What Is The Public Service Loan Forgiveness Limited Waiver Opportunity

The Biden administration used authority under the HEROES Act of 2003 to make all loans and repayment plans qualify for loan forgiveness. You must have made payments while employed at a non profit or government employer full time between October 2007 and October 2022.

If you end up with more than 120 months of qualifying credit due to this PSLF order, you will receive a refund.

Borrowers who have already received loan forgiveness, paid off their loans, or who have refinanced with a private company will not receive this benefit.

What Is Public Service Loan Forgiveness

Youve probably heard talk of the student loan crisis. In fact, you may be living it. Americans owe over $1.5 trillion in student debt. In response to this crippling debt load, the federal government initiated a student loan forgiveness program back in 2007 for those working in public service. It is called Public Service Loan Forgiveness and commonly goes by the acronym PSLF.

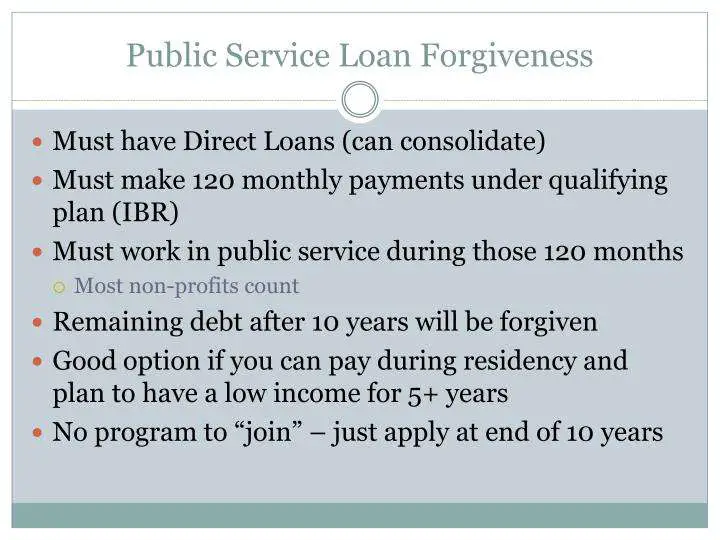

Not everyone is eligible for PSLF. Eligibility requires that 120 payments are made, the loans themselves are Direct government loans being paid on an income-driven repayment plan, and that the borrower works for a qualified employer. Let me break each of those down for you.

If you make 120 qualifying monthly payments under a qualifying repayment plan while doing qualifying work for a qualifying employer, then you can submit an application to have your student loans forgiven. You must still be working for that qualifying employer when you submit the application and when the loan is actually forgiven. Since thats a lot of qualifying going on, lets break it down to see what qualifying actually means:

Past Ffel Loan Payments Will Now Count Toward Forgiveness

PSLF was designed to encourage borrowers to consolidate their old federal loans, known as Federal Family Education Loans , into federal Direct Loans. But for myriad reasons on a spectrum from mistakes to mismanagement to misconduct loan servicing companies and the Education Department muddied this message to borrowers.

Read Also: How To Get Loan Originator License

What Is Public Service Loan Forgiveness How Did It Originate

The Public Service Loan Forgiveness is a program that was launched in 2007 in an effort to steer more college graduates into public service. As long as they made 10 years of payments on their federal student loans, the program promised to erase the remainder.

The program, however, has proved anything but forgiving. Before Wednesdays announcement, only 16,000 borrowers had seen their debt forgiven via the program, according to the Education Department. About 1.3 million people are trying to have their debts discharged through the program.

One of the most problematic pieces of Public Service Loan Forgiveness: Many borrowers had the wrong type of loan and didn’t realize they weren’t eligible for relief.

When the loan forgiveness program was first introduced, many of the loans offered from the federal government were Family Federal Education Loans , or loans made through private entities but insured by the federal government.

The government stopped offering those loans in 2010 and now relies on direct loans the kind eligible for forgiveness. The Education Department said about 60% of borrowers with an approved employer hold FFEL loans.

A New Shortcut The Department Of Education Pslf Help Tool

When this article was first written, people like Dave had to do a bunch of research into employer eligibility for PSLF.

The Department of Education recently made employment verification much easier. Using the PSLF Help Tool, borrowers can verify employer eligibility and generate the necessary form that needs to be completed.

According to the Department of Education, the process takes about 30 minutes. Borrowers will need their FSA ID and a W-2 or Federal Employer Identification Number from their employer.

Also Check: Car Loan Transfer To Another Person

Student Loan Forgiveness: Major Changes

Student loan borrowers have been rejected for public service loan forgiveness for many reasons, including ineligible student loans, missing or incomplete paperwork, ineligible student loan payments, ineligible student loan repayment plans, and ineligible work experience, among other reasons. To correct these errors and get more student loan borrowers to qualify for student loan forgiveness, Biden and the U.S. Department of Education announced the following changes, among others:

- count student loan payments toward student loan forgiveness, even if made before student loan consolidation

- make FFELP Loans and Perkins Loans eligible for student loan cancellation

- get student loan forgiveness even if you made student loan payments under the wrong student loan repayment plan

- be eligible for student loan forgiveness even if you made late student loan payments or incomplete student loan payments and

- allow active duty members of the military to count payments even if enrolled in student loan forbearance or student loan deferment.

