Choosing The Right Mortgage Term

Mortgage terms vary so that you can take advantages of opportunities that align with your current financial circumstances. There are advantages to both short- and long-term commitments. Well help you make the right choice.

| Term | ||

|---|---|---|

| Short | Shorter terms typically have lower rates. You have the option to renew your mortgage more often, taking advantage if interest rates decline. | You could find yourself having to renew your mortgage at a higher rate if interest rates increase. Short-term mortgages are advantageous if you foresee the opportunity to pay off your entire balance in the near future. |

| Long | Longer terms provide predictability and stability. | Committing to an interest rate for a long period of time may make it more difficult for you to obtain a lower rate if rates drop over time. |

Mortgage terms vary so that you can take advantages of opportunities that align with your current financial circumstances. There are advantages to both short- and long-term commitments. Well help you make the right choice.

What Is The Difference Between A Fixed And A Variable Interest Rate At Td

A fixed interest rate means your interest rate, along with your principal and interest payments, will stay exactly the same during your mortgage term.

With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the amounts from each payment that go toward the principal and interest can vary.

What Is A Second Mortgage

A second mortgage is a home equity loan that allows you to borrow money based on the equity you have in your home, without having to refinance your current mortgage. Equity is the difference between the appraised value of your home and the amount you owe on your first mortgage.

A second mortgage is not the mortgage on a second property. The term second means that the loan does not have priority on your home in case you default on your mortgage payments. If you were to default, your first mortgage has priority and that loan would be paid off before any funds go towards the second mortgage. A third mortgage would be subordinate to the first and second mortgages.

A home equity line of credit , is a type of a second mortgage that is a revolving line of credit, available to you as you need it, as opposed to a lump sum loan. Its still secured against your home.

Because second and third mortgages are a higher risk to lenders, the interest rates are higher than first mortgages.

