Consider A Business Loan

A business loan can effectively ensure your business has enough capital to cover your expenses or fund a growth period. If youre considering a business loan, its essential to compare the options available to your business. You want to ensure you get the best rate with lending options that meet your businesss requirements.

What Types Of Business Loans Are Available

There are many different types of business loans. A term loan will likely be the most familiar the business owner borrows a set amount and pays it back over a set period with interest. Other forms of financing, such as a business cash advance or invoice factoring, borrow against future earnings or unpaid invoices. A line of credit gives you access to a sum of money that you can draw from as needed.

What Proportion Of Australian Smes Will See Impacts To Their Cash Flow Due To The Current Economic Climate

Small Business Loans Australia sought to determine how Australian SMEs would be impacted by the current climate of fast-growing interest rates and inflation, and how this may affect their cash flow in FY23. Respondents were asked to identify the impact to their cash flow.

76%

When asked how, more than a quarter said it will be more challenging to collect customer payments, while 26 per cent said sales will be more difficult to attract, and a fifth revealed both factors will have an impact on their cash flow.

Just 24 per cent revealed their cash flow will not be impacted.

Will the current climate of fast-growing interest rates and inflation impact your cash flow in 2022 and 2023?

03

Don’t Miss: What Is My Loan To Value

Other Factors That May Impact The Cost Of Your Small Business Funding

In addition to loan costs, other factors like the application process, timing and right loan product can influence your decision-making process.

What’s the loan application process?

Get a sense of how complex your application may be, starting with if its a paper or digital application and how many documents are required. In many cases one to several years of business and personal tax returns may be required in addition to interim financial statements. Learn more about what banks look for when they review your business loan request.

When do you need to receive the funds?

Are you willing to wait longer to receive funds in exchange for better terms? Sometimes lenders that are willing to provide the funds more quickly also charge higher rates and fees. If there is flexibility in waiting to obtain the funds for up to 30-60 days, this may allow you to shop around and find a lender that is willing to provide lower rates and fees

How will you use the money?

Do you need funding all at once to make a major purchase? Or do you want to fund lower occasional or regular expenses you can pay off periodically? If you need lower regular or occasional funding, a small business credit card or line of credit may be a good option for your business. A small business loan can be a good choice when you need larger funds up front

How Much Small Business Rates Relief Can You Receive

If your property has a rateable value of £12,000 or less, you will not pay any business rates. Concurrently, for properties with a rateable value of £12,001 to £15,000, the relief rate will go down gradually from 100% to 0%.

For example, if the rateable value of your property is £13,500, you would receive 50% off your bill. However, if your rateable value is £14,000, you would receive 33% off.

