Can You Obtain Va Loans Above Conforming Loan Limits

New Law Starting January 2020

Military veterans and activy duty military members can now obtain VA loans with no money down for homes exceeding the conforming loan limit:

In January, Mr. Colletti and his wife, Rachel Ewing Colletti, closed with no money down on a $965,000 house.

The new rules also affect refinances. Evan Banning, president of California Housing and Lending, a real-estate brokerage and mortgage firm in San Diego, said he refinanced a loan for a vet and active reservist in mid-January. The client had purchased a house for $1.7 million a few years earlier with 10% down, but didnt use a VA loan. Under the prior VA rules, refinancing would have required his client to boost his home equity. Instead, Mr. Banning provided a refinance of $1.62 million with no additional money down. He lowered the rate from 4.125% to 3.25%, he said.

Law Before 2020

Before the new law came into being, if you purchase a home valued above the local conforming mortgage limit then you will need to cover the downpayment for the portion of the loan which is above the local limit. For example, if you lived in a county where the maximum conforming loan limit is $636,150 and wanted to buy a house which cost more than this, then you would need to make a down payment of 25% of the amount beyond the limit. If you were to buy a house for $836,150 with a VA loan then you would need to cover 25% of the loan amount above the local limit.

- $836,150 – $636,150 = $200,000

What Is The Benefit Of Signing Up With A Veterans Anonymous Specialist

Getting an interest rate as low as possible is important for your long term financial health. There are private lenders who attempt to gain your business by initially telling you that to qualify for an extremely low VA loan rates is practically guaranteed. This is hardly the case as super low interest rates are usually very tough to qualify for.

The specialists on our site have been vetted and have demonstrated a knowledge of the VA Loan process and a track record of setting realistic expectations from the beginning.

Tags:

Current Mortgage Rates: 15

- The 15-year rate is 2.368%.

- That’s a one-day decrease of 0.031 percentage points.

- That’s a one-month decrease of 0.075 percentage points.

The shorter payback time of a 15-year mortgage means that the monthly payments will be higher compared to a 30-year loan of the same amount. On the plus side, the interest rate is typically lower, so you’ll actually save money by not paying as much interest.

Read Also: How To Get 150k Business Loan

Should I Get A Va Loan I Heard The Va Funding Fee Was Too Expensive

Some will tell you to avoid VA loans because of the VA funding fee. What is that and how much does it cost?

- 2.3% of the loan amount for first-time VA loan users

- 3.6% for repeat users

- 0.5% for streamline refinances

Most home buyers will pay a VA funding fee of $5,750 for a home price of $250,000 with no down payment.

At first, that sounds like a lot, but its reasonable given the benefits of the program.

Most non-VA home buyers must come up with a 3% to 5% down payment. Thats at least $7,500 on the same home a big hurdle, especially for first-time homebuyers.

You can wrap the VA funding fee into the loan amount, meaning it can still be a zero-out-of-pocket loan. With a conventional or FHA loan, you must make the down payment in cash.

Making a down payment is the single biggest barrier to homeownership for buyers today.

Monthly mortgage insurance is also eliminated with a VA loan.

The average home buyer will spend about 1% of the home loan amount per year on PMI. Over five years, thats about $12,500 for a $250,000 loan amount.

Sure, the VA funding fee isnt cheap. But it lets you buy a home now and reduces your monthly payment significantly.

Perhaps the only reason you would consider a non-VA loan is if you already had 20% down and great credit.

