What Are The Va Home Loan Limits By Year And County

Find the VA home loan limit for the county your property is in.

2020 VA home loan limits

VA home loan limits are the same as the Federal Housing Finance Agency limits. These are called conforming loan limits.

Go to FHFAs Conforming Loan Limits page

You’ll find the link to this page below.;

Scroll to the Previously Announced Loan Limits section

Review the table with past loan limit information.;

Find the year with the limits you need

Years are located in the first column, labeled Description.;

How To Qualify For An Fha Loan In Fort Bend County Texas

The minimum loan amount in Fort Bend County is $5,000 dollars and may go up to $685,400depending on home size and loan type.In order to qualify for an FHA loan, you must be planning to live in the home.Although a loan can include some renovation costs,FHA loans cannot be used for real estate investments in Fort Bend County.

Additionally, your loan amount cannot exceed the value of home you are purchasing. Learn more about FHA Loan Requirements.

Do I Need A Jumbo Loan

There are always cases where potential homebuyers want to a purchase a house that exceeds the FHA’s loan limit for that county. In this case, FHA Jumbo Loans come into play.

Jumbo loans are mortgages which exceed the FHA’s county limit for home loans in a given zip code. When a lender approves a jumbo loan, they are essentially taking on an even greater risk. That’s why the FHA has a more stringent set of requirements for borrowers looking to apply for such a large loan.

Instead of the FHA’s established minimum credit score of 580, the minimum for a jumbo loan is 600, and 640 for refinances. Additionally, jumbo loan borrowers cannot receive down payment assistance; the FHA mandates that the minimum 3.5% down payment is paid with the homebuyer’s own funds to ensure there are sufficient financial resources to cover closing costs.

An FHA Jumbo Loan might require two separate appraisals if the market is declining or the borrower is making a down payment of 5% or less. It is also important to note that FHA jumbo loans typically have higher interest rates than conventional jumbo loans. Keep in mind that FHA lending limits vary by area, which means what constitutes a Jumbo Loan in one county isn’t the same as another.

Also Check: How To Get Loan Signing Jobs

How To Qualify For An Fha Loan

You’ll need to satisfy a number of requirements to qualify for an FHA loan. It’s important to note that these are the FHA’s minimum requirements and lenders may have additional stipulations. To make sure you get the best FHA mortgage rate and loan terms, shop more than one FHA-approved lender and compare offers.

It’s important to note that lenders may have additional stipulations.

