Factors That Affect How Much Interest You Pay

There are a handful of important factors that have the biggest impact on your potential interest rates. You can probably guess them:, debt-to-income ratio, and the overall amount of debt you already have.

The interest rates any borrower is offered will depend to a great extent upon that borrowers . Lenders will require higher interest rates from people with weaker credit scores. The best rates are offered to those with a high credit score and low debt-income ratio. The lender, after all, is taking a risk in letting you use his money, says Glenn Downing, a certified financial planner and founder of CameronDowning.

But these days, lenders are offering new types of loan products that can take into account lots of other aspects of your financial health.

Many of these new lenders use, literally, thousands of other variables, says Anuj Nayar, financial health officer at LendingClub.

His company is a prime example: They might look at your bank account balances or your monthly cash flow to try to get you a lower rate, Nayar says.

The loan amount affects interest rates, too. The more money you borrow, the higher the risk for the lender, which usually means a higher interest rate for you, too. Nayar advises that borrowers think critically about how much money they really need and try to minimize the loan, which can in turn reduce the amount of interest paid.

How Interest Is Charged

The interest rate is fixed for the life of the loan.

At the beginning of the loan we work out the interest you will pay over the whole length of your loan and add this to your loan amount. We calculate your interest charge by applying interest at a monthly rate based on the APR to the balance of your loan, as reduced by your monthly repayments. We add this to the loan amount and then divide this total by the number of monthly repayments.

The loans calculator will give you an example of what it might cost you based on the loan amount and term you want. However, the interest rate we offer may be higher depending on your individual circumstances.

What Are The Benefits Of Using A Bank Loan Calculator

You can avail the following advantages when you use the interest rate calculator we provide.

- Our calculator saves you from the troubles and pitfalls of opting for manual calculations. If you have multiple on-going loan repayments, you will need some technological aid.

- The calculator is immune to error.

- You can now plan for the future without pondering over the existing loan details.

You will see a wide array of other calculators below. They will help you with financial planning.

Looking to invest? Open an account with Groww and start investing in direct;Mutual Funds;for free

You May Like: Is It Too Late To Apply For Ppp Loan

Installment And Revolving Credit Payments

Installment credit represents borrowing usually associated with the two major purchases concerning consumers: Homes and vehicles.; Repayment terms vary, according to lender terms and how much money is borrowed, but monthly payments always contain interest obligations.; Each installment also contains a contribution toward repaying principal, which is based on loan size and amortization schedule.; From the moment you initiate your installment loan, it is possible to look at a comprehensive payment schedule, outlining your repayment obligations over the course of the loan’s life.; If your financing is structured using fixed rates then the schedule only changes if you pay ahead, which is allowed under some installment contracts. In other words, there are no surprises for consumers, who know exactly what their monthly home mortgage payments and vehicle loan obligations will be.

Can You Get A Cash Advance With No Bank Account Credit

Can you get a payday loan without a bank account? While many payday lenders require a bank account, others dont, and you might be able to get a payday;

Loans Without Bank Account Up To $1000. Paperless Process, Quick to Apply, Same Day Approved. Secure and Confidential; 2,451+ Americans get their loan; Cash;

One of the main features of payday loans no checking account is that you need not submit any security against your loan. Hence, you can use your loan amount to;

