Message From Upstart Personal Loans

This is Upstart. Our mission is to enable effortless credit based on true risk. Why? Because credit really matters. Money is a fundamental ingredient of life, and unless youre one of the few percent of Americans with significant wealth, the price of borrowing affects you every day. Throughout history, affordable credit has been central to unlocking mobility and opportunity. Upstart is a leading artificial intelligence lending platform designed to improve access to affordable credit while reducing the risk and costs of lending for our bank partners. By leveraging Upstart’s AI platform, Upstart-powered banks can offer higher approval rates and experience lower loss rates, while simultaneously delivering the exceptional digital-first lending experience their customers demand. Upstart is one of the first to apply AI to the multi-trillion dollar credit industry. Upstart goes beyond the FICO score, using non-conventional variables at scale to provide superior loan performance and improve consumers’ access to credit.

You are more than your credit score. Fair and fast personal loans, next day funding, no prepayment penalty.

Where Upstart Falls Short

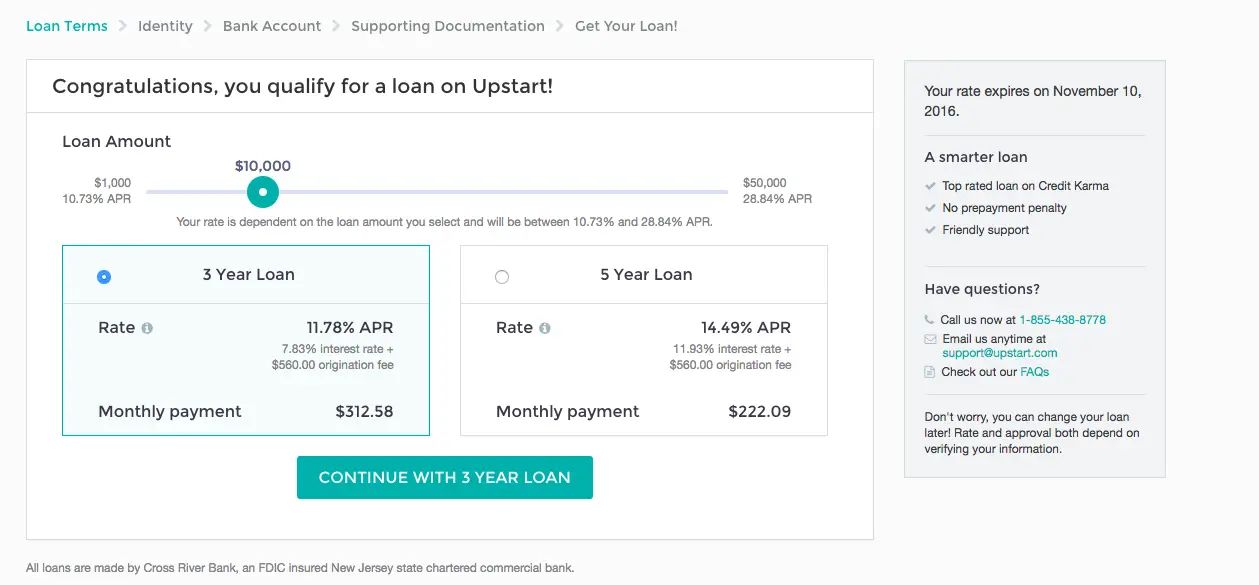

Limited repayment terms: Borrowers can choose a three- or five-year repayment term. Those same terms are offered by a few other online lenders, but theyre inflexible compared with lenders with as many as five or six repayment term options. The more repayment terms you have to choose from, the more control you have over monthly payments and overall interest costs.