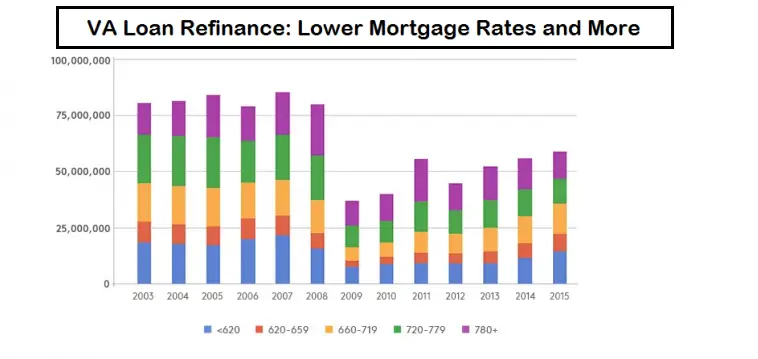

What Is A Va Refinance Loan

Like VA home loans, which are backed by the U.S. Department of Veterans Affairs, VA refinance programs are valuable benefits for those who have served or are serving in the armed forces. These programs enable veterans and current service members to refinance into a new mortgage when borrowing from VA-approved lenders.

VA refinances fall into two buckets:

1. VA streamline refinance loans

These mortgage loans allow homeowners with a current VA loan to refinance into a more affordable mortgage. True to its name, this program has little paperwork and typically has no out-of-pocket costs at the time of closing. VA streamline refinance rates are the mortgage rates for what are known as Interest Rate Reduction Refinance Loans . They are called streamline because the lending approval process is simplified to reduce paperwork and fees, and to save time for borrowers who already have a VA mortgage.

2. VA cash-out refinance loans

You May Like: How To Apply Loan In Sss

Why Are Va Interest Rates So Ridiculously Low

Strong government backing means lenders can offer rock-bottom interest rates with very little risk. And, they dont require a down payment or private mortgage insurance.

VA loan rates offer the best value in the marketplace today, and a fantastic benefit for our nations veterans and active duty service members.

What Is A Va Loan

A VA loan, also known as a Veterans Affairs loan, is a mortgage option backed by the United States government that requires no down payment and has easier qualifications for military service members and their spouses.

Private lenders issue these loans, and they are guaranteed by the U.S. Department of Veterans Affairs. These loans were designed specifically for active military homebuyers, many of which have difficulties getting approved for standard loans due to low or no credit and unique circumstances related to serving in the military.

However, its important to note that while VA loans have less stringent eligibility requirements than traditional loans, some lenders will have their own set of criteria, such as requiring a small down payment, higher credit score or more extensive credit history for applicants to qualify. Be sure you understand the requirements for qualification with each lender before you apply.

Don’t Miss: What Is My Monthly Loan Payment

Advantages Of Va Loans

Many financial professionals will tell you that VA loans are quite simply the best mortgages available to homebuyers. And theyd be right in nearly all circumstances.

Because these mortgages are backed by the U.S. Department of Veterans Affairs. In the case of a foreclosure, the lender will still get some of its money back. This means your mortgage lender assumes less risk and theyll pass that benefit along to you in a number of ways.

Down Payment And Assets

VA loans are one of the few loan options that dont require a down payment. Your lender may have specific requirements for a no-down-payment VA loan.

For example, they may require that you have a higher credit score if youre putting down less than 10%. The requirement to purchase a home with a VA loan through Rocket Mortgage® with no down payment is still a median of 580.

Its important to keep in mind that no down payment doesnt mean zero cost. Here are some other costs, akin to closing costs due at a conventional mortgage closing, to be prepared for, even if youre putting 0% down:

Also Check: How Long For Sba Loan Approval

Lower Your Student Loan Interest Debtorg

Federal student loan servicers award a 0.25% interest rate deduction when you enroll in automated debit. Many private lenders also have this perk. Sometimes;

May 5, 2021 How to Lower Student Loan Interest Rates · Consider Refinancing if Your Credit Has Improved · Sign Up for Autopay · Choose a Shorter Repayment Term.