You May Like: Loans Online With Monthly Payments

Whats The Bottom Line

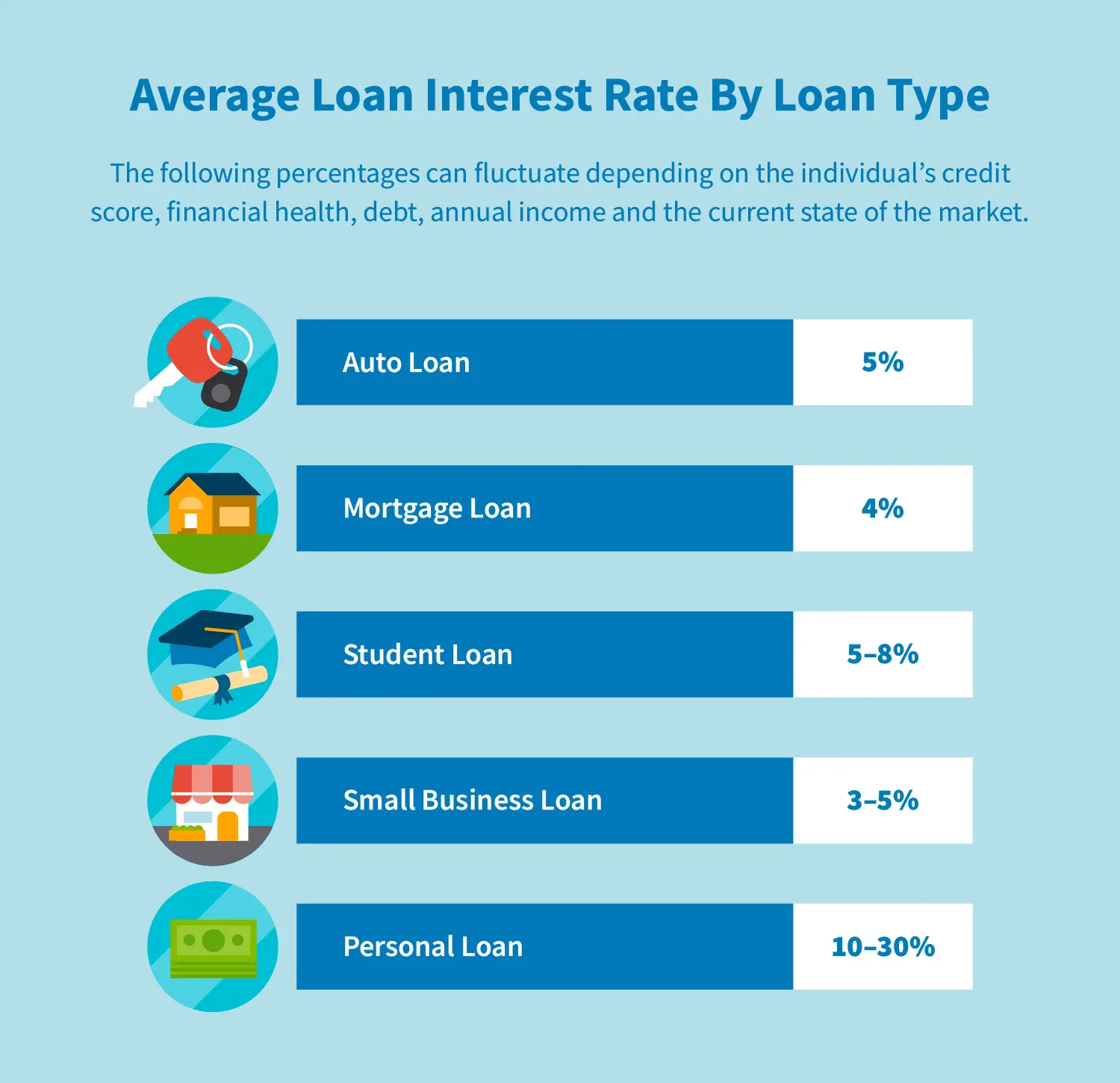

You clicked on this article to learn the average interest rates of small business loans, presumably because that information will help you make a decision. With the information above in mind, here is the most complete information we could find:

