Paypal Business Loan Review

PayPal is best know for its service that makes it easy for people to send and receive money. In this PayPal Business Loan review, we take a look at the small business loan division of PayPal.

Trusted for years, PayPal is a must have for small businesses as it allows you to accept all types of payments from your customers.

So consider this scenario: Say youve been using PayPal for quite some time and used it pay vendors and receive money. Youve sent PayPal invoices to clients, youve installed PayPal as a checkout option in your ecommerce store, you might even have the PayPal debit card, and sales are increasing.

But what if you need some more cash to continue growing your business?

Discounts And Rebates For Loyal Customers

Special discounts are given to loyal customers who shop online through PayPal. You can find a list of the currently available discounts offered by PayPals retailers through this page.

#deals#buildapc Heads Up for Paypal Users : Free Return Shipping on Up To 12 Purchases through 2017 (Up To

Frank Jasson May 22, 2017

Why Should I Take Out A Paypal Business Loan

Before you take out a loan of any size, it is important to consider whether your company has the means to pay back the loan weekly for the set number of weeks. Commonly a business will take out a PayPal loan if:

- They need to cover expenses to do with payroll

- They are investing in new equipment or technology

- They are expanding or relocating

- They are investing

- They have other business costs

To date, PayPal has provided $10 billion of loans to over 225000 businesses.

Also Check: Do Pawn Shops Loan Money

Seamless Online Shopping Through Paypal

Millions of websites accept PayPal as payment, and shopping with PayPal is a snap on e-commerce websites like eBay!; When you go to check out, simply select PayPal as your payment type, log into your account, and select where you want the money to come from: your bank account, your credit card, or your balance on PayPal.; No credit card details required!

Xiii How To Withdraw Money From Paypal

When you make enough sales, you may want to withdraw money from PayPal. Below youll find the checklist that will help you transfer money from PayPal to your bank account:

- Go to Wallet.

- Select where you are transferring the money from, and then select the bank account.

- Choose the amount you want to transfer.

- Review your request, and then click Transfer.

To withdraw money from PayPal and transfer it to your bank account using your PayPal app:

- Tap your PayPal balance

- Tap Withdraw Money

Normally it takes 1 business day to transfer the money to a bank account but it might take longer and there are some fees for international conversions.

Recommended Reading: What Car Loan Can I Afford Calculator

What Is A Quick Business Loan

For your business, a quick business loan gives you fast access to cash that can help your company thrive, or even expand.

This could be launching another product, buying new vehicles or anything like paying for new employees.

Plus, you can make manageable monthly repayments that are typically under two years in loan lengths, instead of other loans that might take years to pay back.

So while your repayment amounts might be high, you might be able to pay it off in a few months which will let your budget more manageable.

The Best Alternative To A Paypal Loan

Online loans, like this, are an excellent way to get funding for your business. If a PayPal loan isnt what you are looking for, then Camino Financial might be the better option for you.;

We are equipped to serve you, and your growing business better needs one personal level that PayPal cant offer. Were also able to give you loans with fixed rates and can help you see if you are eligible right away.;

Our motto is No business left behind, and thats why our loans have very few requirements. With Camino Financial, you can expect results right away at great rates.;Learn more and manage well your business finances!

Read Also: Are There Student Loan Forgiveness Programs

Ways A Working Capital Loan Can Help Your Business Grow

If you own a business, you know how tough it is. You are working hard, making tough decisions, and always focus on having enough cash flow to keep your business afloat. With so many unexpected expenses, sometimes you might need extra funding. Once you realize you need funding, its time to apply for a business loan. Although business loans dont seem like the best idea at first, youll be surprised in the numerous ways they can help grow your business. Below are 5 five ways PayPal working capital business loans can help your business.

Purchasing equipment ; Having proper equipment is crucial to running a good business. It can improve your overall productivity and help you grow. Purchasing or upgrading equipment can be expensive, and getting money is hard. Business loans can help you out, and allow you to purchase equipment you need.

