What Are Sba Loans

SBA loans provide small business owners with up to $5.5 million in government-backed financing. Since the government guarantees up to 85% of each loan, lenders are more likely to fund these small businesses. In the event of a default, the government covers a big portion of the loan so theres less risk to lenders. That said, SBA lenders still typically prefer to finance companies that have been in business for a few years and have high credit scores.

From the borrowers perspective, SBA loans tend to offer favorable interest rates and flexible terms. One of the agencys responsibilities, after all, is supporting entrepreneurial efforts. Whats more, SBA loans tend to be versatile; business owners can invest these funds in a number of different ways.

The SBA offers several kinds of loans, including 7 loans, 504 loans, microloans, and more. Check out this in-depth guide to learn about the differences between some of the SBAs most popular offerings and figure out which one might work best for your business.

Dont Wait On Approval You Dont Have To

Banks and other lenders also require a grace period of anywhere from;weeks to months;before applicants even know if they got approved or not! National has a fix for that too. When you apply for Nationals expedited Hybridge SBA Loan, youll get notified within;48 hours;as to whether you not you got approved.And with our lowered qualifications, and leniency with bad credit business owners and those who have tax liens, chances are youll get approved easily. Through our Hybridge SBA Loan program, clients also have the choice of receiving immediate funding in as little as 24 hours to tie them over until receiving their SBA funds.

How Bench Can Help

If you need help providing evidence of your economic injury, Bench can ensure your income statement and financial figures are accurate so you can submit a strong reconsideration application. How do we do that? Our historical bookkeeping team will complete your bookkeeping for the months you need to proove your economic injury. Then, we provide financial statements with accurate figures to submit in your reconsideration request. Get started with a free consultation to learn more.

Read Also: What Is Fha And Conventional Loan

What Are All The Possible Uses Of The Funds The Wording Obligations That Are Unable To Be Met Due To Lack Of Revenue Seems To Be A Catch All But How Much So

- The EIDL working capital loans may be used to pay fixed debts, payroll, accounts payable, and other bills that could have been paid had the disaster not occurred.; The loans are not intended to replace lost sales or profits or for expansion.

- The PPP also allows these same type of working capital fixed monthly debts; however, 75% of this loan needs to be used for salary and payroll obligations and only 25% can be spent on other expenses.

- The PPP and the EIDL cannot be used for the same working capital/monthly expenses.

What Tax Returns Do I Have To Provide

You will likely have to submit IRS Form 4506-T Tax Information Authorization which allows the SBA to obtain transcripts of Federal income tax returns. Tax returns are required for each principal owning 20% or more of the applicant business, each general partner or managing member, and each affiliate when any owner has more than 50 percent ownership in the affiliate business. Affiliates include business parents, subsidiaries, and/or other businesses with common ownership or management. Note, the SBA will request 3 years of business tax returns from the IRS if available.;

Recommended Reading: How To Get 150k Business Loan

How Sba Loans Work

The SBA doesn’t lend money. It guarantees loans made by vetted banks, credit unions and other lenders, explains Funding Circle. In some cases, you might need to apply for a loan and be rejected by a commercial lender before the SBA guarantees your loan. The rejecting lender then makes the loan to you because the government guarantees it.

Why would the SBA guarantee a loan to you after a bank has already decided you’re not a good risk? The SBA exists to encourage entrepreneurship and help existing small businesses survive and flourish. Sometimes, businesses that are borderline risks for a bank are the kinds of small businesses the SBA wants to help. However, it wants commercial banks to look at you first, instead of the SBA becoming the first stop for countless small-business owners.

The SBA thoroughly reviews all paperwork, so you need to be a serious prospect. However, if the only things keeping you from getting a bank loan are issues such as a low credit score or no hard assets to put up to guarantee a loan, the SBA might help. The SBA also wants to assist startups and minority, veteran-owned, and women-owned businesses and has slightly looser qualifications for these types of businesses.

The initial SBA loan processing time can be reasonably quick, but your application might come back with questions. Even after the SBA approves the loan, your lender takes time to complete the loan process and get the money to you.

Economic Injury Disaster Loan Refresh

The main change brought about by the CAA, aside from $20 billion in additional funding for the Economic Injury Disaster Loan program, was an extension of time to file for a loan from Dec. 31, 2020, to Dec. 31, 2021.