Read Also: When Will I Receive My Student Loan

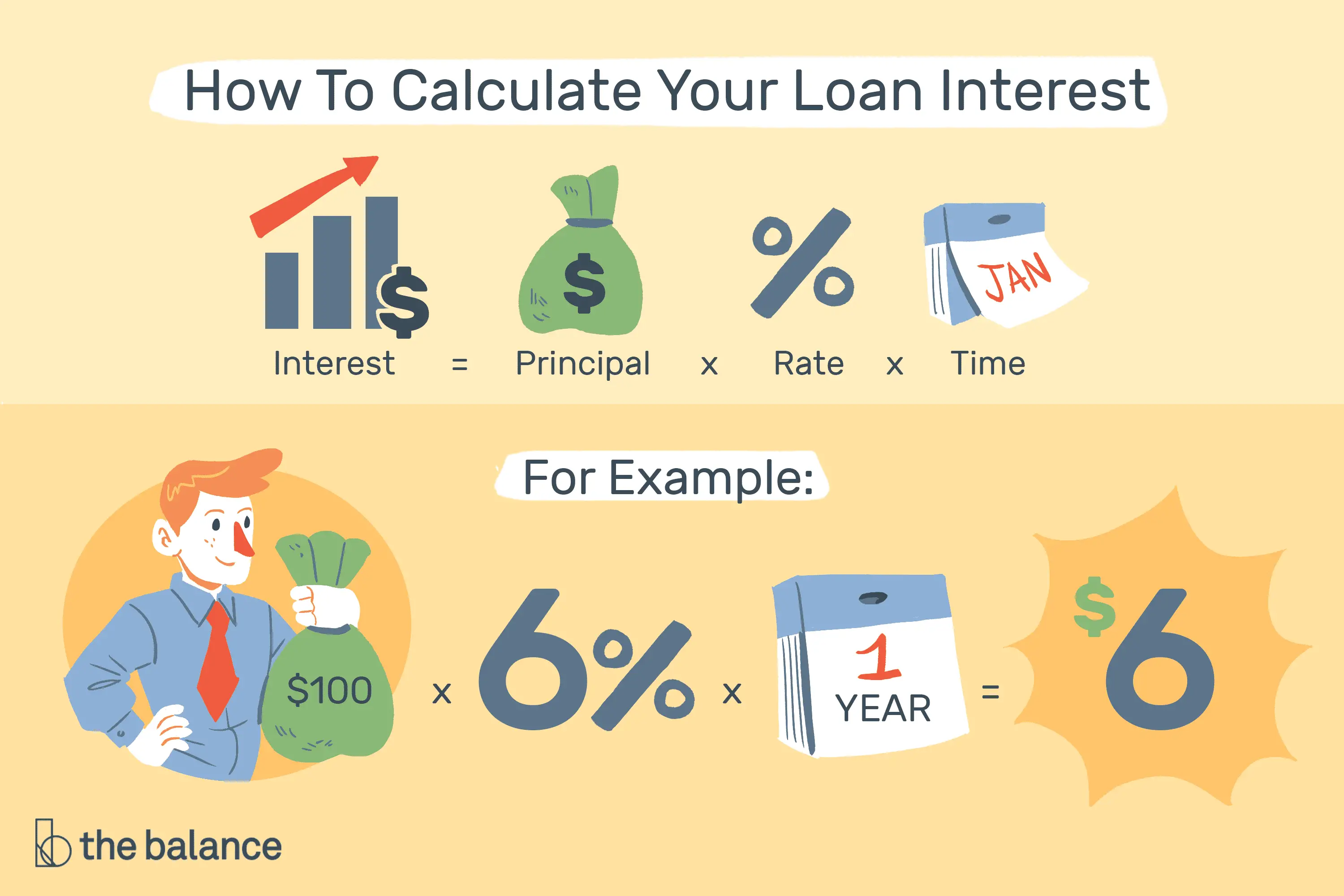

Calculating Interest On A One

If you borrow $1,000 from a bank for one year and have to pay $60 in interest for that year, your stated interest rate is 6%. Here’s the calculation:

Effective Rate on a Simple Interest Loan = Interest/Principal = $60/$1,000 = 6%

Your annual percentage rate or APR is the same as the stated rate in this example because there is no compound interest to consider. This is a simple interest loan.

Meanwhile, this particular loan becomes less favorable if you keep the money for a shorter period of time. For example, if you borrow $1,000 from a bank for 120 days and the interest rate remains at 6%, the effective annual interest rate is much higher.

Effective rate = Interest/Principal X Days in the Year /Days Loan Is Outstanding

Effective rate on a Loan with a Term of Less Than One Year = $60/$1,000 X 360/120 = 18%

The effective rate of interest is 18% since you only have use of the funds for 120 days instead of 360 days.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Read Also: Can I Get Another Loan From Upstart

How To Get The Best Deals On Your Loan Payments

Your monthly loan payment is just a result of the loan amount, the interest rate, and the length of your loan. Salespeople and lenders can make a low monthly payment seem like youre getting a good dealeven when youre not.

