Fha Loan Income Requirements

There is no minimum or maximum salary that will qualify you for or prevent you from getting an FHA-insured mortgage. However, you must:

-

Have at least two established credit accounts. For example, a credit card and a car loan.

-

Not have delinquent federal debt or judgments, tax-related or otherwise, or debt associated with past FHA-insured mortgages.

-

Account for cash gifts that help with the down payment. That can include money from a friend or family member, a charity, your employer or union, or from a government agency. These gifts must be verified in writing, signed and dated by the donor.

If you are using a state or local assistance program to obtain an FHA loan, that program may have its own income limits and requirements.

Is A Florida Fha Loan Right For You

Buying a home is a life-changing decision that should be considered carefully. You dont want to be one of the63% of millennial homebuyers who have regrets about their home purchase because they did not fully understand all of the costs and fees that come with homeownership. Educating yourself about the homeownership process is the best thing you can do for your bottom line.

If you think that a Florida FHA loan could be the mortgage solution youve been looking for, contact Associates Home Loan of Florida, Inc., today to connect with a local lender.

Fha Loan Down Payments Decoded

Federal Housing Administration loans are mortgage loans backed and insured by the government. These loans are available through FHA-approved mortgage lenders and are typically offered at fixed-rate terms of 15 to 30 years. Many first-time homebuyers like FHA loans because they require lower down payments and a lower minimum credit score than many traditional loans.

One benefit of an FHA loan over a conventional loan is that conventional loans typically require a higher down payment. It can be difficult for first-time homebuyers to save up for a larger down payment, particularly for those with student loans and credit card debt.

Also Check: Are Student Loan Forgiveness Programs Legitimate

Florida Fha Loans Requirements And Loan Limits For 2023 Florida Fha Lenders

Florida home buyers who need a small down payment or have poor credit scores may be able to purchase a home with an Florida FHA loan. There are many FHA lenders in Florida who offer FHA loans, but not all of them participate in all of the FHA loan options available.

We will take you through the Florida FHA loan requirements, detail what is needed to qualify, then help you to get pre-qualified. If you already know that an FHA loan is right for you, then click to connect with an Florida FHA lender whether you live in Jacksonville, Miami, Tampa, St Petersburg, Orlando, or anywhere else.

Federal Housing Administration Loan Relief

When you get an FHA loan, you may be eligible for loan relief if youâve experienced a legitimate financial hardship such as a loss of income or an increase in living expenses. The FHA Home Affordable Modification Program , for example, can permanently lower your monthly mortgage payment to an affordable level.

To become a full participant in the program, you must successfully complete a trial payment plan in which you make three scheduled paymentsâon timeâat the lower, modified amount.

You May Like: How Home Equity Loan Calculator

Down Payment Assistance Programs

If savings for the 3.5% FHA down payment is proving difficult, you can still achieve your homeownership dream in Columbia County through the Florida Housing down-payment assistance program.

Florida Housing runs the Bond Loan Program, which provides down payment and closing costs assistance if you are an eligible home buyer in Columbia County.

The down payment assistance takes the form of a zero-interest deferred second mortgage for FHA loans. With this non-amortizing loan, you can access grants of up to $10,000 as of June 1, 2021.

The program is only available with Florida Housing’s first mortgage loan and is not forgivable. The total amount is payable if you sell your home or refinance the FHA mortgage.

Why Rent When You Can Own With An Fha Loan

The down payment is the out-of-pocket investment you make when you buy your property. The required amount is generally calculated as a percentage of the purchase price, determined by the requirements of the loan. This upfront payment is essentially seen as your investment in the mortgage, since you stand to lose it if you’re unable to meet your monthly payment obligations.

Also Check: Can I Lower My Student Loan Interest Rate

How Do Mortgages Work

In the simplest terms, mortgages are basically large loans from banks or financial institutions. Its just another way to borrow money.

For example, if you borrow $200,000 at 3.00% APR, you will pay approximately $6,000 per year for the ability to have $200,000 to purchase a house to live in. This is why mortgage rates are so important, because the higher your mortgage rate, the more money you will pay in the long-run.