Also Check: Dept Of Education Student Loan Forgiveness

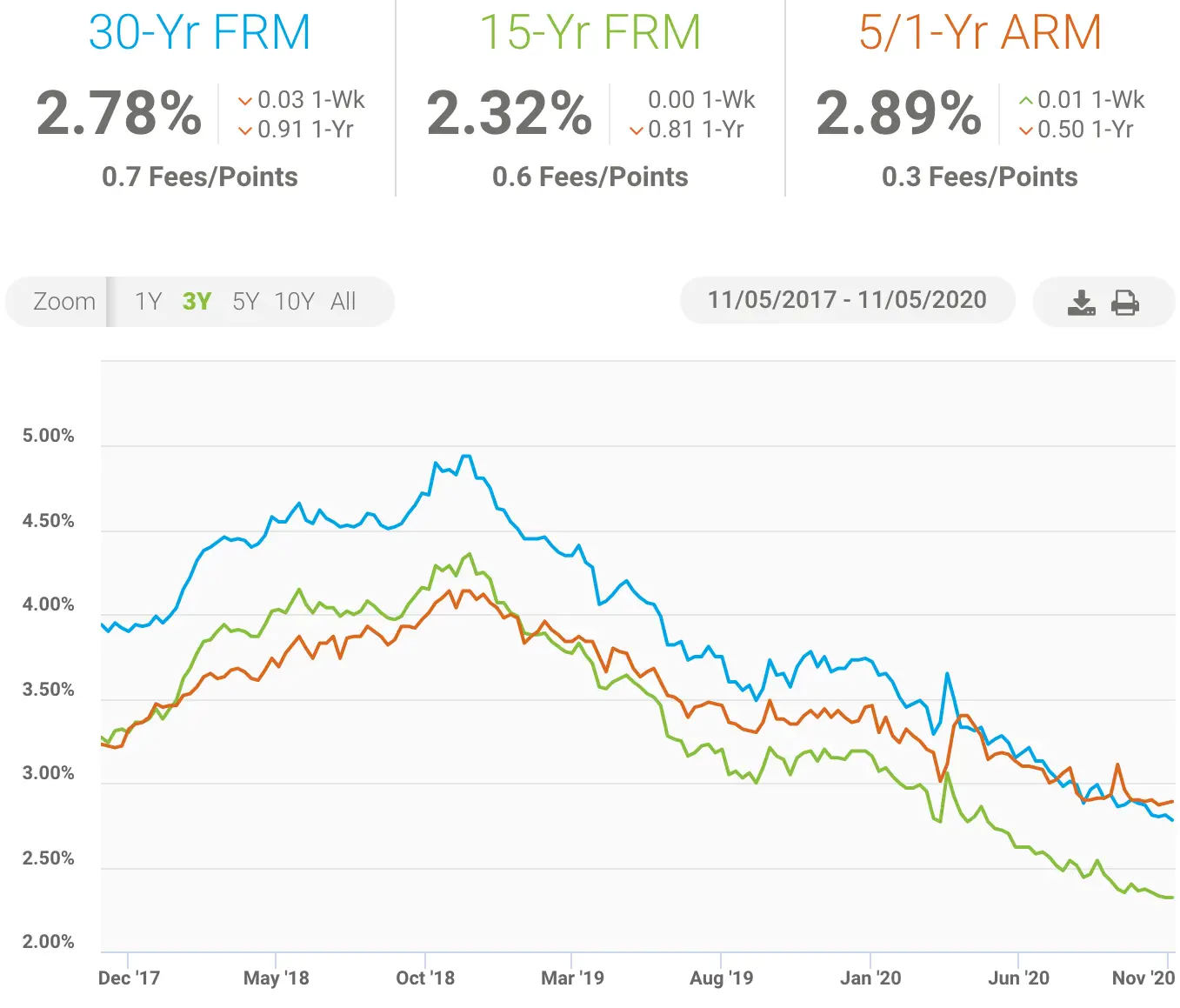

Money’s Daily Mortgage Rates For December 1 2022

Almost all loan types inched higher yesterday, according to Money’s daily mortgage report.

The average rate on a 30-year fixed-rate mortgage increased by 0.026 percentage points to 7.826%. Rates on adjustable-rate loans also increased across the board. On the other hand, the rate on a 15-year fixed-rate loan moved down.

- The latest rate on a 30-year fixed-rate mortgage is 7.826%.

- The latest rate on a 15-year fixed-rate mortgage is 6.217%.

- The latest rate on a 5/6 ARM is 7.215%.

- The latest rate on a 7/6 ARM is 7.281%.

- The latest rate on a 10/6 ARM is 7.242%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on mortgage application data submitted to Freddie Mac by thousands of lenders across the country. The weekly rate averages are based on applications for conventional, conforming loans for borrowers with excellent credit who made a 20% down payment and no longer include discounts for points/fees paid.

Guide To Comparing Mortgage Rates In Canada

The mortgage rates displayed on this page are provided to NerdWallet by Homewise, a licensed mortgage broker that partners with lenders across Canada.

These mortgage rates are refreshed daily, representing the latest mortgage options available from Homewises lender partners. The rates come directly from Homewises lender partners and are updated by Homewise to provide the most accurate options for you each day.

» MORE:How mortgages work in Canada

Recommended Reading: Car Loan Refinance Bad Credit

Is The Lowest Mortgage Rate The Best Mortgage Rate

It may seem counterintuitive, but the best mortgage depends on more than just the annual percentage rate you can get for a mortgage though thats certainly a good place to start.

Interest rates alone dont tell the whole story. Other factors worth comparing when looking at mortgage rates include fees, the terms and conditions of your mortgage contract, ease of online access and customer service. In some cases, lenders will make up for low mortgage rates by charging higher fees, so its important to evaluate all of these factors.

Comparing Different Mortgage Terms

The 30-year fixed-rate mortgage is the most popular loan for homeowners. This mortgage has a number of advantages. Among them:

- Lower monthly payment: Compared to a shorter term, such as 15 years, the 30-year mortgage offers lower payments spread over time.

