Can I Transfer Balances From Other Accounts To My Home Equity Line Of Credit Or Loan Shows Details

Yes. When opening a home equity account, your personal banker can transfer any higher-rate balances to your new home equity line of credit or loan. After opening the account, you can transfer balances to a home equity line of credit via convenience checks, U.S. Bank Online and Mobile Banking, telephone transfers into a U.S. Bank checking account, or at any U.S. Bank branch.

Mortgage Loan Process Faq

Whats the best loan term for a mortgage?

The loan term or repayment period on your mortgage determines how large your mortgage payments will be. It also determines how much interest youll pay in total. Therefore, the best loan term balances your loan costs with your monthly budget. Shorter loan terms cost less over time but have higher monthly payments. Most mortgages have 15 or 30year loan terms. You can also find 10 or 12year loan terms. You could even find an 8year term through Rocket Mortgages Yourgage loan.

Is a fixed-rate mortgage better than an adjustable-rate mortgage?

A fixedrate mortgage locks in an interest rate and payment for the life of the loan. With todays fixed rates hovering around historic lows, a fixedrate loan makes a lot of sense. An adjustablerate loan features a fixed rate for a while, but then the interest rate fluctuates with the market each year. Some borrowers choose an adjustablerate mortgage if they plan to sell or refinance the home within the first few years. Otherwise, ARMs can be quite risky.

How much down payment is required?How long does the loan process take for a mortgage?

For most lenders, the mortgage loan process takes approximately 30 days. But it can vary quite a bit from one lender to the next. Banks and credit unions tend to take a bit longer than mortgage companies. Also, high volume can alter turn times. It may take 45 to 60 days to close a mortgage during busy months.

How long does underwriting take?

How Much Equity Is Enough

If you apply for a HELOC, for example, you should have at least 20 percent equity in your home. Many people buy their first homes through FHA programs that dont require very large down payments. This is also the case for buyers who go through the U.S. Dept. of Agricultures rural area loan program. In cases like that, it might take you a long time to reach the equity level where you can apply for a HELOC.

Likewise, even when you do qualify, dont expect to receive more than 85 percent of the total value of your home in the form of an equity line of credit. That 85 percent is the loan-to-value that the lender allows. Heres an example: If your home is valued at $200,000 and your equity in it is 20 percent, or $40,000, your HELOC will bring you, at most, $10,000 dollars.

Lenders look at the total value of all loans, including the HELOC amount, when figuring out how much they can lend to you. In the above example, you still owe $160,000 on the house, so the additional $10,000 HELOC pushes your total amount owed up to the 85 percent maximum.

Read Also: Va Second-tier Entitlement Calculator

What Affects Approval Time

Getting approved for a cash-out refinance is largely dependent on how quickly you can verify your personal information and the speed at which the lender decides to move. The initial application process is fairly simple and can be done in a few minutes or done online. After that, youll need to provide documentation such as your income history and information pertaining to the homes value. Any delays in responding to requests for clarification or even setting up an appraisal appointment will mean a longer approval time.

Eric Rosenberg, a former bank manager, mentions that you can help speed up the process by being proactive with your paperwork. Its usually a little detail like a forgotten letter or statement that slows things down, he says. If you provide all required documentation alongside your application, you can expect a smoother process overall.

Approval time can also depend on your financial situation, such as your credit history and how much home equity you have. The higher your credit score, the more likely youll be approved faster than someone with a fair score. Your credit history will also be taken into consideration, so if yours is less than stellar, it could mean approval time could be delayed or you might be rejected.

Its always a good idea to gather all necessary documentation before you apply. That way, not only can you speed up the process, you can also check to see if you can even afford a loan in the first place.

How A Heloc Affects Your Credit Score

Although a HELOC acts a lot like a credit card, giving you ongoing access to your homes equity, theres one big difference when it comes to your : Some bureaus treat HELOCs of a certain size like installment loans rather than revolving lines of credit.

This means borrowing 100% of your HELOC limit may not have the same negative effect as maxing out your credit card. Like any line of credit, a new HELOC on your report will likely reduce your credit score temporarily. However, if you borrow responsibly making timely payments and not utilizing the full credit line your HELOC could help you improve your credit score over time.

Don’t Miss: What Degree Do You Need To Be A Loan Officer

If You Decide To Cancel

If you decide to cancel, you must tell the lender in writing. You may not cancel by phone or in a face-to-face conversation with the lender. Your written notice must be mailed, filed electronically, or delivered, before midnight of the third business day.

If you cancel the contract, the security interest in your home also is cancelled, and you are not liable for any amount, including the finance charge. The lender has 20 days to return all money or property you paid as part of the transaction and to release any security interest in your home. If you received money or property from the creditor, you may keep it until the lender shows that your home is no longer being used as collateral and returns any money you have paid. Then, you must offer to return the lenders money or property. If the lender does not claim the money or property within 20 days, you may keep it.

If you have a bona fide personal financial emergency like damage to your home from a storm or other natural disaster you can waive your right to cancel and eliminate the three-day period. To waive your right, you must give the lender a written statement describing the emergency and stating that you are waiving your right to cancel. The statement must be dated and signed by you and anyone else who shares ownership of the home.

