Review Your Budget And Make A Plan

Now is a great opportunity to review your finances and make a plan for resuming payments. You may need to cut spending in certain areas to make sure you have room in your budget for when payment is due or pull from your emergency fund. Even though the forbearance period has been extended, its still a good idea to take this time to prepare for the future. Sooner or later, your monthly payments will start again and its better to be ahead of the curve.

Use Your Results To Save Money

If you have unsubsidized or private student loans, you can lower your total to repay by making monthly interest payments while youre going to school. Or, you may opt to make a lump sum payment of the total interest that accrues before repayment begins. Either method will prevent the interest that accrues from being capitalized. The result: a lower monthly bill amount.

You can submit more than your monthly minimum to pay off your loan faster. The quicker you finish paying your loans, the more youll save in interest. Learn how to pay off your student loans fast.

If youre having trouble making payments on your federal loans, you can extend the term to 20 or 25 years with an income-driven repayment plan. Income-driven plans lower your monthly loan payments, but increase the total interest youll pay throughout the life of your loan.

Private lenders may allow you to lower monthly payment temporarily. To permanently lower monthly payments youll need to refinance student loans. By doing so, you replace your current loan or loans with a new, private loan at a lower interest rate. To qualify youll need a credit score in the high 600s and steady income, or a co-signer who does.

Student Loan Deferment And Forbearance

Loan deferment is a temporary period when you dont make payments on your loans. You have to apply and be approved for deferment. If you have Direct Subsidized Loans;and Perkins Loans, the federal government pays any interest that adds up during the deferment. If you have Direct Unsubsidized Loans, you are responsible for paying any interest that adds up during the deferment.

Loan forbearance is another temporary period when you either make reduced payments or dont make payments on your loans. You would typically request forbearance if you are experiencing financial difficulty.

Deferment and forbearance are good loan management tools and can help you avoid student loan default.

Recommended Reading: What Are The Qualifications For First Time Home Buyers Loan

Look Into Other Deferment Or Forbearance Options

If an income-driven repayment plan is not affordable, you can potentially request a different type of forbearance or deferment after this forbearance period, says Ferastoaru. Additional deferment and forbearance outside of COVID-19 relief can give you more time to get back on your feet, but should be a last resort.;

For example, theres unemployment deferment, which temporarily suspends payments on your student loans. It covers your interest for subsidized student loans, but not unsubsidized loans, and is limited to three years.;

Theres also economic hardship deferment, which is similar to unemployment deferment, except you have to receive federal or state public assistance, earn below 150% of the federal poverty line, and work at least 30 hours per week to qualify. The last option is applying for federal forbearance, which can last up to three years. But unlike a deferment, the government wont cover any of the interest on your loan.;

How To Calculate Student Loan Interest

If youve recently graduated or left college, you might be surprised at how much of your student loan payment goes just to the interest portion of your debt. To understand why that is, you first need to understand how that interest accrues and how its applied toward each payment.

Don’t Miss: How Does Pre Approval For Auto Loan Work

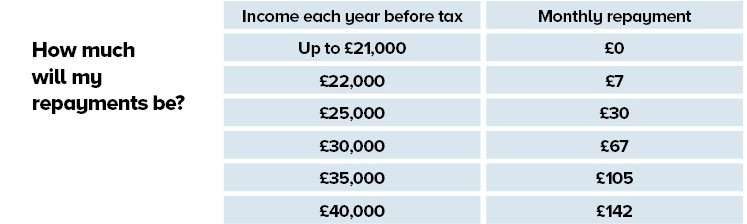

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Read Also: How To Transfer Car Loan To Another Person

Can My Loans Be Forgiven

Federal student loans may be eligible for certain forgiveness programs, depending on your profession.

As described above, if you have an IBR plan, any balance remaining after 10 years will be forgiven if you spend those years in a public service sector such as the military, public education, or police work or work for certain nonprofit 501 organizations.

You can have up to $17,500 in loans forgiven if you teach in a low-income area for five years.

If you ever find yourself struggling with student loans, keep in mind that you always have options. Dont wait until youve missed several payments or have already defaulted on your loans; get help as soon as possible to create a plan that works for you and your budget.

Meanwhile, keep an eye on Washington.

About The Author

What If I Want To Continue Making Payments

Any payments you make during the forbearance period will be applied to principal once all the interest that accrued before March 13, 2020 and any fees are paid.

Making any voluntary payments right now will help you pay down your loan balance faster, but Farnoosh Torabi, editor-at-large of personal finance at CNET and host of the podcast So Money, says you shouldnt worry about paying down your student loans too aggressively this year. You should instead focus on building an emergency fund or paying off high-interest debt.

Even if were to believe that the loans will come due again in early 2021, I dont recommend working extra hard to erase your government loans this year. Pay the minimums, as needed, but not a penny more, Torabi writes.

If youre determined to pay down your student loans right now, these strategies can help you.;

Recommended Reading: How Many Years After Foreclosure For Conventional Loan

Create Your Student Loan Repayment Strategy Great Lakes

If you have private loans, you can usually find your lender or servicer on may forgive a portion of your loan balance, if you meet certain criteria!