How Long Do Borrowers Have To Pay Fha Mortgage Insurance

The duration of your annual MIP will depend on the amortization term and LTV ratio on your loan origination date.

For loans with FHA case numbers assigned on or after June 3, 2013:

Borrowers will have to pay mortgage insurance for the entire loan term if the LTV is greater than 90% at the time the loan was originated. If your LTV was 90% or less, the borrower will pay mortgage insurance for the mortgage term or 11 years, whichever occurs first.

| Term |

|---|

Recommended Reading: How Long Is Car Loan Approval Good For

Fha Loans Vs Conventional Loans

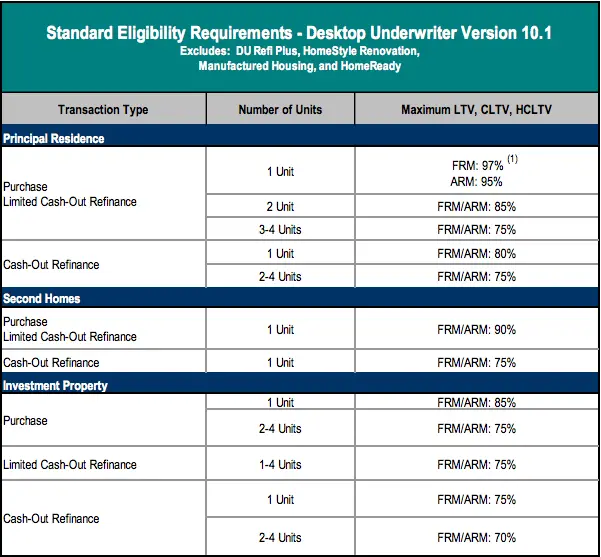

Often the choice between an FHA loan and a conventional mortgage comes down to credit scores and total debt. Conventional loans are the most popular mortgage type, but borrowers have to meet higher qualifying standards than for FHA loans.

However, conventional loans allow you to finance second homes and investment properties, whereas you need to live in the home you finance with an FHA mortgage as a primary residence for at least 12 months. And you may even be eligible for an appraisal waiver if you buy a home with a conventional loan, while FHA purchase loans require a more detailed home appraisal.

The table below highlights the major differences between FHA and conventional loans.

| Loan feature | |

|---|---|

|

|

THINGS YOU SHOULD KNOW

Even if your credit scores are above 620, you may want to compare how much youd pay in FHA mortgage insurance with conventional private mortgage insurance , especially if you dont have a 20% down payment. Conventional PMI premiums are based on your credit scores FHA MI premiums arent, which could make a big difference in your monthly payment and how much you qualify to borrow.

What Is The Fha

FHA stands for the Federal Housing Administration, which is a part of the U.S. Department of Housing and Urban Development. The FHA provides mortgage insurance on loans made by lenders that are FHA-approved. The FHA insures mortgages on single-family homes, multi-family properties, residential care facilities, and hospitals in the U.S. .

Mortgage insurance from the FHA protects lenders against losses, such as paying a claim to the lender for unpaid principal balance if a property owner defaults on their mortgage. Since this alleviates risk, lenders can offer more mortgages to homebuyers. Qualifying for FHA mortgage insurance means meeting certain requirements.

The FHA generates its own income by collecting mortgage insurance premiums from borrowers through lenders. The income is then used to operate the FHAs mortgage insurance programs which benefit renters, homebuyers, and communities.

Recommended Reading: How Can Nurses Get Student Loan Forgiveness

Are Fha Loans Only For First

FHA loans are attractive for many homebuyers, not just first-time buyers because they have more flexible requirements than conventional mortgage loans.

For homebuyers with lower credit scores or who plan to make a low down payment, FHA loans are especially attractive. But anyone, even homeowners looking to refinance their mortgage, can apply for an FHA loan if they meet the eligibility requirements.

