How Long Does It Take To Get A Personal Loan Rocket

Typically, you can expect to wait 1 7 business days for a personal loan to go through. Approval will generally take 1 3 business days, while disbursal will;

Tips for Fast Approval 5 Youll need to back up information you provide the lender, and the bank will review your credit history. That process takes time;Funding After Approval: One to seven business

How Long Does It Take To Get Approved For A Personal Loan

Jun 24, 2021 Read all about the personal loan application process to understand how long it will take to get approved, as well as tips for speeding up;

If you need cash fast, a same day loan can help eliminate your stress. Typically, personal loans with shorter terms have lower rates than loans with;Can I get a loan on the same day?How fast can you get approved for a loan?

Where you can get a personal loan that come to mind when you think of where to get a loan. Quick tip: Many internet lenders have emerged in;

Apply for a personal loan or for debt consolidation without hurting your credit Fair & fast personal loans How long will it take to get my money? Rating: 4.9 · 7,813 reviews

1. How much do I need? · 2. Do I want to pay my creditors directly or have money sent to my bank account? · 3. How long will I have to pay it back? · 4. How much;

Apply For A Sofi Personal Loan

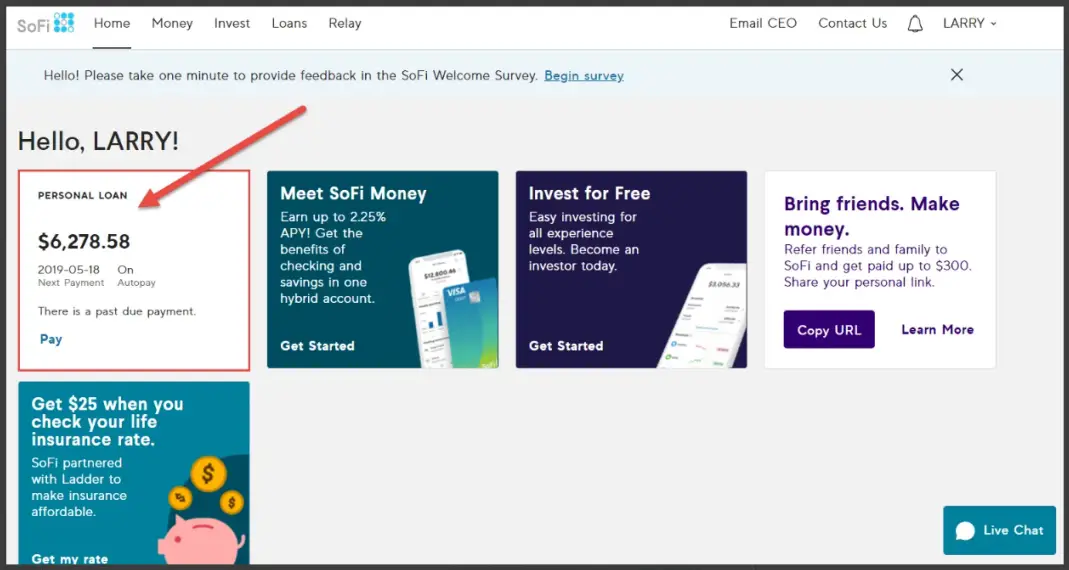

You can discover whether you may be eligible for a SoFi personal loan, along with your rate and terms, with a soft initial credit check. Use either the SoFi website or app to initiate this process. Heres what to expect.;

After your loan is approved and you e-sign your loan agreement, you should be able to access your funds within a few days.;

Recommended Reading: How To Pay Down Student Loan Debt

Getting Better Overall Terms

Not all loans are created equal. Especially now that borrowers can access loans from a variety of lenders online and arent relegated to their local brick-and-mortar bank, they can afford to do their research and compare the terms, rates, fees, penalties, and customer service that different lenders are offering.

Prepare Your Personal Financial Information

If you decide that refinancing is right for you, or you just want to give it a shot and see if you qualify for a better rate, its a good idea to shop around at different lenders to check their rates. But before you do that, youll want to have your basic personal financial information ready. In general, potential lenders need some combination of the following information about you to give you a quote:

;;-Name

;;-Total Housing Costs

;;-Credit Score Estimate

The information a borrower needs to provide varies from lender to lender, but this is the basic idea.