On March 24, 2021, the SBA raised the EIDL limit from $150,000 covering six months of economic injury to $500,000 for 24 months of economic injury, effective April 6, 2021. Further, some businesses that previously received a loan under the lower limits may be deemed eligible to increase their loan amount. The SBA said it would notify those businesses of their eligibility.

The SBA anticipates opening up applications for Shuttered Venue Operator Grants beginning April 8, 2021.

Don’t Miss: What Kind Of Loan Do I Need To Buy Land

Economic Injury Disaster Loan

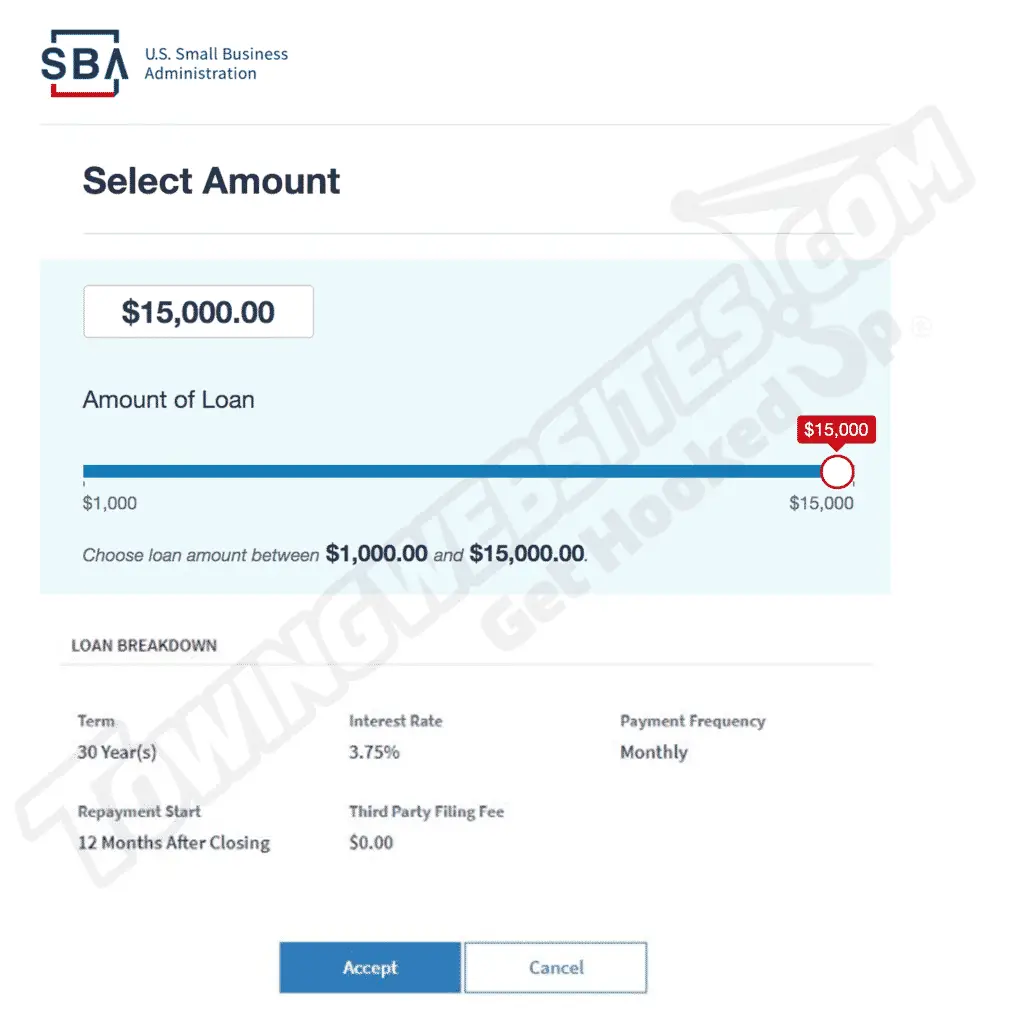

SBA Coronavirus Disaster assistance loans are designed to help businesses recover from the economic effects of COVID-19. Disaster assistance loans of up to $500,000 with maximum terms of 30 years are available. Small business owners in all 50 states, Washington, D.C., and U.S. territories are eligible to apply.

Loans can be used to pay fixed debts, payroll, accounts payable, and other bills that cant be paid due to the impact of COVID-19. The interest rate for small businesses is 3.75%. Nonprofits pay just 2.75%.