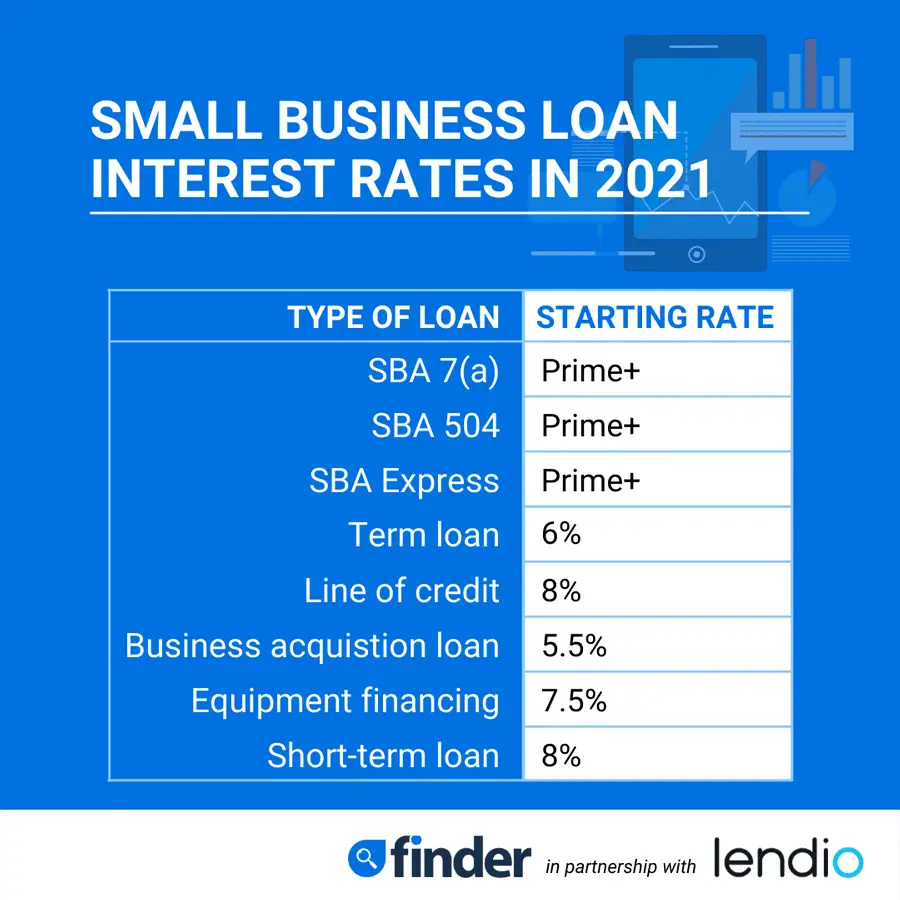

With variations according to region, industry and credit rating, the average annual interest rates on small business loans are:

- For Business Installment Loans, the average APR can range anywhere from 2.5 percent to 71 percent. However, these typically skew toward the lower end of the spectrum the higher the amount of the loan.

- For Business Lines of Credit, the average APR can range anywhere from 8 percent to 80 percent.

The advantages of a line of credit may outweigh the costs, however. For example, with a line of credit, once youâre approved, you can borrow funds whenever you want. You donât have to take the money and begin payments immediately . You also only pay back what you borrow. Letâs say youâre approved for a line of credit of up to $250,000, and you only borrow $50,000. You only make payments on that $50,000 .

In both cases, these numbers donât include the fees we warned you about earlier. Fees range wildly for both kinds of loans and are a common trick used by predatory lenders to make their loans nearly impossible to pay off. Make sure you read the terms of any funding you borrow to ensure there are no hidden fees youâll be hit with.

What Business Loans Are The Easiest To Be Approved For

The answer to this question depends on how much you need and how you intend to use the funds. Many lenders have minimum qualification requirements for annual revenue, time in business and the business owners personal credit score. This is helpful for startups without a financial history that cannot meet the requirements lenders have for more established organizations. Read our reviews to see which lenders have less onerous eligibility requirements.

Read Also: How To File Bankruptcy On Car Loan

What Are The Qualifications For Food Truck Loans

Each lender that offers food truck financing has their own specific requirements. But in general, they require that youâve been in business for at least six months and earn a revenue of at least $10,000 per month or $100,000 per year.

Ideally, youâd also have a credit score of at least 680. If your credit isnât the best, however, you might have to offer cash or collateral as a down payment. A lender may also request that you apply with a cosigner.

In addition, a lender will likely require documentation to support your food truck loan application. This may include a business plan, financial statements, and tax returns.

Food Truck Loans: What You Need To Know

8 Min Anna Baluch

| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

If you donât have the money to purchase the food truck or you have purchased a food truck but donât have the funds to renovate it or you have succeeded in buying the food truck, renovating it but have run out of funds to buy supplies, knowing what type of loans and how they work can solve many monetary conundrums all small business owners find them self in.