Total Mortgage Expense Dti Ratio

The FHA’s rule of thumb is that your mortgage payment should not be more than 31 percent of your gross monthly income. The rest of the mortgage industry calls this the front-end ratio.

Total Mortgage Payment

- Some personal loans

*For installment debt, submit your loan documents showing your monthly installment payment.

Once you submit these documents, your lender takes the total amount of your mortgage expenses, plus all your recurring monthly revolving and installment debt and weighs that against your pre-tax income. The FHA’s rule of thumb is that your total fixed payment expenses should be no more than 43 percent of your gross monthly income.

You can exceed the FHA’s 31/43 rule if you have compensating factors, such as a high credit score or a large down payment. Expect that if you have a DTI above 43 percent and a credit score below 620, you will undergo additional underwriting scrutiny.

Also Check: How Many Times Can You Refinance An Auto Loan

Fha Rules For Down Payment Sources

The FHA has strict rules about where the money for your down payment comes from. For instance, if you receive money as a gift from a relative to make your down payment, the FHA requires a letter stating the money is a gift, not a loan youll have to pay back. The FHA allows down payment funds from the following approved sources:

- Cash and checking or saving accounts

- Investment funds

- Cash from the sale of personal or real property

- Loans and grants

- Employer assistance

Additionally, you cant make your down payment with financing like a payday loan, credit cards or a cash advance because the FHA doesnt want homebuyers to get further into debt to make their down payment.

You also cant obtain down payment assistance from charitable organizations that provide monetary gifts to pay off installment loans, credit cards, collections, judgments, liens or similar debts.

But you can get the money for your down payment from charitable organizations that provide homeownership assistance to low- and moderate-income buyers and first-time homebuyers.

Are Fha Loan Down Payments Required

Down payments are required when you buy homes with FHA loans. FHA loans have lower minimum down payment requirements compared to conventional loans but down payments are still needed.

Your minimum FHA loan down payment is determined by your credit score. If your credit score is 550 or higher, you only need to put down 3.5% of the purchase price of the home with an FHA loan through Freedom Mortgage. This means if you wanted to buy a $270,000 home with an FHA loan, you will need to make at least a $9,450 down payment.

You can choose to make a larger down payment than the FHA requires. Making a larger down payment can help you save on interest because you are borrowing less money to buy your home. Finally keep in mind that the amount of your FHA loan down payment can affect how much you pay for mortgage insurance premiums and for how long you need to pay these premiums.

To learn more about how much your monthly payment might be, check out our FHA loan calculator.

Recommended Reading: How To Lower Student Loan Repayment

Tips For Paying Your Down Payment

One of the most difficult parts of the mortgage application process for first-time buyers is coming up with enough money for a down payment. While FHA loans require much lower down payments than conventional mortgages, that 3.5% or 10% down can still be a big expense, especially for younger buyers who havent had time to grow their savings.

Luckily, the Department of Housing & Urban Development is somewhat flexible when it comes to acceptable down payment sources. In addition to money from a checking or savings account, you can also use:

Cash on hand

Stocks and bonds

Retirement accounts

Gifted funds

Its not uncommon for parents, in-laws, and other relatives to gift down payment funds. As long as they dont expect repayment, that money can be used to cover the entire down payment cost on an FHA loan.

Just because you can use a family gift to cover 100% of your down payment doesnt mean that you should.

Remember, youre going to be dealing with individual private lenders, not the government. If you dont put any of your own money into a down payment, thats a red flag telling potential lenders that youre more likely to default. Even if you have generous family members, its still a good idea to practicesmart saving habits so that you can contribute some of your own funds and potentially avoid paying mortgage insurance.

Fha Appraisals Are Tougher Than Conventional Loan Appraisals

FHA appraisal standards go beyond those of conventional lenders. The FHA standards are designed to ensure the livability of the home and the health and safety of its inhabitants. That means these appraisals may require testing not typically included in conventional appraisal standards. In a sellers market, homeowners looking to sell may not be inclined to accept an offer that risks their home not meeting FHA appraisal standards.

