How To Apply For The Usda Rural Development Loan

To serve rural populations as effectively as possible, the USDA Rural Development Program has designed its programs to offer applicants a level of assistance best suited to their situation.

To apply for the Single-Family Housing Direct Loan Program, youll submit an application to your local USDA Rural Development office. The USDA offers an online Single-Family Housing Direct Self-Assessment tool that helps potential applicants assess their options. Both the self-assessment tool and formal applications can be found on the USDA Rural Development website.

To apply for the Single-Family Housing Guaranteed Loan Program, youll work with an accredited financial lending institution, also known as an SFH Guaranteed Lender. You can find a link to active lenders listed by state on the USDA Rural Development Single-Family Housing Guaranteed Loan Program webpage under the To Apply tab. Your lender can help qualify you and get you started in the process of buying or building a home.

La Capitol Federal Credit Union is an approved, experienced lender for USDA Rural Development loans in Louisiana, and weve helped many Louisiana residents achieve their dream of homeownership. If youd like to learn more about USDA Rural Development Program loans and how you can become a homeowner too, our mortgage financing specialists are ready to help you get started.

How To Apply For A Usda Loan

When applying for a USDA loan, you’ll need to submit documentation to prove your identity and income levels, just as you would for any financing agreement. Plan on submitting a copy of your driver’s license or passport, your Social Security card, your previous two years’ tax returns and pay stubs, and recent bank statements.

You may also be asked to turn in additional documentation if you do not have a credit score, apply with nontraditional credit or have unpredictable income. You can review the complete list of requirements on the USDA website.

What Is The Purpose Of A Rural Development Loan

The RD loan program aims to make well-built, affordable housing accessible to rural communities. RD Housing Programs give families and individuals the opportunity to buy, build, repair, or own safe and affordable homes in qualified rural areas. Eligibility for these loans, loan guarantees, and grants is based on income and varies according to the average median income for each area.

Recommended Reading: Bayview Loan Servicing Class Action Lawsuit

Usda Business & Industry Loan

Stearns Bank is dedicated to the economic growth and vitality of rural communities. Through the USDA Business & Industry loan guarantee program, we provide financing for plants, factories, service businesses and offices throughout the country. Our personal service and expertise in government loan programs ensure a successful financing process, from eligibility to final funding.

What Are The Rates And Terms For A Usda Loan

Mortgage interest rates are low right now across the industry. Government-backed loans, such as USDA mortgages, are typically lower than conventional loans. Rates can be a half-point lower than a comparable conventional mortgage rate, says Dan Green, founder and CEO of Homebuyer, a mortgage lender for first-time homeowners. Every homebuyer in a USDA-eligible area should at least apply for a USDA mortgage.

Those with poor or fair credit may see greater benefit, as USDA mortgages are intended to bring more people into homeownership and those rates arent as driven by credit score as conventional loans, Grech says.

As for terms, USDA guaranteed loans are offered for only 30-year terms at fixed rates. Direct loans have payback periods of up to 33 years, with a 38 year-option available to low-income applicants who cant afford a 33-year term. Interest rates for a direct loan are fixed and can be as low as 1% when factoring in payment assistance.

You May Like: Aer Allotment

What Is A Usda Loan Am I Eligible For One

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Perhaps you feel more at home surrounded by pastures than pavement. If so, buying a home might be well within reach, thanks to the U.S. Department of Agriculture mortgage program. In fact, the USDA might have one of the governments least-known mortgage assistance programs.

A USDA home loan is a zero down payment mortgage for eligible rural homebuyers. USDA loans are issued through the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, by the United States Department of Agriculture.

» MORE: Best USDA lenders

In 2017, as a part of its Rural Development program, the USDA helped some 127,000 families buy and upgrade their homes. The program is designed to improve the economy and quality of life in rural America. It offers low interest rates and no down payments, and you may be surprised to find just how accessible it is.

With all types of mortgage loans to choose from, how do you know whether a USDA loan is right for you? Heres an overview of how it works and who qualifies:

Fill Out Your Application

After you find a property you like, you fill out your complete application. With Assurance Financial, you can complete your application online. We perform the rest of the process in-house â we never outsource underwriting.

To fill out your application, here is some of the financial information that youll need:

- Assets: You no longer have to fax bank statements to give us information on your assets. With our integrated system, you can simply log in to your bank accounts.

- Tax returns: Copies of your federal tax returns from the past two years may be requested. If you use TurboTax, you can simply log in using our system and complete this step quickly.