General Rules For Va Loan Eligibility

A Veteran is eligible for VA home loan benefits if they have served on active duty in the Army, Navy, Air Force, Marine Corps, or Coast Guard after September 15, 1940, and was discharged under conditions other than dishonorable after either:

- Served 90 consecutive days of active service during wartime

- Served 181 days of active service during peacetime

Also Check: What Is Fha And Conventional Loan

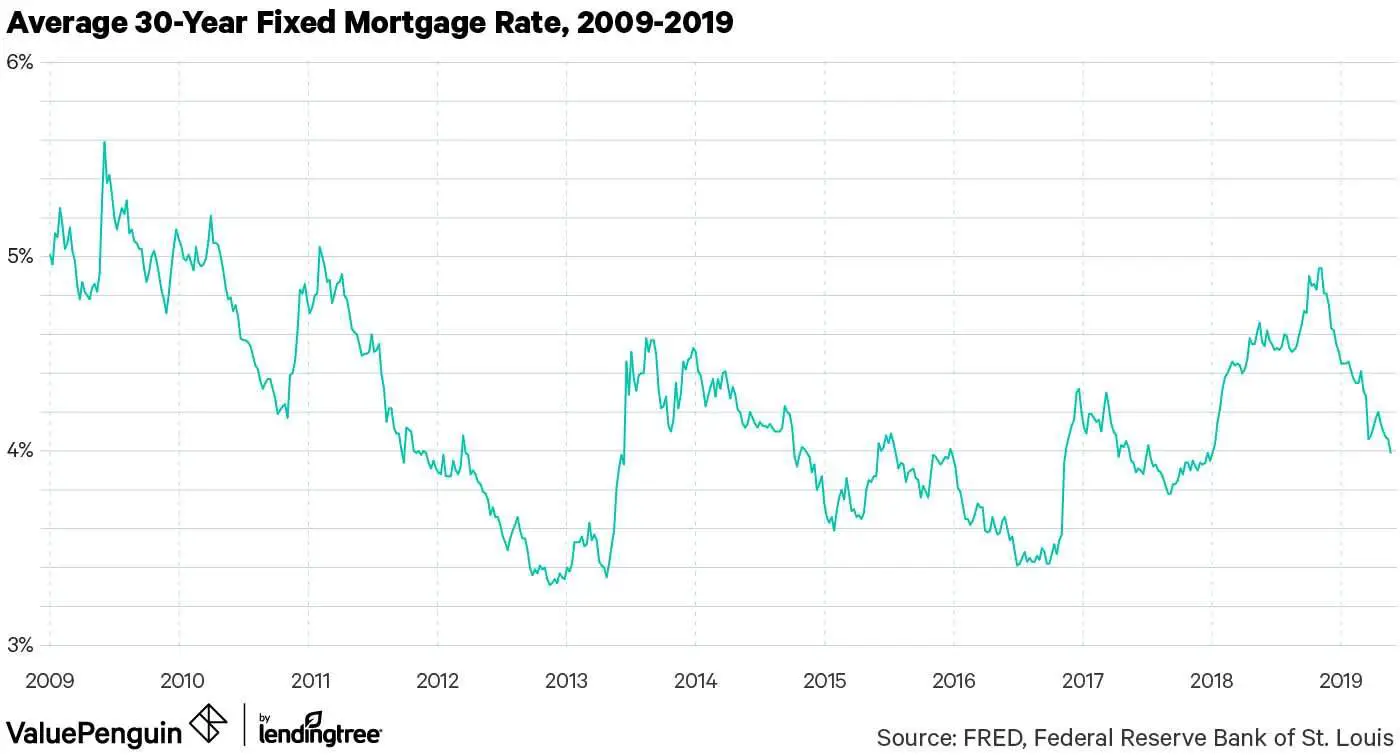

Current Mortgage Interest Rate Trends

Mortgage rates were up slightly this last week. The average 30-year fixed rate is 2.88%, up from 2.87% the week prior, according to Freddie Macs weekly rate survey.

Per the survey, 15-year fixed rates increased slightly from 2.18% to 2.19%. And the average rate for a 5/1 ARM moved slightly down from 2.43% to 2.42%.

Overall, mortgage rates are still close to their lowest levels in history.

The lowest 30-year mortgage rate ever was just 2.65%, recorded by Freddie Mac in January 2021. So anyone who can lock in at or near todays mortgage rates is getting a fantastic deal on their home loan.

Also keep in mind that average rates are just that averages. Prime borrowers with great credit and large down payments often get lower interest rates than the ones shown here. And borrowers with lower credit or fewer assets may get higher rates.

