Guide On How To Apply For Sss Housing Loan For House Repair / Improvement Purposes

APPLY FOR SSS HOUSING LOAN Here is a guide on how to apply for this loan offer for the purpose of house repairs and improvements.

From time to time, residential properties need some repairs. Damages can come from different causes and one of the most common is the propertys exposure to changing weather. The roof needs to be replaced after a few years to make sure you wont have a problem when rainy days come.

If you are an active member of the Social Security System or more commonly called SSS, you have something to turn to. It has a loan offer for house repair and as well as for home improvement.

SSS is one of the biggest social insurance institutions in the Philippines. It has retirement benefits, sickness benefits, and several other benefits aside from its multiple loan offers.

With regards to its loans, one parent offer is the Housing Loan. Aside from the house repair purposes, you may also apply for it for home improvement purposes in case you are planning to add another room in your house, construct another bathroom, widen the balcony area, etc.

How to apply for SSS Housing Loan for repairs and improvements? There are qualifications and as well as documentary requirements to prepare.

Steps on How To Apply for SSS Housing Loan for Repairs and Improvements

Sss Calamity Loan Requirements

First of all, you have to be eligible before you can apply for a calamity loan assistance program.

Below are the eligibility requirements:

You must be a resident of the Philippines;

The residency must be declared as within the state of calamity;

You must have at least 36 months of monthly contributions; the last 6 months must also be paid prior to applying for a loan.

If you meet these requirements, you can get a SSS Calamity Loan form 2021 from any SSS office, fill it up, and then submit the other requirements.

Here are all the requirements:

The accomplished loan application form;

Barangay certification that you really live in the area that was declared as in a state of calamity;

2 valid government IDs.

Once you have all these, you can now proceed with the loan application.

Alternative For Sss Salary Loan

If you already have an SSS loan and you still need more money, you have to borrow somewhere else. The problem is that if you borrow from banks, you will pay a lot of interest.

The best alternative that you should try is Digido. It is a loan institution where you do not have to apply in person.

Here are the basic eligibility requirements:

- You must be a Filipino citizen;

- You must be between 21 and 70 years old;

- You must have a valid government-issued ID;

- You must have an active phone number.

To apply, all you have to do is to create an account, and then scan the documents and attach them. On top of the requirements, you also have to present a certificate of employment or proof of income. After filing a loan, you could get approved within 24 hours.