Read Also: Can I Refinance My Parent Plus Loan

What Options Do I Have To Repay My Sofi Student Loans

You have four options to repay your student loan after you’ve taken it out: deferred, partial, interest-only, and immediate payment. Each option has its advantages for different types of borrowers.;

| Deferred |

|

Deferred payments are the most expensive option because you’re not paying off anything during your time in school or in your grace period, so your balance will continue to grow until you graduate and start making payments.

Immediate payments are the least expensive option because by paying down your debt in full monthly payments right away, there’s less time for interest to accrue on your loan.;

Sofi Doesnt Accept All Borrowers

Unfortunately, SoFi has certain qualifications theyre looking for in order to refinance your student loans.; Generally, they are looking for people with large loan balances, a higher income, and a good credit score.

Also, you need to be employed or have a job offer to start in the next 90 days and currently be in good standing with your student loans.

Fortunately, the readers here at CFF tend to fit that profile, which is one of the main reasons I wrote this article!

Also Check: Can I Transfer My Mortgage Loan To Another Bank

Your Credit Might Be A Factor In The Application Process

Of course, this doesnt have to be a disadvantage! In general, good credit may help borrowers qualify for better terms or interest rates when refinancing.

In fact, an improved credit score may be a reason to seek out a personal loan refinancethough its not the only factor lenders may consider. However, if your credit is hindering your application, it might mean youd want to take steps toward improving your score before refinancing your personal loan.

How Sofi Student Loans Work

SoFi offers student loans for several types of degrees, including undergraduate, graduate, law school, and MBAs. The minimum you can take out is $5,000, with a maximum of up to 100% of the cost of attendance.;;

You need to meet the following qualifications to get a loan:

- Be a US citizen or permanent resident or visa holder

- Be at least 18 years old

- Be enrolled in a degree-granting school half-time or more

- Be making satisfactory academic progress as defined by your school

- Pass a credit check

- You or your cosigner need to be employed or have enough income from other sources

Prioritize your federal student loan options before applying for any private student loan, including one with SoFi, as you can often get better terms and protections through the government.

You can apply for a loan in as few as three minutes, and you’ll need to give the following information:;

- Social Security number

- Financial aid you expect to receive

- If you’ve had a previous private student loan with SoFi

Some borrowers may also need to provide proof of income or a government-issued ID.;

You can contact SoFi’s customer support by phone from Monday to Thursday, 5:00 a.m. to 7:00 p.m. PT, or from Friday to Sunday, 5:00 a.m. to 5:00 p.m. PT. You may also reach out to the company by mail, or tweet at them to get help.;

Don’t Miss: Can Closing Costs Be Rolled Into Fha Loan

Benefits Of Student Loan Refinancing

- Spending less on interest. A borrower who secures a lower interest rate can often save money on the loan.;