For example, some auto dealers want you to focus solely on your monthly payment, which is why they often ask how much you can afford each month. With that information, they can sell you almost anything and fit it into your monthly budget by extending the life of the loan.

It is better to negotiate a lower purchase price than a lower monthly payment. Lowering the sales price decreases one of the three components of the total loan cost.

Stretching out your loan means youll pay more in interest over the life of the loan, increasing the total cost of the loan. Plus, longer-term loans might be riskier: When they’re used by buyers with lower credit to finance larger amounts, there’s a greater risk of default.

Questions To Ask Before You Take Out A Personal Loan Cnbc

Do I want to pay my creditors directly or have money sent to my bank account? When you take out a personal loan, the cash is usually delivered directly to your;

Jun 15, 2021 For some payday loans, you cant miss a payment because the lender will automatically take the money out of your bank account on payday,;

Don’t Miss: Can You Get Personal Loan From Bank

Why Do Banks Charge Different Interest Rates

While the cash rate is one of the main things banks will consider when setting commercial interest rates, itâs not the only one. Banks will also be keeping an eye on overhead costs, as well as maintaining a healthy margin between the loan and deposit rates theyâre offering.

Generally speaking, online banks tend to offer cheaper home loan rates and more generous savings account rates than their larger counterparts, as they have fewer overhead costs to worry about. The flipside to this is that larger banks tend to offer more when it comes to physical branches and face-to-face services.

What Are Loan Payment Calculations

The type of calculation you use will vary based on the type of loan. Here are three helpful calculations to know about when considering borrowing money:

- Interest-only loans: With interest-only loans, you dont pay down any of the principal in the early yearsonly interest.

- Amortizing loans: On the other hand, amortizing loans involve paying toward both principal and interest over a set period of time, such as with a five-year auto loan.

- When using a credit card, you’re given a line of credit that acts as a reusable loan so long as you pay it off in time. If you’re late on making monthly payments and begin to carry a balance, you’ll likely be charged interest.

You May Like: Should I Get An Unsubsidized Student Loan

Effective Interest Rate With Compensating Balances

Some banks require that a small business applying for a business bank loan hold a balance, called a compensating balance, with their bank before they will approve a loan. This requirement makes the effective rate of interest higher.

Effective rate with compensating balances = Interest/

Effective rate compensating balance = 6%/ = 7.5 percent

What Is My Loan Payment Formula

Now that you have identified the type of loan you have, the second step is plugging numbers into a loan payment formula based on your loan type.

If you have an amortized loan, calculating your loan payment can get a little hairy and potentially bring back not-so-fond memories of high school math, but stick with us and we’ll help you with the numbers.

Here’s an example: let’s say you get an auto loan for $10,000 at a 7.5% annual interest rate for 5 years after making a $1,000 down payment. To solve the equation, you’ll need to find the numbers for these values:

-

A = Payment amount per period

-

P = Initial principal or loan amount

-

r = Interest rate per period

-

n = Total number of payments or periods

The formula for calculating your monthly payment is:

A = P ^n) / ^n -1 )

When you plug in your numbers, it would shake out as this:

-

P = $10,000

-

r = 7.5% per year / 12 months = 0.625% per period

-

n = 5 years x 12 months = 60 total periods

So, when we follow through on the arithmetic you find your monthly payment:

10,000 / – 1)

10,000 /

10,000

10,000 = $200.38

In this case, your monthly payment for your cars loan term would be $200.38.

If you have an interest-only loan, calculating the monthly payment is exponentially easier . Here is the formula the lender uses to calculate your monthly payment:

loan payment = loan balance x

In this case, your monthly interest-only payment for the loan above would be $62.50.

