What Credit Scores Do Car Dealers Use

Its no secret that the overwhelming majority of auto lending decisions are based on FICO Scores. However, not as well understood is that most auto lenders pull FICO Auto Scores, an industry-specific version of the FICO Score tailored to be a better predictor of paying your auto loan on time. Similar to the broad-based FICO Scores, a history of paying as agreed, using available credit wisely, and only applying for credit when needed will typically result in a higher FICO Auto Score.

Dont Miss: How To Get Bankruptcy Off Credit Report Early

How Does Bad Credit Impact Your Insurance Premiums

Insurance companies use your AIS to determine your premiums. This amount is meant to offset the companys risk if you end up filing a claim. Because the AIS is heavily related to your credit score, it stands to reason that a low score may raise your monthly premium. Some agents may even deny you coverage if they decide the risk of taking you on as a client is too great.

Not all insurance companies use an AIS as part of their underwriting procedure, but many do. To get the most-comprehensive coverage at the lowest rate, its wise to focus your attention on improving your credit. In addition to elevating your AIS and lowering premiums, better credit can help you pay less for your car in the long run.

How Are Credit Scores Determined

FICO scores are largely based on a persons payment history and outstanding balances. Other considerations include the length of their credit history, recently opened credit lines, and their credit mix:;how many credit cards they have and how much of that credit is being used, the number of retail accounts they have, their student loans, installment loans, etc.

In addition to the FICO score, a credit report will also note all open and closed credit sources, credit inquiries/applications made, and information on overdue debt, bankruptcies, or civil lawsuits. Lenders will further consider an applicants annual income to assess how large a monthly car payment they can afford.

Late or missed payments, debts that have gone to collection agencies, bankruptcies, exceeded credit limits, and outstanding tax liens all negatively affect FICO scores.

Recommended Reading: How Much Business Loan Can I Get

Tldr; What Credit Score Is Required For An Auto Loan

In conclusion, there are no specific set requirements when it comes to the credit requirements needed to purchase a car. Each lender has different requirements, and you have a number of different credit scores that your lender may look at. Its important to do all that you can to make sure your credit is in the best shape possible before purchasing a new car. By doing a little bit of due diligence now, youll be well on your way to buying the car of your dreams.

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

Don’t Miss: What Is The Maximum Va Loan Entitlement

What Credit Score Is Needed To Buy A Car Wallethub

Mar 29, 2021 There is no specific minimum credit score required to buy a car. But the higher your credit score is, the more options youll have and the;

Jun 11, 2021 MyFICO.com recognizes 720 as the preferred credit score when buying a car. MyAutoloan.com also identifies a credit score of 720 or higher as the;

Some Auto Lenders May Use A Specific Credit

When deciding whether to extend a loan, auto lenders may use a specific Fair Issac Corporation credit-scoring model called the FICO Auto Score. The FICO Auto Score is a variation on the general scoring model, designed specifically to predict the risk of a borrower defaulting on car payments. It ranges from 250 to 900, according to Experian.

Many auto lenders will consider more than a credit score, though. A borrower’s debt-to-income ratio, full credit history, and down payment amount will also affect the terms of the loan.

Read Also: What Kind Of Loan Do You Get For An Rv

Down Payment To The Rescue

Putting a;down payment on an auto purchase;can be important to auto lenders because they reduce the lenders risk. They also reduce the chance that youll end up owing more on the car than it is worth shortly after making the purchase.

Zero down payment auto loans have become extremely common in recent years for

Many auto lenders dont have specific down payment requirements. However, they will limit the amount of the loan, based on both your credit and your income. If the loan is insufficient for the car that you want to purchase, then youll have to make up the difference with a down payment.

It can often help your application if you offer to make even a small down payment, say 10%. Increasing your down payment to 20% is even more convincing, since few people make a down payment that large on a car purchase anymore.

The trade-in on your current vehicle can also represent a down payment. So can a cash rebate from the dealer.

According to a recent report on Cars.com, the average rebate on a new car as of March of 2017 was $3,563. If youre purchasing a new car with a $30,000 purchase price, a rebate of that size would represent nearly 12% of the purchase price. A trade-in or any cash that you want to put down will make the overall down payment even larger.

Unfortunately, cash incentive rebates are not available on used cars. However, you can still use either a trade-in or good old-fashioned cash for a down payment.

