What Am I Reviewing On Your Bank Statements

Christopher Ulrich

Vice President, Mortgage Lending

Whether you are purchasing or refinancing a home, we need to review bank statements. Its important to know what we are looking for to prepare yourself for a smooth process.

In addition to assessing whether or not youre able to regularly make your monthly mortgage payments, another role of mine is to make sure you have enough money for a down payment and closing costs. Part of how we do this is by reviewing your bank statements. However, we look a little deeper than just your account balance when approving or denying you for a home loan.

Its important to make sure all your documents and records are sorted and straightforward before applying for a home loan.

How Do I Identify Fake Bank Statements

Fake bank statements can be identified by confirming the authenticity of the statements with the bank, inspecting actual documents closely and asking for original documents. Some people try to commit fraud using falsified bank statements when applying for a loan, while others create fake bank statements to cover up embezzlement or theft, according to IAG Forensics and Valuation.

If there is any doubt regarding the authenticity of a bank statement provided by a borrower, it is important to confirm the document’s accuracy with the originating bank, advises Investment at People. Bank statements often contain identifiable markings that a counterfeiter might overlook. Bank statements that have been printed on a computer are especially suspect, as the person committing the fraud may have altered or deleted entries. Computer-generated statements should be examined closely for inconsistencies in type face, print quality or color. Original bank statements likely are folded as a result of the mailing from the bank. Investment at People suggests that a business that may have received fake bank statements ask the originating bank to provide copies of statements for extra security.

Will I Have To Provide Bank Statements To Get A Mortgage If Im Self Employed

If you own your own business or are a contractor, you may be more likely to have to provide bank statements. Most mortgage lenders will also request at least 1-3 years worth of accounts to prove you have a reliable source of stable income.

You can read more in our guide on;mortgages for self-employed;people.

Also Check: How To Get An Aer Loan

How Underwriters Analyze Bank Statements On Regular Deposits

One of the things that a mortgage loan underwriter will analyze is regular deposits.

- For example, with regular payroll check automated deposited electronically to a bank account every other week, that will be looked at as normal and no further explanation is necessary

- The mortgage underwriter will look at the electronic deposit and notice being payroll check being electronically deposited by employers payroll service and that is okay

- If there are other regular deposits on a regular basis to the bank account, whether it is electronically or a physical deposit, the underwriter will ask and question what the source of the deposit is

Borrowers with part-time jobs that are being cashed by the employer and depositing that cash, that cash deposit cannot be used.

Can You Lie About Current Salary

It goes against every rule in the negotiating book. You wouldnt walk into a used car dealer and tell them what your absolute maximum budget is, because you can bet your last pound that, if you do, youll probably end up paying it. Lying about your salary in order to achieve more money from a new employer can backfire.

Also Check: Can I Refinance My Car Loan After 3 Months

A Guide To Bank Statements For Your Mortgage

6-minute read

Your lender will ask you for a few different financial documents when you apply for a mortgage including your bank statements. But what does your bank statement tell your mortgage lender, besides how much you spend per month? Read on to learn everything your lender might glean from the numbers on your bank statement.

Why Does The Lender Need My Bank Statements And How Do I Obtain Them

The reason a lender will need to see your bank statements is to learn more about you as a person and what your spending habits are like. How you have acted lately and the presentation of this on your bank statements can be the difference in how much a lender will let you borrow, if anything at all.This is down to risk. A lender needs to know youre responsible with your money and can be trusted to handle finances appropriately. After all, a mortgage is likely the biggest financial commitment you will ever make in your life and is not something to be taken lightly.Your bank statements are easily obtained either in the post from your bank, over the counter from your local bank, or as often seen these days, as a printable version from your banks online platform.;

Read Also: Can Other Than Honorable Discharge Get Va Loan

Who Has The Best Auto Refinance Rates

Category: Loans 1. 10 Best Auto Loan Refinancing Lenders of September 2021 Refinancing an auto loan could lower your rate and monthly payment, Apply to multiple lenders, because each one has different credit score requirements. Best Refinance Rates: OpenRoad Lending · Best Bank for Auto Refinance: Bank of America ·

How Do Mortgage Lenders Check & Verify Bank Statements

- Post author

- Post date September 29, 2021

If you seek a mortgage for buying a new home or for refurbishing, it has to be approved by a mortgage lender for you to get your loan. One of the major factors involved in loan approval is the verification of the borrowers financial information, but how do mortgage lenders verify bank statements for loan approval.