Add more products ; When you want to add a new product, or service, to your company, youll need cash. Besides being able to purchase new equipment, you can also use the money to conduct R&D to develop new services and products. Adding new products and services can attract new potential consumers to your business, especially if your product is unique.

Investing in marketing ; Successful marketing campaigns can bring you immense publicity, and help you get new customers to buy your product/service.

What Fees Dopaypal Charge For

Just like most PayPal business loans reviews we read, wealso find the fees charged by PayPal relatively low as compared to othershort-term lenders out there.

AdministrativeFees

Fortunately, PayPal does not charge administrative feessuch as application or origination fees on any of the companys business loans.Without admin fee, it means you get the exact amount you loaned for, which isgreat.

Late Fees

Another notable thing about PayPal Business Loans is thatthere are no late fees. However, payments are automated.

If in case your payment is rejected because of a lack of funds, the lender will then charge you a fee, which is acceptable and totally normal.

Same with PayPal Working Capital, no late fees orperiodic fees charged as well. If you fail to pay though, based on the terms ofyour agreement, you will need to catch up payments.

Returned PaymentFees

If your PayPal Business Loan payment is returned, PayPalwill charge a $20 returned-item fee.

For Working Capital, payments are takes as a percentageof your PayPal sales. Thus, you will not be charged for a returned payment fee.

Early Payment Fees

For both PayPal Business Loans and Working Capitalbusiness loans, the company charges a fixed fee. The payback amount stays thesame regardless if you use the entire term to repay the loan or pay funds backthe day after disbursement.

You May Like: How To Get An Aer Loan

Key Steps To Getting A Small Business Loan

Small business loans are available from a large number of traditional and alternative lenders. Small business loans can help your business grow, fund new research and development, help you expand into new territories, enhance sales and marketing efforts, allow you to hire new people, and much more.

This article sets forth 10 key steps to take in getting a small business loan, with some practical advice and insight on the lending process.

Paypal Bank Account Transfer Fees And Options

Transferring money to your bank account is easy as long as you have a U.S. PayPal account already set up and linked to your bank account. This transfer can be done through a personal or business PayPal account, and there are two options to consider:

Zero-cost Standard Transfers

If youve linked a bank account to your PayPal business or personal account, then you dont have to pay a transfer fee. Transfers typically take one to three business days to be deposited. If you opt to complete a transfer on a weekend or holiday, it may take slightly longer for the money to show up in your account.;;;

Costs for Instant Transfers

With Instant Transfers, you can transfer money from your business or personal account to your bank account or debit card in a matter of minutes. Keep in mind that transfers can take up to 30 minutes depending on your bank, and you do have to pay an additional fee for this service. The cost to use Instant Transfer is 1 percent of the total amount you transferred, up to a maximum fee of $10.

Eligibility requirements for transfers

Both standard and Instant Transfers require a linked and eligible bank account. Your bank is eligible if its part of the Clearing House Real Time Payments program. If youre transferring funds to a linked debit card using Instant Transfer, your debit card must be a Visa or Mastercard to be eligible.

PayPal business account vs personal account withdrawal limits

| Withdrawal limit type |

| debit card |

Don’t Miss: Are Va Loan Interest Rates Lower

Reasons For Paypal Working Capital Decline

The loan approval process for PayPal working capital is fully automated, which means there is no human involvement. And because there is no perfect system, the algorithm sometimes processes the applicants data incorrectly. This results in the rejection of loan applications.

Another popular reason for applicants to be turned Also, an applicant can be turned down if their sales are not regular. Sometimes, sales fluctuate during off seasons or when the chargebacks are higher than usual. When you have chargebacks that are higher than average, you can fail to get a loan even when your sales are strong. Hence, you can be declined for factors that you cannot control.