- Stability: With a 30-year mortgage, you lock in a consistent principal and interest payment. Because of the predictability, you can plan your housing expenses for the long term. Remember: Your monthly housing payment can change if your homeowners insurance and property taxes go up or, less likely, down.

- Buying power: With lower payments, you can qualify for a larger loan amount and a more expensive home.

- Flexibility: Lower monthly payments can free up some of your monthly budget for other goals, like saving for emergencies, retirement, college tuition or home repairs and maintenance.

- Strategic use of debt: Some argue that Americans focus too much on paying down their mortgages rather than adding to their retirement accounts. A 30-year fixed mortgage with a smaller monthly payment can allow you to save more for retirement.

That said, shorter-term loans have gained popularity as rates have been historically low. Although they have higher monthly payments compared to 30-year mortgages, there are some big benefits if you can afford the upfront costs. Shorter-term loans can help you achieve:

Don’t Miss: Where Can I Cash My 401k Loan Check

Save Time Apply Online

Apply online for conditional approval or a new home loan.

- You could get approval in 1 business day

- Dedicated lender will support you from application to settlement.

A member of our team will be in touch within 1 business day.

- They’ll answer your questions and guide you through your next steps

- A lender can start your application for you.

Conditions, credit criteria, fees and charges apply. Terms and conditions available on request. Based on Westpac’s credit criteria, residential lending is not available for Non-Australian Resident borrowers. This information has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness of the information and, if necessary, seek appropriate professional advice. This includes any tax consequences arising from any promotions for investors and customers should seek independent advice on any taxation matters.

1Break costs on prepayments and switching: Customers can make total prepayments of up to $15,000 for loans fixed prior to 21 March 2009, $25,000 for loans fixed between 21 March 2009 and 16 March 2012 or $30,000 for loans fixed on or after 17 March 2012, without costs or fees applying. Prepayments exceeding this threshold may incur a break cost

^Flexi First Option special offer rates with Principal & Interest repayments

Flexi First Option special offer rates with Interest Only repayments

^^Fixed rate home loan:

What Is A Mortgage Rate

A mortgage rate is a percentage of the total loan amount paid by the borrower to the lender for the term of the loan. Fixed mortgage rates stay the same for the term of the mortgage, while variable mortgage rates fluctuate with a benchmark interest rate that is updated publicly to reflect the cost of borrowing money in different markets.

Also Check: How To Get An Fha Loan In Ny

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Summary Of What Affects Your Mortgage Rate

- A short mortgage term will have a lower mortgage rate. A long mortgage term will have a higher mortgage rate.

- Variable mortgage rates are lower than fixed mortgage rates, but increases in the prime rate will cause variable rates to rise.

- Insured mortgages will have the lowest mortgage rates, followed by insurable mortgages, then uninsured mortgages.

- Making a larger down payment for insurable or uninsured mortgages will lower your mortgage rate.

- A low credit score will increase your mortgage rate. Agood credit scoregives you access to lower mortgage rates.

Also Check: What Is The Max Student Loan Amount

How To Get A Mortgage

A mortgage is a type of loan designed for buying a home. Mortgage loans allow buyers to break up their payments over a set number of years, paying an agreed amount of interest.

Because a home is typically the biggest purchase a person makes, a mortgage is usually a households largest chunk of debt. Getting the best possible terms on your loan can mean a difference of hundreds of extra dollars in or out of your budget each month, and tens of thousands of dollars in or out of your pocket over the life of the loan. Its important to prepare for the mortgage application process to ensure you get the best rate and most affordable monthly payments.

Here are quick steps to prepare for a mortgage:

Different types of mortgages

There are many different types of mortgages, broadly put into three buckets: conventional, government-insured and jumbo loans, also known as non-conforming mortgages. There are also different loan terms within these categories, such as 15 years or 30 years, and different interest rate structures, generally either fixed or adjustable .