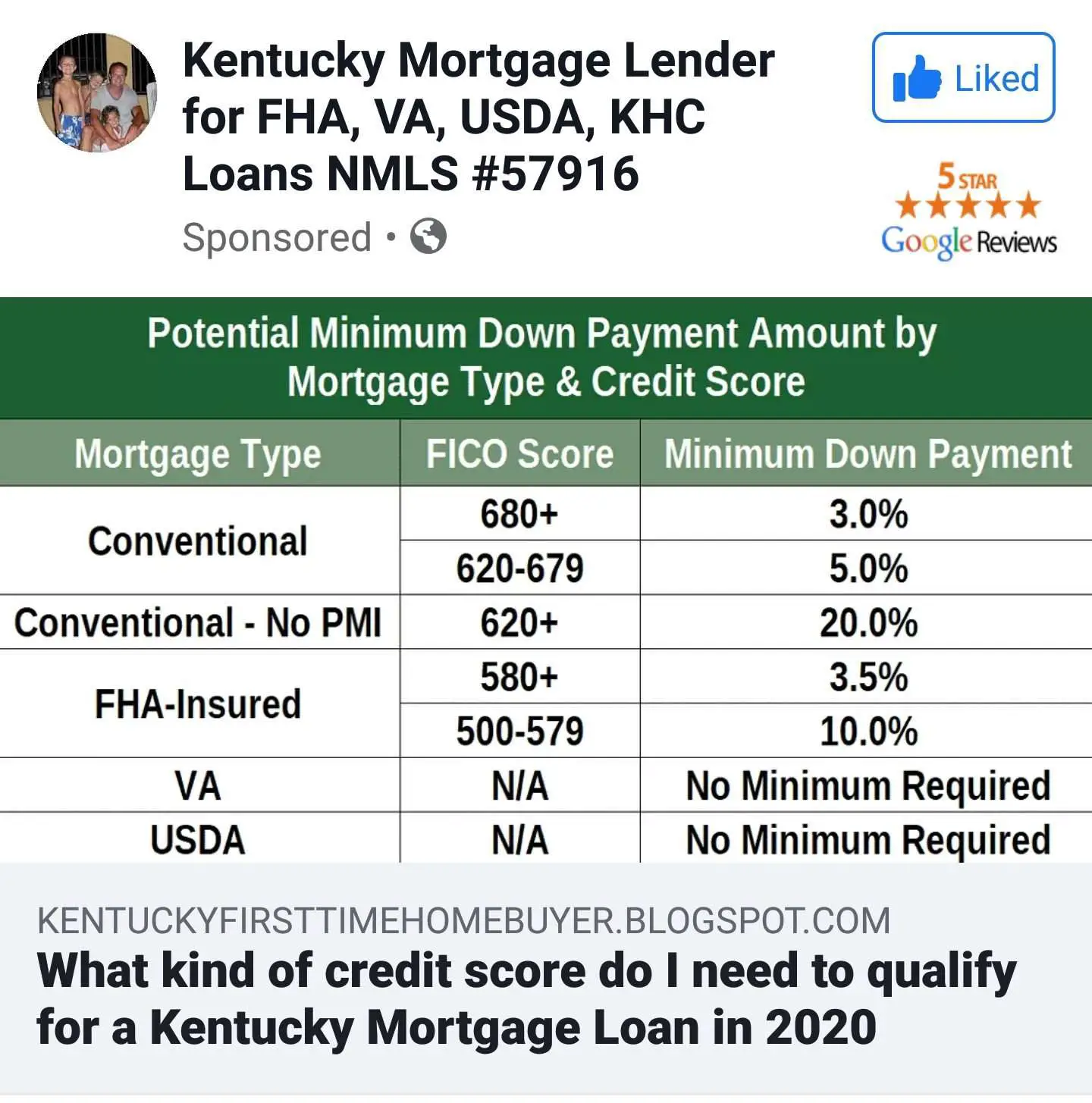

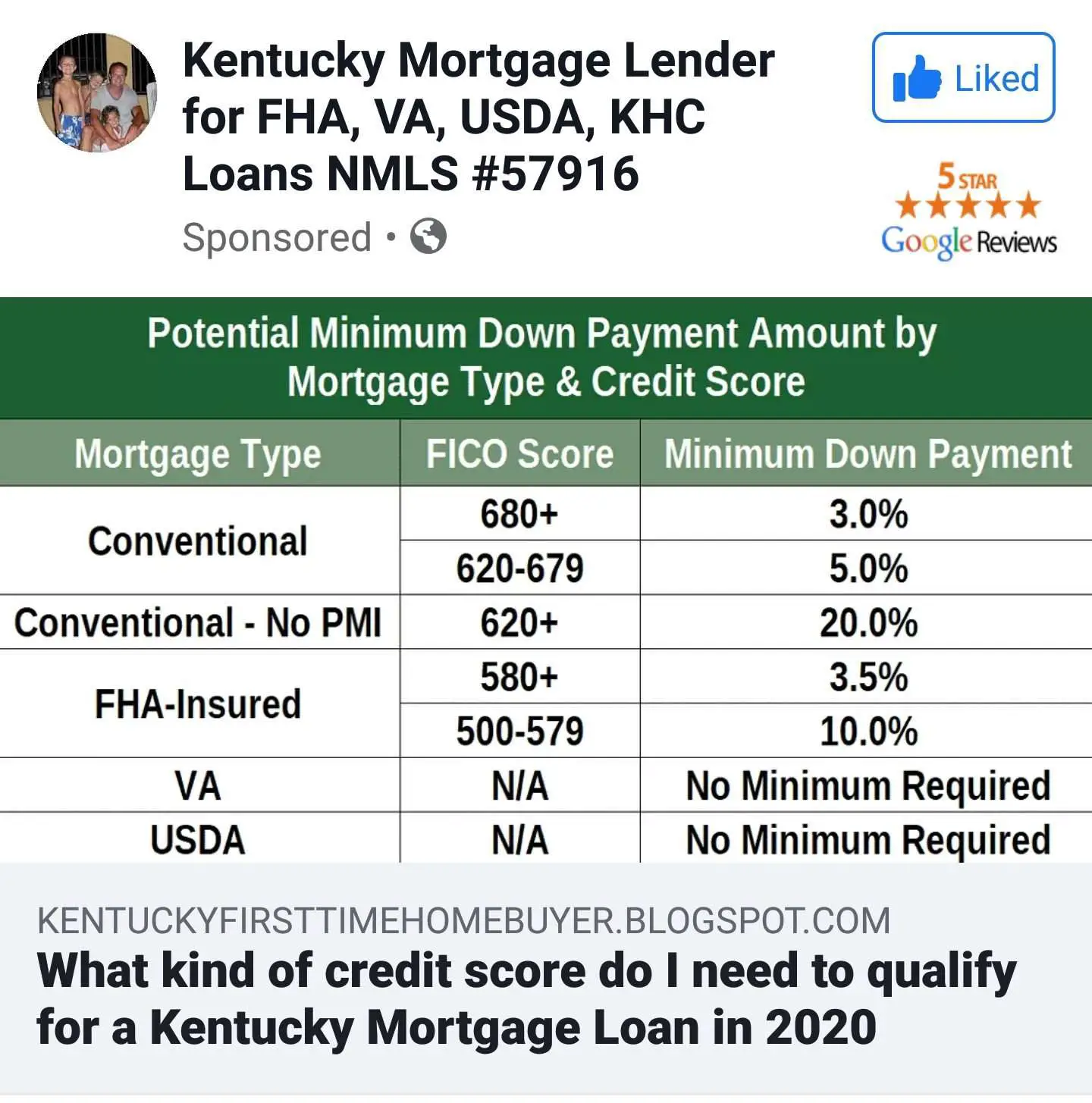

- Your credit score can determine whether you qualify for a mortgage and what the terms of your mortgage will be, so your payment history, debt and other types of credit may all be taken into account during your application process.

- Proof of income: If your employer uses a well-known payroll company such as ADP, you just need to use your payroll login to prove your income.

- Proof of identification: Snap a photo of your government-issued photo ID to prove your identity and upload it to your application. Yep, its that simple.

Read Also: How Does Paypal Business Loan Work

How Usda Loans Work

Using a USDA loan, buyers canfinance 100 percent of a homes purchase price whilegetting access to better-than-average mortgage rates. This is because USDAmortgage rates are discounted as compared to other low-down paymentloans.

Beyond that, USDA loans arent allthat unusual.

The repayment schedule doesntfeature a balloon or anything non-standard the closing costs are ordinary and, prepayment penalties never apply.

The two areas where USDA loans are different is with respect to the loantype and down payment amount.

- With a USDA loan, you dont have to make a down payment. This is one of only two major loan programs that allow zero-down financing

- The USDA loan program requires you to take a fixed-rate loan. Adjustable-rate mortgages are not available via the USDA rural loan program

Rural loans can be used byfirst-time home buyers and repeat home buyers alike.Homeowner counseling is not requiredto use the USDA program.