The federal three day cancellation rule doesnt apply in all situations when you are using your home for collateral. Exceptions include when:

What To Watch Out For

Unlike home equity loans, HELOCs usually have variable interest rates. If your rate increases, so will your payments. HELOC starting rates tend to be lower than HEL rates, however, since HEL rates are fixed for the entire loan term. Youll also pay for closing costs, though they may be lower than HEL closing costs and they may even be waived altogether.

Don’t Miss: Can I Refinance My Fha Loan

How Long Does It Take To Get A Home Equity Loan Or Heloc

If youre looking to use the equity in your home through a home equity loan or HELOC, you probably want to get the money fast. Whether youre doing a home remodel, paying for a college education, or using the money for something else, you dont want to wait around.

In some case, getting a home equity loan can happen quickly. Adam Carroll, a homeowner we spoke to who is also the Founder of National Financial Educators, liked the idea of a HELOC because of the availability to access funds to do projects around his house. He found it easy to apply for a loan and get it approved within a short amount of time. It was super easy, he said. It was a simple application process and they did a drive-by appraisal to determine the value of our home.

However, its not true that everyone can get a home equity loan or HELOC as quickly as Adam did. The approval process can take anywhere from 2-6 weeks or even longer, depending on your situation. See below for factors that affect your timeline.

Check The Qualification Requirements

Because home equity loans are secured by real estate ownership stakes, borrowers usually find the loan qualification requirements to be relatively manageable. Weâve listed four of the most important qualification requirements below:

- You need to hold between 15% to 20% of the equity in your home.

- You need to show evidence of both an income record and proof of steady employment.

- You need to have a debt-to-income ratio of less than 50% .

- You need to have a FICO Score of at least 620.

Recommended Reading: How Long Does Sba Approval Take

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

What Do You Need To Apply For A Heloc

The requirements for a HELOC application vary between lenders, but generally, you must have the following:

- At least 15% of home equity

- A credit score of at least 620

- A debt-to-income ratio of less than 43%

- A stable and sufficient income based on the lenders standards

- A history of making reliable and timely payments

Also Check: Fha Max Loan Amount Texas

Where Can I Apply For A Home Equity Loan

Home equity loans are available at many banks, credit unions and online lenders. You may use these funds for a range of purposes, including debt consolidation, home improvement projects or higher education costs. The amount you can borrow depends on how much equity you have, your financial situation and other factors.

Loan Or Line Of Credit

A home equity loan and a home equity line of credit sound very similar, and the process of applying for both is similar, too.

A second mortgage is a loan thats secured by the value of your home when you still have a first mortgage. If you need a large, fixed amount of money for repairs or other expenses, taking out a second mortgage can allow you to pay for them at a favorable interest rate. This is an option for major planned purchases or for expensive emergencies.

A home equity line of credit is like having a credit card thats secured by your home. Like a credit card, there is a credit limit. In a home equity loan, the limit is usually pegged to the value of your house and what is still owed on the first mortgage at the time of opening the account. Its good for a specific term, called a draw period, which is generally 10 to 15 years. In many cases, the interest on a HELOC is tax-deductible, but you should confirm that with your trusted tax preparation professional.

If you want a large chunk of money right now, you need a home equity loan. If you need small amounts of money over time, consider a home equity line of credit.

Also Check: Usaa Auto Loan Refinance Calculator

The Heloc Approval Process Timeline

Every lender differs in how long they take for the HELOC approval process. Some go through the process quickly, especially if you use the same lender who holds your first mortgage. Others take longer because they are going through your information for the first time. There are also some third parties involved in the process, which the lender cannot control. For example, the appraiser plays an important role in the HELOC approval process. The lender cannot determine the amount of equity you have in the home until the appraisal is complete. You play a role in this process as well because you need to be available in order for the appraiser to gain access to the home.

Other considerations in the time it takes to approve a HELOC is the amount of time the lender takes to obtain your mortgage payment history, if it does not report on your credit report. The length of time the title company takes to provide the title search also matters. Each of these parties plays a role in the HELOC approval process, either speeding it up or slowing it down.

The HELOC approval process will vary by lender. In order to secure the lowest rates and costs, you should apply with several HELOC lenders at once. This way you can compare the rates and costs, as well as the APR. This enables you to make an informed decision regarding the best choice for your home equity loan.