Wed Like To Introduce Ourselves

Were Kasasa® a financial and technology services company. We believe that small banks and credit unions supply critical resources to drive the growth of businesses and families. Nobody knows your communitys needs the way you do.

At Kasasa®, we also partner with institutions like yours, providing our relationship platform, Kasasa, as a comprehensive strategy. It begins with innovative banking products and includes marketing, training, compliance, research, support, and consulting.

Together we can show the next generation of banking customers an experience the mega-banks will never match.

Also Check: What Is Better Home Equity Loan Or Second Mortgage

Current Auto Loan Rates In 2021 Bankratecom

Can I get an auto loan with bad credit? How do I get a car loan? Best auto loan lenders in 2021; Frequently asked questions about auto loans. What are car loans;

Aug 9, 2021 Both score consumers on a scale from 300 to 850, and auto lenders may use either to approve you for a new car loan or lease. Knowing the widely;

Your credit score can be an important factor when youre purchasing a car. Heres why its best to have a score of at least 700.

Jan 31, 2020 To get an auto loan without a high interest rate, our research shows youll want a credit score of 700 or above on the 300- to 850-point scale.

You dont need a specific credit score to buy a car, but higher scores mean lower rates. Navy Federal Credit Union explains how to get a low rate.

How Do You Check Your Credit Score

Even if youre not buying a car right now, its wise to keep track of your credit score. Federal law allows consumers to obtain one free report each year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Many banks and credit card companies also provide free credit scores to their customers, so take advantage of that if you can. Checking your credit report regularly will not adversely impact your score.

Don’t Miss: How To Be Eligible For Fha Loan

Car Loan Options With Bad Credit

You can pursue the following options to get a car loan with bad credit:

- Secure your loan with an asset. You may be able to get financing if you use an asset such as your home, jewellery or a vehicle youve paid off to secure your repayments. This should bring your interest rates down and help you get approved.

- Get a cosigner. It may be possible to get a friend or family member with good credit to cosign your car loan with you. Just be aware that the person you ask will be on the hook to make your repayments if you default on your loan.

- Apply for a bad credit car loan. Some lenders specialize in offering bad credit car loans to people who cant meet the eligibility requirements for traditional loans. The issue with these loans is that they often come with extremely high interest rates.

Most Lending Institutions Require At Least A 600 Credit Score To Approve An Auto Loan Without A Downpayment

However, it is possible to purchase a vehicle with a score a score as low as 400. There are a lot of factors that determine your loan eligibility and what interest rate you are eligible for. These factors include:

- Are you paying money up-front. How much is the downpayment?

- Have you had past auto loans and did you pay them well?

- How much of a percieved risk is the bank taking to extend you this loan?

Also Check: How To Get Personal Loan With Low Interest

A Numbers Game: What Is A Good Credit Score For A Car Loan

Some things may be nothing but numbers , but your credit score is much more than that. Those three digits are like keys to a door, allowing or not allowing you to buy or apply for certain things, such as a car loan.

If youre in the process of buying a car with financing in mind, youre likely thinking about your credit score, especially if your finances arent the greatest.

So what is a good credit score for a car loan, you ask? ;

What Credit Score Do You Need For A Car Loan

Categories

Credit scores play an essential role in our financial life. Whether youre searching for a personal loan, mortgage or credit card, boosting your score can get you more affordable loan options. When it comes to car loans, the same rules apply. Instead of searching for what credit score will merely gain you loan approval, its best to figure out what credit score will get you the best deal on your car loan.;Lets learn more.;

Recommended Reading: Will I Qualify For Fha Loan

How Do You Buy A Car With Bad Credit

If your credit score is less than optimal, thoroughly check your credit report. If you find an inaccuracy or mistake in your report, be sure to contact both the lender and the reporting agency to have it corrected. In a study conducted by the Federal Trade Commission, one in five people had an error on at least one of their credit reports.