âIf you donât have the cash to cover all of the costs that come with running and growing a food truck, itâs certainly worth considering.â

Also Check: Veteran United Home Loans Reviews

What Proportion Of Australian Smes Will See Impacts To Their Cash Flow Due To The Current Economic Climate By State

Across the States, a higher proportion of NSW SMEs revealed potential cash flow problems, at 82 per cent followed by 81 per cent of Western Australian SMEs, 77 per cent of Victorian, 73 per cent South Australian SMEs and 67 per cent of those in Queensland who said the same.

Queensland businesses appeared to be the most prepared for the changing economic climate, with a third stating their cashflow would not be impacted by growing interest rates and inflation. This was followed by 27 per cent of South Australian SMEs, 23 per cent in Victoria, and compared with 19 per cent and 18 per cent in Western Australia and NSW, respectively.

Will the current climate of fast-growing interest rates and inflation impact your cash flow in 2022 and 2023?

| Response |

|---|

04

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Can You Deduct Equity Loan Interest

Choosing A Business Loan Provider

When seeking a loan, you must understand the ins and outs of the lending process, the lenders qualification requirements and the terms of your loan if you want to secure the capital you need without compromising your businesss future. As you compare various lenders, pay attention to the following elements.

What Rates And Terms Are Offered On Food Truck Loans

The terms and rates you receive on a food truck loan will depend on several factors, such as the lender, type of financing, and what your credit looks like. With a business term loan, for example, you can expect rates between 5.99% and 35.36% with terms ranging from 1 to 5 years.

Food truck lines of credit usually come with . If you opt for an equipment loan, you may qualify for millions of dollars in funding and repayment terms of 1 to 6 years. A microloan from the SBA may offer rates in the 0% to 13% range and terms of up to 6 years.

You May Like: What Are Home Equity Loans

How Much Money Do I Need To Fund My Small Business

The amount of working capital a small business needs to cover day-to-day operations depends on a variety of factors, like equipment, inventory and payroll costs, monthly revenue and other expenses. Startups typically have many one-time, up-front costs based on details like the specific industry, type of business, local and/or federal regulations. While actual amounts vary widely, recent reports suggest that microbusiness startup costs are around $3,000, while home-based small businesses can range from roughly $2,000 to $5,000.1 Keep in mind that the maximum business loan amount that startups and other small businesses may qualify for varies based on details like the credit type, the borrowers personal credit history and the lender.

Factors That Can Impact A Businesss Ability To Secure A Loan

While specific business loan requirements will vary, generally, most creditors consider a prospective borrowers Five Cs of Credit when reviewing credit requests. If your company does not qualify for a small business loan, improving your businesss finances in the following areas can also help increase your chances of securing a loan in the future:

You May Like: Can You Get An Auto Loan After Bankruptcy

Where To Get A Small Business Loan

You can get a small business loan through a bank or a non-bank online lender. Again, banks tend to offer more competitive rates than online lenders, but online lenders typically offer quicker application and funding times.

Another form of lending thats become popular for small businesses is peer-to-peer lending. P2P loans are funded by individual investors as opposed to lending institutions. These loans are available through P2P lending platforms that act as intermediaries to match investors with qualifying borrowers.

How To Choose The Right Food Truck Loan For Your Business

As you look for food truck financing, be sure to compare the following:

- Loan Features: This refers to the minimum and maximum borrowing amounts as well as the terms or how long youâll have to pay back what you borrow.

- Application Process: Some lenders have quick, online applications while others request a more extensive application with many documents.

- Interest Rates and Fees: Ideally, youâd choose the option with the lowest rate and minimal to no fees.

- Qualification Requirements: Pick a food truck loan with credit score, annual revenue, and business history criteria you can meet.

- Customer Service: You want to ensure the lender you choose is easily accessible via phone, email, and/or live chat.

- Perks: Some lenders go above and beyond with extras such as hardship assistance and payment flexibility.

Recommended Reading: Average Interest Rate On Car Loans

Business Loan Interest Rate Faq

Unfortunately, there arent any concrete stats that tell us the average rate for a small-business loan in Canada. But weve found plenty of lenders that offer rates between around 8% to 20%.

