What Is The Difference Between Federal And Private Student Loans

Most students begin by applying for federal direct loans and then use private student loans to fill in any funding gaps. Here are the biggest differences between the two types of loans.

| FEDERAL STUDENT LOANS | |

|---|---|

| Federal loans come with income-driven repayment plans, deferment, forbearance, and;loan forgiveness. | Private loans have fewer borrower protections. These protections will be set by the lender. |

Texas Property Tax Loans

Contact Info

433-5851Official Website10497 Town and Country Way, Houston, TX 77024

A property tax lender in Houston TX, Texas Property Tax Loans, provides and maintains a high quality of service for all of its residential and commercial loan customers. Starting out in 2005, the property tax loan company services its own loans and ensures that each customer makes it successfully through the life of the loan.

You can apply online for both a residential and a commercial loan, and you only need to provide the bare minimal of information. Texas Property Tax Loans will make initial contact with you after you complete the online portion of the application. The company hopes to make your loan process easier with an online payment calculator, as well as online applications including one for its Fast Track Loan.

Types Of Federal Student Loans

There are three types of federal student loans:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans, of which there are two types: Grad PLUS Loans for graduate and professional students, as well as loans that can be issued to a student’s parents, also known as;.

These loans are available through the Federal Direct Loan Program. Since federal loans offer different benefits than private student loans, you should always explore them first.

Learn more about the three types of federal student loans:

Don’t Miss: How To Transfer Car Loan To Another Person

Entrance Loan Counseling Requirement

Federal laws require all borrowers to participate in Student Loan Entrance Counseling.; The counseling explains the terms and conditions for the loan you plan to borrow.; It also provides borrowers with information about the various Direct Loan repayment options as well as understand your rights and responsibilities as a student loan borrower.

NOTE:; Los Angeles Pierce College is part of a Loan Counseling Experiment with the U.S. Department of Education.; Students who have previously completed Entrance Loan Counseling and are selected for the experiment will be required to complete the Entrance Loan Counseling on an annual basis.; As part of this experiment, student’s Direct Loan disbursements are conditional upon completion of additional Entrance Loan Counseling.; Students may use the U.S. Department of Education’s online Entrance Loan Counseling website and select “Login to Start” to begin your loan counseling.; You will need your Federal Student Aid User ID to complete the Entrance Loan Counseling.; Make sure you save the confirmation of completion for your records and for submission with your loan request.

Review And Accept Your Financial Aid Letter

Once youve filled out the FAFSA, the schools you were accepted at will send you a financial aid offer letter. This letter will arrive by mail and will summarize the financial aid you qualify for.

You should review this letter carefully so you understand what kind of financial aid youll receive. The letter will include the following information:

- The total cost of attendance

- Your expected family contribution

- Any grants and scholarships youre eligible for

- Any subsidized or unsubsidized loans you qualified for

Once youre ready, youll accept your financial aid offer through your schools financial aid office. They can help you work out the details of how your loans will be distributed.

See also:Beginners Guide to Federal Student Loans for 2021

Recommended Reading: What Are Assets For Home Loan

How Does A Federal Direct Loan Work

To see whether youre eligible for Direct Loan financial aid, youll need to submit the Free Application for Federal Student Aid , which opens on Oct. 1 every year. Once your school reviews your FAFSA, it determines which types of aid youre eligible for based on your expected family contribution, financial need and other factors. If youre eligible for federal Direct Loans, youll see the offer in your award letter.

You can choose to take some or all of the Direct Loan aid offered to you. Youll need to complete entrance counseling, which reminds you of your responsibility upon accepting federal Direct Loans. Borrowers are also required to sign a Master Promissory Note. This outlines the details of your loan, including important information about repayment.

At this point, the Department of Education will disburse the funds directly to your school. The school will apply funds toward tuition and fees and other costs that you owe. If there are any remaining loan funds, the school will disburse it to you or your parent, if they received parent PLUS loans.

Understand What Student Aid Is

Student Aid is a government service that provides student loans, grants, scholarships, and awards to help you pay for your post-secondary education. Student aid may not cover all of your costs, so youll need to plan to make up the difference.

You only have to submit one application to be considered for loans and grants from both Albertas government and Canadas government. Most students get money from both, which means you may get two smaller loans instead of one big one. Learn more about scholarships and awards.