Paypal Working Capital Vs Other Small Business Loan Options

PayPal is just one of the many financing options available to you. Before you get a PayPal working capital loan you should understand other options you have, and how getting it compares to other options, their costs, repayment schedules, etc. PayPals loans are more expensive than traditional bank loans. Banks offer low cost small business loans with an APR of less than 10%. In order to qualify for a traditional bank loan you have to be in business for many years, have good credit, and be able to provide collateral. Many business owners dont meet these guidelines, or simply cant wait long enough to get the funding. Bank loans can also include SBA loans, which are federally guaranteed term loans which have low interest rates, and long repayment terms. The term can depend on how you plan on using the money. For example, if you need working capital you can get up to 7 years, if you need equipment purchases then you can get a term for 10 years, and if youre purchasing real estate then you can get a 25 year term. Additionally, business bank loans can boost your business if you make the payments for it on time. PayPal working capital loans dont necessarily help you build credit.

Recommended Reading: How To Calculate Bank Loan

Sending Money To Friends And Family Is Free

PayPal does charge fees.;Fortunately, sending money to a friend or a family member doesnt fall under those fees, and is free.

Instead of lining up at a money transfer service center, you might wanna sign up for PayPal to send money locally or abroad to a friend or a relative through PayPal, for free.

Factor Paypal Fees Into Your Payment Equation

A tip Ive picked up that doesnt really reduce your PayPal fees, but helps you to feel better about them, is factoring them into your payment equation.

For example, instead of charging your client $50 for writing a blog post, you could increase your rate to $55 per blog post. This will help you cover those fees so you are still making $50 after the fees are taken out of your earnings.

Another way to avoid PayPal fees is to ask your clients to pay the fees instead. Make sure you get this in writing as part of your contract. Then you can include a 45% fee at the bottom of each invoice to cover your PayPal fees.

Most clients are totally OK with this. You just need to ask!

Also Check: How To Get An Fha Loan With No Money Down

How Does Paypal Working Capital Work

PayPals working capital program are treated as loans which are backed by your regular PayPal business transactions. Your approval amount is entirely based on your annual PayPal sales .