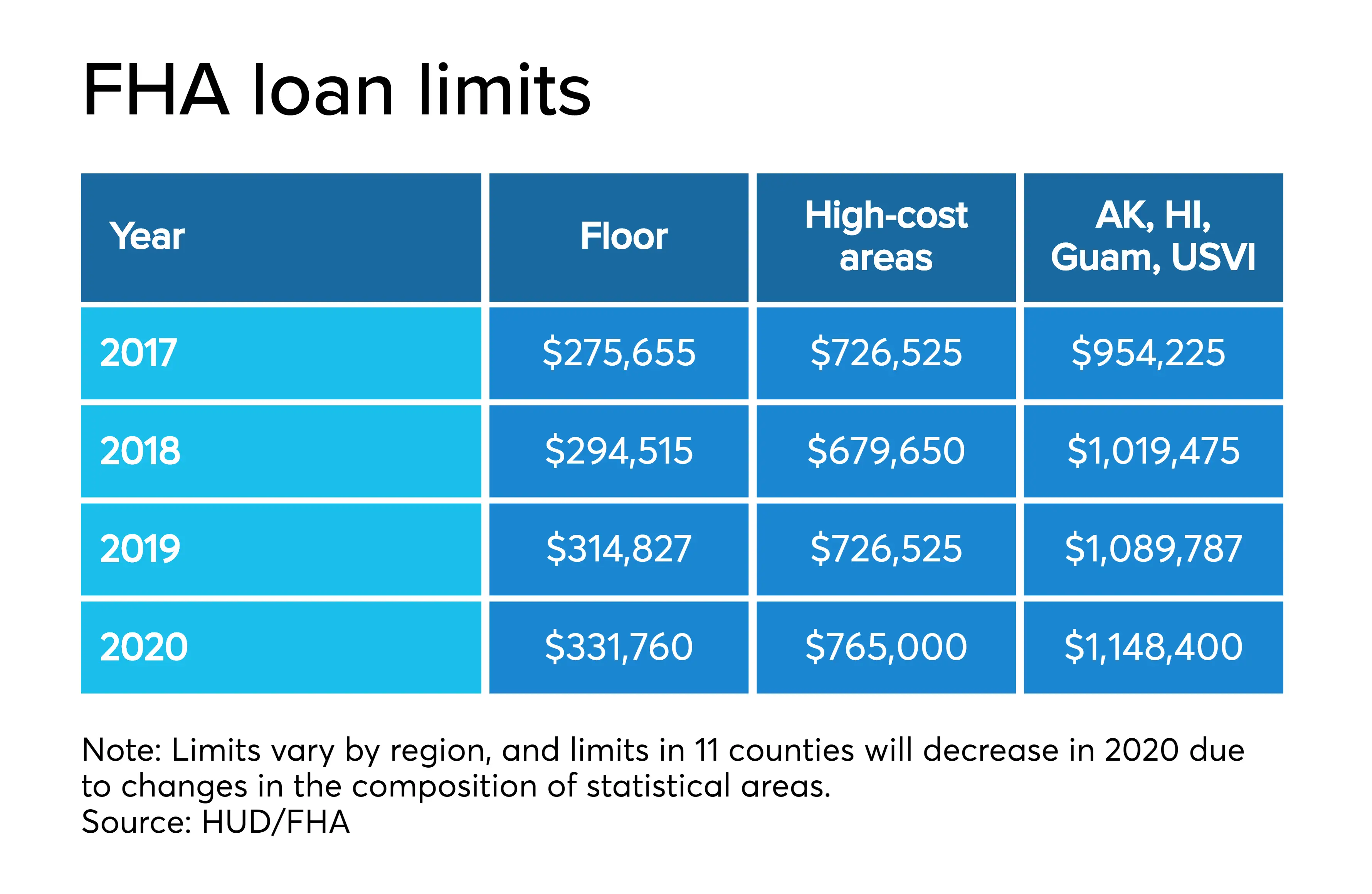

Understanding Fha Limits For 2021

Through the U.S. Department of Housing and Urban Development, the FHA loan program helps people get mortgages and become homeowners when their options to do so might have been limited before. With a lower income and maybe less than perfect credit, people can get a mortgage.

The FHA loan limits for 2021 help you understand what limits will be placed on you as you look for a home, hoping to secure an FHA loan.

If you are looking for mortgage services, we can help. We offer various mortgage services to those living in New Jersey, Pennsylvania, Virginia, New York, Delaware, Maryland, Florida, Georgia, or Colorado. Contact us today to start discussing your mortgage options.

7th Level Mortgage is a leading one-stop mortgage company providing deeply informed, custom-tailored assistance with each mortgage transaction phase. If you are searching for a home loan in New Jersey, Pennsylvania, Virginia, Delaware, Maryland, New York, South Carolina, Georgia,m Colorado, or Florida, please contact us today so that we can determine the best Mortgage Lender to place your loan with and get you the best possible rate and program.

Read Also: What Credit Score Do You Need For An Fha Loan

What Is An Fha Loan Limit

FHA loan limits are the maximum amount you can borrow with a mortgage backed by the FHA. These limits vary by county and are adjusted annually based on home values.

FHA loans are popular with first-time homebuyers and can be good options for low and moderate-income borrowers. The FHA program has always been about, from its genesis, making homeownership more accessible, says Barry Rothman, housing counseling program manager with the HUD-certified agency Consolidated Credit Solutions. Because these home loans are insured by the federal government, theyre considered less risky by lenders. This usually makes FHA loan rates better for homeowners with lower credit scores, compared to conventional mortgage rates.

Fha Multifamily Loan Limits

The Federal Housing Administration also backsmortgages on 2-, 3-, and 4-unit properties. These types of homes have higherloan limits than single-family residences.

FHA multifamily loan limits

| $1,909,125 | $2,372,625 |

Although FHA allows multifamily home loans, theproperty must still be considered a primary residence. That means thehomebuyer needs to live in one of the units full time.

In other words, an FHA loan cannot be used topurchase an investment property. However, you can use an FHA mortgage topurchase a 2-4 unit property, live in one unit, and rent out the others.

In this way its possible to get a multifamily loanup to $1.5 million with a low-rate FHA loan and just 3.5% down payment.

Read Also: How To Calculate Bank Loan

Check Your Usda Loan Eligibility

USDA loan limits curb the borrowing power of Direct Loan homebuyers, but loan sizes tend to be high enough to finance safe, comfortable homes for borrowers who are borrowing in qualifying areas.