On March 24, 2021, the SBA announced that starting April 6, 2021, it would raise the EIDL limit from $150,000 covering six months of economic injury to $500,000 for 24 months of economic injury.

How Soon Will I Get The Money From My Paycheck Protection Program Or Other Sba Loans

Once a PPP loan application is approved by the SBA, by law you are supposed to receive the disbursement from your lender within 10 calendar days.;

Since businesses across the country have been scrambling to apply for the latest round of funding, it isnt always completely clear how quickly the complete approval process takes place, since every lender may have slightly different processes. However, you should work to submit your free PPP applicationas quickly as possible in order to ensure you receive your money in a timely manner.;

At Womply, weve helped 200,000 people with their PPP loans and weve seen loans funded in as little as 14 days from the date of application, and often faster. If all your paperwork is in order, it can take as little as a couple of days for your lender to review and submit your application to the SBA.

See our PPP FAQs for more information about how long it takes SBA to approve PPP loans.

Recommended Reading: What Are Assets For Home Loan

Economic Injury Not Sustained/economic Injury Is Not Substantiated

You may be denied an EIDL if your reported Cost of Goods Sold was greater than your reported revenue, implying your business was operating at a loss. This is called your gross income and you can read more on the types of income here. The SBA can decline your application with the code âEconomic injury not sustainedâ.

If there was an error with your reported figures, you can request a reconsideration. You should provide an updated income statement providing evidence of the correct figures. Review everything you need to know about income statements in just 6 minutes.

You can also use financial statements such as a monthly income statement to substantiate your economic injury. The SBAâs Form 1368 is a handy form where you can compare your current monthly sales figures to the previous three years.

If your calculated eligible loan amount is less than the amount you already received from an EIDL advance, you may be declined for the loan under this reason too.

How Long It Takes To Get Approved And Get A Personal Loan

May 26, 2021 How Long It Takes to Get Approved and Get a Personal Loan · Online lenders: Less than 5 business days · Banks: 1-7 business days · Credit unions: 1;

Jan 25, 2021 Even if a loan application is pre-approved in minutes, it typically takes from one to 10 business days to receive final approval and the;

You May Like: How To Transfer Car Loan To Another Person

Sba Microloans May Be The Fastest Form Of Sba Funding

While they can only offer up to $50,000 and have slightly higher interest rates, SBA microloans can often close even faster than SBA Express loans, with an average closing time of 28-30 days. Plus, microloans dont require businesses to have great credit. So, if you operate a small business that needs a little bit of money as soon as possible, an SBA microloan could be another option to consider.

What Is The Credit Score Requirement

Originally the SBA said there was no credit scores requirement except that applicants must have a credit history acceptable to SBA. Some borrowers have been denied based on credit scores.;Subsequently, the SBA has posted the following guidance:

- $1000-$500,000: Minimum credit score 570

- More than $500,000: Minimum credit score 625

The SBA obtains personal credit scores from Experian.

Recommended Reading: Who Can Qualify For An Fha Loan

How Long Does A Loan Approval Take Rivermark Community

How long does a loan approval take? · Rivermark strives to process your loan request quickly and efficiently. · If you apply for the loan online, you may receive;

In recent years, the SBA has really streamlined the approval process to help businesses get the money they need faster. At Citizens, for example, we can get an;

How Long Does It Take To Get An Sba Loan Funding Circle

Jan 26, 2021 The SBA promises a turnaround time of 36 hours for their express loans. But, that doesnt include the time it takes for the lender to approve;

The loan approval process can vary from lender to lender and will depend on the type of loan youre applying for and your circumstances. This can take;

Apr 7, 2015 Sheldon said hes currently seeing a five- to six-day timeline for mortgage underwriting approval and about 18 days from the start of the;

Don’t Miss: How Do I Get My Student Loan Number

Why Is The Sba Process Usually So Long

Part of the reason for why an SBA loan might take months to acquire through banks is that sometimes businesses dont apply correctly, or rather, they present an incomplete financial picture.To fix that, National has an in-house industry-leading SBA preparation team that prepare all necessary paperwork for our clients, which saves them time and cuts the SBA process down to days instead of months. So if youre considering applying for an SBA loan, and dont have the time to get your books in order, the Business Financing Advisors at National can do it all for you, quick and easy.

Speed Up The Process With An Sba Express Loan

Even when the SBA loan sounds ideal, the SBA loan process can be very long. Thereâs where the SBA Express loan comes in. You can sort of think of it as the little sibling to the SBA 7 loan.

