Can I Open A Savings Account Online

Yes. You can open a personal savings account online, with up to two applicants per account. To complete the online application, youll need to have your Social Security number your U.S. issued photo ID the ABA routing and account numbers of your existing accounts, , or your credit or debit card information .

How Do I Send Money To Someone Directly From My Bank Of The West Account

You can use Zelle® to send money to friends, family and almost anyone you know and trust with a bank account in the U.S., typically within minutes.1 Sign in to your Bank of the West Online Banking account from your computer or the Bank of the West Mobile App. Select Payments & Transfers > Send Money with Zelle®> Send. From there, you can send money directly to someone using their email address or U.S. mobile phone number.

Repayment Mode: I Want To Change The Repayment Mode To Some Other Bank Account Can I Initiate A Request Online For A Change In The Repayment Mode

Yes, you can initiate the request through Internet Banking and follow the E-NACH process.

For registering a swap request, .

Post the completion of all mandatory details on the NACH E-Mandate form, you will have to click on Authorise mandate and tick the check box for terms and condition.

- Account information for mandate creation

- Debit Account details, from where the funds get debited

- Mandate information amount, etc).

Recommended Reading: How To Get 60000 Loan

Why Finance Through Becu

Financing is subject to BECU membership, credit approval, and other underwriting criteria not every applicant will qualify.

AutoSMART services are provided by Credit Union Direct Lending and is not affiliated with BECU. BECU specifically disclaims all warranties with regard to dealers’ products and services. Dealer fees apply. BECU loan financing subject to credit and underwriting approval, and may change without notice.

*APR based on borrower’s credit history, 48-month or less repayment term, collateral two years old or newer with up to 90% loan-to-value , and based on wholesale Kelley Blue Book or dealer invoice. Loans with repayment terms that exceed 48 months, 90% LTV, involve lesser applicant creditworthiness, or collateral older than two years are subject to higher APRs and lower loan amounts. Certain conditions apply. The specific amount of the loan shall be based on the approved value of the collateral. Final loan approval is subject to funding review by BECU. Actual rate may be higher. Financing is subject to BECU credit approval and other underwriting criteria not every applicant will qualify. Applicants must open and maintain BECU membership to obtain a loan. Payment Example: $356.20 a month based on a five year, $20,000 loan at 2.64% APR.

*This is a summary of BECU auto loan program. Loans and BECU financing program subject to BECU credit and underwriting approval.

What Are Aftermarket Products

Aftermarket products are optional products, services, or insurance that may be purchased when you buy your vehicle. They may cover unforeseen vehicle repair needs or assist with loan payments.

Common examples include:

- Guaranteed Asset Protection pays all or a portion of the loan balance after the payment of a total loss insurance claim.

- Service contracts provide coverage in the event that a major mechanical component of the vehicle, such as engine, transmission, heating/cooling system, seals, gaskets, and fuel system, need repair. The coverage typically lasts for a specific period of time or vehicle mileage.

- Anti-theft protection includes devices or services, such as tracking, that make the vehicle more difficult to steal or easier to recover if it is stolen.

- Maintenance packages are prepaid plans that typically cover scheduled maintenance, such as oil changes, on the vehicle.

- pays off all or some of your loan if you pass away.

- assists with making your loan payments if you become unable to do so due to disability.

Don’t Miss: How Can I Get An Rv Loan With Bad Credit

Cibc Personal Car Loan

With up to 8 years to pay off the loan and the possibility of no down payment, this loan makes it easy to purchase a new or used vehicle.

Term: 1 year – 8 years

Special offer: Get up to 10% cash back with a new CIBC Dividend Platinum® Visa* Card. Plus, save up to 10 cents per litre3,4 on gas at participating Chevron, Pioneer and Ultramar gas stations4 when you link and use your CIBC card with Journie Rewards. Learn more about Journie Rewards.