Lock In Your Usda Loan Rate

A USDA loan rate lock is a guarantee the USDA lender will provide a specific interest rate by a specific date, thereby protecting the borrower from rate fluctuations during the rate lock period. Rate locks are often set for 30, 45 or 60 days, but can be shorter or longer.

Policies and guidelines on rate locks and when you can lock your rate can vary by lender.

Locking in your interest rate at the right time is key, which means it’s important to find a lender who understands your needs and the forces that shape USDA loan interest rates.

Read Also: Defaulting On Sba Disaster Loan

Qualifying For A Usda

Income limits to qualify for a home loan guarantee vary by location and depend on household size. To find the loan guarantee income limit for the county where you live, consult this USDA map and table.

USDA guaranteed home loans can fund only owner-occupied primary residences. Other eligibility requirements include:

-

U.S. citizenship

-

A monthly payment including principal, interest, insurance and taxes thats 29% or less of your monthly income. Other monthly debt payments you make cannot exceed 41% of your income. However, the USDA will consider higher debt ratios if you have a above 680.

-

Dependable income, typically for a minimum of 24 months

-

An acceptable credit history, with no accounts converted to collections within the last 12 months, among other criteria. If you can prove that your credit was affected by circumstances that were temporary or outside of your control, including a medical emergency, you may still qualify.

Applicants with credit scores of 640 or higher receive streamlined processing. Below that, you must meet more stringent underwriting standards. You can also qualify with a nontraditional credit history.

Applicants with credit scores of 640 or higher receive streamlined processing. Those with scores below that must meet more stringent underwriting standards. And those without a credit score, or a limited credit history, can qualify with nontraditional credit references, such as rental and utility payment histories.

Benefits Of Usda Rural Home Loan Program For Minnesota Home Buyers

Why explore the USDA Rural Home Loan Program as a Minnesota home buyer? Here are just some advantages of the program:

- Low Interest Rates – Lower interest rates means qualified applicants can save big time over the term of the loan.

- No Down Payment – Perhaps the most attractive benefit of all is that the USDA Rural Home Loan Program doesn’t require buyers to put any money down.

- Flexible Closing Options – Closing costs can be expensive, but with the USDA Rural Home Loan Program, closing expenses can be covered through gifting, or even be covered by the seller if its negotiated into a possible deal.

- Ideal For a Wide-Range of Buyers – Although defined as being for low to moderate income families, the definition of low to moderate income is actually quite broad, making this a realistic financing option for plenty of active home buyers in Minnesota.

Buying your first home can be overwhelming. Let us help! We are committed to finding you any grant monies or assistance programs available to you. Our buyer agent services are FREE! Please contact us for more information. We have assisted hundreds of first time home buyers and look forward to the opportunity to assist you!

Read Also: Texas Fha Loan Limits 2020

Section 502 Direct Loans

Through its Single Family Housing Direct Home Loans program , the USDA lends money directly to homebuyers. Some people who take out direct loans from the USDA also qualify for payment assistance, which temporarily lowers the monthly payment they owe.

If eligible, you can use these loans to buy an existing home, and even repair it, if needed. You can also use the money to build a new home.

You dont have to make a down payment, unless your assets are above a certain threshold. Another plus: You dont have to pay for mortgage insurance.

The loans have a fixed interest rate thats determined by market rates. If you qualify for payment assistance, the effective rate can be as low as 1%. Loan terms are typically 33 years, though borrowers with very low income may have up to 38 years to repay the loan.

The loan amount is determined by your income, assets, debt-to-income ratio and other financial details, but it cant be higher than the USDAs loan limit for the area. And this type of loan cant be used to buy or build a home thats unusually large or valuable for its location, that has an in-ground swimming pool, or thats constructed to serve as the site of a business or to generate income.

How To Qualify For A Usda Rural Development B& i Loan

USDA Rural Development B& I Loans are available for both new and existing businesses that can meet the minimum qualifying criteria set forth by the USDA. The types of businesses that are eligible to apply for a loan include:

- For-profit and nonprofit businesses

- Public bodies

- Federally recognized Native American tribes

A qualifying business must be located in a rural area that falls under the USDAs population maximum. Loans are only made available for businesses in communities that have 50,000 or fewer residents. Notably, in the United States, this constitutes about 97% of the country, including many communities directly adjacent to large metropolitan areas. In addition, companies can be headquartered in larger metros, as long as the business itself is located in a qualifying area. Business owners can easily see if their address qualifies by looking at NACs USDA loan eligibility map.