Banks and other financial institutions may demand a proof of verification deposit form to be filled in and sent to the borrowers bank for process completion. A proof of deposit may also require the borrower to provide a minimum of 2 consecutive months bank statements. During the loan approval process, if youve ever wondered why is verification of bank statements for mortgages required? then the answer is to reduce the chances of people with fake documents acquiring funds for illegal activities.;

With thousands of sophisticated technologies out there, it doesnt take more than minutes to forge bank statements and other documents. Keeping this in mind, mortgage lenders are legally obligated to identify and authenticate bank statements. In recent years, there have been multiple instances where mortgage lenders have been scammed out of their money with fake bank statements. To save themselves such cases of financial fraud, mortgage leaders need to find ways to check and verify bank statements.

Also Check: What Is The Current Va Loan To Value Rate

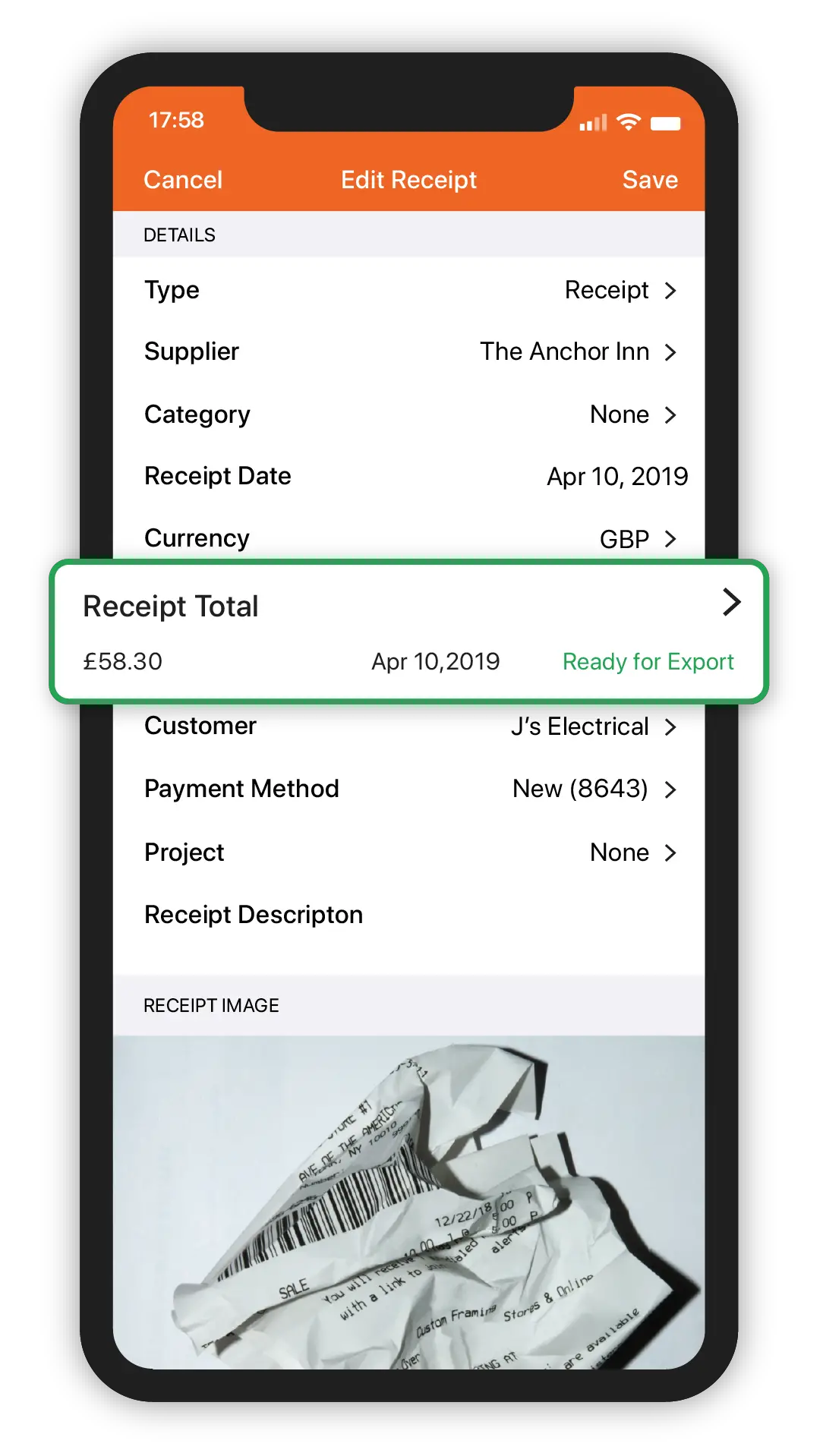

A Faster Alternative To Uploading Bank Statements

Instead of logging into your online banking, downloading your bank statements and uploading them to your loan application , you can get this all done in one quick step.