Can You Get Retroactive Credit For Public Service Loan Forgiveness

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Unfortunately, there is nothing simple about student loan forgiveness programs, and a few missteps could mean youve made yourself ineligible for relief or you never took advantage of a program when you had the chance.

So, what happens if you worked in public service for 10 years? Can you still get credit towards Public Service Loan Forgiveness ?

Unfortunately, you cannot get retroactive credit if you worked those jobs before 2007. You may be able to seek PSLF retroactively on jobs worked since Oct. 1, 2007, but only if you took out the eligible loan after 2007.

Heres what you need to know about retroactive PSLF and eligibility for it:

Recommended Reading: How Do I Find Out My Auto Loan Account Number

The Waiver Has A Deadline

Perhaps the biggest change announced is that the Department of Education will offer a limited waiver so that borrowers can have their payments counted, “regardless of loan type or repayment plan.”

The Department estimates the waiver will bring over 550,000 borrowers an average of 23 payments closer to loan forgiveness and make 22,000 borrowers immediately entitled to the cancellation.

The Department also reiterates that the waiver is strictly a “temporary opportunity.”

Borrowers who need to consolidate will have to submit an application and a PSLF form by October 31, 2022 to have previously ineligible payments counted.

Additionally, the Limited PSLF Waiver will only be available to borrowerswho have Direct Loans, Federal Family Education Loans and Perkins Loans and will only apply to loans taken out by students.

What If I Didnt Make Full Payments On Time

Theres a waiver here, too. The department is waiving the requirement that people were supposed to have made payments in full and on time in order to get credit toward that all-important 120-month figure.

This will help not just people who paid late but people who paid too much or too little , which has been a particular scourge of the program.

These waivers are also temporary. Some adjustments may end up being automatic here, too, say for people who have already consolidated loans and certified some of their employment. Other borrowers will need to submit a form by that same October date next year to trigger a review of past payments.

Read Also: How To Find My Loan Servicer

How Did The Biden Pslf Forgiveness Expansion Happen

President Biden had campaigned on the idea of expanding loan forgiveness for public servants.

President Trump and President Biden had previously used powers in the HEROES ACT of 2003 to waive payments and interest during the pandemic due to special authority over student aid programs during periods of national emergency.

The Department of Education determined that they had the authority to eliminate many of the programs normal requirements until October 31, 2022.

Submit Your Application For Pslf

After youve worked for an eligible employer for 10 years and made 120 qualifying monthly payments, you can submit the Public Service Loan Forgiveness: Application for Forgiveness form. The form can be filled out through the PSLF Help Tool, or you can download it and mail it to the same address or fax number you used to send your annual employment certification form.

If your application is approved, youll receive a notification that the remaining balance was forgiven. If you made any additional payments, the excess payments would be refunded to you.

Don’t Miss: What Car Loan Can I Afford Calculator

Processes For Active Military Duty Borrowers With Loans On Deferment Or Forbearance Are Still Undetermined

Many military members may have put their student loans in deferment or forbearance while on active duty, only to later find out those months in deferment or forbearance did not qualify for PSLF. For these borrowers, details on how the PSLF waiver would impact borrowers in these instances are not yet clear.

The Education Department does say that âFederal Student Aid will develop and implement a process to address periods of student loan deferments and forbearance for active-duty service members and will update affected borrowers to let them know what they need to do to take advantage of this change.â

Fedloans Departure Brings Uncertainty Of Future Pslf Service Providers

In addition to the already-complex PSLF application process , FedLoan, the service provider that services PSLF loans, adds another layer of complexity to determining the best strategies for navigating student loan debt with their recent announcement that they will not renew their contract past December 2021. And as of now, it is still unclear which servicer will be in charge of PSLF in the future.

For borrowers with FFEL loans who consolidate and then apply for PSLF, this may mean their loans first get sent to FedLoan, and then FedLoan will transfer them to whoever is chosen to service PSLF borrowers in the future.

Accordingly, borrowers who decide to wait a couple of months to see which company will service the PSLF program before consolidating previously ineligible loans may benefit by avoiding multiple switches between multiple loan servicers. However, the caveat is that this will bump them right into the current timeline of payments resuming for all student loan borrowers in February of 2022.

Which means that there are potential risks involved with pursuing consolidation as soon as possible , as there are with waiting until 2022 in hopes of knowing more about who will actually service the loans and applying for consolidation and PSLF then.

Read Also: Credit Score Needed For Usaa Personal Loan

I Have The Right Kind Of Loan But Ive Been Tripped Up In The Past By Payments Not Counting What Changes Now

There is more good news here. The department intends to look at your payment history and credit people for many that had not counted before. It will do this for payments that people make through the end of this month.

First, its waiving its restrictions on the type of repayment plans that were eligible. For instance, the payments people made through so-called extended repayment plans should be eligible now if they were working for a qualifying employer at the time. Extended repayment plans stretch the repayment term up to 25 years, but they are different from the so-called income-driven repayment plans that were eligible for the P.S.L.F. program.

