How Frequently Do Commercial Mortgage Rates Change

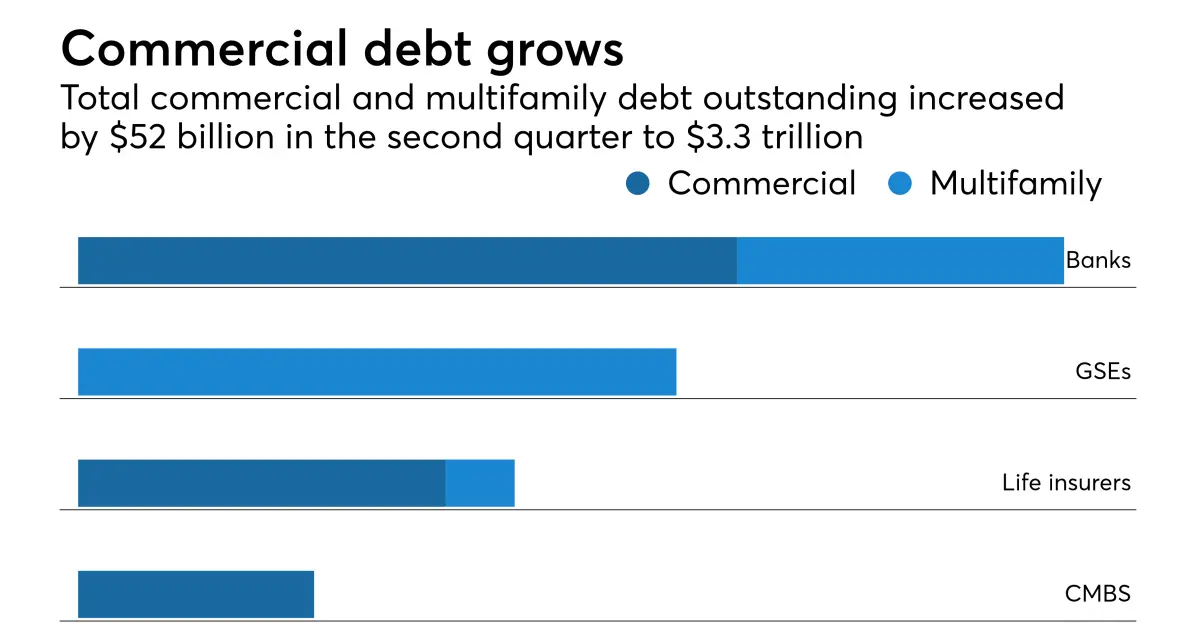

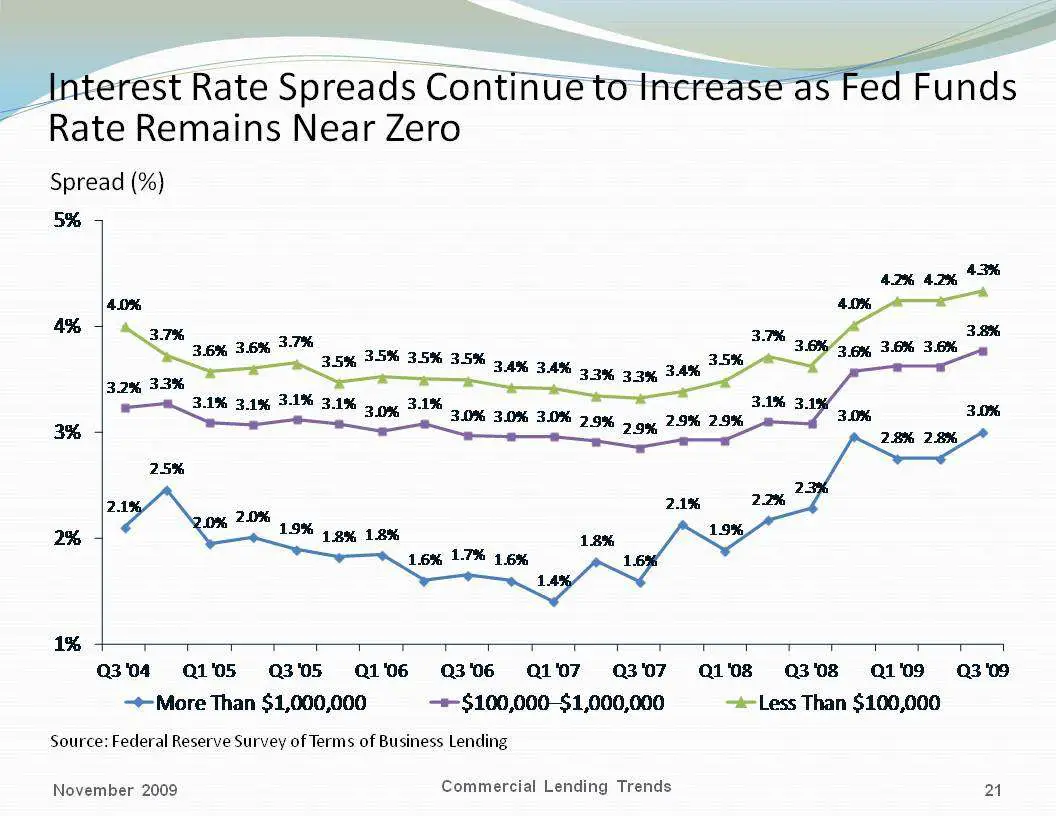

Commercial Mortgage Rates change every day because most lenders, particularly banks and credit unions, set their interest rates in accordance with âindexâ rates ultimately governed by national institutions like the United States Federal Reserve and the US Department of Housing and Urban Development . Commercial real estate loans have more risk involved than government-backed bonds, so interest rates are usually at a premium, or âspreadâ over the underlying financial indeces. Commercial mortgage rates are also usually somewhat higher than residential mortgages, with exceptions for lower leveraged loans for the strongest borrowers.

What Is The Minimum Interest Rate For A Business Loan

Again, theres no single answer to this question. Lenders want to make money, so they will charge some interest for business lines of credit and loans. But its often based on current economic conditions. Right now, the interest rate is incredibly low, so to compete and get your business, lenders may offer rates as low as 2%. If you get a loan with a fixed rate, you will pay just 2% for the life of the loan. But as economic conditions improve, that rate would rise if you have a variable interest rate.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Also Check: Auto Loan Self Employed

Average Rates For Different Types Of Commercial Real Estate Loans

A wide variety of lenders provide business loans for commercial real estate financing. While SBA loans and bank loans are generally reserved for the most qualified borrowers, hard money loans and bridge loans are more widely available.

Hereâs a summary of commercial mortgage rates for some of the most common types of commercial real estate loans:

The Complete Guide To Understanding Commercial Mortgages

Running a new or old business? Coming up with strategic plans to achieve your goals is a must. But besides all the careful planning, you need enough working capital to jumpstart your operations. This is important whether youre a establishing a new company or getting ready for expansion.

As your business grows, its crucial to find the appropriate commercial property that can accommodate your needs. This is where securing commercial mortgage can help. It saves money on rising rental expenses and reduces your overall cost structure. In the long run, this provides financial leeway for your business, especially during unfavorable economic periods.