You should:

- Apply early. The only way to know for sure how much money youll get is to apply and wait for your award letter. You should apply at least 60 days before your classes start so that you have time to figure out your finances.

- Apply every year. You can apply for student aid for up to 12 months at a time. If your period of study is longer, you need to submit another application.

| Student loans are interest-free while you study. You dont make any payments while youre a student, and they wont acquire interest until 6 months after you leave school. |

Don’t Miss: What Is Fha And Conventional Loan

Unsubsidized Vs Subsidized Direct Student Loans

Let us clarify matters first.

For Direct Loans you have subsidized and unsubsidized ones.

What makes one different from the other?

Subsidized direct student loans are open only to those who have financial need.

Application for this type of loan requires you to show that you are financially incapable of paying for your cost of attendance.

In short, subsidized direct loans have a more stringent process.

They are, however, still very helpful.

In contrast, anyone may avail of unsubsidized direct student loans.

This kind of loan does not require any proof of financial incapacity.

Unsubsidized direct student loans are the most popular form of federal loans.

They cater to everyone, but this is not an issue.

Everyone has equal chances of obtaining unsubsidized direct student loans.

Furthermore, the issue of interest varies between subsidized direct loans and unsubsidized ones.

For the former, the government pays the interest of the loan.

On the other hand, the borrower is required to pay the interest for unsubsidized direct student loans.

If the borrower chooses to wait until after graduation, the interest still accrues.

Download this free cheat sheet to repayment plans to make sure you are taking advantage of the best one for you. Learn more here.)

Federal Direct Unsubsidized Loans

During your undergrad, you might have qualified for subsidized loans, unsubsidized loans, or a combination of the two. The biggest benefit of subsidized loans is that the interest does not accrue while attending school because the Department of Education pays the interest. Also, the loan fee is only about 1 percent of the amount you borrow.

Law students are not eligible for subsidized loans but can apply for Federal Direct Unsubsidized Loans. They may borrow up to $20,500 each year. The loans start accruing simple interest while law students are in school. Law students have a six-month grace period after graduation before they have to start paying back Federal Direct Unsubsidized Loans.