What Is An Ffelp Loan

The Federal Family Education Loan Program was a student loan program backed by the federal government. It began as part of the Higher Education Act of 1965 and officially launched in 1966. Through the program, private lenders provided student loans to students and parents that were backed by federal or non-profit guaranty agencies. Also, the government-mandated specific interest rate levels for all FFEL loans.

The terms FFELP loans and FFEL loans are often used interchangeably to refer to Federal Family Education Loan Program loans. There are 4 types of FFEL loans that were available to student loan borrowers during the programs existence:

- Subsidized Stafford loans: Interest is paid by the government while students are in school as well as during periods of grace and deferment.

- Unsubsidized Stafford loans: Interest isnt paid by the government at all.

- Plus loans: Available to parents and grad students to help to pay for education costs.

- Consolidation loans: Combines more than one student loan into one single loan.

Since 1966, over 60 million Americans have used FFEL to help pay for college expenses. The program was discontinued on July 1, 2010 and now FFELP loans have been made since.

Also Check: Drb Student Loan Refinancing Review

Have Federal Loans That Dont Qualifyconsolidate Them

Many borrowers do not have Direct Loans and thus would not qualify for the program in their current scenario, but fortunately there is a way to convert your federal loans into Direct Loans. The Direct Loan Consolidation program will take all of your federal loans, and consolidate them into one new Direct Loan. If you do not have Direct Loans but want to apply for Public Service Loan Forgiveness, you will need to consolidate your loans. You can attempt the yourself, or, Student Debt Relief is a private company that for a fee, can help you through this process.

Fact Sheet: Public Service Loan Forgiveness Program Overhaul

Contact:

The Public Service Loan Forgiveness Program is an importantbut largely unmetpromise to provide debt relief to support the teachers, nurses, firefighters, and others serving their communities through hard work that is essential to our countrys success. By cancelling loans after 10 years of public service, PSLF removes the burden of student debt on public servants, makes it possible for many borrowers to stay in their jobs, and entices others to work in high-need fields.

Today, the Department of Education is announcing a set of actions that, over the coming months, will restore the promise of PSLF. We will offer a time-limited waiver so that student borrowers can count payments from all federal loan programs or repayment plans toward forgiveness. This includes loan types and payment plans that were not previously eligible. We will pursue opportunities to automate PSLF eligibility, give borrowers a way to get errors corrected, and make it easier for members of the military to get credit toward forgiveness while they serve. We will pair these changes with an expanded communications campaign to make sure affected borrowers learn about these opportunities and encourage them to apply.

Today the Department is announcing it will:

To further strengthen oversight of PSLF, the Department will improve its reporting on PSLF, including information on timelines for processing applications and results of servicer audits.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How Do I Know If My Employer Qualifies

People in Daves position who are not clear if their employer is eligible for Public Service Loan Forgiveness should submit an employer certification form. This form is available on the Department of Educations website and must be completed by your employer. We recommend anyone pursuing PSLF submit this form every year to ensure the records stay up to date.

Once submitted, the form will be reviewed for verification that your employer qualifies as a public service employer.

Not only with the Employer certification form help you verify that your employer is eligible, but it is also confirms that you are on an eligible repayment plan and that your loans are eligible. Successful form submission will result in FedLoan servicing sending a letter explaining how many qualifying payments you have made towards PSLF. Once you get to 120 certified payments, your loans will be eligible to be discharged.

Is Pslf And An Idr Plan Right For Me

IDR plans provide a lower monthly payment amount for borrowers who have high student loan debt relative to their income. However, in some cases an IDR plan might give you a higher monthly payment than you want to pay, and your monthly payment might be lower under a traditional repayment plan. In that case, PSLF may not be right for you.

Don’t Miss: Usaa 84 Month Auto Loan

Not A Fedloan Servicing Borrower

If your loans are not currently serviced by FedLoan Servicingthat’s OK. You should still fill out a PSLF form and return it to our office. If your qualifying employment is approved, your federal student loans owned by the U.S. Department of Education will automatically be transferred to us and we will begin tracking your progress towards completing the 120 qualifying payments each time you submit a PSLF form.

Submit Your Pslf Form For Forgiveness

Once you have made your 120th payment, submit a PSLF form to count your qualifying payments and apply for forgiveness.

After we receive your PSLF form, your loans will be reviewed for eligibility for forgiveness. If it appears you are eligible for PSLF/TEPSLF, your employer may be contacted before granting loan forgiveness. Additionally, the amount to be forgiven will be the principal and interest that was due on your eligible loan.

While your loans are being reviewed for loan forgiveness you have two options:

KEEP IN MIND

Contact a PSLF Specialist

We are here to help you with every step of the process. Contact one of our Public Service Loan Forgiveness specialists at 855-265-4038 for more information.

Learn More About PSLF

Learn More About the Qualifications

If you get a job at a government or eligible not-for-profit organization and repay your loans based on your income, you may qualify for forgiveness of your Direct Loans after 120 qualifying payments and employment. See StudentAid.gov/publicservice for more information and for a form you can fill out when you start working to receive confirmation that your employment qualifies for the program.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan