Why Is Ltv Ratio One Of The Top Metrics Every Investor Should Know

The loan to value ratio can be used for many different purposes. Investors often use the LTV ratio when making key decisions about when to sell or refinance. A low LTV is a clear signal that a lot of equity has accumulated in a property. When this happens, investors often look to re-deploy some of that equity into new investments. They typically accomplish this one of two ways: 1) sell the asset, 2) cash-out refinance.

Lenders often use the LTV to assess the relative strength of their position and the potential risk of a borrower default. When an LTV is low, lenders know that the borrower has a lot of equity in the deal and is less likely to walk away. As an LTV rises towards 100%, the loan is increasingly at risk of default since the borrower has less remaining equity to lose.

On the front end of an acquisition, lenders typically assess how much of the total purchase price theyre willing to finance based on a loan to value ratio. Some lenders are comfortable with higher LTVs while others are more choosy and prefer to work with borrowers who bring more skin to the table.

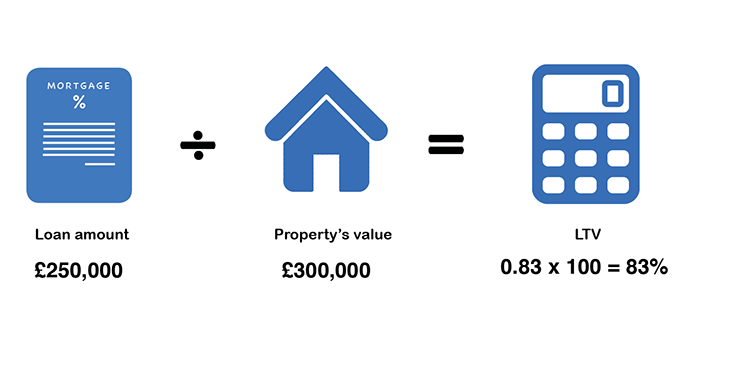

And now for a case study.Lets imagine Chris is a Stessa investor and owns a single-family rental house in Kansas. The property has a current market value of $292,857 and the current debt balance is $171,923. So his LTV ratio is:

$171,923 / $292,857 = .587 or 58.7% LTV Ratio

When Your Ltv Ratio Is Over 100%

When the housing market is down, home prices will begin to fall. If your home is worth less than the principal balance on your mortgage loan, youre considered underwater. Being underwater on your mortgage means you owe more than its worth.

Fortunately, government programs can help borrowers who are underwater to refinance their mortgage and get a lower monthly payment and rate.

|

Home Affordable Refinance Program |

Borrowers unable to refinance their loan because the value of their home has declined may be eligible through HARP to lower their monthly payments. |

|

Principal Reduction Alternative |

PRA was designed to help homeowners whose homes are worth significantly less than they owe by encouraging servicers and investors to reduce the amount you owe on your home. |

|

Treasury/FHA Second Lien Program |

Your second mortgage on the home may be reduced or eliminated through FHA2LP. If your second mortgage servicer agrees, the total amount of your mortgage debt after refinancing cannot exceed 115% of the market value of your home. |

What Does Loan To Value Mean In Real Estate And How Do You Calculate It

Financial institutions and other lenders use the loan-to-value ratio to determine how much risk theyre taking on with a secured loan. Loan assessments with high LTV ratios are typically seen as higher-risk loans and may come with higher interest rates and could require the borrower to purchase mortgage insurance.

While the loan-to-value ratio can apply to any secured loan, it is most commonly used with mortgages. Investors can use the LTV ratio when making decisions about when to sell or refinance a property.

Read Also: How Much Car Can I Afford Based On Income

Possible Effects On Insurance

If you pay private mortgage insurance on your mortgage, keep an eye on your LTV ratio. Your lender is required by federal law to cancel PMI when a homeâs LTV ratio is 78% or lower than the homeâs original appraised value . This cancellation is generally preplanned for when your loan balance reaches that percentage. However, if your LTV ratio drops below 80% because of extra payments you made, you have the right to request your lender cancel your PMI.

What Is Considered A Good Ltv

For the most part, borrowers looking to take out a conventional loan will want to have a loan to value ratio of 80% or less. As was mentioned earlier, PMI is usually required for mortgages with LTV ratios greater than 80%. PMI could potentially add thousands of dollars to a borrowers payments throughout their loan.

Note that, however, not all loans are the same. Those looking for a federally backed government loan can carry a higher LTV because these loans often require a lower down payment. For example, an FHA loan only requires a 3.5% down payment which would leave the borrower at an LTV ratio of 96.5%. Additionally, both the USDA and VA loans dont require any down payment, making those loans carry a 100% LTV ratio.

Keep in mind that many federal loans will require a form of mortgage insurance or come with extra fees in closing costs to offset the risk associated with their high LTV ratios.

Also Check: Bayview Loan Servicing Class Action Lawsuit

What Is The Loan

The loan-to-value ratio is an assessment of lending risk that financial institutions and other lenders examine before approving a mortgage. Typically, loan assessments with high LTV ratios are considered higher risk loans. Therefore, if the mortgage is approved, the loan has a higher interest rate.

Additionally, a loan with a high LTV ratio may require the borrower to purchase mortgage insurance to offset the risk to the lender. This type of insurance is called private mortgage insurance .

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Also Check: Average Apr For Motorcycle

How Is The Ltv Ratio Calculated

Calculation of the LTV Ratio

The maximum allowable LTV ratio for a first mortgage is based on a number of factors including, the representative credit score, the type of mortgage product, the number of dwelling units, and the occupancy status of the property.

The following table describes the requirements for calculating LTV ratios for a first mortgage transaction. The result of these calculations must be truncated to two decimal places, then rounded up to the nearest whole percent. For example:

-

94.01% will be delivered as 95%, and

-

80.001% will be delivered as 80%.

The rounding rules noted above also apply to the CLTV and HCLTV ratio calculations. Lenders’ systems must contain rounding methodology that results in the same or a higher LTV ratio.

| Underwriting Method |

|---|

Why Do Mortgage Lenders Offer Lower Interest Rates With At Lower Loan To Value Ratios

Lending money is all about risk. The risk in this instance is all about whether you, the mortgage borrower will repay the mortgage and interest payments so that the mortgage lender makes a profit. You may be thinking that the risk is the same regardless of how much you borrow. Sadly, that isn’t true, let’s look at why.

When mortgage lenders look at lending you money in the form of a mortgage, they look at the following factors:

Recommended Reading: Should I Choose Fixed Or Variable Student Loan

What Is Loan To Value

Loan to value is all about how much your mortgage borrowing is in relation to how much your property is worth. It’s a percentage figure that reflects the proportion of your property that is mortgaged, and the amount that is yours .

For example, if you have a mortgage of £150,000 on a house that’s worth £200,000, you have a loan-to-value of 75% therefore you have £50,000 as equity. Loan-to-value becomes a key consideration when you come to buy or sell your property, remortgage or release equity.

Bottom Line: What Is Loan

Your loan-to-value ratio reveals the size of your home loan compared to the appraised value of the home you intend to purchase.

And the lower your LTV ratio, the higher your chances of getting approved for a mortgage.

Keeping your LTV ratio at 80 percent or below is one of the many ways to avoid paying for mortgage insurance and high-interest rates.

Before applying for a mortgage loan, it is advisable that you save up for a more significant down payment, shop across lenders, and find homes within your budget.

While your LTV ratio is a small piece of a bigger pie, it can impact the money you spend monthly on mortgage payments.

Keep Reading:

You May Like: Rv Loan Rates Usaa

Fha Loan: Up To 965% Ltv Allowed

FHA loans are insured by the Federal Housing Administration, an agency within the U.S. Department of Housing and Urban Development .