Once a business is determined as being eligible to apply, the owner must meet the following requirements:

While USDA Business & Industry Loans are designed to help empower credit-worthy businesses, qualifying for a rural development loan can be easier than you think, especially with the assistance of an experienced direct lender like North Avenue Capital. USDA B& I Loans are similar to SBA 7a Commercial Loans but with benefits that can outweigh those of SBA loans. North Avenue Capital can help you investigate the feasibility of a USDA loan for your business plans and help you apply for one.

You May Like: Genisys Loan Calculator

Understanding How Usda Guaranteed Loans Work

The USDA guaranteed loan program specifically caters to low to moderate-income homebuyers searching for affordable housing in eligible rural areas. The program aims to improve rural development by offering financing to qualified borrowers. USDA loan borrowers can buy, build, reconstruct, or relocate their dwelling as long as its within an approved USDA rural location.

USDA loans come with relaxed credit standards compared to conventional mortgages. If your income and credit score does not meet conventional loan standards, you may qualify for a USDA loan. And unlike traditional conventional loans, USDA loans come with lower interest rates and a zero-down payment option for borrowers. Thus, homebuyers with limited funds do not have to make a down payment. However, consider making a small down payment to help reduce your monthly payments and increase your overall mortgage savings.

USDA Loans During the COVID-19 Crisis

Borrowers have a good chance of securing a USDA loan if theyre coping with reduced income, but have maintained a good credit record. When the COVID-19 pandemic caused widespread unemployment, many Americans had trouble making mortgage payments from April to July 2020. Despite the economic crisis, the USDA reported that mortgage applications increased by around 53% in June 2020 compared to June 2019.

Take Note of Mortgage Insurance

Debt Ratios 2020 To Maintain Changes Rolled Out In 2014

The program adopted new debt ratio requirements on December 1, 2014. There are no planned updates to this policy in 2020.

Prior to December 2014, there were no maximum ratios as long as the USDA computerized underwriting system, called GUS, approved the loan. Going forward, the borrower must have ratios below 29 and 41. That means the borrowers house payment, taxes, insurance, and HOA dues cannot exceed 29 percent of his or her gross income. In addition, all the borrowers debt payments added to the total house payment must be below 41 percent of gross monthly income.

For example, a borrower with $4,000 per month in gross income could have a house payment as high as $1,160 and debt payments of $480.

USDA lenders can override these ratio requirements with a manual underwrite when a person reviews the file instead of the algorithm. Borrowers with great credit, spare money in the bank after closing, or other compensating factors may be approved with ratios higher than 29/41.

Don’t Miss: Loan Originator License California

Tips For Getting A Usda Loan

- Do your research. Qualifying for a USDA loan boils down to your income and location. So look up USDAs website to see where its designated areas are and what the income limits are in those locations.

- Applying for a USDA loan requires extensive documentation so be sure to have a mortgage preapproval checklist at hand.

- Before you house hunt, even with a USDA loan, its a good idea to know how much house you can afford. This process will help you figure out which rates you can manage.

Shop Around For A Usda

This is the fun part: going on home tours and scrolling through Zillow. Whatever home youre seeking should be in an approved rural or suburban area. Otherwise, you wont be eligible for the USDA loan. Additionally, you should prepare to live in the home you purchase, since vacation homes and investment properties are not allowed.

Once youve put in an offer and been approved, youll start the underwriting process. USDA loans take longer to underwrite , so talk to your loan officer about the expected timeline. USDA mortgage applications are paperwork-heavy, says Green. You dont want long approval times to jeopardize your closing date.

Don’t Miss: Usaa Auto Loan Approval Odds

How Long Is The Process For Getting A Guaranteed Usda Loan

The process of securing a USDA-guaranteed loan normally lasts a few weeks and breaks down into the following stages.

Get preapproved: Your lender reviews your financial, employment and credit history before giving you mortgage preapproval. At that point, the lender notifies you of the mortgage amount they feel comfortable offering you. Keep in mind the lender may have specific requirements and conditions outside USDA standards. So read all documentation and ask questions.

House hunt: Hold onto your mortgage preapproval document and search for an affordable home in a USDA-designated area.

Sign off on the mortgage: After you sign off on the mortgage, your lender makes one final review before formally associating t with the property. A third-party appraisal body generally inspects the home youre considering to make sure it follows USDA guidelines and that your mortgage lines up with the propertys value against current market rates.

Final USDA approval: Your lender submits the application to the USDA for its final review.

Close on the deal: You sign the remaining documents and youre ready to move into your new home within a few days.