Read Also: What Size Mortgage Loan Can I Qualify For

Enroll Your Bank Account

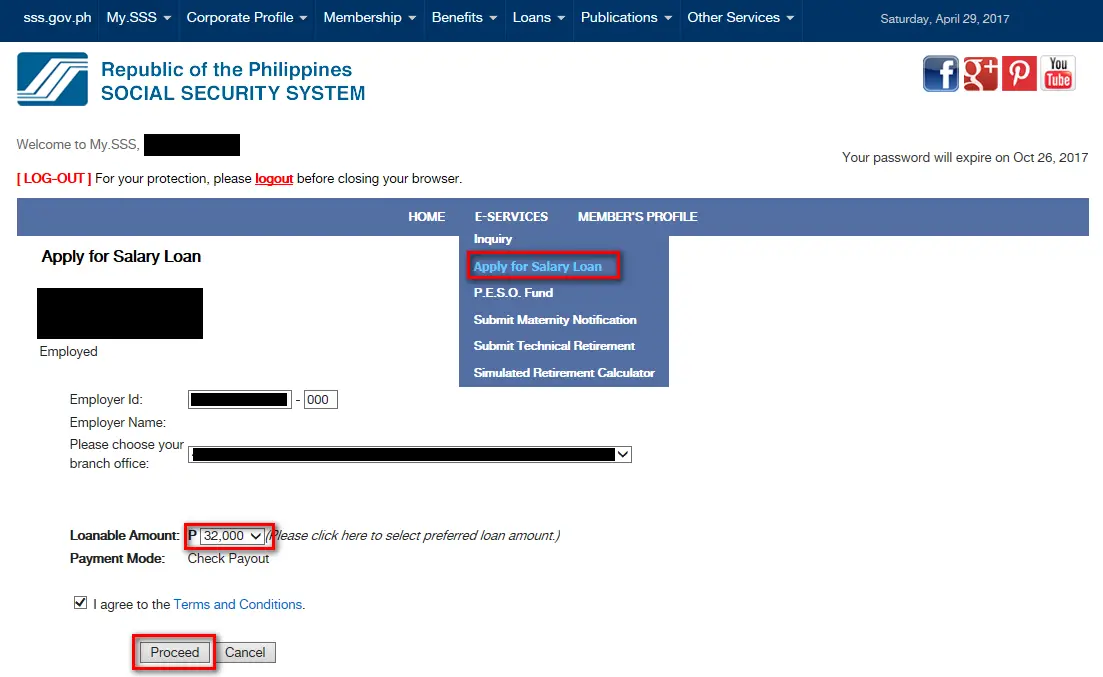

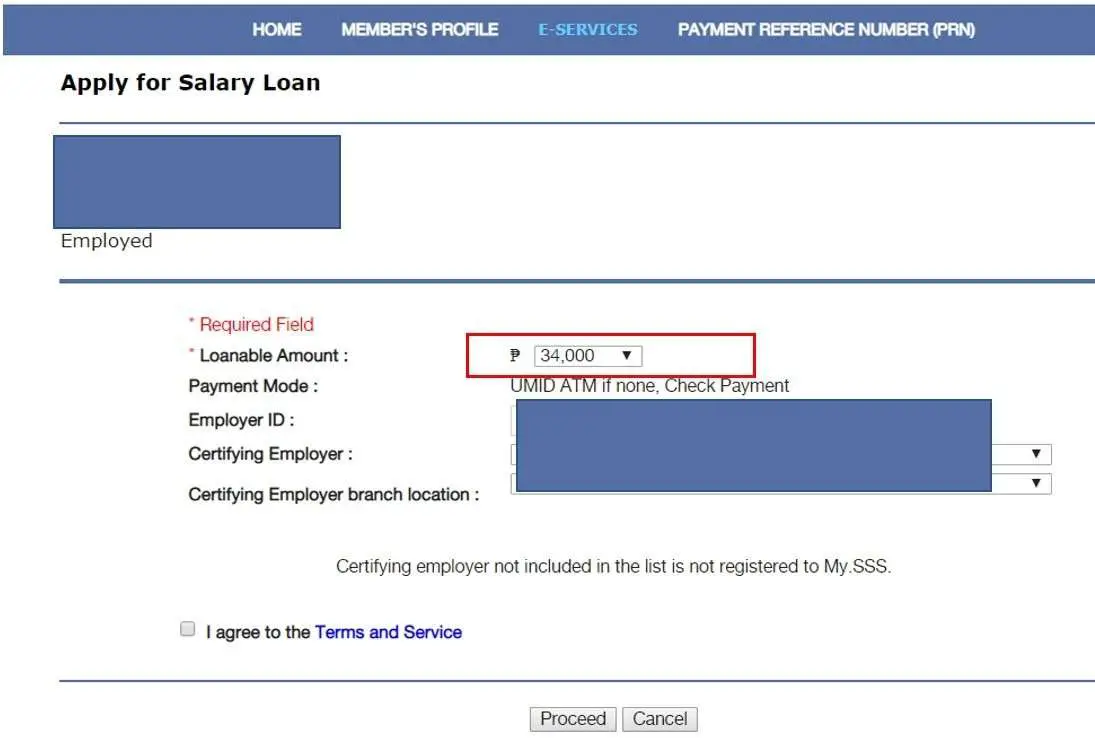

If you see this message below, you will have to enroll your Unionbank savings account for electronic loan disbursement. If you dont have a Unionbank account, your SSS salary loan will be released through check.

You may also need to update your local mailing address using the link provided.

If you dont see this message in your My.SSS account, proceed to Step 4.

For bank enrollment, select UNION BANK OF THE PHILIPPINES from the dropdown list. Enter your Unionbank account number twice.

Check the box before I agree that the information and click Enroll Savings Account. Click OK when a pop-up message appears.