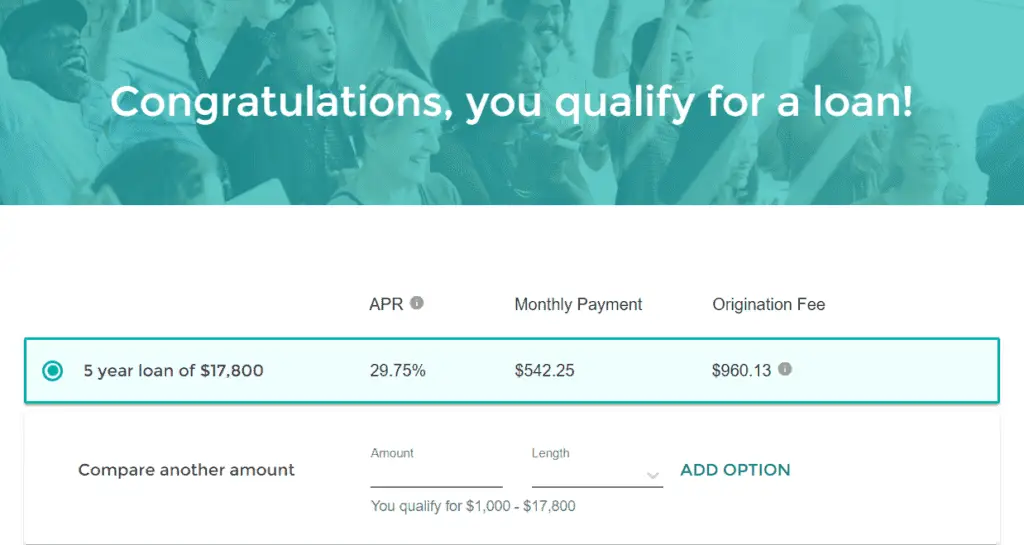

Origination fee: Some lenders that use Upstarts online lending platform charge an origination fee, which isnt uncommon with personal loans, but the fee cuts into your total loan amount. Upstarts fee can range from 0% to 8% of the loan amount.

No mobile app to manage a loan: Some online lenders have mobile apps where borrowers can make loan payments, view their payment history and see their latest credit score. Upstart doesnt offer these features.

No co-signed, joint or secured loan options: Adding a co-signer, co-borrower or securing a loan can help borrowers who may not otherwise qualify get a reasonable rate on a personal loan. Upstart offers unsecured loans only.

What Are My Payment Obligations

Your loan is an unsecured debt obligation that requires you to repay full principal and accrued interest in 36, 60 or 84 monthly installments . You may also prepay your loan at any time without penalty.;

Failing to meet your monthly payment obligation may result in negative credit reporting to credit bureaus potentially negatively impacting your credit score.

Read Also: How To Check Credit Score For Home Loan

Will Upstart Hurt Your Credit

According to the Upstart website, your credit score will not be hurt if you apply for a personal loan with Upstart.

However, if you stick to the repayment schedule and pay the monthly installments on time, your credit score stands to increase. And when you pay off the loan in full, your credit should also improve.

Some borrowers have reported that after being denied credit from Upstart, their credit report was negatively impacted. And some borrowers with already poor credit who have tried to use Upstart for debt consolidation have noticed that rejections have hurt their credit standing.

So while it may not hurt your credit if youre approved, you could see a ding on your credit if you are rejected and already have poor credit.

Upstart states on their site that they only do a soft inquiry first. And then when you accept the loan, they do a hard credit check, which will impact your score.

A post shared by Upstart | Personal Loans on Feb 26, 2020 at 4:17pm PST

NOTE: Upstart will report you to the credit bureaus when you do take out the loan as well as your repayment information, so keep this in mind.

Defaulting on a Loan

Your credit score will most certainly take a hit if you default on payments. Or if you fail to pay off the loan in during the timeline set forth in the terms of the loan.

As I mentioned above, the minute you take out the loan you will be reported to the credit bureaus from that point on.

Upstart Personal Loan Features

Online Application

Upstart makes it easy for applicants to apply for a personal loan online, no doubt because its the only option available. Borrowers who prefer to apply for loans over the phone or in-person may not be happy with this limitation.

Second Loan

Even if you already have a personal loan through the Upstart platform, you may be able to take out a second loan. To qualify for one, you will need to satisfy the following criteria:;

- Your last six monthly payments must have been made on time.

- You have no more than one outstanding loan with Upstart.

- The outstanding balance on your existing loan cannot be higher than $50,000.

Soft Initial Credit Inquiry

As do many providers in the personal loan space, Upstart allows you to see if you prequalify and check your rate with just a soft credit inquiry. Such a credit check does not damage your credit score; indeed, it doesnt even appear on credit reports viewed by lenders, though you can see soft inquiries when you check your credit personally. If you accept your rate and decide to move forward with an official loan application, Upstart will then perform a hard credit inquiry, which could potentially impact your credit score temporarily.;

Also Check: What Is The Commitment Fee On Mortgage Loan

I Already Have A Personal Loan Can I Get Another

That depends on several factors, but most likely you can. Lenders will re-assess your creditworthiness, so your payment history on your current personal loan, any changes to your credit report, and any increase or decrease in your income and expenses would impact your ability to get another loan. Also, your current personal loan will be taken into account when lenders assess your debt to income ratio to determine if too much of your income is going towards paying debt. If you have been making on-time payments on your loan, its likely your credit score has improved and your rate may be lower on a new loan.

Does Upstart Require Collateral

An Upstart personal loan does not require any collateral. The only collateral it requires is your personal guarantee and some proof of your financial ability to pay back the loan.

Although they dont require collateral, the do require a few things. Heres a list of some of the conditions for a personal loan with Upstart:

- The borrower must be at least 18 years of age and 19 for some states, such as Alabama and Nebraska.

- Must be a US citizen or permanent resident.

- You will need to have a valid email account.

- Should be able to verify name, Social Security number, date of birth.

- Proof of a regular income.

- You will need to have a US bank account.

You May Like: How To Apply Loan In Sss

What Could Upstart Do Better

Upstart does have some flaws to consider. One is that because it has an unusual process for determining creditworthiness, those with strong credit might get denied. If you have great credit but little education and work history, Upstart may not approve your application.

The companys rates may also be higher than some of its competitors rates because of its unusual process.

This Personal Loan Is Right For You If:

If you want to borrow a lower amount of money or have a limited credit history, Upstart personal loans are worth a look. Upstart will consider other positives, such as a college degree when evaluating your application.

However, it’s worth shopping around to see if you qualify for a personal loan that does not charge an origination fee — or even if a 0% intro APR balance transfer card might be a better fit. And if your credit score is good or excellent, you may find a better deal elsewhere.

And remember, if you don’t find an interest rate and terms you like, you can always take the time to build your credit score. Low-interest personal loans are worth the time and effort it takes to give your credit score a boost.

Recommended Reading: How To Get 150k Business Loan

Who Should Get An Upstart Loan

If your credit score is at least 600, Upstarts personal loans could be a good option. Youll also need a clean credit history with timely payments, no bankruptcies, and few or no hard inquiries.

Upstarts personal loans can be used to:

- Pay off credit cards

- Pay off student loans, take a course or bootcamp, or pay for college or grad school, except in California, Connecticut, Illinois, Washington, and Washington, D.C.

- Start or expand a business

- Pay medical bills

Upstart Vs Avant Personal Loans

Both Avant and Upstart allow borrowers with poor credit to get approved. For borrowers who meet Upstart’s minimum credit score requirement of 600, this lender could have an advantage with a wider range of interest rates and higher loan amounts.;

Upstart offers loans of up to $50,000, while Avant’s loans top out at $35,000. Interest rates start lower at Upstart, ranging from 7.86% to 35.99% APR, as opposed to Avant’s interest rates ranging from 9.95% to 35.99%.

However, Avant’s maximum origination fee is lower than Upstart’s, topping out at 4.75% as opposed to Upstart’s maximum of 8%.;

You May Like: How To Get Loan Signing Jobs

How Are Interest Rates Determined

Interest rates are proportionate to risk. Based on their own individual underwriting, each lender assesses each borrowers risk of defaulting. The lower the risk, the lower the rate the lender will offer. Lenders also look to make a profit on the personal loans they make, so the interest rate includes both the cost of the risk and the cost of servicing the personal loan.

Can I Apply For A Second Loan

If you have already received a loan on Upstart, in order to be eligible for another loan, you must:

Have made on-time monthly payments for the six previous consecutive months. On-time payments means that a payment was received during the 15 day grace period

Have no currently past due payment

Have no more than 1 outstanding loan through Upstart at the time of application

Have no more than the maximum amount of outstanding principal that each banking partner allows, at the time the loan originates

If you have finished paying off an existing Upstart loan and made on-time monthly payments for the 6 previous consecutive months, you are able to apply for a second loan after your most recent payment is cleared .;

If you have finished paying off an existing Upstart loan and any of the 6 most recent monthly payments were not on time or you paid off the loan before reaching 6 monthly payments, there is a 60 day cooling off period before reapplying.;

To create a second application we require you to use a different email address than what you may have previously used on another application. To apply for a second loan, check your rate here!

Read Also: What Is My Monthly Loan Payment

Medical Loans & Financing: What You Need To Know Debtorg

Nov 30, 2020 Medical bills can be overwhelming, especially if they are unexpected. Medical loans can be a way to make these situations manageable.

However, you must itemize your tax return to claim your medical expense deductions. If you itemize, you will not be allowed to take the standard deduction. You;

your health care provider to offer loans and financing to cover out-of-pocket medical expenses. Take a closer look at financing for fertility care.

What Are The Fees And Penalties

Upstart charges pretty hefty origination fees. This makes up for the risk they take accepting lower credit scores than most lenders.

Origination fees are 0% – 8% on average, depending on your loan amount, credit score, and your risk of default. The riskier your loan, the more your origination fee will be.

Other Upstart fees include:

- Late payment fee: 5% of the past-due amount or $15, whichever is more

- ACH return or Check refund fee: $15 per check that fails or is returned due to insufficient funds

- Paper copies fee: $10 if you withdraw eSign consent and request paper copies

Upstart also does not charge an early payment fee . However, you are also not entitled to a refund of the origination fee you paid.

