Making Sure Your Loan Servicer Is Working With You

Understanding the complicated world of student loan repayment is no easy feat, and it gets even harder if your loan servicer isnt giving you all the information you need to manage your student loans.

Not only should your loan servicer explain your options for repayment plans and forgiveness programs, but it should also help you choose the repayment strategy thats best for your individual situation.

Unfortunately, some loan servicers have led borrowers into forbearance or income-driven plans even when these approaches were unnecessary and cost them extra money in the long run.

Because your loan servicer might not always give you the best guidance, its crucial to empower yourself with knowledge about your student loans. Learn about your options for repayment .

Using these student loan calculators can also help you estimate the long-term costs of your loans and come up with a solid repayment strategy.

Sign up for weekly digest to receive the latest rate updates and refinance news!

Thank you! Keep an

Learn More About Direct Loan Servicers

As a Direct Loan or Direct PLUS Loan borrower, you know that one key to successful management of your loans is to understand your obligations and how to manage those loans. That includes knowing what changes are occurring that could impact your student loan repayment. Right now, some borrowers are experiencing changes in the servicer for their loans and possibly how those loans are being processed.

If you are one of those borrowers, you may have been contacted by a new servicer an organization other than the U.S. Department of Education and you may have some questions.

Find A Real Estate Agent To Help You Sell Your Home

If you can’t afford your mortgage once forbearance runs out, or you simply no longer want to deal with the expense of owning your home, you may have the option to sell it for enough money to pay off your mortgage and walk away clean. These days, home values are up on a national level, so if the idea of paying a mortgage again worries you, you may be able to sell your home and then start fresh with a less expensive place to live.

Say you owe $240,000 on your mortgage and your home would normally only sell for $220,000. Because home values have risen and the demand for homes is so high, you may, in today’s market, manage to command $260,000 for your home. That would be enough to cover your home loan balance plus the typical fee charged by a real estate agent.

A lot of homeowners will soon see their mortgages exit forbearance. The good news is that if you’re in that situation, you do have different avenues to explore. The key is to start thinking about them now, before that protection officially runs out.

Recommended Reading: How To See My Loan Balance

What Is A Mortgage Servicer

The first step in determining who owns or backs your mortgage is identifying your loan servicer. The servicer might be the same as the holder of the debt, but not always. Mortgage holders often retain a servicer, which might or might not be a lending institution, to handle the loan.

The servicer deals with the day-to-day management of the loan. For instance, the servicer:

- collects and processes your monthly payments

- tracks your account balance

- manages the escrow account, if you have one, and

- supervises the foreclosure process, if you’re in default.

Shop For A Mortgage Loan Not A Mortgage Servicer

The bottom line is that you likely wont have to interact with your loan servicer much if at all.

That means it shouldnt be a top concern when shopping for a mortgage.

Its more important to shop for the right loan type, a low rate, and fair loan terms, since these are the things that decide how much youll pay in the long run.

But if youre concerned about who your servicer will be, dont be afraid to ask. If a lender is quiet or cagey about its servicing partners, thats probably a bad sign.

But if theyre forthcoming with the name, youre free to do your own research and decide if its a servicer youd be comfortable working with.

Popular Articles

Step by Step Guide

You May Like: Can The Bank Loan You Money

If My Loan Servicer Is Fedloan Servicing Or Granite State What Should I Do

FedLoan Servicing and Granite State Resources & Management announced that they will not be renewing their federal loan servicer contracts, so they will no longer service federal loans after December 31, 2021.;

Before that date, youll receive a notification telling you who your new loan servicer is. To ensure you get that information, log into your current loan servicers portal and update your contact information.

Reach Out To Your Loan Servicer For Help If You Want To Stay In Your Home

Loan servicers are being told they need to work with borrowers coming out of forbearance to help them stay in their homes. If you can’t make your regular mortgage payments once forbearance comes to an end, reach out to your loan servicer and explain your situation.

Your loan servicer will likely agree to modify the terms of your mortgage so that you’re able to keep up with it. In many cases, that will mean extending the length of your repayment period so your monthly payments are smaller and easier to manage.