Also Check: Which Credit Union Is Best For Home Loan

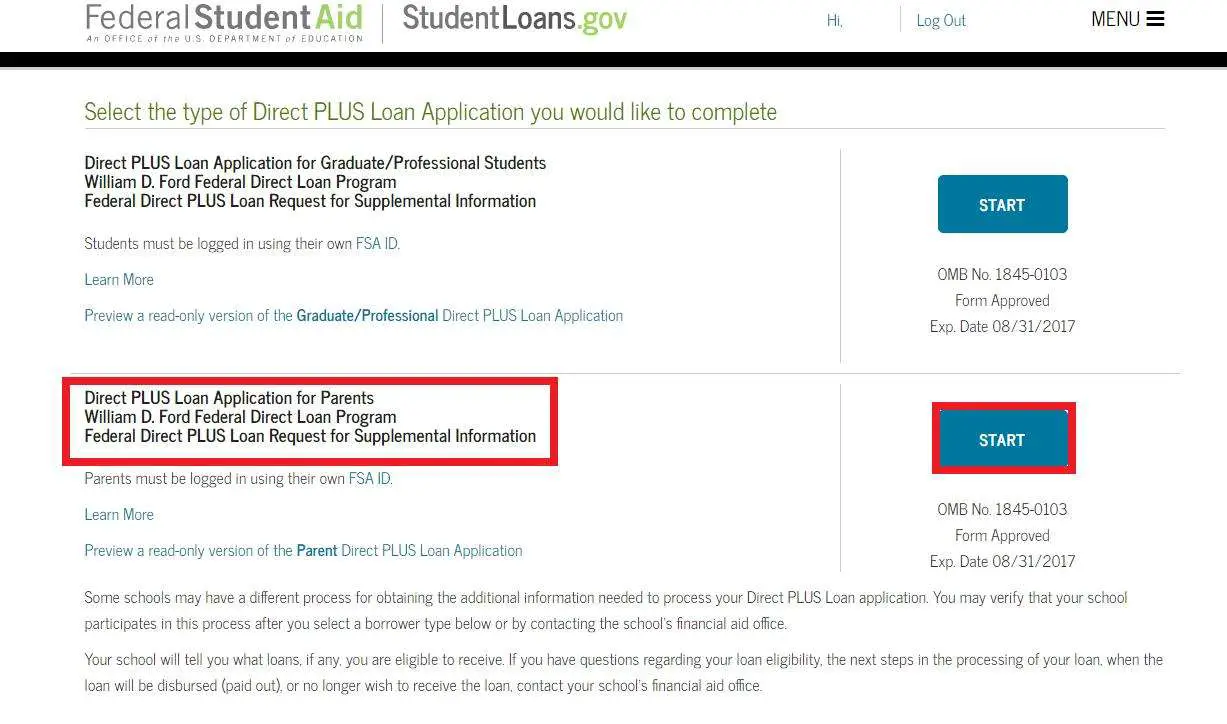

Federal Direct Parent Loan For Undergraduate Students Loans

PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay educational expenses. The U.S. Department of Education makes Direct PLUS Loans to eligible borrowers through schools participating in the Direct Loan Program.;;Ventura College participates in the William D. Ford Direct Loan Program.; The lender for this program is the U.S. Department of Education.

Here is a quick overview of Direct PLUS Loans:

- The U.S. Department of Education is the lender.

- The borrower must not have an adverse credit history.

- The maximum loan amount is the student’s cost of attendance minus any other financial aid received.

Types Of Federal Direct Loans

Direct Subsidized Loan This need-based loan program is referred to as “subsidized” because the student is not charged interest while they are enrolled in school at least half-time and during grace periods and deferment periods.

Direct Unsubsidized loan This non-need-based loan program is referred to as “unsubsidized” because interest accrues while the student in enrolled in school. Interest on Direct Unsubsidized Loans begins to accrue after disbursement of the loan funds; however, the student may choose to have the payment of the interest deferred during enrollment and later capitalized at the time of repayment.

You May Like: Is Student Loan Refinancing Worth It

What Is A Federal Direct Loan Everything You Need To Know

- News

A federal Direct Loan is a type of student loan issued by the U.S. Department of Education that both undergraduates and graduates can use to cover the cost of education. Because of their low interest rates and additional benefits, these are usually the best starting point if youre considering taking out loans for school.

Closing The Deal For An Online Home Loan

Yes, it is a new way of thinking to turn to an online lender for a home loan as compared to your local bank. However, there are many benefits to doing so, including a faster process, less back and forth communication, and the ability to shop around for the best deal. If you are getting ready to buy a house and need to start working on your financing, consider the three options weve listed above. While we put Consumer Direct Mortgage at the top of the list, each of the three is worthy of your attention. Good luck!

Also Check: What Is The Commitment Fee On Mortgage Loan

How We Determined Our Top Pick: Consumer Direct

It is the overall package offered by Consumer Direct Mortgage that earns it our top spot in this review. As you search for a conventional home loan to purchase a property, this lender steps to the front due to their combination of rates, service, and simplicity. In a market that is famous for being complicated and frustrating to manage, Consumer Direct Mortgage takes a different approach, and it pays off nicely.

Pros

- A simple process. One of the biggest advantages of shopping for a mortgage online is simplicity, and Consumer Direct Mortgage delivers on that promise. Youll follow along with a straightforward, four-step process to work toward selecting the right loan offer for your situation.

- Easy rate quotes. If you are in the early stages of the home buying process and simply want to check out your options and look at some rates, the Consumer Direct Mortgage website makes it easy to do so.

- Approachable for first-timers. It can be intimidating to try and secure a loan for your first home, but those new to the process are welcomed here and will be able to get answers to all of their questions.

- Nearly nationwide. If you live in the United States, there is a good chance that Consumer Direct Mortgage can serve you. Maryland is the only one of the 50 states where home loans are not offered by this company.

Cons

Applying For Law School Loans

Even with an understanding of the different kinds of loans available for law school, your choice will be driven by what’s available to you and what you qualify for. Here are the steps you need to take, including timelines to apply for law school loans.

Investigate financial aid procedures at the schools for which you are applying while you investigate admissions procedures and deadlines.

Complete your federal tax returns as early as possible each year because you will need your most current tax information to apply for federal or private loans.

Fill out your Free Application for Federal Student Aid . This is the same form you had to fill out for financial aid as an undergrad. The new form comes out October 1 for the following year. For example, if you want to enter law school in Fall 2022, you can fill out your FAFSA beginning October 2021. You should complete it as soon as possible; you can always update it with new tax information. At the very least, you should have your FAFSA complete by the time you complete your admissions package.