In this digital age theres a solution for all you time-deprived business owners.

Instead of providing your bank statements the old fashioned way, when you apply for a business loan through Become;you can now simply link your bank account to your loan application and youll unlock optimal funding options from the top lenders. This gives you better results, in a fraction of the time.; Read on to learn more about the benefits of linking your bank account.;

Theres also the added benefit of saving the lender from having to verify your bank statements, which means an even quicker approval for you.

At Become, we use Plaid, one of the leading and most secure services available, to enable our customers to link their bank accounts to their loan applications. You dont need to know the technicalities behind how Plaid works .

What will interest you though is that one in four Americans with a bank account now uses Plaid. In a country where 93.5% of people have bank accounts ;, this means that 81.4 million people in the US use Plaid.

Plaid works with top companies including Citi, American Express, Venmo and more. The company is rock-solid and growing and, according to Forbes, Plaid is now valued at $2.65 billion.

Value Add Of Loanconnect:

LoanConnect is an account verification software that is; affordable, secure, extremely efficient and most importantly provides higher level monitoring lessening the prospect of a defaulted loan.

Here are the key benefits:

*;Access Actual PDF Statements:

Via the LoanConnect product from 3RDVISTA a lender can view the;actual;PDF Bank statement as it exists on the Bank’s web site. We have heard horror stories of tens of thousands of dollars lost on a single loan because the PDF Bank statements were photo-shopped and assumes that the statements are legitimate.

The possibility of a “doctored” Financial statement is;impossible;via LoanConnect, since the technology logs into the bank’s web site and extracts the PDF automatically.;In other words, no hands touches the pristine bank statements.;Via the statements you can verify and match the borrower’s Account Name, Account Address, Account Number, transactional data and more.

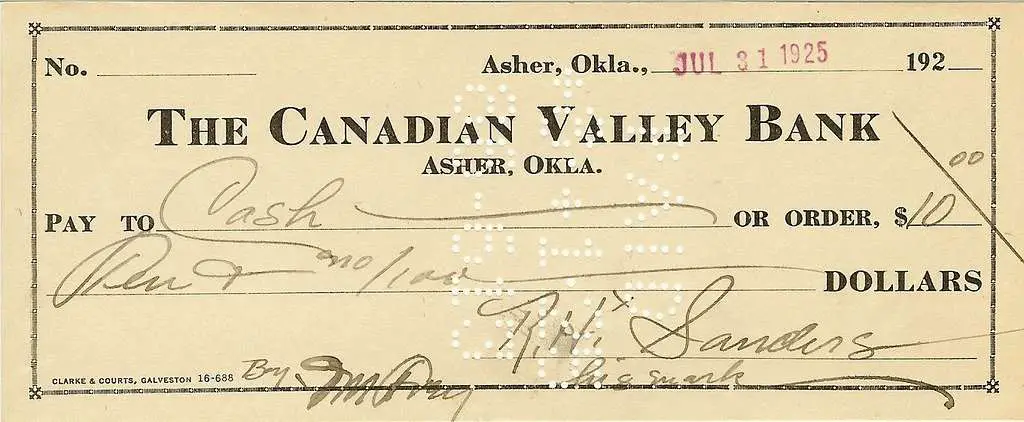

* Check Images:

An additional value add to LoanConnect is that this technology pulls in check images as well. Imagine doing your due diligence and viewing a check transaction ;for $10,000. As a lender I would be nervous. Is this $10k in revenue, is it check from Grandma or even a check from another lender ? ;LoanConnect as part of our account verification process allows you view the check image payee so that no suspicious transaction is ever left unanswered.

* Extremely Efficient:

* Daily Monitoring:

Article authored;by Maurice Berdugo

You May Like: What Is Fha And Conventional Loan

Why Do Mortgage Companies Look At Bank Statements

It helps to be prepared and understand why mortgage companies look at bank statements and what transactions may raise questions. Before applying for a loan, we recommend reviewing your recent bank statements and asking yourself these six questions. If potential issues come up, you may need to explain what youve done to address them.

What Is Account Verification

Account Verification is probably one of the best “tools” out there in the market to validate and vet a prospective borrower, prior to funding a loan. Account Verification is the process of requesting a borrower’s login credentials to their online bank and verifying via the bank that the borrower has cash flow and is in good standing. In short, you are securely accessing the borrower’s financial institution and looking up history, cash flow and verifying that the borrower is a real person with a real bank account with real cash flow. ;This is not new!