You May Like: How Much Does My Loan Cost

How To Apply For A Personal Loan With Upstart

Applying for a personal loan with Upstart is an easy and simple process. All youll need to do is visit the Upstart website and make an inquiry for your rate. After that you can apply for a personal loan.

There is a Check Your Rate button on the site, which starts the process.

The application fields ask you basic information such as:

- How much would you like to borrow?

- Name, Date of birth, Address.

- What is your highest level of education?

- What is your primary source of income?

- How much do you have in savings?

- Have you taken out any new loans in the past 3 months?

The site claims that checking your rate wont hurt your credit score.

Once you have provided all the information and submitted the online rate inquiry form, you will receive your rate.

If you are fine with the rate, you will have to fill out an online application form for the loan to be processed.

With your application, you may have to upload some documents pertaining to:

- Your bank account

- Academic history

Promissory Note

After you have submitted the loan application, if accepted, you will receive an approval. At this stage, you will be asked to review disclosures and provide a promissory note with your signature.

A promissory note is a written legal document where one party promises to pay another party a specified sum of money, based on the terms of the document.

After signing the promissory note, the money will then be credited to your bank account in 1 to 2 business days.

How To Qualify For An Upstart Loan

-

Minimum credit score: 580.

-

Minimum credit history: None; borrowers with credit histories too limited to produce a FICO score may be accepted.

-

Minimum gross income: $12,000.

-

Employment: Full-time job, full-time job offer starting in six months, a regular part-time job or another source of regular income.

-

Must have a U.S. address where the borrower resides .

-

Must be at least 18 years old.

-

Valid email account required.

-

Personal bank account with U.S. routing number required.

Loan example: A three-year, $12,000 loan with a 23.4% APR would cost $467 in monthly payments. A borrower would pay $4,812 in total interest on that loan.

Recommended Reading: What’s Better Refinance Or Home Equity Loan

How To Get A Personal Loan From Upstart

The application process is entirely online and, according to Upstart, you can check your rate within minutes. Click on Check your rate on Upstarts personal loan page. In addition to being asked for the usual financial information and how you plan to use the proceeds, youll be asked to share more personal details, such as:

- Where you went to school

- What year you graduated;

- The company you work for;

- Your current job title

- Loans youve taken out in the past three months

- How much you earn at your job

- Your savings and investment account balances

Upstart will perform a soft credit check and use its underwriting model to assess your creditworthiness. If you accept the rate youre offered, Upstart will then pull your credit report again and process your application. Upstart will also analyze your income, credit history, and other factors when setting your available loan amount.

If you accept Upstarts offer by 5 p.m. Eastern Time on a weekday, your money may be deposited in your account as soon as the next business day.

Funds for educational-related purposes will take an extra three business days to process.

Upstart offers applicants a unique opportunity to use personal data, such as education and job history, to bolster their applications and secure competitive loans that they may not otherwise have been able to get.

Get Personal Loan Rates

Editor’s Rating

Good for

- Borrowers with fair or better credit

- Financing educational courses or bootcamps

Bad for

- on LendingTree’s secure website

For borrowers with fair or better credit, a personal loan from Upstart can be an affordable option. The lender offers loans up to $50,000 with rates between 6.46% and 35.99%. While you will need a credit score of 600 to apply, the lender also evaluates your educational and job history when making a loan decision. The lender also works with 17 different coding and technical bootcamps, so it can be a good source of funding for your education.

- on LendingTree’s secure website

Upstart is a good choice for a personal loan for borrowers with fair or better credit or for financing a coding or technical bootcamp course. Through Upstart, you can borrow up to $50,000 for 3 or 5 years. APRs range from 6.46% to 35.99%. On average, it takes one business day to receive your funds once approved for a loan.

| Good for… | |

|---|---|

|

|

Upstart is available in all 50 states, with the exception of Iowa and West Virginia. You can use an Upstart loan to consolidate debt, pay off student loans, start or expand a business, pay for education, pay medical expenses, make a large purchase, relocate, travel and many other purposes.

You May Like: What Is An Sba 504 Loan

What We Love About Upstart

Upstart is a company that looks at more than just your credit score. For example, Upstart will look at things like your employment history, education, and future earnings potential when making a lending decision. That means that you may be able to qualify for a loan from Upstart, even if you have poor credit.

The company offers a quick and easy online application process and lets people borrow up to $50,000, which is sufficient to cover most expenses that people would need to use a personal loan for. If approved, Upstart can get the funds to your bank account as soon as the next business day.

Borrowers can work with Upstart from almost anywhere in the US. The only state where Upstart isnt available is West Virginia.