You May Like: How Much Time It Takes To Get Personal Loan

Payday Loans Without Checking Account Opencashadvance

One such option is a cash advance without checking account. Cash advances are popular ways to circumvent direct deposits. Best of all, you dont even need to;How Direct Deposit Payday Loans Work · Other Available Options

Can You Get a Payday Loan Without a Bank Account? Yes, if you do not have any bank accounts with a direct deposit facility, you can still get the loan; Rating: 5 · 1 vote

Can I Get Cash Advance Without a Bank Account However, if you do not have a checking account, your chances of getting a loan to become narrower. Rating: 5 · 1 vote

How To Get A Payday Loan With No Bank Account Cashfloat

Mar 26, 2020 It is possible to get payday loans without a bank account the answer is doorstep loans. The agent will come to your house and discuss the;

When you apply for a new credit account, lenders evaluate your application based on key factors commonly known as the 5 Cs of Credit. Credit History; Capacity;

Cash Loans without Bank Account from Private Lenders You may try to contact private lendersincluding those that provide online loans, fast cash loans,;

You May Like: What Kind Of Car Loan Interest Rate Can I Get

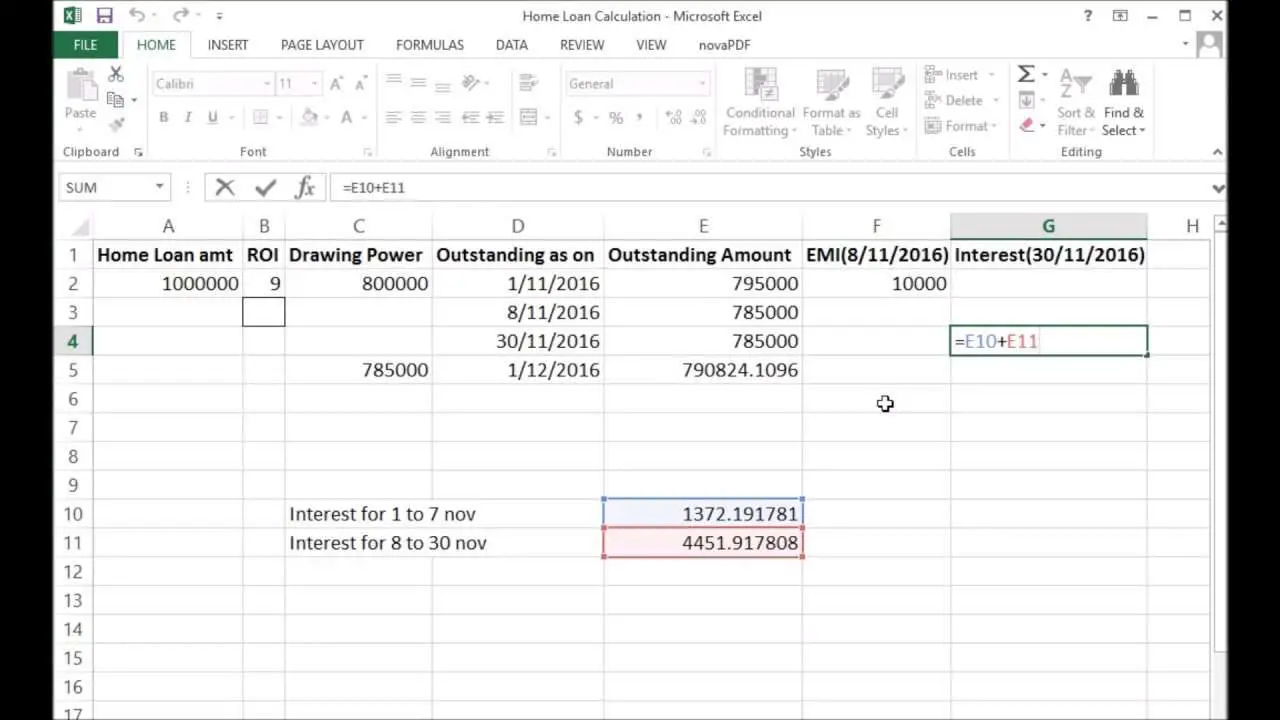

How To Calculate Home Loan Emi Using Excel Sheet

Calculation of home loan EMI is a simple method using an excel spreadsheet. In order to do so, three variable of a housing loan is utilised, namely, rate of interest, period, and loan amount. It must be noted that the rate of interest should be calculated on a monthly basis.