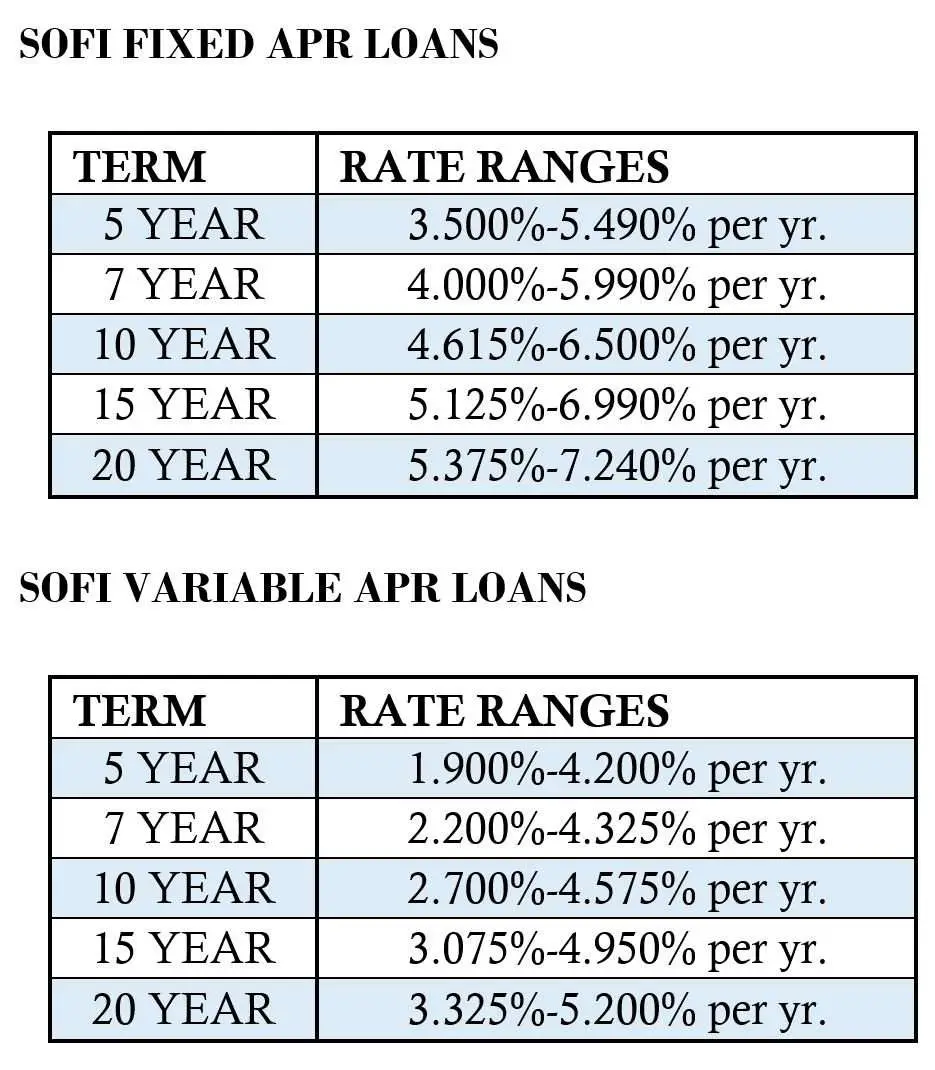

- Picking a new term. When borrowers refinance, they can generally choose their new repayment term. Some may prefer a shorter term, of, say, five years, and others may want 15 or 20 years to repay the loan. A longer repayment term will typically lower the monthly payment but equate to paying more in interest over the life of the loan. A shorter term may not lower a monthly payment by much, but the interest savings can be substantial. ;

- Streamlined payments. Say goodbye to making multiple student loan payments each month to different lenders. Refinancing means one loan and one monthly payment.;

- Having a co-signer. If a borrower is struggling to qualify for refinancing because of a poor credit score or high debt-to-income ratio, a solid co-signer can make it easier to get approved and get a better rate.;