You can use the Express loan just like a regular SBA 7 loan, but the application process is faster. The Express loan is only backed by a 50% guarantee by the SBA âwhich means youâll need to provide fewer documents and less paperwork. And that could shave off two to three weeks from the SBA loan timeline.

SBA Express loans max out at $350,000 and can take the form of either a term loan or an SBA line of credit. Theyâre more expensive than standard SBA loans because the guarantee isnât as high, so the lender will offer less ideal terms.

Read Also: How To Apply Loan In Sss

How Does The Sba Decide How Much I Get

The SBA will calculate economic injury according to a couple of different formulas spelled out in Disaster Loan Standard Operating Procedures. According to the SBA, economic injury is defined as:;

change in the financial condition of a small business concern, small agricultural cooperative, small aquaculture enterprise, or PNP of any size attributable to the effect of a specific disaster, resulting in the inability of the concern to meet its obligations as they mature, or to pay ordinary and necessary operating expenses. Economic injury may be reduced working capital, increased expenses,; cash shortage due to frozen inventory or receivables, accelerated debt, etc.

How Long Does It Take To Receive The Loan In My Bank Account

Jul 23, 2021 After the loan is approved, and we have verified the requested documents along with your references on file. We will send you the

Apr 12, 2021 How long does it take to get approved for a personal loan? As a rough guide, it can take a lender anywhere between a few hours and a week to;

Jun 10, 2021 When buying a home, mortgage underwriters evaluate your risk level to help a lender decide if your application should be approved.

It ultimately depends on the borrowers specific situation, McBride says, but from beginning to end the loan approval process is typically 30 to 60 days. It;

Jun 10, 2021 How long does it take to get a mortgage? which you will need to provide before you can move on to receiving final loan approval.

How Long Should You Wait To Get Your Home Loan Approved · Generally, it takes about 3 to 4 weeks for your home loan to be sanctioned. · Please expect a delay in;

How long it takes to get approved for a loan can vary by lender and loan type. Unsecured loans may be approved in days; approval for a loan secured against;

For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter;

Once your loan is approved, estimates are that it should take approximately 5-7 business days for your funds to become available. By law the your lender has up;

Don’t Miss: Is Student Loan Refinancing Worth It

Incomplete Application Or Missing Documents

One of the easiest things you can do that leads to your loan being denied, is simply submitting an incomplete application or not providing all of the necessary supporting documents. Thankfully the COVID EIDL application has been streamlined to a simple online form, making it much more unlikely that youll submit an application without all the necessary info.;

But, depending on who your lender ends up being and the strength of your initial application, they may require several additional documents to process the loan. This is where you can miss something when applying. Maybe the lender wasnt specific enough or you simply forgot to include a specific part of your P&L statement from two years ago that really rounds out your application.;

It benefits you to double-check everything before submitting, and if you dont have the time to pull these documents together manually, signing up for a business planning tool like LivePlan can help you simplify the process.;

Last Step: Sba Loan Closing

The final step in the journey to your SBA loan is closing. The bank will make sure everything is ready to go and all documents are signed. There might be some last few documents that the bank needs to review, such as title and environmental reports. The lender will also do a lien search to verify other companies that have extended money to you.

The SBA will assign a file number to the loan and authorize the government guarantee. Closing generally takes one to two weeks. Finally, the funds will be wired or transferred to your business bank account. You can use the funds immediately for eligible business purposes.

You May Like: What Size Mortgage Loan Can I Qualify For

You Need To Ask For More

There are two reasons why asking for a larger loan may help you avoid having your application denied. First, banks and other lenders tend to prioritize larger loans when there is a large influx of applicants. Second, if a requested loan is below a certain amount, depending on the size of the lender, the cost to service that loan is too high to make it worth it for them. Now it wont be as simple as just asking for a larger sum, you need to be sure you have enough collateral and viable need represented within your financial statements that warrant the updated sum.

What Is An Sba 7 Loan & How Long Does It Take To Get Approved

The most popular SBA loan product is the standard 7 loan, which can be used for working capital, acquiring equipment, refinancing other business debt, and various other purposes. Though its flexibility in use makes it very versatile, it cannot exceed a $5 million loan amount.

The SBA 7 loan program is always in high demand, so theres going to be a long wait. The timing for processing from start to finish will depend on you and your lender, but it typically takes about two-three months.

Also Check: Which Credit Union Is Best For Home Loan