Also Check: Is It Worth It To Refinance Car Loan

How Can I Find Out The Servicer Of My Student Loan

President Joe Biden signed the American Rescue Plan Act of 2021 into law on March 11, 2021. This Act includes a provision exempting all student loan forgiveness after December 31, 2020, and before January 1, 2026, from federal taxation.

Federal laws usually treat forgiven student loan debt as a taxable event for the borrower unless they were forgiven for specific reasons, like death or disability . The American Rescue Plan Act makes all student debt forgiveness tax-free until January 1, 2026. The tax exemption under this law applies to direct federal student loans, Federal Family Education Loans , and private student loans.

When it comes to federal student loans, your servicer is typically a private company that contracts with the U.S. Department of Education. Servicers handle the day-to-day activities associated with managing your federal student loans, like billing and crediting of payments. So, if you have a question about your account, want to change your repayment plan, get a forbearance or deferment, or apply for loan forgiveness, you need to know who your servicer is. And, if you arent happy with your servicer, you might be able to switch.

Heres what you need to know about student loan servicers and how to find out who services your loans.

If you have questions about your bill, how payments are applied, or other questions about your loan, contact your servicer.

How To Find Out Who Your Mortgage Servicer Is

Once you close on your mortgage, your mortgage servicer is responsible for questions pertaining to your loan. Your servicer might be the lender, but it could be another company. To find out who your mortgage servicer is, check your loan statement; if applicable, your payment coupon book, or you can check the MERS website, which is a free service set up by the mortgage industry to assist homeowners.

Your lender might or might not be the same as your mortgage servicer. Oftentimes, lenders will sell your loan so you could end up with a different servicer or your original lender might also hire a different company to service your loan.

When the servicer receives your payment, it distributes the money:

- Principal and interest go to the bank or the investor that owns the loan.

- Taxes go to the government.

- Homeowners insurance premiums go to the insurer.

- Mortgage insurance premiums go to the mortgage insurer.

- Condo or homeowners association dues go to the association.

- Any other fees are disbursed to wherever theyre supposed to go.

If you have an escrow account, which is a fund you pay into each month for the purpose of paying annual property taxes and homeowners insurance, your mortgage lender is responsible for making escrow payments.

Recommended Reading: How Much Does My Loan Cost

Here’s How To Find Out Who Owns Your Mortgage And Who Services It

By Amy Loftsgordon, Attorney

Finding out what company or entity owns or backs your mortgage loan isn’t always simple. Your loan might have been sold, perhaps several times since you took it out with the original lender. And the company that services the loan might not own the underlying debt.

Here’s how to figure out who holds or guarantees your mortgage.

How Do I Find My Student Loans

The process for finding your loan servicer will be different depending on whether you have federal or private student loans.