FHA mortgage guidelines require a downpayment of at least 3.5 percent. Unlike VA and USDA loans, FHA loans are not limited by military background or location there are no special eligibility requirements.

FHA loans can be an especially good fit for home buyers with lessthanperfect credit scores.

Why Ltv Is Important In Real Estate

LTV is important when you buy a home or refinance because it determines how risky your loan is.

The more you borrow compared to your homes value, the riskier it is for lenders. Thats because if you default on the loan for some reason, they have more money on the line.

Thats why all mortgages have a maximum LTV to qualify. The maximum loan to value can also be thought of as a minimum down payment.

For example, the popular FHA loan program allows a down payment of just 3.5%. Thats the same as saying the program has a max LTV of 96.5% because if you make a 3.5% down payment, the most you can borrow is 96.5% of the home price.

Recommended Reading: Capital One Pre Approved Auto Loan Program

Choose The Right Mortgage

If you cannot provide a considerable down payment or find a less expensive house, you may want to consider mortgage loans with lower down payment requirements.

Loan programs like USDA and VA loans do not require a down payment, but you must meet the necessary eligibility requirements.

Also, you can take advantage of FHA loans and conventional loans that require as little as a 3.5% down payment.

Fannie Mae And Freddie Mac

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. However, they require mortgage insurance until the ratio falls to 80%.

For FHA, VA, and USDA loans, there are streamline refinancing options available. These waive appraisal requirements so the home’s LTV ratio doesn’t affect the loan. For borrowers with an LTV ratio over 100%also known as being “underwater” or “upside down”Fannie Mae’s High Loan-to-Value Refinance Option and Freddie Mac’s Enhanced Relief Refinance are also available options.

Also Check: Bayview Loan Servicing Payments

Maintaining And Increasing The Value Of Your Property

By keeping your house ‘in order’ you will minimise any loss of value if house prices go down. You can even increase your property’s value by carrying out home improvements like replacing the windows and doors with uPVC, upgrading the kitchen or bathroom and adding things like an en-suite. These may well increase the value of your property and give you a bigger equity in the process. This could, in turn, help lower your LTV when it’s time to remortgage.

What Is A Good Loan To Value Ratio

From a lenders perspective, an 80% loan to value ratio is ideal because it minimizes their risk of losing money if the borrower defaults. Thats why home buyers with 20% down, and an 80% LTV, get special perks like avoiding mortgage insurance.

But and its a big but it doesnt always make sense to aim for 80% LTV. Because a 20% down payment is simply not doable for many home buyers.

Therefore, a good loan to value ratio depends on your home buying goals. For one person, 100% might be a good LTV. For another, 70% might be ideal.

Heres what to consider.

If your goal is to make a small down payment and buy a home sooner, look for one of these mortgage programs with high LTV allowances:

- USDA loan 100% LTV

- Conventional 97 loan 97% LTV

- HomeReady & Home Possible 97% LTV

- FHA loan 96.5% LTV

If your goal is to get the lowest possible interest rate and minimize your overall loan costs, you should aim for a lower LTV. This usually means getting a conventional loan with 10%20% down.

You May Like: Marcus Goldman Sachs Loan Reviews

Whats Behind The Numbers In Our Loan

This calculator helps you unlock one of the prime factors that lenders consider when making a mortgage loan: The loan-to-value ratio. Sure, a lender is going to determine your ability to repay including your , payment history and all the rest. But most likely, the first thing they look at is the amount of the loan youre requesting compared to the market value of the property.

An LTV of 80% or lower is most lenders sweet spot. They really like making loans with that amount of LTV cushion, though these days most lenders will write loans with LTVs as high as 97%.

Lets see how your LTV shakes out.

Mortgage Loan To Value Calculator

The chances are that you are reading this Mortgage guide because you are doing your homework in reperation for buying a new home and keep encountering the term Loan to value or seeing the Letters LTV displayed after mortgage deals or in mortgage offers when comparing mortgages.