Requirements To Borrow From Home Equity

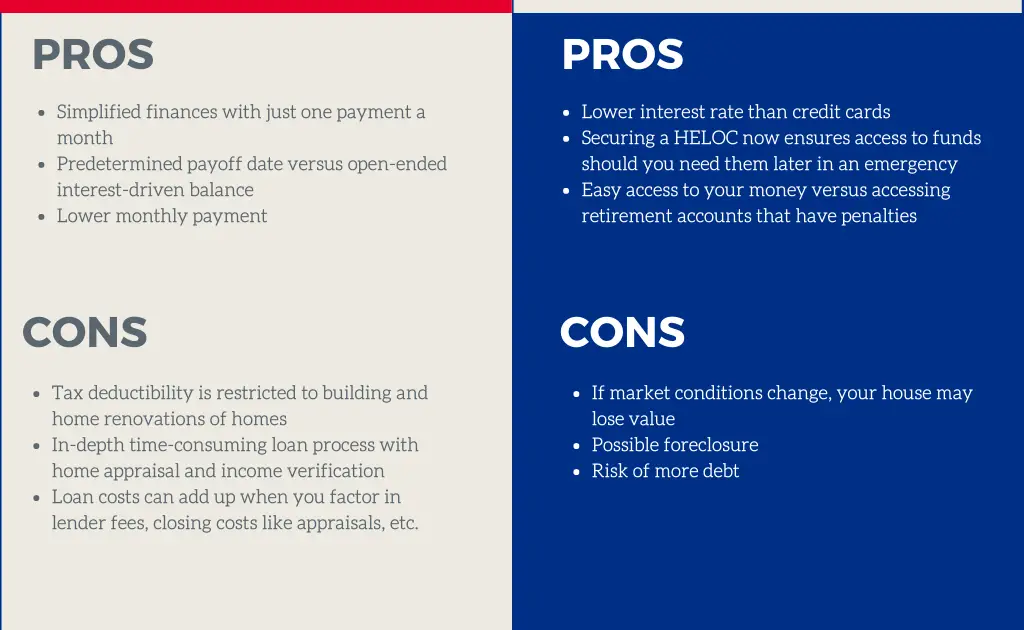

Home equity loans and HELOCs have their own sets of pros and cons, so consider your needs and how each option would fit your budget and lifestyle. Regardless of which type of loan you choose, home equity loan requirements and HELOC requirements are typically the same.

The requirements vary by lender, but you generally need:

- A certain percentage of equity in your home

- Good credit

- Reliable payment history

Don’t Miss: One Main Financial Bill Payment

Whats The Difference Between A Heloc And A Home Improvement Loan

The biggest difference between a HELOC and a home improvement loan is that a HELOC borrows against the existing equity in your home, while the latter does not. Because of this, home improvement loans have a lower limit that you can borrow. These loans can also carry higher interest rates than HELOCs.

The money from HELOCs also doesnt have to be used for home improvement. It can be used in other ways, from debt consolidation to making major purchases.

How Do I Access My Home Equity Line Of Credit

How soon after closing can I access my line of credit?

After closing, you have three business days to cancel the account. This three-day period is called your right of rescission and it must pass before you can access your line of credit. You can schedule with your loan processor to have funds from your line of credit deposited into your checking account. Once your right-of-rescission period is over, funds can be disbursed on the fourth business day after closing, then you’ll have access to your funds on the fifth day.

How do I access my Chase home equity line of credit?

We make accessing your line of credit easy. You can:

- Go to us online to transfer funds to your Chase checking account or to an external account.

- Request a cash advance to your Chase checking account, you can call 1-800-836-5656 or go to your nearest branch.

- If your account includes check access, you can use your line of credit checks to draw money from your account.

Can I use a home equity line of credit to pay off balances from other accounts?

Yes, you can use funds from your line of credit to pay off other balances. Or we can combine those other balances into your line of creditreturning your other balances to zeroand youll make one monthly payment.

You May Like: Upstart Second Loan

Factors That Can Impact Timelines

There are several factors that can either speed up or slow down the home equity loan timeline. Many closing dates get pushed back to allow for more time to review documents, finish the appraisal, and more.

While some factors may be out of your control, here are a few likely culprits behind delayed approval timelines:

How To Use A Home Equity Line Of Credit Calculator

A HELOC calculator can provide you with an estimate of how much you need to pay every month based on the interest rate. Different factors will be considered including your home, value, outstanding mortgage balance, preferred line of credit. Other calculators may also consider other important factors, such as the payoff goal, interest rate, possible yearly rate changes, and annual fees.

You May Like: What Credit Score Does Usaa Use For Auto Loans

What Are The Terms Of A Home Equity Installment Loan Shows Details

You can borrow up to $750,000 depending on the amount of equity in your home. Terms are flexible up to 360 months . The interest rate is fixed for the term of your loan, and repayments are made in monthly installments of principal and interest.

If you are looking to consolidate debt or pay for large household expenses, the home equity loan may offer you a convenient solution. You can apply by phone, in person or online.

Phase : The Repayment Period

Once you reach the end of your draw period, youll no longer have access to the HELOC funds and will have to start making full monthly payments that cover both the principal and interest. This is the repayment period. If youve been making interest-only payments up to this point, be prepared for your payments to go up, potentially by a lot.

The length of both periods will depend on the loan you get. For example, you may decide that a 30-year HELOC, with a 10-year draw period and 20-year repayment period, makes the most sense for you.

Typically, lenders wont allow you to borrow against all the equity you have in your home in order to keep your loan-to-value ratio below a certain percentage. This is because lenders want you to have a certain amount of equity in the home, since youre less likely to default if you could possibly lose the equity youve built up.

Read Also: Usaa Car Loan Refinance