Answers to your top questions about student loans and mygreatlakes.org. Finanacial Student Aid. Official Servicer of Federal Student Aid.

1. Minimum Payment Due: The amount you are currently obligated to pay based on the terms of your promissory note. 2. Loan Balance :;

Student Loan Default: What It Is And How To Recover

6 days ago Student loan default usually happens after 270 days of missed payments. Get federal loans out of default with options like rehabilitation;

May 24, 2021 Student loans can be confusing, but these resources offer Nervous about contacting your lender, or scared to look at your loan balance?

Recommended Reading: Can You Pay Off Mortgage With Home Equity Loan

Average Payments For Graduate Student Loans

Graduate students logically must make higher monthly payments. For some degrees, this doesnt just mean paying a higher dollar amount; it may also mean a significant portion of a borrowers income goes toward repaying student loan debt.

- 4.3% is the interest rate for Direct Unsubsidized federal student loans to graduate or professional borrowers.

- 5.3% is the interest rate for Direct PLUS loans, which go to graduate or professional borrowers as well as parents of undergraduates borrowing on their behalf.

- A low-end salary for a graduate degree holder has $42,000 GI.

- An average salary is for a professional degree holder, who can make over $100,000.

Masters Student Loan Payments

- $58,300 is the average student debt for a borrower who graduated from a public institution with a Masters degree.

- $96,700 is the average debt for Masters degree holders who attended a private, for-profit institution.

- $77,800 is the average salary for a Masters degree holder.

- $42,000 is the low-end salary for a Masters degree holder.

| Monthly Payment |

|---|

| $124,800 |

Professional & Doctorate Student Loan Payments

The average debt for a graduate from a private, nonprofit institution with a Professional degree is about the same as the average medical school debt.

Payments on a Doctorates Low-End Salary| Monthly Payment |

|---|

| $291,900 |

Payments for Law School Debt

Payments on a Lawyers Starting Salary¶| Monthly Payment |

|---|

| $206,500 |

Private Student Loan Payments

Additional Factors To Consider When Calculating Student Loan Interest

When calculating your student loan interest, keep in mind that there are a few other key factors at play:

- Fixed vs. variable rates. Unlike federal student loans, which offer only fixed interest rates, some private lenders offer fixed or variable student loan interest rates. A fixed rate wont change during your loan term, but variable rates can decrease or increase based on market conditions.

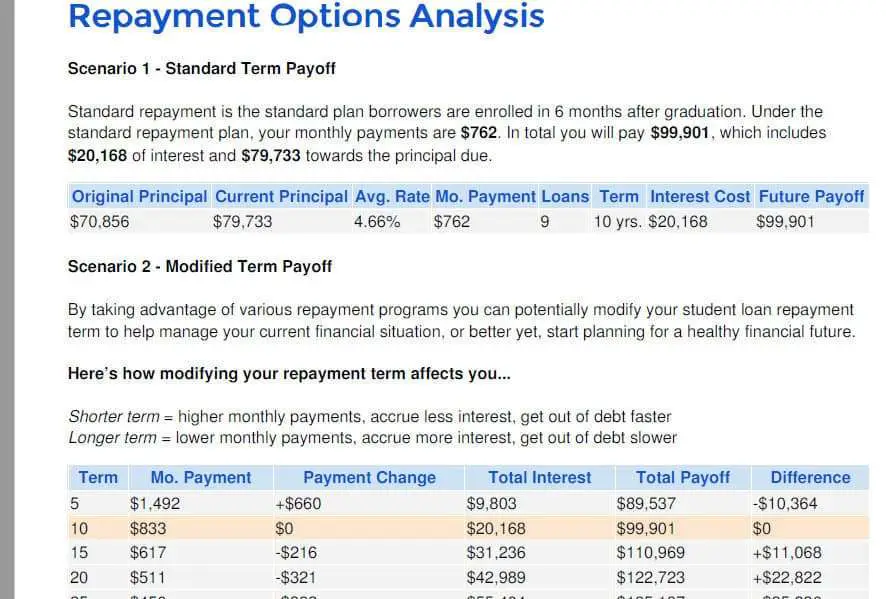

- Term length. How short or long your student loan term is dramatically changes how much total interest youll pay. In addition to calculating your total interest paid, the student loan calculator above shows you how much of your monthly payment goes toward interest; to see this view, click on show amortization schedule.

- Private student loans require a credit check. The stronger your credit, the more likely youll be offered competitive, low interest rates. Borrowers with bad credit might be approved at a higher interest rate, which means more money spent on interest charges overall.

You May Like: How To Check Credit Score For Home Loan

How Much Do I Pay Each Month Can I Pay More

Your minimum monthly payment is based on the type of loan, the amount you owe, the length of your repayment plan and your interest rate. Typically, borrowers have 10 to 25 years to repay federal loans entirely. Shorter lengths of repayment time or larger loans will result in higher monthly payments.