Just like we cant provide a real stat for the average business loan rate, we also cant give you a reliable stat for the average business loan size or term length. And frankly, with loans going to businesses ranging from a part-time Etsy seller to a multimillion-dollar corporation, the average wouldnt tell you that much anyway.

Banks & Credit Unions

Traditional banks and credit unions typically offer a limited range of small business loans, including those backed by the SBA. While traditional banks often have tighter borrowing standards than online lenders, small business owners may still find it easier to qualify at an institution where they have an existing banking relationship.

Not only will the bank already have the business financial statements on file, but it may also be easier to get approved with a local lender who is familiar with your operation.

Recommended Reading: How To Lower Loan Payments

How Does A Food Truck Loan Work

Put simply, a food truck loan is designed to help food truck businesses pay for a wide array of expenses. If you donât have the cash to cover all of the costs that come with running and growing a food truck, itâs certainly worth considering.

While there are different types of food truck loans available, most of them require you to repay what you borrow with interest and potential fees over a predetermined set of time.

Whats The Difference Between Fixed And Variable Business Loan Rates

A fixed-rate loan has an interest rate that stays constant until you pay off the loan, whereas a variable rate may change. Variable-rate business loans usually have a lower interest rate to start, but since they can change, your payment amount and the total interest you pay over time can change too.

Read Also: Get Loan With No Credit

Loan Repayment Term Length

The term of your business loan will also have an impact on what your rate will be. Short-term loans have higher APRs, but youâll pay less in total interest since youâre borrowing the money for a shorter period of time. Long-term loans are the opposite. They have lower APRs, but youâll have more in total interest.

If you have a genuinely short-term need for cash , a short-term loan might be a better value than a long-term loan. However, for genuine long-term needs like business expansion, a long-term loan will be better.

More Entrepreneurs Cite Financing As Top Problem

A monthly NFIB survey of business owners released earlier this week found that the percentage of entrepreneurs who reported financing as their top business problem reached its highest reading since December 2018 the last time the Fed was raising rates. Almost a quarter of small business owners said they are paying a higher rate on their most recent loan, and the highest since 2008. A majority of owners told NFIB they are not interested in applying for a loan.

“The pain is already in, and there will be more,” Arora said.

That’s because beyond the psychological threshold of the 10% interest level being breached, the expectation is that the Fed will keep rates elevated for an extended period of time. Even in slowing rate hikes and potentially stopping rate hikes as soon as early next year, there is no indication the Fed will move to cut rates, even if the economy enters a recession. The latest CNBC Fed Survey shows the market forecasting a peak Fed rate around 5% in March 2023 and the rate being held there for nine months. Survey respondents said a recession, which 61% of them expect next year, would not alter that “higher for longer” view.

The latest Fed projection for the terminal rate released on Wednesday rose to 5.1%.

This problem will be exacerbated by the fact that as the economy slows the need to borrow will increase for business owners facing declining sales, and unlikely to see additional support from the Fed or federal government.

Recommended Reading: How Much Do Loan Signing Agents Make

Sba 7 Loans Small Business Administration Loans

The 7 is the SBA’s most widely used loan program. While the loan is partially guaranteed by the Small Business Administration, the financing is delivered through an approved SBA lender. This way, you can borrow anywhere between $20,000 and $5 million for as long as a 10-year term. Keep in mind, a 10 to 30 percent down payment is usually required for these types of loans. The SBAâs 7 loan program is attractive to many small business owners for its below-market interest rate. If you apply through Funding Circle’s network of SBA lenders, you’ll see that the interest rate is currently set at Prime + 2.75% .1 Payments are made monthly and you won’t face any fees for early repayment. Your business should have an operating history of at least three years to qualify. Use the proceeds for working capital, refinancing debt, making major purchases, and more. Learn more about applying for SBA loans through Funding Circle.