Wait for acceptance letters from the schools where you applied. If accepted, they will determine the type and amount of financial aid you can receive and send you instructions on how to complete your financial aid package.

Apply for loans with private lenders if you do not get the funding you need or wish to borrow from a private lender instead of taking out a PLUS loan.

Also Check: How Do I Get My Student Loan Number

Comparing Private Loans With Federal Loans

Loans offer you the opportunity to cover the cost of your educational expenses. It is important to explore all options and find what works best for you and your family. The Federal Student Loans VS Private Student Loans Comparison Chart;provides you with additional information on the differences between the Federal PLUS Loan and Private Student Loan options for those families who demonstrate credit worthiness and wish to explore private options that may better suit your family’s financial situation.

When choosing a private loan, there are many factors to consider, including the fees the lender charges to make the loan, the interest rate, repayment terms and deferment options. Lenders are required by federal law to collect the Private Loan Certification Form. If you plan to apply for a private loan, complete and submit this form to your lender.

As a general rule, students should only consider obtaining a private educational loan if they have maxed out the Federal;Direct Loan. We strongly encourage students to file a Free Application for Federal Student Aid which may qualify them for grants, work-study and Federal Direct Loans. Undergraduate dependent students should also compare costs with the Federal Direct Parent PLUS Loan, as this loan is usually much less expensive and has better repayment terms.;

What Are Federal Direct Loans

Federal Direct Loans are education loans from the U.S. government. They are either subsidized or unsubsidized. They can also be made either to a student or to a parent .

A subsidized Stafford loan is awarded on the basis of financial need. You wont be charged any interest before you begin repayment or during authorized periods of deferment because the federal government subsidizes the interest during these periods.

Unlike a subsidized Stafford loan, an unsubsidized Stafford loan and a Grad PLUS loan is not based on financial need. Youll be charged interest from the time the loan is disbursed until it is paid in full. If you allow the interest to accumulate while you are in school or during other periods of nonpayment, it will be capitalized that is, the interest will be added to the principal amount of your loan, and then additional interest will be based on that higher principal amount.

You can receive a subsidized loan and an unsubsidized loan for the same enrollment period.

Also Check: When Do I Pay Back Student Loan

Complete A Federal Direct Loan Request Form

All student loan borrowers are required to complete an AIMS Education Direct Loan Request Form each year. Students are asked to indicate the loan amount to borrow for the academic year or term. The AIMS Education Direct Loan Request Form may be obtained;at the Financial Aid Office on campus.

After completion of the above procedures and submission of all required documents to the Financial Aid Office, students will typically be notified of their Financial Aid Awards within two to three weeks.

Would Student Loan Forgiveness Include Private Student Loans

Private student loans likely won’t be included in any student loan forgiveness passed by the Biden Administration. The loan forgiveness being discussed by Biden and members of Congress applies only to federal student loans. These loans include:

- Direct Subsidized Loans

The PSLF Program considers you to be a full-time employee if:

- you meet your employer’s definition of “full-time” OR

- you work at least 30 hours per week, whichever is greater.

But what if you work part-time for two qualifying employers?

In that case, part-time employees can still meet the full-time eligibility requirements by working a combined 30 hours per week on average.

How to certify employment

Until recently, borrowers could submit a PSLF Employment Certification Form to certify they work for a qualifying employer. As part of a policy change, the certification form has now been merged into the Public Service Loan Forgiveness & Temporary Expanded PSLF Certification & Application.

Recommended Reading: What Kind Of Loan Do I Need To Buy Land

Benefits Of Direct Plus Loans

Since Direct PLUS Loans are federally guaranteed, they share some of the same program regulatory protections as Direct Unsubsidized Loans. They offer deferment and forbearance options, various repayment plans, and in the event of death or disability, can be forgiven. If the borrower chooses, a Direct PLUS Loan can be consolidated after graduation into a Direct Consolidation Loan. A Direct Consolidation Loan can help simplify repayment by combining all federal loans into one new loan, extending the term of the loan, and possibly lowering the monthly payment amount. Keep in mind though, the longer it takes to pay off your loan, the more it will cost overall, and consolidation isnt always necessary. To find out if consolidation is right for you, take this quiz.Another benefit of Direct PLUS Loans is that they are eligible for Public Service Loan Forgiveness , either when consolidated or in their original form. Review the Public Service Loan Forgiveness Fact Sheet and the PSLF booklet for more information.