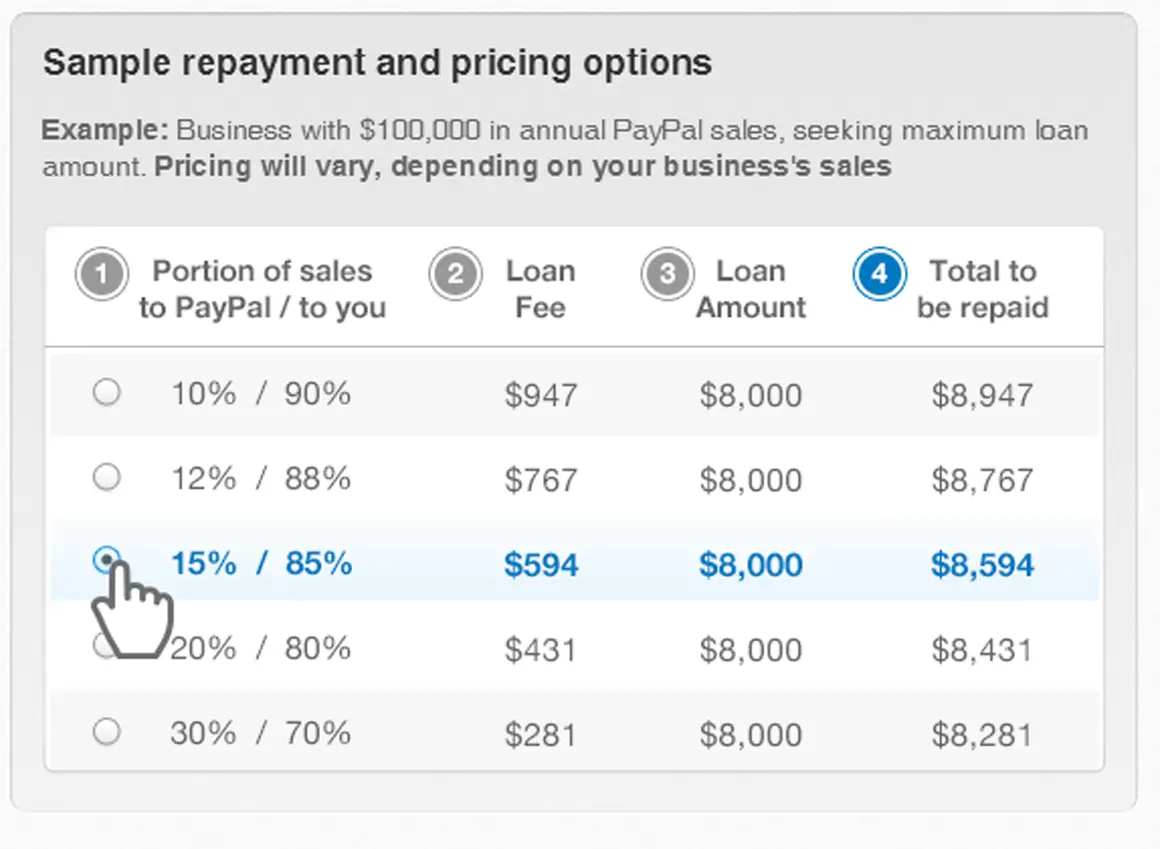

Instead of an interest rate, PayPal charges you a 1-time fee based on a percentage of the loan which gets added to your repayment total. There are no additional fees attached to the PayPal Working Capital program.

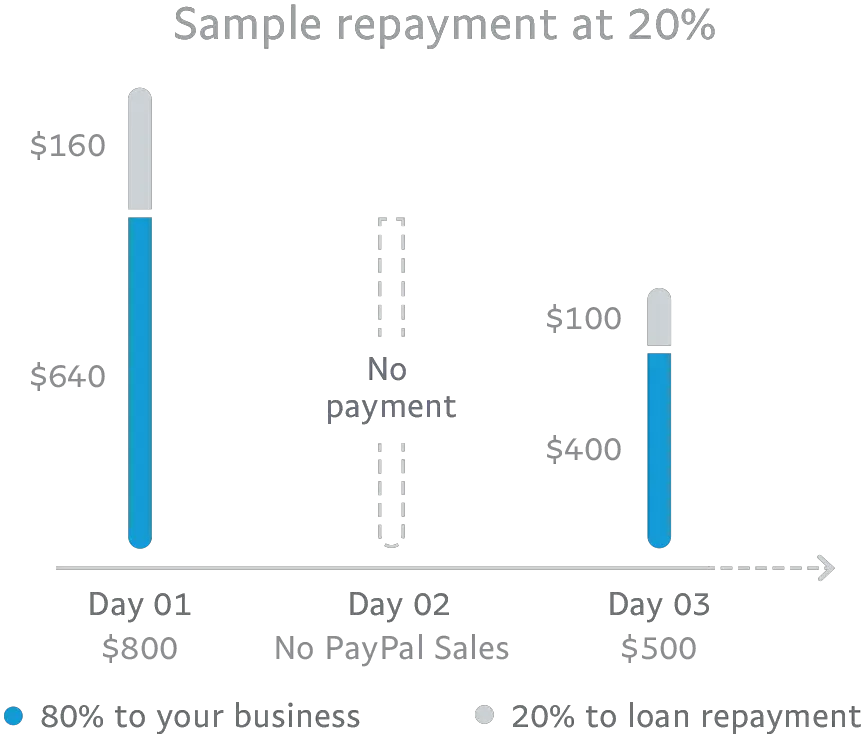

Although there is no set repayment date for a PayPal Working Capital loan, a set percentage is taken from your weekly PayPal business transactions to repay the loan within an 18-month time period.