Get And Sign Sss Loan Application Form 2013

Use this step-by-step instruction to complete the Calamity loan sss form quickly and with perfect precision. Tips on how to fill out the Sss loan form online:. Rating: 4.8 · 201 votes

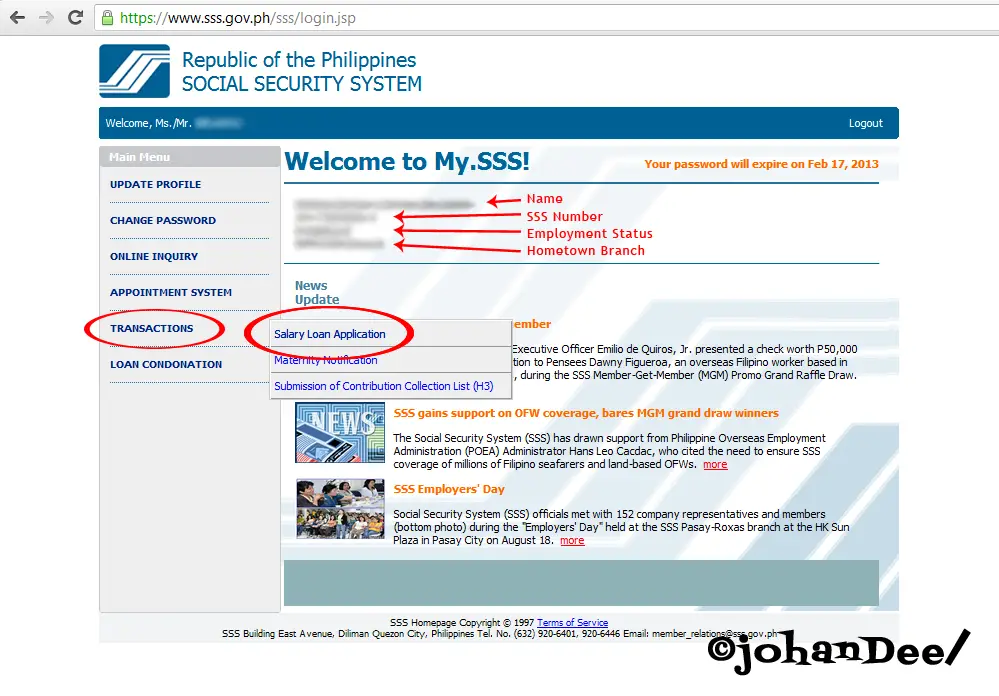

Share this Image On Your Site · Make sure you have signed up online. · After the registration confirmation, log in to your SSS online account. · On the Main Menu;

When you apply for an SSS loan, you will need an application form and two valid You can create your SSS online account via member.sss.gov.ph so you can;

Read Also: How To Apply For Direct Loan

Sss Calamity Loan Covid

This is a new SSS program to help address the pandemic called SSS Calamity Loan COVID 2020. This was only launched in April of 2020. Members of SSS could borrow up to 20,000 or something equivalent to one month of salary.

To apply, you can use the SSS website or app.

Below are the eligibility requirements:

; Members must have paid 36 months in monthly contributions and must at least have paid the last 6 months prior to the loan application.

; The home address of the member must also be in a state of calamity. In the case of COVID, not everyone can apply but only those who live in towns and cities that have high cases of the virus this must be announced by the government.

Of course, the borrower must not be a delinquent before and must not have availed of the same; loan recently. The COVID; loan is payable in 27 months.

If you do not have SSS but you have a PAG-IBIG account, you can also get a PAG-IBIG Calamity Loan program to help you with your financial woes.

Like the SSS loan, the PAG-IBIG; Loan is reserved for people who need immediate financial assistance. Only those that were affected by a calamity can apply.

How To Make An Esignature For Putting It On The Mlp 01213 Form In Gmail

Below are five simple steps to get your sss online loan application eSigned without leaving your Gmail account:

The sigNow extension was developed to help busy people like you to reduce the stress of putting your signature on forms. Start eSigning sss loan application by means of tool and join the numerous satisfied customers whove previously experienced the advantages of in-mail signing.

Don’t Miss: What Are Assets For Home Loan

Direct Housing Loan Facility For Workers Organization Members

The Direct Housing Loan Facility for Workers Organization Members caters to people in the private sector. To qualify, you need to be employed and a member of any of the workers organizations accredited by the Department of Labor and Employment , the Securities and Exchange Commission , or the Cooperative Development Authority.

