What Are Fha Loan Requirements In Nc And Sc

FHA loans in Charlotte, NC or other areas in the Carolinas are available to buyers as long as they meet FHA loan requirements. North and South Carolina FHA loan requirements include:

- A credit score of at least 580. However, if your score is between 500 and 579, you may still be eligible for an FHA loan if you make a down payment of at least 10% of the homes purchase price.

- Borrowing no more than 96.5% of the homes value through the loan, meaning you need to have at least 3.5 percent of the sale price of the home as a down payment.

- Choosing a home loan with a 15-year or 30-year term.

- Purchasing mortgage insurance, paying 1.75% upfront and 0.45% to 1.05% annually in premiums. This can be rolled into the loan rather than paying out of pocket.

- A debt-to-income ratio less than 57% in some circumstances.

- A housing ratio of 31% or less.

FHA lenders in NC and SC will provide you with all the information you need and can help determine if you qualify for an FHA loan.

Income Requirements for FHA Loans

Theres a common misconception that FHA loan requirements include income restrictions. While FHA income guidelines can be confusing, FHA loans are available to those who have any type of income. There are no minimum or maximum income requirements.

How To Find The Max Fha Loan Amount For Your County

HUDs search engine can help you figure out what the limit is in your area. You can search the limits based on your county or metropolitan statistical area. This is often defined by the nearest urban area, like Detroit or Chicago.

In addition to finding the FHA limit, the search engine has a couple of other neat features for home buyers. The table that comes up in the search results will show you the median sale price for the area you searched on, which can help you compare the affordability of the different regions at a glance.

Of course, this is only a very broad first look. There are typically many counties around a big city with different areas that have varying price ranges for homes.

In addition to finding the limits on FHA loans, you can use the engine to find the local limits on Fannie Mae and Freddie Mac loans. These are known as conforming loans, and the limits will apply to VA loans as well.

How New Fha Loan Limits Are Calculated

The FHA limits loans to 115% of the median home price in a county. A median price is not the same thing as an average price, although the two numbers may be similar. The FHA uses the median price to estimate the typical price of a typical house.

Home prices vary from county to county, so the FHA takes this into account when it sets its county loan limits. For example, the FHA loan limit for New York County is $822,375 in 2021. The loan limit for Niagara County is $356,362. The current median home price in New York City is higher than that in Buffalo, so the limit is higher as a result.

These median home prices are based on the Home Price Index as calculated by the Federal Housing Finance Agency and includes figures for the 50 states and the District of Columbia.

If you are thinking about buying a house, knowing your FHA county loan limit and how much money you might be able to borrow is important. It is also important to decide how much money you can afford to spend on a house. You can use our Mortgage Affordability Calculator to get an estimate of a house price you may be able to afford.

Freedom Mortgage is the #1 FHA lender1 in the United States. Your Freedom Mortgage Loan Advisor can help you explore options to make the right decision about an FHA loan. Get Started todayor call us at .

1. Inside Mortgage Finance, Jan-Mar 2021

Other Insights

Recommended Reading: How Do I Find Out My Auto Loan Account Number

Usda Financing: Zero Down

If youd like to live-in a much less densely populated place, you might be qualified to receive a USDA financing with zero down.

Whichs inclined than you possibly might consider: around 97percent with the United states landmass is so specified, like some suburbs.

But these mortgages are arranged for many with regular incomes to 115percent of the areas average as exact. For instance, homebuyers near Portland, Oregon can make around $105,950 and still be eligible. Theres a high probability that youre income-eligible.

Youve kept to cover some mortgage insurance rates on a USDA mortgage, but most likely significantly less than you might with an FHA one.

The Beginnings Of The Fha

In 1934, the United States was starting to recover from the Great Depression, and around one in four people found themselves renting their homes instead of buying them. The Federal Housing Administration was established to get more people owning their homes quicker.

In 1934, getting a home mortgage was a difficult process as credit standards tightened in response to the stock market crash of 1929 & the ongoing great depression. The individual who wanted to obtain the home loan had to pay up to 50% of the loan’s cost as a down-payment. Additionally, the mortgages usually came with five-year balloon payment terms. This would be a hard loan to obtain today, and it was nearly impossible by 1934’s standards.

The government wanted to increase the number of people who owned their homes. To do this, they introduced the FHA loan program. The government believed that the more people who owned their homes, the more stable neighborhoods would be, and the quicker the economy would improve.

The FHA loan program came with its Mortgage Insurance Premium program, and this program insured lenders against any ‘bad’ loans. Once the FHA program caught on, people saw mortgage rates dropping, the requirements dropped, and the traditional five-year mortgage was replaced with 15 and 30-year terms. Today, the FHA is the biggest mortgage lender in the world.

Recommended Reading: How Much Car Loan Can I Afford Calculator

Minimal Fha Downpayment By Credit Score

Your own downpayment selection with an FHA financing is determined by your credit score. Who happen to be the exclusions to the 3.5%-minimum rule? Homeowners that happen to be already borderline individuals due to their existing credit or really low credit scores. They could be in a position to persuade lenders to agree her programs by placing lower 5per cent or 10%.