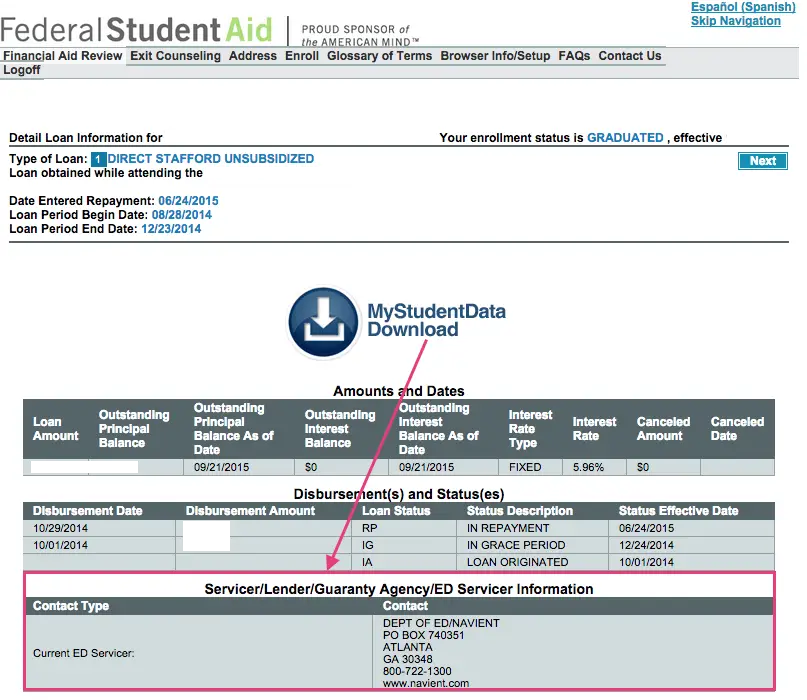

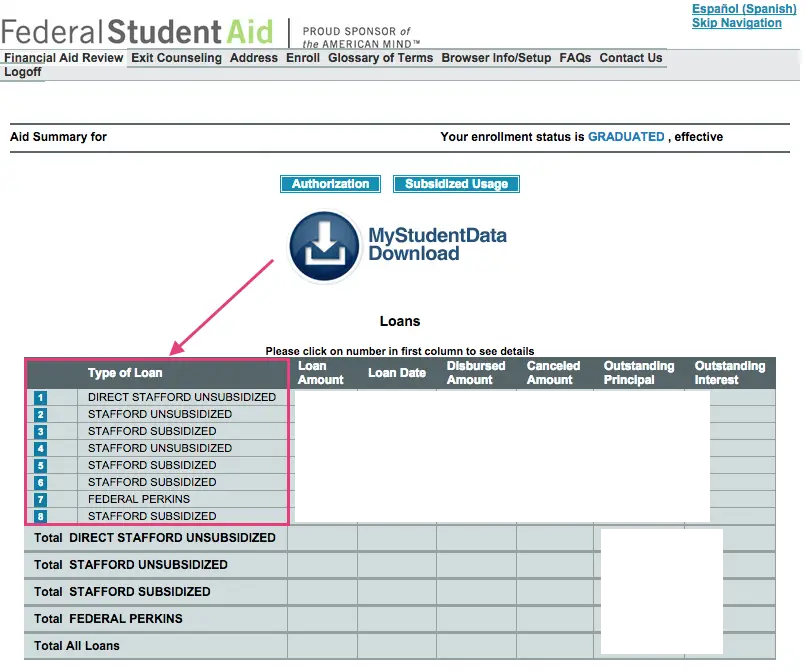

If you have federal student loans, you can find your loan servicer by signing into your Federal Student Aid account. Youll log in with your FSA ID. Once youve accessed your dashboard, youll see your student loan servicer and other details about your loans.

Alternatively, you can find your federal student loan servicer by calling 1-800-4-FED-AID .

Along with identifying your loan servicer, you will also find other information on your student loans, including the type of student loans you have, the loan amounts, interest accrued and outstanding balances.

You May Like: Who Should I Refinance My Car Loan With

Loan Servicer For Private Student Loans

If you have private student loans, your loan information wont show up in the NSLDS. Private institutions such as banks, credit unions and online lenders originate these loans and hire loan servicers to manage the accounts much like federal student loans.

To find out who services your private student loan, log in to your lender website or app. You should be able to find details about your loans, including the loan balance, interest rates and loan servicer.

You can also check your credit reports. The loan servicer should be listed next to the account, along with contact information.

Graduate Or Leave Full

You have six months after you graduate or leave full-time studies before you need to start repaying your OSAP loan. This is your 6-month grace period.

You will be charged interest on the Ontario portion of your loan during your 6-month grace period. This interest will be added to your loan balance .

Read Also: Who Will Loan Money With Bad Credit

How To Change Mortgage Loan Servicers

Now for the direct answer. The only way to change mortgage servicers is to refinance your loan and move to a lender that services the loans they originate. Keep in mind, just because a company services a loan today doesnt mean theyll continue to do so long term. The industry is always changing.

Dont put yourself through a mortgage refinance if your only reason is to change mortgage servicers. Make sure there are other refinance benefits you can take advantage of, like: a lower interest rate, shorter loan term, access to cash, debt consolidation, or dropping private mortgage insurance .

Tip: If refinancing makes sense for your financial situation, know that you can work with the loan officer who originated your loan. Its your choice when you refinance your mortgage.