Workers who are also members of any trade union center, federation, national union, chapter, or independent union as defined in Book V of the Labor code of the Philippines can avail of this housing loan.;

If youre interested on how to apply for an SSS housing loan through this method, here are the criteria for eligibility and document requirements:;

To apply, you can file your application at your nearest SSS cluster branch or at the Housing and Business Loans Department, 5/F, SSS Bldg., East Avenue, Diliman, Quezon City.

How To Create An Electronic Signature For The Mlp 01213 Form On Ios Devices

To sign a sss loan application right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export youMLPlp 01213 form: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is just as productive and powerful as the web app is. Connect to a strong connection to the internet and start completing documents with a fully legitimate electronic signature within minutes.

You May Like: When Do I Pay Back Student Loan

Quick Guide On How To Complete Forms Of Sss

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

signNow’s web-based software is specially created to simplify the organization of workflow and improve the process of proficient document management. Use this step-by-step guideline to complete the Get And Sign MLP 01213 Form swiftly and with perfect precision.

How To Pay For Your Sss Salary Loan

Borrowers need to pay their salary loan in 24 monthly installments. The monthly amortization begins on the second month following the date of the loan. Its due on or before the SSS salary loan payment deadline detailed below:

The interest rate on the loan is 10% per annum based on diminishing principal balance. This will continue to be charged on the outstanding balance until fully paid.

In cases where the loan defaults, the unpaid amount will be deducted from benefits claimed by the member.

- Self-employed and voluntary members will have the amount deducted from their short-term benefits .

- In the case of death, total disability, or retirement under the Social Security Act, the amount, interest, and penalties will be deducted from the corresponding benefits.

Members with outstanding loans must also inform the agency via mail, email, or over-the-counter at the nearest SSS branch of any changes to address or employer. The notice should include the SSS number along with the members name and signature.

Related Article: 10 Helpful SSS Benefits You Might Not Know Of

You May Like: Is Student Loan Refinancing Worth It

How The Lrp Works

When youre approved for loan restructuring, all your overdue loans with the SSS will be consolidated into one restructured loan. You can pay either in full or by monthly installments, depending on your ability to pay.;Payments are accepted at SSS branches and authorized collection agents. If you choose the full payment scheme, youll have to pay off your SSS loan within 30 days from your LRP approval date. On the other hand, the installment scheme involves repaying your SSS loan over a certain number of months based on your restructured loan amount. Amortizations are due every 10th of the month.

| Restructured SSS Loan Amount |

How To Apply For Sss Calamity Loan

If you want to apply in person, you have to go to any SSS office and then submit all the requirements mentioned above. Do not forget to make photocopies of them.

The faster way is to apply online. To do this, go to the SSS portal and create an account.

Once this is done, log in to your account and then follow the steps below:

Click on E-SERVICES;

Choose to Apply for Calamity Loan;

Fill in the required details.

Next, wait for instructions that will be sent to you. You may also receive a call or text from the government office.

You May Like: What Is The Commitment Fee On Mortgage Loan

How To Apply Sss Pension Loan Online For Ofws The Pinoy

Applying for an SSS pension loan online is every OFW-members right and well-deserved benefit after their long years of hard work overseas.

Jun 20, 2020 Members must also be registered at the My.SSS web portal on the SSS website at www.sss.gov.ph to apply for the loan. Qualified members may apply;

Jun 20, 2020 One of the features in the SSS Mobile app is the Salary Loan Application. Using the my. · To determine if you are eligible to apply for the;

Can I Pay My Sss Loan In Full

Yes. To pay your remaining loan balance in full, log in to the SSS member portal and click RTPL PRN on the main menu. Make sure you havent paid your most recent loan bill yet otherwise the billing statement wont be displayed. Look for Amount to be Paid and enter the exact amount of your outstanding balance. Click Save All and then proceed with the payment using the latest PRN.

You May Like: Which Credit Union Is Best For Home Loan

Sss Opens Online Application For Retirees’ Pension Loan

RETIREE-pensioners of the Social Security System can now file their Pension Loan Program applications online, the state-run pension fund announced.