Fortunately, USDA Guaranteed Loan borrowers dont have to worry about loan limits at all, making this 0% down payment mortgage all the more attractive.

The 2021 Fha Loan Limit In Texas Is $356362

FHA loan limit in Texas

What is an FHA Loan?

FHA Loans in Texas are easy with Texas Premier Mortgage. No Lender Fees, Low Credit and First Time Home Buyers are easy to qualify. 3.5% Down Payment. An FHA loan is a mortgage loan that is insured by the Federal Housing Administration . Essentially, the federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments.The FHA program was created in response to the rash of foreclosures and defaults that happened in 1930s; to provide mortgage lenders with adequate insurance; and to help stimulate the housing market by making loans accessible and affordable. Nowadays, FHA loans are very popular, especially with first-time home buyers.

You May Like: How To Be Eligible For Fha Loan

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE:;Facts about FHA home loans

Using Fha Loans As An Investor

Since FHA loans are exclusively available to owner-occupants, using an FHA loan as a real estate investor can get complicated. Fortunately, the FHA will guarantee purchases of multi-unit properties, so this opens the door for what many investors call “house hacking.”

In this scenario, you’d purchase a duplex, triplex, or four-unit property, live in one of the units, and rent the others out. Doing so can allow you to both cover the costs of the mortgage and, in many cases, also generate income from the property. It’s a method often used by first-time real estate investors.

Another nice perk? FHA rules only require you to live in the property for a year, so at that point, you’d be free to move out, rent out that additional unit, and move onto other investments .

Don’t Miss: Is Bayview Loan Servicing Legitimate

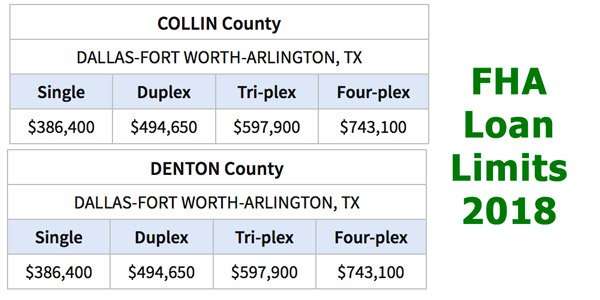

How Are Texas Fha Limits Set

Mortgage limits for Texas;FHA loans are based on median housing prices for the particular Metropolitan Statistical Area and county. More specifically, Median Sale Price for area homes in each county or MSA;is considered the determining factor. National FHA;mortgage limits for low costs areas are set at 65 percent of the national conventional conforming loan limit.;FHA loan limits are updated yearly.

Fha Vs Conforming Loan Limits

FHA mortgage limits are closely tied to conforming loan limits.

Every year, the Federal Housing Finance Agency updates its home price index. This is used to set both conforming loanlimits and FHA loan limits. But the two are calculated differently.;

Conforming loans which follow guidelines set byFannie Mae and Freddie Mac have higher loan limits than FHA mortgages.

For example, look at the standard, single-family loan limits for 2021.

- FHAs loanlimit floor is $356,362

- Theconforming loan floor is $548,250 a full $190K higher

However, not everyone can qualify for higher loan amounts via a conventional mortgage.

Fannie Mae and Freddie Mac require a minimum creditscore of 620 for a conforming loan. And for borrowers with credit on the lowerend of the spectrum, they charge higher rates and expensive private mortgageinsurance .

FHA loans are more attractive for borrowers withfair credit despite having lower loan limits.

Its possible to qualify for FHA financing with acredit score as low as 580, and a low score wont force you into a highinterest rate.

The FHA does charge its own mortgage insurance premium.But this is often more affordable than conventional loan PMI for borrowers withlow credit and a small down payment.

Also Check: How To File Bankruptcy On Car Loan

Property Needs To Meet Certain Standards

Also, an FHA loan requires that a property meet certain minimum standards at appraisal. If the home you are purchasing does not meet these standards and a seller will not agree to the required repairs, your only option is to pay for the required repairs at closing .

Keep current on the premium costs for FHA loans by visiting the;U.S. Department of Housing and Urban Development .

Qualifying For An Fha Loan

While FHA loan limits have increased in Texas, the requirements for qualifying have not. A potential buyer with a credit score of at least 500 can qualify. However, those with credit scores of 580 or better will be eligible for down payment costs of as little as 3.5% versus 10%.

Other buyer qualifications still apply, including a debt to income ratio of less than 43%, proof of employment, and a steady income showing your ability to make the required loan payments each month.