In practical terminology, meaning the minimum credit score requirement of an FHA loan with a 3.5% downpayment are 580. If your own website is or more, it is possible to typically put-down 3.5per cent.

However, if your own try 500-579, you could nevertheless become approved if you develop a 10percent advance payment.

How Much Of An Fha Loan Can I Qualify For And Afford

We receive a lot of questions from readers that fall into the how much category. Some of the most frequently asked questions in this area include:

- How much house can I afford with an FHA loan?

- How much of a mortgage loan can I qualify for?

- How much money do you have to make to qualify for an FHA loan?

All of these questions are addressed below. Well start by looking at the official guidelines issued by HUD. Then well look at how mortgage lenders use those guidelines to determine how much of an FHA loan you might qualify for, based on your income.

Short answer: The general rule for FHA loans is 43% debt-to-income ratio. This means your combined debts should use no more than 43% of your gross monthly income after taking on the loan. But there are exceptions. If you have a lot of cash in the bank, and/or other sources of income, you could get approved with a ratio up to 50%.

You May Like: Firstloan Com Legit

How Do You Qualify For An Fha Loan

Because FHA loans are backed by a government agency, they’re usually easier to qualify for than conventional loans. The purpose of FHA loans is to make homeownership possible for people who would otherwise be denied loans.

You don’t need to be a first-time homebuyer to qualify for an FHA loan. Current homeowners and repeat buyers can also qualify.

The requirements necessary to get an FHA loan typically include:

- A credit score that meets the minimum requirement, which varies by lender

- Good payment history

- No history of bankruptcy in the last two years

- No history of foreclosure in the past three years

- A debt-to-income ratio of less than 43%

- The home must be your main place of residence

- Steady income and proof of employment

What Are The Fha Mortgage Qualification Requirements

The FHA program is designed for low and middle-income Americans, but you dont have to be eating ramen noodles five nights a week to qualify. There are no minimum or maximum salary requirements.

You must, however, have at least two established credit accounts like a car loan or credit cards. And you cant have any outstanding debts to the federal government.

Applicants also must have a FICO credit score of at least 580 if they want to qualify for the lowest down payment, which hovers around 3.5%. The average FICO score for a first-time homebuyer using an FHA loan was 668, in 2019. For repeat buyers it was 673.

You are not out of luck if your score is less than 580. It just means youll have to put down a 10% down payment if you want a loan.

If your FICO score is below 500, you probably are out of luck and need to enroll in a debt management program before attempting to buy a cheeseburger, much less a house.

FHA loans also have a debt-to-income requirement. That is determined by taking your monthly bills and dividing that by your gross monthly income.

For instance, if your monthly bills are $2,000 and your monthly pay is $5,000, your DTI is 40% . To qualify for an FHA loan, your DTI cannot be above 50%.

Don’t Miss: How To Refinance An Avant Loan

Downsides Of Fha Loans

- Mortgage insurance can be costly. You may pay a price for making a small down payment. Youll have to pay a one-time upfront mortgage insurance premium, as well as an annual premium thats collected in monthly installments. The one-time premium is generally equal to 1.75% of the home purchase price and can be financed in the mortgage or paid for in cash but not a combination. The annual premium depends on your loan amount and loan-to-value ratio.

- Theres a limit to how much you can borrow. The FHA establishes loan limits based on median home prices in metro areas and counties. As of July 2020, the FHA maximum for a single-family home in a low-cost area is $331,760 while its $765,600 in a high-cost area. Alaska, Hawaii, Guam and the Virgin Islands are exceptions with a maximum of $1,148,400 for a single-family unit. These loan limits change periodically, so be sure to check for updated information. The Department of Housing and Urban Development has a search tool on its website to identify mortgage limits by county and state, so you can find out how much youre able to borrow where you live.

- Good credit? Consider other options. If you have strong credit and dont have enough money for a large down payment, you still might want to consider other options because of FHA loans mortgage premiums. Just keep in mind that if you dont put at least 20% down, youll likely have to pay private mortgage insurance, or PMI.

With An Fha Financing Nearly All Consumers Will Be Able To Shell Out As Few As 35per Cent Of Homes Purchase Price As A Downpayment

But, as with all mortgage loans, youll probably bring a lesser financial speed if you possibly could find a way to scrape collectively much more maybe 5%.

But a bigger down-payment is normally not important for FHA homeowners. Generally, theyre nervous purchasing a home as quickly as possible to allow them to be on the best part of climbing home values.