In this guide, well detail how commercial real estate loans work and how to qualify for this type of mortgage. Youll learn about commercial loan terms, its payment structure, and rates. Well also discuss various sources of commercial real estate loans, as well as different options available in the market.

What is a Commercial Mortgage?

A loan secured by business property is called a commercial mortgage. It is used to purchase commercial property, develop land, or a building. This type of mortgage is also used to renovate offices and refinance existing commercial loans. Examples of property that use commercial mortgages include apartment complexes, restaurants, office buildings, industrial facilities, and shopping centers.

In summary, companies use commercial mortgages to accomplish the following goals:

Also Check: Stilt Loan

How Do I Get The Best Rates For A Commercial Mortgage

Interest rates for commercial loans change frequently so citing current interest rates rarely helps an individual understand the rate that they may be offered.

Ask an expert with access to the UK market to compare and identify the best options for you. Theyll already know which lenders are more likely to be able to offer you a preferable rate and can guide you through the process of qualifying and successfully making an application.

Send an enquiry or give us a call and our advisors can explain your next steps, with practical advice that can help you get the finance you need for your business.

Structure Of The Loan

Another factor that can affect your commercial real estate loan rate is the structure of the loan. Your loan might be fully amortizing for the entire term, which means that youll make a series of payments to pay off your loan, with a decreasing amount of your payment going to interest over time.

In contrast, some lenders structure commercial real estate loans with a balloon payment. In this case, you might make lower monthly payments for 10 years, at the end of which you will owe the remaining balance in one lump sum. At that point, if you cant afford the balloon payment, youll need to renegotiate with the lender or refinance your loan.

Read Also: Usaa Refinance Auto Loan

Fixed Vs Variable Commercial Real Estate Loan Rates

Commercial real estate loan rates can be fixed for the life of the loan or variable. Variable rates change based on market rates. A variable interest rate might also reset periodically according to a schedule that the lender will provide in your loan agreement.

Fixed rates give you more peace of mind, but if youâre a less-qualified borrower, the lender may only offer you a variable rate. It also depends on the lender and the specifics of your loan. SBA 7 loan rates, for instance, are variable, whereas SBA 504 loan rates are fixed.