Choose A Lender And A Loan

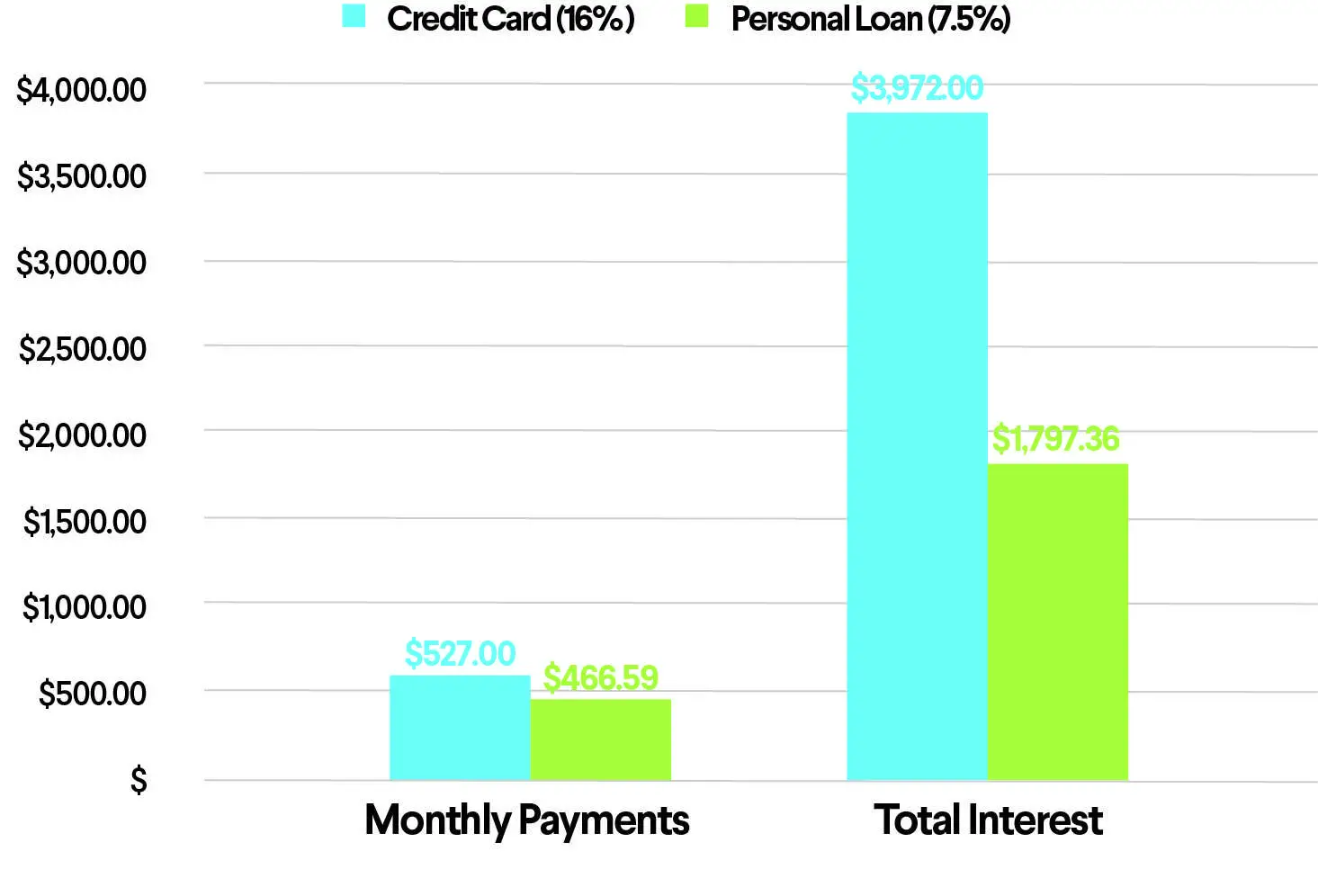

After youve had the chance to review both the loan offers and the lenders themselves, its time to decide.While many borrowers gravitate toward the loan with the lowest rate of interest, it is worth remembering that the lowest rate might not amount to the lowest amount of total interest paid on a loan.

The longer the loans term, the more interest a borrower will pay.

The longer the loans term, the more interest a borrower will pay. For example, if you have a loan term of 10 years, youll have to pay off the entire loan balance plus the interest that was accrued over the 10 years. But, if you extend your loan term to, say, 20 years, that means 10 more years of interest accruing on your loan.

Also, a loan that charges an origination fee could end up costing more than a loan with a higher rate of interest that does not charge an origination fee. Often, an origination fee is added to the balance of the loan, with the interest rate calculated on top of this new figure.

Again, weigh all of the information you discover.

You May Like: Will Refinancing My Auto Loan Help My Credit

What If You Want To Borrow More In Personal Loans

Unsecured personal loans are available from a variety of banks, credit unions, online lenders, nonprofit organizations, and other institutions.

If youve already taken out a personal loan but need additional funds, you might be wondering if you can increase your current loans amount.

In most cases, the answer is no. But instead of increasing your loan balance, you may be able to apply for a second loan. This can have similar consequences as increasing your existing loan amount, however, so the same warnings above apply here.

While eligibility can vary by lender, in some cases in order to qualify for an additional personal loan, you need to at least have made three consecutive scheduled payments on your existing loan. Theres no guarantee that youll receive another loan when you apply; it depends upon many factors. To be prepared, it helps to understand the general process.

Lenders That Allow Refinancing

Some lenders allow you to refinance loans from other lenders, but not their own loans. Other lenders let you use the proceeds of a personal loan for any reason, including refinancing.

These are some lenders with the best rates and their refinance policies.

|

Lender |

|

|---|---|

|

From Upgrade or another lender. |

5.94% – 35.47% |

|

From Discover or another lender. |

6.99% – 24.99% |

|

From Wells Fargo or another lender. |

5.74% – 24.24% |

|

at Best Egg |

Read Also: Should I Pick Variable Or Fixed Rate Student Loan

Which Student Loans Should I Refinance

Your safest bet is to refinance high-interest private loans. Thats because you wont lose potentially useful federal repayment options, including up to three years of deferment or forbearance, since private loans usually come with less generous repayment terms.

Under the CARES Act, which was passed in response to the coronavirus pandemic, and President Donald Trumps Aug. 8 executive order, federal student loan borrowers have an additional forbearance option: They do not have to make payments from March 13 through Dec. 31, 2021, and federal student loan interest rates are set at 0% during that time.

You do not have to refinance all of your loans, so consider keeping federal loans federal and leaving them out of your refinance package.

If you do not plan to make use of any federal loan benefitsor you want to refinance so that you can pay off loans very quicklyits possible to refinance federal loans. Consider doing so, though, after the Covid-19 monthly payment pause has ended.

