private lenders and credit unions, and then they are backed by the Small Business Administration . The basic purpose of the PPP is to incentivize small businesses to keep workers on payroll and/or to rehire laid-off workers that lost wages due to COVID-19 disruptions. As long as businesses spend their loan money correctly, the full amount can be forgiven.

What Is A Ppp Loan

The Paycheck Protection Program is a loan program thats backed by the Small Business Administration . This loan program has one purpose: helping small business owners keep their workers on the job during the coronavirus pandemic.

Currently, loan funding is available through May 31, 2021. There are two types of loans you can get:

- First Draw PPP loan

Also Check: How To Get Pmi Off Fha Loan

How Can I Get My Ppp Loan Forgiven

Generally speaking, the loan can be fully forgiven if at least 60% has been spent on employee payroll. As of December 2020, the other 40% can be used on the following: qualifying mortgage interest or rent obligations utility costs operations costs such as business and accounting software property damage such as destruction from civil unrest that was not insured supplier costs on essential goods and worker protection expenditures such as personal protective equipment and sneeze-guards.

Forgiveness is primarily based on employers continuing to pay employees at normal levels during the eight-to-24-week period following the origination of the loan. Employers must attempt to keep headcount and payroll at the level it was before the pandemic to have the loan fully or partially forgiven.

How Can I Apply For A Cash App Business Loan

The most straightforward strategy to get a business loan when you have terrible credit is to raise it. Although it takes time, doing this will help you obtain the most acceptable loans.

Business loans with adverse credit have a lot of possibilities. Youll have more selections and a greater chance of being accepted if you can verify that youre a potential client.

You must provide your full name and Social Security number if you havent already validated it. If not, youll need to give more details to finish the process. Youll be accepted when your account has been validated. You may use a Cash App to borrow money for your company.

Recommended Reading: How Can I Get An Auto Loan

Whats Different About The Second

The CRRSAA created the opportunity for businesses and nonprofits to apply for a second PPP loan if they meet certain criteria. The second-draw loans are more targeted than first-time PPP loans, and to qualify, businesses must 1) have previously received a PPP loan and used the full amount only for authorized uses 2) have fewer than 300 employees and 3) have had a 25% reduction in gross receipts during at least one quarter of 2020 versus the same quarter of 2019. The maximum loan size for a second PPP loan is $2 million versus $10 million for a first-time PPP loan. Additionally, the SBA has that may be useful.

Amounts Up To $2 Million

If this is your second PPP loan, and your business is not a restaurant or hotel, get up to 2.5x or 250% of your 2019 or 2020 average monthly payroll expenses . If your business is a restaurant or hotel, get up to 3.5x or 350% of your 2019 or 2020 average monthly payroll expenses .

If this is your first PPP loan, the PPP loan amount will be equal to your 2019 or 2020 average monthly payroll x 2.5.

You May Like: What Is An Agency Loan

Second Draw Ppp Loans

Second Draw PPP loans are for business owners who have already received a PPP loan previously. Second Draw loans can be used for the same purposes as a First Draw loan and the same 1% interest rate applies.

The maximum amount you can borrow with a Second Draw PPP loan is 2.5 times the average monthly 2019 or 2020 payroll costs for your business, up to a $2 million cap. Accommodation and food service businesses can use 3.5 times the monthly average for 2019 or 2020 payroll costs to determine their maximum loan amount, up to the $2 million cap.

Womply And The Ppp Loan

Womply is one platform that business owners can use to apply online for PPP loans. The website says that the platform helped 100,000 small businesses receive PPP loan funds in 2020. Womply has already served 150,000 businesses and independent contractors in 2021.

Although Womply isn’t a lender, the platform gives users access to over 25 different lenders.

Recommended Reading: What Are Current New Car Loan Rates

Don’t: Spend Your Ppp Money On Ineligible Expenses

Your PPP loan essentially becomes a grant, provided you use the proceeds as outlined by the Small Business Administration. That means using the bulk of your funds on payroll costs, such as salaries, hourly wages, paid sick leave and group insurance benefits.

The other 40% of your loan can now be used on a broader range of expenses, including operating expenses, health and safety modifications and certain supplier costs.

Failure to meet the SBAs loan forgiveness requirements means that you could have to repay a portion of your loan.

Can You Use Cash App For Small Business Loan

Can You Use Cash App for a Ppp loan? It depends. First, you must have at least $1000 in your Cash App wallet. You can do this by transferring money from a bank account or through Cash App Direct Deposit. Once you have this money, you can use Cash App to get a loan. You should note that Cash App charges a 5% fee for loans. After the grace period, the fee goes up to 1.25%. If you can repay the loan in a short period of time, you may be eligible.

CashApp offers low-interest loans that are waived or forgiven in certain situations. The amount you borrow can be repaid within five years. The company hopes that PPP loans will bring up small businesses. Cash App can help you with your business needs. This mobile app is available for both the US and UK. It has 36 million users and supports direct deposit. Just make sure that the amount youre transferring is below $25k per day.

Read Also: Is Max Loan 365 Legit