Beyond that, youll have to work to improve a low credit score. Experts advise steadily paying down your existing debt especially high-interest credit cards and making all payments on time.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Recommended Reading: What Happens When I Refinance My Car Loan

What Credit Score Is Needed To Buy A Car Lexington Law Firm

May 19, 2021 Buying a car is easy if you have the upfront cash, but if you are looking to finance a vehicle purchase you will need to pay close attention;

Jun 11, 2021 If you apply for a car loan, you can be sure that the lender will check your credit score. Lenders use a variety of different credit rating;

Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer;

Why Credit Matters When Buying A Car Ufcu

How much can you afford and what would your monthly payment be? · Do you need a down payment? · How would trading in your current car affect the purchase? · Do you;

According to credit reporting agency Experian, more than 21% of auto loans in the fourth quarter of 2018 were extended to borrowers with subprime or;

Aug 2, 2019 A good credit score to buy a car is usually above 660, which is the minimum score to be considered a prime borrower by Experian.

Recommended Reading: How To Apply For Fha Loan In Illinois

Why Bad Credit Scores Mean Higher Interest Loans

Imagine you want a new car thats worth $33,000. If you have a great credit score and get a 60-month loan;with a 3.24% interest rate, youll pay around $596 per month for your vehicleand $35,790 in total.;

If you have a really poor credit score, your 60-month loan might come with a 12% interest rate. In that case, youll pay around $734 per month, or $44,044 overalla full $8,254 more than someone with stellar credit.

In a nutshell, lower credit scores dont just mean higher monthly paymentsthey also mean more money spent over five years. Meanwhile, borrowers with better credit can potentially stash over $8,000 in their savings accounts.

Things get even worse for borrowers in the deep subprime market if they buy used cars rather than new cars. Some unfortunate consumers pay more than 20% interest on their loans.;

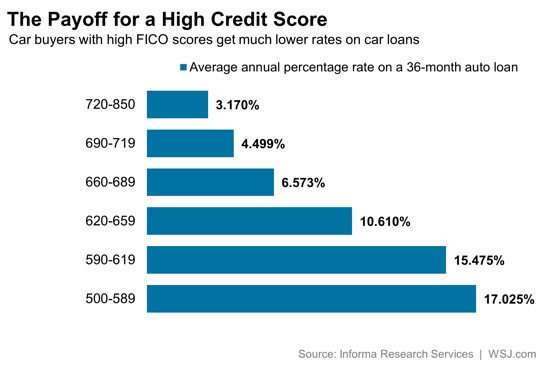

Higher Credit Score = Lower Car Loan Rates

Now, lets get back to the question of having a good credit score for a car loan. Earlier, we mentioned that a score of 630 is generally the minimum for getting approved with few issues, but considering the fact we said that higher scores mean lower rates, it would be better if your score is the 700s or higher.

With a score in the excellent or very good range, youll find the lowest rates. The same is true if youre on the opposite end of the spectrum. A lower score excludes you from the lowest rates; thats usually the case for those who have fair or poor credit.

Keep in mind too, that the minimum standard for lenders differ, even if slightly. Some will only work with those who have outstanding credit, others will cater to those with challenged credit and some, unfortunately, have no standards at all . However, most companies will set their limits in the mid-600 range, somewhere 620 650.

Also Check: How To Take Name Off Car Loan

How Can You Improve Your Auto Insurance Score And Your Credit Score

Because your credit score is a combination of many factors, understanding it can be a complicated process. Despite a long list of positive contributions, you may have a lower score because of one negative item. You might even have items on your reports that are unfair or inaccurate, resulting in a significant decrease in your score.

The first step to turning things around is to do an in-depth review of your reports. You can enlist the help of credit professionals to help you. They can work with creditors and reporting agencies on your behalf, so that inaccurate information can be taken off your reports. What remains are aspects of your score you can take control of: payment history, credit utilization, and new credit inquiries. There are several adjustments you can make to your financial habits that may help improve your score.

How Does Your Credit Score Impact Your Loan Costs

Your auto loan credit score has a big impact on how much you pay for a loan. Take a look at this chart of the average car loan interest rate by credit score for the second quarter of 2022, according to Experian:

| Average APR for new cars | Average APR for used cars | |

|---|---|---|

| Super prime | 2.34% | |

| Deep subprime | 14.59% | 20.58% |

The difference between 20.58% and 3.66% might not seem that huge at first, but lets look at how that affects how much interest you pay over the life of the loan. If you buy a car for $25,000, make a $5,000 down payment and pay it off over five years, youll pay $1,916 in interest by the time that car is paid off with good credit.

However, with bad credit, youll end up paying a staggering $12,181 in interest by the time you paid it offover half as much as the car itself costs.

Don’t Miss: How To Get Sba 7a Loan