How To Find Your Student Loan Servicer

Leah SchmerlUpdated May 17, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If you have a student loan, you often deal with two different but complementary parties, the student loan lender and the student loan servicer. So whats the difference between the two?

The lender is the company or organization that originates the loan. In the case of federal student loans, that lender is the federal government, or more specifically the U.S. Department of Education .

The student loan servicer is the company that manages your loans repayment, and acts as the middleman between you and your lender.

You may work with your loan servicer for years, and its important you understand the role it plays in your financial life.

Well start by looking at loan servicers for federal loans and then look at the role they play in private loans.

Recommended Reading: What Is Portfolio Loan In Real Estate

Advocates Concern Widespread Confusion

Borrowers who do know the cost pause is scheduled to finish are harassed and confused, says Tobin Van Ostern, co-founder of Savi, a startup that helps debtors navigate student loan reimbursement.

Surveys have proven that many debtors dont really feel ready to make funds once more. Some, Van Ostern says, have redirected cash they used to spend on their students loans into vital bills like lease, childcare and meals.

People need to know how much money theyre going to have to come up with, and how quickly, he says.

Pandemic-related student debt aid additionally included the suspension of involuntary collections from debtors whove defaulted on their loans. Those protections are set to run out as effectively, which implies some debtors may even see their wages garnished or tax refunds offset once more.

In latest weeks, shopper advocate teams and a few politicians have lobbied for the forbearance interval to be prolonged, arguing that its too quickly for debtors to start out repaying. Theyve harassed that probably the most susceptible debtors, those that usually tend to default on their loans, are disproportionately Black and Hispanic the identical populations which have borne the brunt of the COVID-19 pandemic.

But other than the controversy over whether or not the economic system is powerful sufficient to help the return of student loan funds, there are difficult logistics that also should be sorted out earlier than funds resume.

What Will Happen If My Loans Are Transferred To A New Servicer

In some instances, you may see some changes in your monthly payment amount or payment schedule. This is due to the different operating procedures at each servicer.

As a borrower, you should monitor this carefully and contact the servicer if you have any questions or don’t understand any changes. The servicer is there to assist you and to make sure you understand any changes to your loans.

There may be a delay in having access to your loan information online when the transfer takes place. Once the new servicer receives your loan information, they review the file and upload the information to their system. This process can take up to 14 business days. It is important to be patient during this process and to keep in communication with your servicer, allowing time for the transfer to be completed.

You May Like: How To Lower Car Loan Payments

What If Im Having Problems With My Federal Loan Servicer

Some loan servicers have come under fire and in the case of Navient, the nations largest servicer, faced high-profile lawsuits for allegedly improperly advising borrowers and mishandling their accounts.

You should understand your rights as a borrower, and educate yourself about your options to pay down your debt in the most manageable and cost-effective way possible. Dont just rely on your servicer to do that for you.

If you have questions or you think something just doesnt seem right, you have three main parties who can help.

Figure Out If You Can Afford To Keep Paying Your Mortgage

At this point, many people have thankfully recovered financially from the impact of the pandemic. If that’s the case for you, then you may be able to start paying your mortgage again.

But if you haven’t fully recovered financially — say, you’re still paying off debt you were forced to rack up, or you haven’t found a job that pays what your former role paid you — then you may not be as comfortable resuming your mortgage payments.

Take a look at your finances and see whether you can afford to start making regular mortgage payments again. If you can’t, you do have options, but it’s important to honestly assess the situation.

Read Also: What Credit Score Do You Need For An Fha Loan

Student Loan Servicers Explained: Who They Are And How To Contact Them

Your loan servicer plays an important role in managing your loans. Heres how to find out who your servicer is and what they can do to help you.

Kat Tretina

There are 43 million federal student loan borrowers. The U.S. Department of Education cant possibly manage them all. Instead, they hire companies to work with borrowers on its behalf. These companies are known as federal loan servicers, and they play an important role in managing your student loans.;

Your loan servicer is who you make payments to and go to when you have questions. The first step in handling your student loans is figuring out who your loan servicer is and setting up an account.;