How Are Commercial Mortgage Rates Decided

The interest rate that you pay will vary depending on a number of factors. The main considerations in pricing an application are the following:

- Loan size

- The length and quality of the tenant and lease

- The type of lender

- The loan to value ratio

- Your credit history

- The financials / strength of the business

If your business is established and affordability comfortable, you will generally benefit from a lower interest rate. If youre planning on using the property as premises for your own business, the interest rate is likely to be lower than if you intend to let the property.

Don’t Miss: Vehicle Loan Calculator Usaa

Commercial Real Estate Loan Interest Rates And Fees

Interest rates on commercial loans are generally higher than on residential loans. Also, commercial real estate loans usually involve fees that add to the overall cost of the loan, including appraisal, legal, loan application, loan origination and/or survey fees.

Some costs must be paid up front before the loan is approved , while others apply annually. For example, a loan may have a one-time loan origination fee of 1%, due at the time of closing, and an annual fee of one-quarter of one percent until the loan is fully paid. A $1 million loan, for example, might require a 1% loan origination fee equal to $10,000 to be paid up front, with a 0.25% fee of $2,500 paid annually .

Tips For Getting A Competitive Business Loan Interest Rate

Read Also: Credit Score Usaa

The Us Prime Interest Rate

The prime interest rate is relevant to small businesses because banks generally use it as the starting point from which to calculate the interest rate to charge on small business loans. The average small business customer can usually count on banks adding a few percentage points to the current prime rate. In a recession, small businesses may have to pay even higher rates. It is almost unheard of for a small business to be offered a loan at the prime interest rate. Most small businesses will be offered an interest rate based on the prime interest rate plus additional percentage points reflecting their own individual risk factors.

Most small businesses will be offered an interest rate based on the prime interest rate plus additional percentage points reflecting their own individual risk factors.

If I Apply For A Lower Ltv Will I Get A Better Commercial Mortgage Rate

Commercial mortgages typically require higher deposit requirements in comparison to residential mortgages and depending on the circumstances, a borrower can expect to pay between 25 50% of the market value of the property.

Raising the capital for a higher deposit can seem daunting but it can result in less borrowing and therefore a lower interest rate may be offered.

Some applicants may be able to secure their loan against current property that they already own in order to reduce the deposit they need but independent financial advice should always be sought before doing this.

Read Also: Usaa Rv Loan Terms

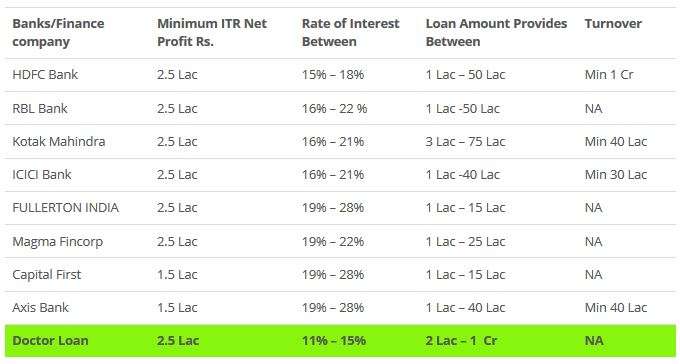

Average Interest Rates By Business Loan Type

Knowing the average interest rates on different types of business loans can help you determine if you’re getting a good deal.

Here are several average interest rate ranges for popular types of business financing, and the potential rate range for the Small Business Loan 7 loan program. The ranges come from Nav’s research:

- Traditional bank loans: 2% to 13%

- Online business loans and financing: 7% to 100%

- SBA 7 loans: 5.5% to 11.25%

- Invoice financing: 13% to 60%

The interest rates don’t include fees that creditors may charge, such as an origination fee on the amount you borrow or an annual fee on a business credit card.

How Much Does A Business Loan Cost

When taking out financing, its important to understand the true cost of financing. You can borrow hundreds of thousands of dollarsat a price. The interest you pay, as well as any fees the lender charges, contribute to your cost for financing. And if you miss a payment or are late, more fees can incur.

In the application process, carefully review the loan terms and conditions so you understand how much you will pay for the loan. You may be able to pay off the loan early to save on interest, though make sure you wont be charged an early repayment penalty fee.

Don’t Miss: Car Loan Calculator Usaa

How Are Commercial Loan Rates Determined

In general, the average commercial loan rates are determined by the market. Interest rates can dip low and then climb back up again depending on a range of factors impacting the economy at a given point in time.

On a case by case basis, your commercial loan rates are determined by your creditworthiness, loan terms, and other details. The best commercial mortgage rates are usually reserved for those with good credit, ability to make a substantial downpayment, and a history of on-time payments of other loans.