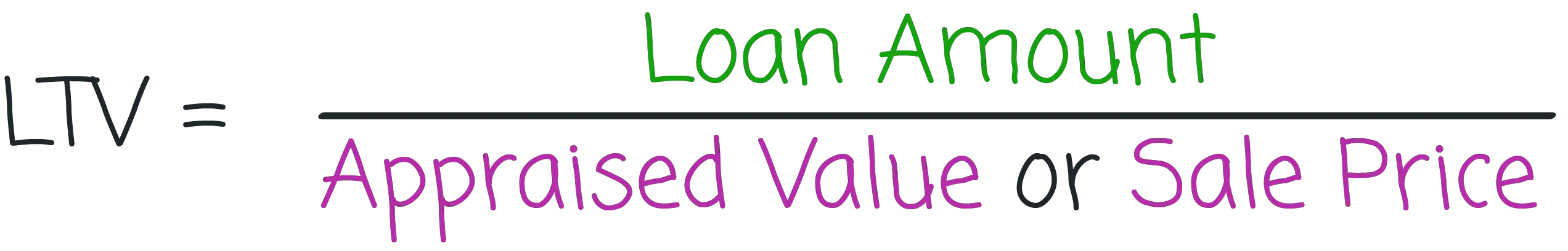

Loan to Value is actually a very simple calculation:

LTV = pp – mr

- pp = Property Price

- mr = Mortgage Required

So, a maximum LTV of 90% is basically the same as saying a minimum of 10% deposit required, at the end of the day, they equate to the same figure. Most homebuyers prefer to work in real terms they understand, the deposit amount is a more practical figure to focus on as this is a target that you need to save to achieve the next step of buying a home.

Our loan to value calculator also has an input field for you to enter the current deposit you have saved. This will then provide the deposit as a percentage of the property price and calculate how much more you have to save to meet the Loan to Value requirement .

Loan to Value Mortgage Calculator| £ |

| Loan to Value |

|---|

| Loan to Value |

|---|

Don’t Miss: Www Upstart Com Myoffer

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Private Lenders And Secured Mortgage Options

If your credit has been damaged or income may have been reduced, private lending options are widely available for an Ontario homeowner. A private lender will be calculating the LTV on a secured private loan option just as all the other lenders in the Province.

Unlike other lenders that may lend up to 95% LTV, private lenders will be able to provide loan options based on LTV that will not exceed 75% LTV for homeowners that do not have strong credit or unable to meet the criteria that are required by the banks. Private lenders will assess the LTV and look at the property location when determining mortgage loan approval. These mortgage loans will be short-term loans and will be negotiated faster than with other Ontario lenders. Mortgage Broker Store can help you achieve your mortgage goals. We have access to a broad network of private lenders throughout the Province who can negotiate various private mortgage loan options depending on your unique set of financial circumstances. Dont hesitate to contact us at your convenience to secure your mortgage goals.

Don’t Miss: Average Interest Rate For Commercial Real Estate Loan

Summary: Ltv Is Just One Factor

Remember, your LTV is only one piece of your mortgage application. The lower your LTV, the lower your interest rates and mortgage insurance is likely to be. Understanding your LTV can help you determine if youre ready to get a mortgage and show you what home loans are available to you.

Our Home Loan Experts can guide you through each loan option and help you decide what will work for you. Visit Rocket Mortgage®or give us a call at 785-4788.

Financing Options For High Ltv Ratios

Depending on other factors, such as your credit history, existing debt and income, lenders may very well approve your loan application even with a high LTV. Youll need to pay private mortgage insurance each month until youve gained 20% equity in your home, but that could be a price worth paying to become a homeowner sooner rather than later.

But lets say youve checked with a few different lenders and none of them are willing to extend a mortgage with your current LTV. What then? There are several loan programs you can use to get over this speedbump:

- FHA loans

Also Check: Fha Loan Limits Harris County