What Could Cause Mortgage Rates To Rise Or Fall

Many industry experts believed rates would rise further and faster in 2021.

However, theres a tug-of-war in the current market keeping mortgage rates low even when it seems like they should have risen.

What could drive mortgage rates up?

- An improving economy The better the U.S. economy performs for jobs, consumer spending, and overall growth, the higher interest rates should go

- Inflation ;Inflation almost always leads to higher mortgage rates, and inflation rates in 2021 have far exceeded expectations.

- Real estate demand Despite low inventory, demand for new homes and existing homes remains incredibly strong. Normally, a surge in mortgage financing should lead to higher rates

Whats keeping mortgage rates low?

- The Delta variant Fear that the coronavirus Delta variant could stall economic growth at home and abroad is pushing mortgage rates down. Remember that weaker economies lead to lower mortgage rates;

- Easy money policies by the Federal Reserve By keeping its benchmark interest rate near 0% and continuing to purchase billions of dollars worth of mortgage-backed securities , the Fed is keeping mortgage rates artificially low

- Foreign investment in U.S. debt Foreign investors continue to purchase relatively safe U.S. investments, including things like 10-Year Treasury bonds and MBS. An influx of dollars from these investors means continued low interest rates for borrowers

You May Like: What Is The Commitment Fee On Mortgage Loan

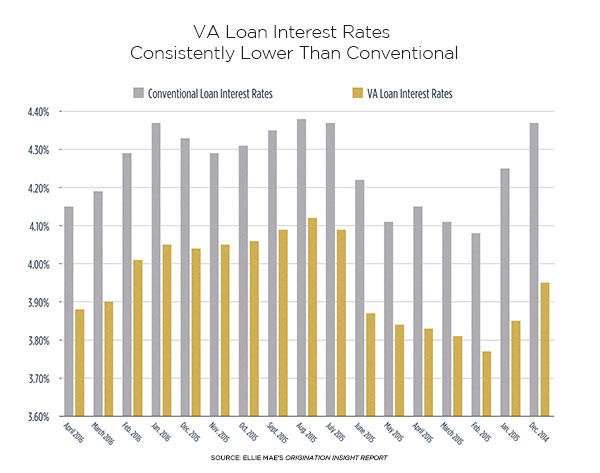

How Va Loan Rates Compare Other Mortgage Rates

Thanks to the government insurance of these mortgages, lenders are able to offer competitive VA loan rates that are usually lower than conventional mortgages.

For example, in March 2021, a typical 30-year fixed mortgage would come with an interest rate of 3.125%. In that same month, a VA loan on the same 30-year plan would come with 2.875% interest attached.

A difference of less than a percent might not seem like much, but throughout the term of the loan, you will have saved thousands in interest with the lower rate. Check out the links below for interest rates on other types of mortgages and how they stack up to VA loans:

How To Qualify For A Va Home Loan

As the name implies, the VA home loan program is reserved for veterans and active members of the United States military. In order to qualify, then, you or your spouse must have either served at least two years of active duty for the United States military, or must currently be enlisted. The entire scope of the U.S. military is included in the program, which means that members of the U.S. Army, Navy, Marine Corps, Air Force and Coast Guard are all eligible for this program.

There is no way to even be considered for a VA home loan if you haven’t actively served in the U.S. military. Even if you have served, if it was for less than two years then you are not going to qualify. During periods of war, active personnel must have served for at least 90 days to qualify. Also, if you are no longer enlisted, your discharge can be for any reason other than dishonorable in order to qualify. As long as all of these criteria are met, you should have no problem securing a VA home loan.

Recommended Reading: What Are Assets For Home Loan

Really No Down Payment Or Pmi

Besides lower interestrates, VA loans offer two other big benefits:

- You dont have to put anythingdown when purchasing a home

- Thereis no monthly mortgage insurance

If you compare a VA loan with an FHA loan, the no-mortgage-insurance rule alone saves you around $220 per month when buying a median-priced home .