Factoring The Closing Costs

Besides gathering a significant down payment, you should prepare your finances for other expenses associated with closing a loan. Refer to the following commercial loan fees below:

Underwriting Fees

Commercial lenders pay a fee for the time their staff dedicate to underwriting and processing a loan request. This typically costs around $500 to $2,500. That fee must be stated in the term sheet and is usually paid upfront or via deposit once the loan term is implemented.

Lender’s Origination Points

Most banks and credit unions charge 0.25 to 0.5 of the loan amount for origination fees. For independent lenders, it can be 2 percent or higher because of the higher risk involved.

Appraisal Fees

Expect appraisal cost to be anywhere between $1,000 to $10,000. Large-scale commercial projects can even cost between $10,000 to $25,000 for appraisal.

Third-party appraisal is commonly done to analyze and estimate the value of the commercial property. Though it’s not strictly imposed, appraisal is commonly practiced by many private lenders. Third-party appraisal is especially required for federally-backed commercial real estate exceeding a value of $500,000.

Title Insurance Policy

Title search and insurance costs around $2,500 to $15,000. This protects the lender from financial losses in case there are claims against the property’s title.

Property Inspections

Environmental Report

Broker’s Fee

Recommended Reading: Firstloan Com Legit

Do Small Business Loans Have Fixed Or Variable Interest Rates

When taking a business loan, you must ask if it carries a fixed or variable interest rate.

Lets take a moment to understand the difference between the two:

- Fixed interest rate loan: If a loan has fixed rates, the interest rate remains the same during the life of the loan.

- Variable interest rate loan: The interest rate fluctuates based on an underlying benchmark rate. If the benchmark rate rises, your monthly installment goes up. If it falls, it goes down.

The problem with variable interest rate loans is that they are unpredictable. Youre never sure how much youll have to pay every month.

AtCamino Financial, the term loans we offer carry fixed rates. As a result, you know exactly how much interest you need to pay.

This makes it easier to plan your cash flows. It also protects you from getting an unpleasant surprise in the form of a higher monthly installment.

If youre looking for capital for your company, why dont you request a quote for a business loan with competitive terms from Camino Financial?

Commercial Real Estate Loan Types

There are several different kinds of commercial real estate loans to choose from:

- Conventional commercial real estate loan, offered by banks and other lenders, with terms ranging from five to 30 years, interest rates as low as 3.5 percent and a minimum down payment of up to 20 percent

- Commercial bridge loan, offered by various lenders, as a means to bridge the financing gap until longer-term financing is found terms usually span up to two years, with only a 10 percent to 20 percent down payment often required

- SBA 7 loan for up to $5 million over a max term of 25 years

- SBA 504 loan, comprising both a Certified Development Company loan portion for up to 40 percent of the loan plus a bank loan for up to 50 percent of the loan that collectively can max out at $5 million

- CMBS or conduit loan, part of a pool of commercial real estate loans sold on the secondary market most conduit lenders finance a max of $3 million, and terms usually span five to 10 years with an amortization of 20 to 30 years

- Hard money loan, which works like a bridge loan but is typically offered by a private lender

If youre looking to close on a transaction quickly or have less-than-perfect credit, youll probably have to work with a private lender, Moreno says.

Commercial real estate loans are also categorized by asset classes. These include apartment buildings, office buildings, medical buildings, industrial buildings and multi-unit versus single-tenant assets.

Recommended Reading: Usaa Car Buying Rates

What Does It Take To Qualify For A Low Interest Rate

Small business lenders will generally look at the following criteria when evaluating loan applications:

- The personal and/or business credit scores of the owners.

- Time in business

- Business income

Other factors such as loan amounts, collateral, and even the industry of the business may have some impact on the rate that will be charged.

Its not possible to control every factor that goes into your eligibility and your interest rate for a small business loan. But there are some things that you can do to reduce your overall credit risk to lenders.

What Is The Difference Between Residential And Commercial Interest Rates

Residential properties usually have much lower interest rates available than commercial properties. Additionally, the term and amortization typically match on a residential loan , whereas the term of a commercial loan is usually shorter than the amortization , causing the borrower to have to refinance or payoff the loan at or before the end of the loan term.

Also Check: Fha Mortgage Insurance Cut Off

Occupying More Than Half Of The Property

A small business is required to occupy 51 percent of the property or more than half of the premises. If you are unable to meet this criteria, you cannot qualify for a commercial mortgage. You should consider applying for an investment property loan instead.

Investment Property Loans

Investment property loans are appropriate for rental properties. Borrowers use them to buy commercial property and rent them out for extra profit. Investment property loans are also used by house flippers who renovate and sell houses in the market.