Best Place To Refinance Student Loans In 2021

Overwhelmed by all your options when it comes to refinancing your student loans? Youre not alone.;

Refinancing your student loan debt can save you a lot of cash an average of $253 a month or $16,183 over the life of your loan.;The key to nabbing those savings is finding the right refi deal for your unique situation. But don’t stress! We’re here to help.;

Refi at-a-glance:

Apply Now & Start Saving On Your Student Loans.

Recommended Reading: Is My Loan Fannie Mae

Checking Your Credit Score

Oftentimes, someone will become interested in refinancing a loan because their credit has improved and they believe that they can lock in a lower rate. The first step is to check in and see if this is the case.Because a personal loan is an unsecured loan, which means that it isnt backed by collateral like a home or car, rates typically depend heavily on the borrowers credit score and overall financial picture.

You are obligated to a free credit report each year from each of the three major credit bureausEquifax, TransUnion, and Experianthrough Annualcreditreport.com , which is the only authorized website for free credit reports. Beware of other sites that offer free credit reports or credit scores but that require you to enter your bank information; they may charge you for a subscription or other services.

Do I Need A High Credit Score To Refinance Federal Loans

Generally speaking, the better your history of dealing with debt , the lower your new interest rate may be, regardless of the lender you choose. While many lenders look at credit score as part of their analysis, however, its not the single defining factor. Underwriting criteria will vary and is different from lender to lender, which means it can pay to shop around.

For example, SoFi evaluates a number of factors, including employment and/or income, credit score, and financial history. For full eligibility requirements for student loan refinancing, check here.

You May Like: Who Should I Refinance My Car Loan With

Federal Student Loan Protections

In 2020, all federal student loan payments went into a forbearance period as a result of the Covid-19 pandemic. This forbearance period was recently extended through Jan. 31, 2022. This means that federal student loan borrowers are not required to make student loan payments at this time, and their balances will not accrue interest until after the pause ends next year. If you have private student loans, or you refinanced your federal student loans, however, you don’t qualify for this protection.

If you take out a personal loan with the intention of using the money to pay off your federal student loan balance, you will lose all the protections that come with federal loans. That means youwon’t be able to qualify for any federal loan repayment programs, like an income-driven repayment plan, grace periods for repayment and public service loan forgiveness , and you’ll lose access to the current forbearance period as well.

These initiatives are designed to make it easier to repay your balance as a federal student loan borrower, but they’ll no longer be available to you once you take on a private personal loan to pay off the balance. This can present a financially strenuous situation if you really end up needing some economic relief from making payments.

A Bit Of Advice To Avoid Student Loans

Student loan debt is a huge problem in this country affecting millions of people to the tune of over $1 Trillion in outstanding debt.; This debt is keeping too many people in a perpetual state of bondage.; As a result, they have trouble buying a house, affording a vehicle, and investing money for the future.; Student loans are hurting our families, our prosperity, and our freedom to live as well as we like.

Its a sad state of affairs

I was very blessed to go to undergrad and Dental school without student loans because my parents planned well and were great at saving money.; Because of their incredible example, Ive made it a priority to pay cash for all three of my wifes college degrees, as well as tuition for both of my kids who are currently in college.

If you are a parent and want to send your kids to college one day, start saving NOW!; Its not hard to do if you make it a priority.; It will pay huge dividends for your kids and their future families to avoid the terrible bondage so many endure on a daily basis.

Get a $100 Welcome Bonus!

Question:; Have you used SoFi to refinance your student loans?; What was your experience?

Additional Resources:

Don’t Miss: How Do I Access My Student Loan Account Number

Personal Loans: How To Qualify For $10k Fast Fox

Apr 9, 2021 If you need to cover a personal expense, a personal loan could help you do it. Heres what you should know before getting a $10000 personal;

Mar 5, 2021 A personal loan can be a great way to get the cash you need to consolidate debt or finance a home improvement project as long as you have;

Use our personal loans marketplace to get a loan for debt consolidation, The process is quick and easy, and it will not impact your credit score. Get;What is a good interest rate on a personal loan?Will a personal loan hurt my credit score?

Potential Student Loan Forgiveness

Some federal student loans are eligible for forgiveness under certain circumstances. Common forgiveness programs are for public service workers or teachers, or those whove participated in an income-driven repayment plan for 20 or 25 years, depending on the plan. There is also talk on Capitol Hill of cancelling some amount of student loans . Private loans generally do not offer forgiveness.

You May Like: Can You Use Va Loan For Renovations