The Standard 10-year Repayment Plan is by far the most popular plan with borrowers, but that doesnt mean it is the best plan for you. This is the default plan. Borrowers are automatically enrolled in the Standard Repayment Plan unless they choose a different one.

Youll make fixed monthly payments for 10 years. Its a great plan if you can afford the monthly payments and the cheapest option long term because youll pay a lot less in interest. If you lack the income to support these payments, however, you should enroll in one of the income-driven repayment plans.

Or perhaps you have in mind applying for the Public Service Loan Forgiveness program. Work full-time in a qualifying field government at any level, or not-for-profit organizations that are tax-exempt under Section 501 of the Internal Revenue Code and make 120 qualifying monthly payments, and whatever balance remains will be forgiven.

If You Enroll In Repaye As A Public Defender

If you begin earning $58,000 as a public defender, your monthly payments in REPAYE will start at $327 and gradually rise to $557 as your salary increases. Over the life of your loan, your payments will average $442 a month, assuming you qualify for more than $170,000 in Public Service Loan Forgiveness.

Don’t Miss: What To Do If Lender Rejects Your Loan Application

Who You Need To Repay

You may have loans or lines of credit that you need to repay to the government and/or your financial institution.

In some provinces and territories, Canada Student Loans are issued separately by the federal and provincial or territorial governments. This means that you could have more than one loan to pay back.

Verify your contracts to determine where your debt comes from and where you need to repay it.

How Do I Make Payments

Once bills are due again, only if they are due youll be responsible for sending your monthly payments to the companies that hold your loans.

If you dont know where to send a payment, check with your schools financial aid office. The financial aid office will be able to tell you who your loan servicers are. You can then contact your loan servicers directly with specific questions.

You also can retrieve loan information via the National Student Loan Data System. Now more than ever, its vital you know your balance details.

Be aware that your payments are due even if you dont receive the bills. If you move after graduation, or you have relocated during the CARES Act pause, tell your loan servicer your new address to ensure you receive bills and can stay on top of your payments when if they resume.

Consider changing your loan due date to make budgeting easier. The monthly payment might be due before you receive your paycheck. Contact your loan servicer to see if your payment date can be switched to a more convenient day.

Read Also: How To Get An Rv Loan With Bad Credit

Make Sure To Repay Your Loans On Time

Keep in the habit of repaying your loans on time and avoid default. Doing so will help you establish good credit. Good credit is important when looking for a job, renting an apartment or buying your first car. Good credit can also lead to lower interest rates and creates more options for you in the future.

Start Your Loan Repayment

Six months after you leave school, youll start repaying your loans. Your monthly payment is automatically calculated. Your repayment schedule depends on:

|

Repayment term for Alberta loans |

Repayment term for Canada loans |

|

$0 – $3000 |

Learn more about adjusting repayment details.

Recommended Reading: How Much To Loan Officers Make

Average Student Loan Payments

An appropriate monthly payment is based on multiple variables. The indebted students income is a significant factor in determining monthly payments. The total debt and interest rate as well as the borrowers repayment timeline may all affect the dollar amount of their monthly payments.

- $393 is the average monthly student loan payment.

- 10% of your gross income should go toward paying off debts according to federal guidelines.

- $393 is 10% of $47,160.

- 36% of income is the maximum amount that should go toward paying off debt according to the same federal guidelines; $393 is 36% of $13,100.

- Financial experts and the federal government list 10 years as the ideal timeline for paying off undergraduate student loan debt.

- The mean starting salary for among all new graduates is $55,800.

- 10% of the mean starting salary is $465.

- The most commonly used federal student loans have an interest rate closer to 3%.

- The average debt per borrower is $36,140; the majority of undergraduate borrowers owe less than $30,000.

- The average debt per enrolled student is $30,000. These are the only parameters available for some historical data.

| Monthly Payment |

|---|

| $34,800 |

Fedloan Servicing Has Announced That It Will Stop Servicing Federal Student Loans When Its Current Contract Ends

In the coming months, we will be working with Federal Student Aid to conduct a smooth transition of your loans to a different servicer over the next year. FedLoan Servicing will continue to service all loans until they are transferred to another FSA-designated servicer. Please note that this change will not affect the existing terms, programs, or available repayment plans on your loans nor will it affect the temporary suspension of payments and 0% interest benefits applied for the COVID-19 emergency.

Communications will be sent as more details become known. You can also visit StudentAid.gov/fedloan for the latest updates and information on loan transfers.

Official Servicer of Federal Student Aid

FedLoan Servicing is a Servicer to Federal Student Aid

You have a network of support to help you succeed with your federal student loan repayment. Find out how Federal Student Aid partners with loan servicers to be here when you need help.

Support You Can Trust

Recommended Reading: What Are The Qualifications For Rural Development Loan

If You Declare Bankruptcy

If you declare bankruptcy, you still have to pay your OSAP loan. This means you must continue to make a regular monthly payment.

Apply to the;Repayment Assistance Plan if you cant make these monthly payments.

If youve been out of;studies for more than five years, you can ask a bankruptcy court to have your;OSAP;loan included in your discharge. Contact your bankruptcy trustee for help.