What Problems Arise In A Va Home Inspection

If you are purchasing a home with a VA loan, you will be required to obtain a home inspection. The cost will vary by location but ranges between $300 and $500. You will also need to obtain an appraisal for your property.;The VA inspection is much more in-depth than the home appraisal.;The inspector will look at the home’s structural integrity, plumbing and electric systems, HVAC, roof, attic and crawl spaces, wood-destroying insects, fungus and dry rot, radon gas, and if applicable, the well and septic systems.;;

The primary defective concerns the VA will have if discovered during the home inspection include construction defects, poor workmanship, foundation problems, dampness, leaks, decay, and termites.

Read Also: Does Applying For Personal Loan Hurt Credit

Pentagon Federal Credit Union: Best Overall Experience

The Pentagon Federal Credit Union is one of the top credit unions in the country and serves military members and their families. Providing 30- and 15-year fixed VA home loans, this credit union also provides a host of additional banking services, including student refinancing, personal loans, rewards credit cards and auto loans.

Pentagon Federal Credit Unions current 30-year and 15-year VA mortgage rates are 2.5% and 2.750% respectively. APR rates for 30-year loans are offered as low as 2.631%, while the 15-year loan APR is offered as low as 2.997%.

How The Loan Works

In order to obtain this loan, along with meeting the service requirements, you must also meet the credit and income requirements required by the lender to be eligible.;

Loans guaranteed by the VA are still made through private lenders like Mortgage companies so that veterans may purchase a home. However, the veteran must live in the home in which they wish to purchase.

Recommended Reading: What Kind Of Loan Do I Need To Buy Land

Auto Approve: Best For Auto Refinance

- Car refinance APRs start at 2.25%

- Terms range from 12120 months

- Amounts up to $150,000

Auto Approve was the most popular choice for auto loan refinance on the Lending Tree platform by far in Q1, 2021 and it averaged one of the lowest APRs on closed loans. The company does a soft credit pull to show you potential refinance offers from lenders and once you choose an offer, that lender will do a hard credit pull to produce an official offer for your approval.

WHAT WE LIKE

Auto Approve offers lease buyouts and refinancing for motorcycles, boats, RVs and ATVs as well.

WHERE IT MAY FALL SHORT

If you have a specific refinance lender in mind, such as a local credit union, apply to them directly as Auto Approve doesnt have a public list of its lender partners.

HOW TO APPLY

Go to AutoApprove.com and hit the apply button.

Interest Rates On Federal Student Loans Will Rise In July

May 29, 2021 Despite the uptick, one financial aid expert says rates are still very low. The new rates for undergraduate loans for next school year are;

They should be consolidated separately, as the federal consolidation loans offer superior benefits and lower interest rates for consolidating federal student;

Jul 15, 2019 Modifying your loan. If youre paying your student loan bill on time every month, the lender wont be motivated to lower your interest rate. But;

Don’t Miss: Which Credit Union Is Best For Home Loan

Why Should I Use The Va Mortgage Calculator

Why should you use a VA home loan calculator? The simplest answer is that you will want an estimate of your monthly mortgage payments before you commit to the purchase of property.

That sounds fairly simple, but what isnt so obvious are the things that go into that calculation. Some VA loan applicants, especially those who are new to buying a home, tend to overlook some crucial details when trying to calculate the monthly VA mortgage payment.

Using an online VA loan calculator eliminates this problem as you will be required to enter all the specifics to arrive at your estimateyou wont be able to overlook or forget key data.

In addition to what is mentioned above, the most important reason to use an online mortgage loan calculator to estimate your VA home loan payments has a lot to do with determining your ability to afford the loan.

Buying a home is a complex process and there are up-front fees, costs that are paid by the seller , and there are charges that are issued by the VA intended to offset the taxpayer burden of the VA loan program.

The problem is, not all VA borrowers are required to pay the same costs and not all the costs associated with your loan may affect your mortgage payment. But sometimes they do. What does this mean?

And there are other variables including whether you choose a 15-year or 30-year loan term, and whether or not you choose to make a down payment.