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnât process the loan before the rate lock expires, youâll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Thereâs income on your application that canât be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but itâs wise to get it in writing as well.

You May Like: How To Apply For Unsubsidized Stafford Loan

How Do I Qualify For A Mortgage

While itâs important to think about qualifying for the best rates, you should also give some thought to the basics that youâll need to qualify and get approved for your mortgage. To qualify for a mortgage, here are some of the most important things that prospective lenders will want to see.

A good credit score – You should have a credit score of 680 or higher to qualify for the best mortgage rates, but to qualify for a mortgage at all, youâll need a credit score of at least 560. In addition to looking at your credit score, prospective lenders will also consider any derogatory information from your credit report, such as any missed payments . If you have bad credit, generally defined as a credit score of less than 660, you are unlikely to qualify for the best mortgage rates, and instead youâll need to use a sub-prime mortgage lender like Equitable Bank or Home Trust. If your credit score is even less than 600, you will most probably need to use a private lender like WealthBridge. Sub-prime mortgage lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates. It’s a good idea to have a detailed understanding of how your affects your ability to obtain a mortgage.

How To Calculate Interest On Home Loan

Home loans are long-term loans on which a borrower has to pay interest. The interest is calculated based on the home loan interest rate. Therefore, before you apply for a home loan, it is vital to estimate the overall interest liability towards the loan. There are two methods to calculate this:

- EMI Calculator : A home loan EMI calculator lets you easily figure out the interest you will need to pay with your home loan. To arrive at a result after the completion of mathematical calculations, you will need to enter the following details on the calculator:

- Home loan amount

If you wish, you can calculate your EMI liability and interest using the following formula:

EMI = /

In this formula, P refers to the principal, r is the home loan interest rate, and n refers to the loan tenure in months or the number of instalments the borrower has to pay.

Also Check: What Is An Interest Only Home Loan

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you donât lock in right away, a mortgage lender might give you a period of timeâsuch as 30 daysâto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, itâs best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While itâs not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you donât lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

When To Pay Your Mortgage Default Insurance

When you are approved for a mortgage that requires mortgage default insurance, you have the choice of either paying the default insurance premium amount up front or adding it to the principal portion of your mortgage.

Mortgage borrowers can see the amount of their mortgage default insurance premium by looking at their TD Canada Trust Mortgage Loan Agreement. From time to time, the company providing the insurance may amend the calculations for the premiums. In that case, because of timing, this document may not reflect the most current percentages. However, your Mortgage Loan Agreement will always reflect the correct premium amount. Depending on your province of residence, you may be charged a provincial sales tax on the mortgage premium amount, which you are required to pay. As of June 1st, 2015 the following provinces charge a sales tax on the mortgage premium amount: Ontario, Quebec and Manitoba.

Don’t Miss: Student Loan Forbearance End Date

How To Choose The Best Mortgage Rates Among Lenders

Comparing mortgage rates between lenders can be more complex than it initially appears.

Firstly, its crucial to compare annual percentage rates and not just interest rates. While the interest rate is a set percentage that a lender charges you to borrow money, APR includes the interest rate, fees and other closing costs that are set by the lender.

Ideally, lenders will publish APRs in addition to interest rates, but if they dont, APR can be calculated by hand:

First, divide total fees by the total loan amount.Then, multiply the result by the number of days in the year.Next, divide that result by the total number of days in the loans term.Finally, multiply that result by 100 and add a % sign.

Looking at the APR will give you a more accurate idea of the true cost of your mortgage. Heres an example:

- Lender A: Offers a 5-year fixed mortgage with a 3% interest rate and 3.25% APR.

- Lender B: Offers a 5-year fixed mortgage with a 3% interest rate and 3.175% APR.

If you compare the above mortgage offers based on interest rate alone, theres no difference. But by also examining APR, you can see that Lender B is charging lower fees, meaning the second mortgage offer is actually the better deal.