Also Check: Car Refinance Usaa

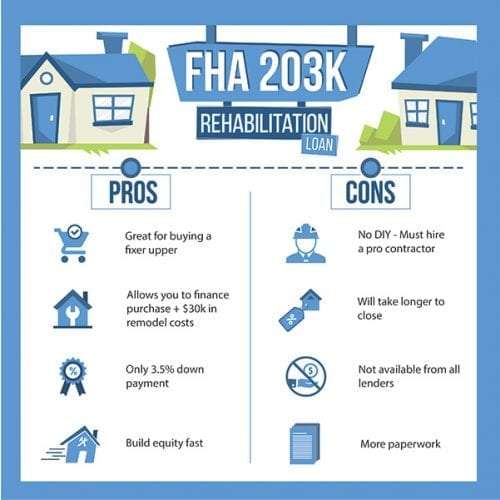

What Are The Pros And Cons Of Fha Loans

Even if your credit score and monthly budget leave you without other choices, be aware that FHA loans involve some trade-offs.

Benefits of FHA loans:

-

Lower minimum credit scores than conventional loans.

-

Down payments as low as 3.5%.

-

Debt-to-income ratios as high as 50% allowed.

Disadvantages of FHA loans:

-

FHA mortgage insurance lasts the full term of the loan with a down payment of less than 10%.

-

Property must meet strict health and safety standards.

-

No jumbo loans: The loan amount cannot exceed the conforming limit for the area.

Even though the FHA sets standard requirements, FHA-approved lenders’ requirements may be different.

FHA interest rates and fees also vary by lender, so it’s important to comparison shop. Getting a mortgage preapproval from more than one lender can help you compare the total cost of the loan.

» MORE:Learn how to compare FHA lenders

How To Apply For An Fha Loan

Applying for an FHA loan will require personal and financial documents, including but not limited to:

-

A valid Social Security number.

-

Proof of U.S. citizenship, legal permanent residency or eligibility to work in the U.S.

-

Bank statements for, at a minimum, the last 30 days. You’ll also need to provide documentation for any deposits made during that time .

Your lender may be able to automatically retrieve some required documentation, like credit reports, tax returns and employment records. Special circumstances like if you’re a student, or you don’t have a credit score may require additional paperwork.

» MORE: Detailed FHA loan requirements

Recommended Reading: Becu Car Repossession

You Need To Show Consistent Income

There are no income or salary requirements or limits to qualify for an FHA mortgage, but youll need to show steady earnings.

Pay stubs and consistent tax returns are important when you apply. FHA lenders want to make sure you have worked in the same field of work for at least a couple of years. Consistent work for a year or more with the same employer helps, too.

Downsizing On Home Purchase With Social Security Income

A large percentage of Americans decide to downsize to a smaller home when they retire or when their children leave the home and are on their own.

- Many times they choose a smaller home but more expensive home because it might be waterfront or golf course frontage

- Even though borrower might have a substantial down payment and a lot of assets, they might run into problems in obtaining a mortgage loan if they retire and qualify with only their social security income

There are options and creative ways of obtaining a mortgage for those planning on retiring.

Read Also: What Is The Commitment Fee On Mortgage Loan

Fha Loan Vs Conventional Loan: Which Is Right For You

FHA loans are commonly compared to conventional home loans to determine which will best fit your situation.

When you meet with your Mortgage Coach at Dash Home Loans, well look at various types of loans available to you. Well help you compare FHA loans to conventional loans as well as others that are applicable in your situation. Our Mortgage Coaches are experienced and will provide in-depth information, but as youre researching loans yourself, here are a few differences to keep in mind:

- The minimum credit score for an FHA loan is 500. For a conventional loan, it is 620.

- Down payments for FHA loans are 3.5%, at least. For conventional loans, it is typically 3% to 20% depending on the lender.

- Loan terms for FHA loans are 15 or 30 years, while conventional loans offer 10, 15, 20, and 30 year loans.

- You have to purchase mortgage insurance with FHA loans, but not with most conventional loans.

- Conventional loans can be more restrictive with what is allowed to be used for gifts for down payment. One hundred percent of your down payment can be a gift with an FHA loan regardless of the down payment percentage. However, there are restrictions here too. If your credit score is below 620 and you get an FHA loan in NC, SC, or another state, you may need to pay at least 3.5% of the down payment yourself.

But Dont Expect To Buy A Mansion With An Fha Loan

You may see a swimming pool and a big house for you and your family. But be realistic. There are limits to how much you can borrow with an FHA loan.

These limits vary by county and are based on home prices in the area. If you can afford a home that costs more than the limits, chances are you dont need an FHA loan and can qualify through for a conventional loan, i.e., one that isnt backed by the government.

You May Like: What Happens If You Default On Sba Loan

Second Home Purchase With Social Security Income

One way John can go about getting his Florida dream home is to see if he can purchase it while he is still employed full time as long as he can afford it.

- John should seek the advise of a Florida mortgage broker

- John should see if he can purchase his Florida home as a second home with a conventional loan

- Second homess interest rates are almost the same as owner occupied home interest rates

- Under Fannie Mae Guidelines On Second Homes, second home mortgages require 10% down payment

- John should consider getting a conventional loan versus a FHA loan

- This is because with a conventional loan, he can cancel his private mortgage insurance premium once his loan to value of his home is at 80%

Whereas with a FHA loan the mortgage insurance will be in effect throughout the term of the loan.