For example, this borrower has annual PayPal sales of $200,000 and theyre approved for a $25,000 working capital loan:

Depending on what repayment percentage you choose, the one-time fee is reduced but the repayment percentage is increased conversely. You have the choice to repay the loan slower and give yourself more flexibility or pay it faster and save money:

Although PayPal offers great flexibility with respect to approval terms and repayment options, as you can see, the 1-time fee can get quite high. However, it should be remembered that this fee is replacing the interest youd typically pay with a traditional bank loan.

As per PayPals program guidelines, to be approved for a PayPal Working Capital loan you must:

To get the latest information about your loan, you can log on to your PayPal Working Capital dashboard and see your loan terms as well as make manual payments:

Things To Keep In Mind:

Because PayPal doesnt check your credit score, you could have a perfect credit score, but if you dont have great sales, you might not get the loan amount desired .

Payments will be deducted automatically from your PayPal account. The more profit your business makes, the quicker you can repay the loan back. In case youre not able to make a sale, your business wont be required to make a payment for that day. However, your business must be able to pay, roughly, every 90 days a minimum of 5% or 10%.

Don’t Miss: How To Get Loan Originator License

How Does Paypal Credit Work

PayPal Credit is a line of credit issued by Synchrony Bank. Approved PayPal users can use this virtual line of credit which functions similarly to a credit card, letting you pay for online purchases in installments, rather than upfront.

Approved PayPal users can use PayPal Credit as a payment option whenever they check out using PayPal, either from a website or at a brick-and-mortar store that accepts PayPal.

Note that PayPal Credit is not the same thing as a PayPal debit or credit card.

Despite filling a very similar niche, PayPal Credit is also not the same thing as PayPals Pay in 4 feature. You can think of PayPal Credit as being closer to a credit card, while Pay in 4 is more akin to POS financing. With PayPal Credit, youll have gone through the vetting process in advance and can utilize your revolving line of credit at will. You also have more flexibility in how and when you pay off your balance. In the case of Pay in 4, the financing decision is approved at checkout, after which youll have a very structured repayment plan.

How Much Money Can I Expect From A Paypal Business Loan

The total loan you can receive is based upon the revenue and eligibility of your company. If eligible for a loan, the minimum amount you can expect to sign for is $5000 USD while the maximum loan available to certain businesses is $500,000 USD.

In terms of the length of the loan, this will depend on thetotal amount you have borrowed. The minimum length of the loan can be 13 weekswhile the maximum period to pay back the loan is 52 weeks. The length of theloan will be determined when you apply and if you are eligible.

Once a loan is agreed on between you and PayPals business support team, you will be able to nominate a linked bank account where a weekly amount will be withdrawn. You can specify a certain day of the week to have the loan amount withdrawn although once chosen, this day is set in stone for the entirety of the loan.;

PayPal accept 56% of all small business loans in comparison to the big banks who approve only 26%.

You May Like: What Is An Ellie Mae Loan

Negative Reviews & Complaints

PayPal has a page on the Better Business Bureau, though its nigh impossible to find any complaints specifically regarding the Working Capital service. That said, as weve talked about in our review of PayPal Here, PayPal is extremely;professional and courteous when responding to and resolving complaints.

Here are the most common complaints I gleaned from PayPals community forum, PayPal Working Capital reviews, and a few other places on the internet:

- Small Borrowing Maximum: The maximum that PayPal offers is 35% of your annual PayPal sales, with a cap of $125K for your first loan and $200K for subsequent loans. Because many businesses only use PayPal as a secondary source of payments, that number might be a very small amount of their total income.

- Denials: Merchants have reported technical errors or denials, even if PayPal has previously loaned money to their business. If youre having trouble, check out the Loan Denial Troubleshooting section above to learn about reasons you might be getting denied and what you can do about it.

- No Early Repayment Incentive:;Because PayPal charges a one-time fixed fee, you cannot save money by repaying early. The only reason to repay early is to get another loan.

- Huge Difference Between High & Low Fees: The spread between PayPal Working Capitals low and high fees is enormous, making them excellent at the low end and red flag-worthy at the high. Make sure youre on the lower end before you accept.