For example, if the rate of interest is 12%, it should be calculated as 12%/12 = 1%. The period represents the total number of EMI payable.

In order to calculate EMI, click on the = symbol, type PMT, and click enter. The excel sheet will the produce an amount in a negative value. This indicates the cash flow that the borrower will have to incur. This is the EMI that a home loan borrower would have to pay.

For example if your loan amount is 5 lakh for 2 years at 12% p.a., the formula to calculate EMI is as follows.

=PMT

Can You Get A Cash Advance With No Bank Account

May 7, 2021 Yes, there are credit cards that dont require the applicant to have a bank account to qualify, but they will likely have more restrictions than;

Can I get a Loan without a Bank Account? Many who need loans with no credit check or a cash advance loan online but do not have a bank account can secure a loan;

A Cash Advance, also known as a Payday Loan, is a short-term loan to help These loans are one of the easiest ways to get money fast, when you need it;

At 1st Choice Money Center, however, we have affordable loan programs that can put money in your hand today, even if you dont have a bank account. Our loan;

May 3, 2021 Simply put: its hard to get any kind of loan with no bank account because lenders get worried that you wont pay them back. Okay, lets;

You May Like: What Is The Commitment Fee On Mortgage Loan

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether it’ll be affordable for you based on your income and other monthly expenses.

Example Of Using An Interest Calculator

To understand how to use our bank loan interest rate calculator, here is a simple example.

If you have availed a loan of Rs. 10 Lakh from a lending institution at an interest rate of 10.50% for a tenure of 10 years or 120 months, the formula determines that the EMIs payable is Rs 13,493.

Of this, our calculator can even help you decode that the total amount repayable after the term ends is Rs 16,19,220. Thus, the interest payable is Rs 6,19,220.

You May Like: Can You Take Out More Than One Student Loan

What Is Loan Interest

Interest is the price you pay to borrow money from someone else. If you take out a $20,000 personal loan, you may wind up paying the lender a total of almost $23,000 over the next five years. That extra $3,000 is the interest.

As you repay the loan over time, a portion of each payment goes toward the amount you borrowed and another portion goes toward interest costs. How much loan interest the lender charges is determined by things like your , income, loan amount, loan terms and the current amount of debt you have.

Calculating Credit Card Interest

With is similar, but it can be more complicated. Your;card issuer;may use a daily interest method or assess interest monthly based on an average balance, for example. Minimum payments will also vary by the card issuer, depending on;the card issuers approach;to generating profits. Check the fine print in the credit card agreement to get the details.

Recommended Reading: What Loan Can I Afford Calculator

Effective Interest Rate On Installment Loans

Many consumers have installment loans, which are loans that are repaid with a set number of payments. Most car loans are installment loans, for example.

Unfortunately, one of the most confusing interest rates that you will hear quoted on a bank loan is that on an installment loan. Installment loan interest rates are generally the highest interest rates you will encounter. Using the example from above:

Effective rate on installment loan = 2 X Annual # of payments X Interest/ X Principal

Effective rate/installment loan = / = 11.08%

The interest rate on this installment loan is 11.08%, as compared to 7.5% on the loan with compensating balances.

What Are The Standard Interest Rates For Personal Loans

Actual interest rates will vary depending on an applicants credit score, repayment history, income sources and the lenders own standards. Interest rates also vary with market conditions, but for 2019 the interest rates for personal credit ranges from about 6% to 36%.

If we compare the average interest rate of personal loans to other forms of financing, we can see they have rates below that of a credit card, though charge a bit more than most secured forms of financing. The big benefits of personal loans for those who take them is they are unsecured and the approval type is typically faster than other forms of financing.

| Financing Type |

|---|

Also Check: Should I Pick Variable Or Fixed Rate Student Loan