Also Check: How To Pay Home Loan Faster

Fha Announces New Single Family Loan Limits For 2021

WASHINGTON – The Federal Housing Administration today announced the agency’s new schedule of loan limits for calendar year 2021 for its Single Family Title II forward and Home Equity Conversion Mortgage insurance programs. Loan limits for most of the country will increase in the coming year resulting from robust house price appreciation, which is factored into the statutorily mandated calculations FHA uses as part of its methodology for determining the limits each year. The new loan limits are effective for FHA case numbers assigned on or after January 1, 2021.

FHA is required by the National Housing Act, as amended by the Housing and Economic Recovery Act of 2008 , to set Single Family forward loan limits at 115 percent of area median house prices, subject to a floor and a ceiling on the limits. FHA calculates forward mortgage limits by Metropolitan Statistical Area and county.

FHA has seen consistent increases in loan limits during the past few years, putting it in a position to serve a segment of borrowers that may be better-served by the conventional market. FHAs mission is to support low-to-moderate income borrowers, so why does the law permit FHA to insure mortgages up to $822,375? This is a question for Congress and the taxpayers who stand behind FHA to answer, said Assistant Secretary for Housing and Federal Housing Commissioner Dana Wade.

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Don’t Miss: How To Apply For Student Loan Forbearance

Types Of Fha Home Loans

There are a number of different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another government-backed FHA loan alternative.

Lets take a look at a few different FHA loan classifications.

How To Apply For An Fha Loan

Applying for an FHA loan will require personal and financial documents, including but not limited to:

-

A valid Social Security number.

-

Proof of U.S. citizenship, legal permanent residency or eligibility to work in the U.S.

-

Bank statements for, at a minimum, the last 30 days. You’ll also need to provide documentation for any deposits made during that time .

Your lender may be able to automatically retrieve some required documentation, like credit reports, tax returns and employment records. Special circumstances like if you’re a student, or you don’t have a credit score may require additional paperwork.

» MORE: Detailed FHA loan requirements

Recommended Reading: Can You Take Out More Than One Student Loan

Why Does My Coe Say This Veterans Basic Entitlement Is $0

This line on your COE is information for your lender. It shows that youve used your home loan benefit before and dont have remaining entitlement. If the basic entitlement listed on your COE is more than $0, you may have remaining entitlement and can use your benefit again.

On your COE, in the table called Prior Loans charged to entitlement, we list the amount of your entitlement youve already used under the Entitlement Charged column. Your entitlement can be restored when you sell your property and pay your VA-backed loan in full, or repay in full any claim weve paid.

Fha Home Appraisal In Fort Bend County

To see if a home qualifies for an FHA loan, the property must be appraised by an approved FHA appraiser.Find FHA-approved appraisers in Fort Bend County.If you need a home inspector, click here to find FHA-approved inspectors in Fort Bend County.You can also save time by looking for FHA Condos that have already been approved.

Read Also: How To Transfer Car Loan To Another Person

No Loan Limits For Va And Usda Loans

VA loans recently eliminated VA loan limits. Eligible VA borrowers will be approved for a loan amount based on their income with no restrictions.

USDA loans have strict income limits; borrowers income cannot exceed 115% of the area median income. Because of the income limit, there is no loan limit for USDA mortgage loans.

What Is It Like To Get An Fha Loan Right Now

Although HUD’s minimum requirements for FHA loans havent changed,;FHA-approved lenders seem to favor applicants with higher credit scores. Nearly 74% of FHA borrowers had FICO scores of 650 or above in June 2021, with an average score of 677 for FHA purchase loans, according to data from ICE Mortgage Technology.

On average, it took longer to close an FHA purchase loan in June 2021 than in June 2020 54 days compared with 46 days a year earlier. Conventional purchase loans, meanwhile, closed in an average of 49 days in June 2021, according to ICE data.

HUD data shows that from April to June 2021, over 30% of FHA loans were for amounts between $250,000 and $399,000 by far the most common range. Nearly 70% of FHA loans issued during this period covered at least 96% of the homes estimated value, implying that most FHA buyers are making the minimum FHA down payment of 3.5%.

Read Also: How Much Does My Loan Cost

Todays Fha Loan Rates

FHA mortgages are riding the low-interest-ratewave. With mortgage rates at historic lows, and loan limits on the rise, itsan excellent time to consider FHA financing.

Check with a lender to see how much home you canafford thanks to 2021 FHA loan limits.

Popular Articles

Step by Step Guide