In a statement on Saturday, the SSS said it added a new facility on its website to allow the online applications of PLP.

According to Aurora Ignacio, SSS president and chief executive officer, the new facility found under the E-Services tab of the My.SSS member portal at;www.sss.gov.ph;aims to provide retiree-pensioners with a safer, faster, and more convenient means of filing their pension loans.

Through the SSS continuous digitalization efforts, the PLP was made available online since last Sept. 15, 2020. Qualified retiree-pensioners can easily apply for the program without visiting our branches, which is either difficult or restricted, particularly for senior citizens, because of the Covid-19 situation, Ignacio added.

Retiree-pensioners who have met all the qualifying conditions of the PLP and have registered My.SSS web accounts, current and active mobile numbers, and disbursement accounts may avail of the SSS Unified Multi-Purpose Identification card enrolled as an automated teller machine card or an SSS-issued Union Bank of the Philippines Quick Card.

The SSS added that the retiree-pensioner will receive an email confirmation of his/her pension loan application. Pension loan proceeds are credited to the retiree-pensioners disbursement account within five working days.

How To Fill Out The Get And Sign Mlp 01213 Form On The Web:

By making use of SignNow’s comprehensive platform, you’re able to execute any needed edits to Get And Sign MLP 01213 Form, make your personalized electronic signature in a couple quick steps, and streamline your workflow without the need of leaving your browser.

Don’t Miss: What Kind Of Loan Do I Need To Buy Land

Sss Online Loan Application Process

In the past, you have to go to the SSS branch to apply for a salary loan. Nowadays, you can apply for an SSS salary loan using your computer or mobile device, and you dont need to submit documents and IDs to SSS when doing so.

To apply for an SSS salary loan online, make sure that you have a My.SSS account and you have posted at least 36 monthly contributions. If you dont have a My.SSS account yet, go here to sign up. Only current SSS members can register for My.SSS. If youre not yet an SSS member, read this article to learn how to become one.

How To Apply For Sss Housing Loan For Ofw

Posted By: sssinquiries_administrat0rApril 25, 2020

Social Security System offers a housing loan for Overseas Filipino Workers for you to be able to construct a new house on a lot owned by the applicant that is free from lien or encumbrance; or to purchase an existing residential unit, which may be a house and lot, a condominium, or a townhouse. For SSS Members working inside the country, you are limited to Salary loans and home improvement loans through SSS or look for housing loans thru Pag-IBIG or any bank offering a housing loan.

to start building the house you have always wanted. It is called the Direct Housing Loan Facility for Overseas Filipino Workers intended to support the governments Pabahay sa Bagong Siglo Program that aims to provide socialized and low-cost housing to workers abroad. If you are working inside the country, you are limited to salary loans and home improvement loans through SSS. For people who are in the country and looking for a housing loan, you can go to;Pag-IBIG or any bank that proposes the said loan.

Related articles:

Purpose of the Loan

- To construct a new house on a lot owned by the applicant that is free from lien or encumbrance;

- To purchase an existing residential unit, which may be a house and lot, a condominium, or a townhouse; and

Here is a checklist of the requirements and qualifications that SSS provided for potential loaners:

Don’t Miss: What’s Better Refinance Or Home Equity Loan

Interest Fees And Penalties

SSS charges an interest of 10% per annum based on the diminishing principal balance, until your loan is fully paid. In addition, there is a 1% service fee which will be deducted from the loan amount.

If you fail to pay on or before the payment deadline, you will be charged a 1% penalty per month until you settle your dues. Any excess payments will be applied to the outstanding principal balance, which means that you can pay your loan in advance.

Read Or Print The Loan Disclosure Statement

The Loan Disclosure Statement contains a summary of all the essential information about your SSS salary loan including:

- Net loan proceeds ;

- Balance of your previous loan ;

- Monthly amortization ;

After reviewing the content of the Loan Disclosure Statement, click Proceed.

Review the âCertification, Agreement, and Promissory Noteâ and then click âSubmitâ.

Keep a copy of the transaction number for future reference. A confirmation message will also be sent to your email address showing the same transaction number.

Read Also: What Is Fha And Conventional Loan