Moreover, in competitive markets, home buyers who arent using government-backed loans are often willing to make contingency-free offers in addition to bidding well over the asking price. Because home buyers using an FHA loan cant waive the more rigorous FHA appraisal standards, they can be at a competitive disadvantage in bidding wars.

You May Like: Can I Get Loan On Agricultural Land

How Long Do You Have To Pay Fha Mortgage Insurance Premiums

Borrowers who put down less than 10% will have to make mortgage insurance payments over the entire life of the loan, even once they have over 10% equity in their homes. If you pay 10% or more for your down payment, you can cancel your mortgage insurance premiums after 11 years.

Some homeowners may decide to refinance their FHA mortgages to get rid of their MIP payments once they have 20% equity. This method can be especially beneficial to borrowers who have improved their credit and can now qualify for a low interest rate with a conventional loan.

Of course, you should make sure you meet your mortgage lenders eligibility requirements for a refinance before starting this process. This step could include checking your debt-to-income ratio and FICO® score or talking to your loan officer about refinancing alternatives.

Fico Scores And Down Payment Requirements

First-time buyers want to know how much they’re expected to save for their FHA loan down payments. For those who qualify financially as new borrowers or return borrowers, the minimum FHA mortgage down payment is 3.5%. However, that low down payment option is not available for everyone.

Those who have marginal FICO scores are required to make a 10% down payment. According to FHA home loan minimum standards, those with FICO scores between 500 and 579 are required to come up with this higher down payment. Those with FICO scores at 580 or higher technically qualify for the lowest down payment offered.

It’s best to start saving early for your down payment and to anticipate how much that payment might be. You’ll need to estimate the price range for the home you want to buy and calculate either the 3.5% or 10% down payment using that potential sales price as your guide.

Recommended Reading: What Is The Highest Fha Loan Amount

Down Payments Assistance Programs And Grants

Saving up for the down payment can be a major obstacle people face when trying to buy a house. It’s why so many people are never able to transition from renters into owners. Borrowers with high credit scores and low debt-to-income ratios might seem like ideal candidates for an FHA loan, but might still not have enough money saved to put down on a new home.

Down Payment Assistance programs, sometimes referred to as grants, can provide homebuyers with funds to cover up front and closing costs when buying a house. Borrowers will need to meet the eligibility requirements of the specific program they’d like to use. Credit scores, household income, family size, and homebuyer education requirements will likely be factors.

More About Fha Loan Down Payments

1) Remember, the FHA does not offer down payment assistance. That doesn’t mean the agency doesn’t provide resources that can help you locate a DPA program in your area. These programs must meet adhere to federal regulations when providing down payment help to borrowers.

2) If you are concerned about your ability to credit qualify for an FHA mortgage, talk to a participating lender and ask some advice about your chances and what can help get you closer to loan approval. There’s no substitute for good credit and you’ll want to review your credit report long before you start filling out loan paperwork.

3) Your rental history can help boost your credit if you pay on time and have a pattern of doing so. But the catch is that your landlord must report this activity to the credit agencies. You’ll need a minimum of 12 months of on-time rent and utility payments anything less can seriously hurt your chances for loan approval.

Read Also: Should I Use My Va Loan

What Are The Mortgage Insurance Requirements For An Fha Loan

FHA loans tend to have stricter mortgage insurance requirements than other types of mortgage loans and typically require homeowners to pay two mortgage insurance premiums: an upfront premium and an annual premium that varies based on several factors. The annual mortgage insurance premiums may remain for the life of the loan. The two types of premiums are:

- Upfront MIP: The borrower is responsible for paying an upfront MIP, which can be financed into the mortgage but will increase the total monthly payment. Typically, the upfront MIP is 1.75% of the total loan amount.

- Annual MIP: The annual MIP is an ongoing, yearly insurance premium, which can range between 0.45% and 1.05%. The amount is then divided by 12 and added to your monthly mortgage payment. The cost of the annual premium depends on your mortgage term, loan balance and your loan-to-value ratio.