Consider this – ;Has a mortgage lender ever financed a loan without asking the prospective borrower for 3+ months of monthly statements? Account Verification technology takes this a step further. ;Let me describe the benefits as we see it via our technology at LoanConnect

Read Also: Who Will Loan Money With Bad Credit

What Is A Verification Of Deposit And Do I Need One

A verification of deposit is a document from your bank that verifies the deposits listed on your loan application. It shows the lender that the cash is yours and that you can access it to fund your down payment and closing costs, or that you have enough to draw from in the event of a financial setback.

You do need verification, but your bank statements might be enough to satisfy your lender. If not, the lender can send your bank a Request for Verification of Deposit form, in which case your bank will supply the lender with the information it needs.

Things Mortgage Lenders Dont Want To See On Bank Statements

You might want to take a look at your bank statements with a mortgage underwriters eye before turning them into the lender.

Thats because the lender looks for red flags that, if found, can require lengthy explanations.;

Mortgage underwriters are trained to unearth unacceptable sources of funds, undisclosed debts, and financial mismanagement when examining your bank statements.

Here are three things you can look for on your bank statements that might turn up a red flag for a mortgage company.

Read Also: Can Closing Costs Be Rolled Into Fha Loan

Special Considerations For Bank Statement Loans

- You may use statements form more than one bank account, but they cannot be a combination of personal and business accounts.

- Deposits which are transferred from a business account into a personal account are acceptable.

- You may combine W2 income with bank statement income as long as the income is not being double counted.

- No commingling of funds.

- Foreign Bank Statements and Foreign Assets may be considered and must be translated to English.

What Underwriters Look For On Your Bank Statements

The underwriter the person who evaluates and approves mortgages will look for four key things on your bank statements:;

An underwriter generallywants to see that the funds in your bank accounts are yours, and not borrowedfrom someone else .;;

In other words, any funds used toqualify for the mortgage need to be sourced and seasoned.

Sourced means its clear wherethe money came from, and any unusual deposits are explained in writing. Andseasoned typically means the money has been in your account for at least 60days.

Bank statements also prove tounderwriters that you havent opened up any credit accounts or created new debtprior to getting the mortgage.;

Also Check: Are Jumbo Loan Rates Higher Than Conventional

Are There Other Types Of Loans That Require Bank Statements

There arent any other loans that require bank statements, but you can use bank statements as a way to prove your income and qualify for other types of mortgages. In fact, you can use bank statements as one source of income verification for many of our Non-QM loans, such as jumbo loans and asset-based loans.

How Do Lenders Verify Your Income

The first step towards verifying your income and getting your loan approved is submitting the lender’s right documents, like KYC documents, bank statements, income statements, etc. In the case of a personal loan, the documentation required is far less, and you can get a quick approval after a few basic checks.

You can avail of special pre-approved offers on home loans, business loans, EMI financing of products, and other financial services from Bajaj Finserv. All you need to do is share a few basic details to check out the offer and submit the required documents online to get instant approval.

Here are some key verification parameters that your lending organization will dig into while verifying your income:

Recommended Reading: Can Closing Costs Be Included In Refinance Loan

Does Quicken Loans Do Bank Statement Loans

Bank statementslendersQuicken LoansmakeQuicken Loans

A stated income loan is a type of mortgage for borrowers who are unable to provide tax returns or pay stubs to prove their income. Since the lender can’t verify your stated income, a higher credit score and down payment may be required to compensate for the risk being taken by your lender.

Secondly, what do loan officers look for in bank statements? Lenders look at bank statements before they issue you a loan because the statements summarize and verify your income. Your bank statement also shows your lender how much money comes into your account and, of course, how much money is taken out of your account.

In respect to this, do loan companies check your bank account?

Payday lenders request your bank account details generally your account number and routing number for a number of reasons. One reason is to verify that you’re eligible, since most loans require you to have an operating bank account to qualify. You may also have to provide copies of your actual bank statements.

Do mortgage lenders ask for bank statements?

Mortgage lenders require you to provide them with recent statements from any account with readily available funds, such as a checking or savings account. In fact, they’ll likely ask for documentation for any and all accounts that hold monetary assets.

How Far Back Do Mortgage Lenders Look At Bank Statements

As above, most providers will request the 3 most recent months of bank statements. A handful may request 1 or 2 months worth, while others might ask for up to 6 months.

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Recommended Reading: Which Bank Gives Loan For Land Purchase