This personal car loan is for you if you want:

- Help with financing a new or used vehicle

- Lower monthly payments by taking up to 8 years to pay off your loan, giving you maximum flexibility

- The choice of weekly, bi-weekly, semi-monthly or monthly payments to coincide with your pay periods

- To apply online for a faster approval

Other loan details:

- Borrow a minimum of $5,000

- Once youve been approved for a CIBC Personal Car Loan, your information only needs to be updated for future credit applications

- To make scheduled payments from your CIBC account at no charge with an Electronic Fund Transfer

- Pay off all or part of the loan at any time without penalty

- You can also skip up to two payments yearly2

You may also want to consider:

- Using a personal loan to buy a used car

- Applying for a Home Power® line of credit for a lower interest rate and a higher credit limit

Tools and advice

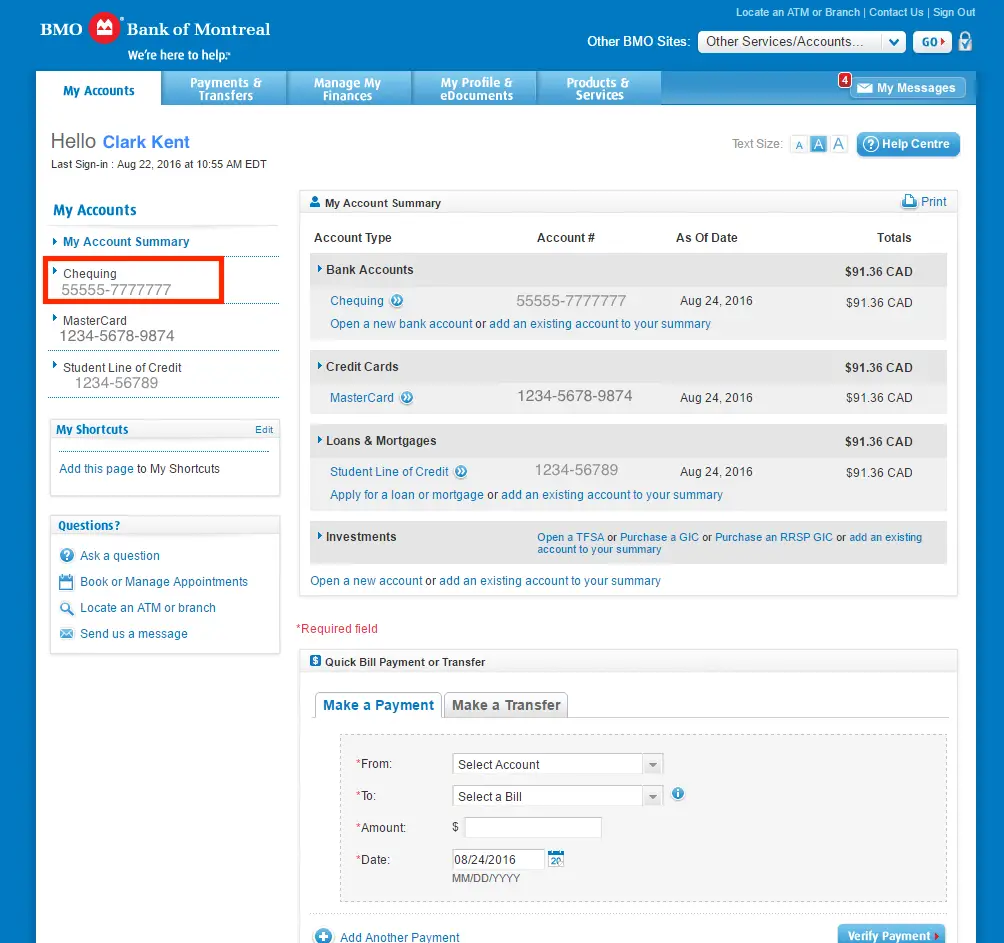

Locating Your Account Number

Recommended Reading: What Is The Best Debt Consolidation Loan Company

Student Loan Stats At A Glance

Do you know what is the best way to bog yourself down in a quagmire of debt?

Get yourself a college degree.

The second highest consumer debt category is student loan debt, preceded by mortgages.

Student loan debt in the United States is higher than both auto loans and credit card debt as well.

The average student loan borrower owes $33,000. About 3 million students owe over $100,000. To put that in context, an average new car costs $36,700. You can get a small starter house in most small or mid-sized cities for $100,000.

When its time to start making repayments, shortly after graduation, the average monthly repayment is $300.

Imagine making monthly $300 payments for 6, 10, 15, or 20 years.

Over 45 million Americans dont have to imagine it. Its their everyday reality.

A student loan is a lifelong investment for many. Its as vital a bill payment as rent, a mortgage, or car loans.

If youre embarking on a decades-long journey of monthly student loan repayments, you must know how to find the student loan account information.

I Bought An Aftermarket Product And Can’t Remember What It Covers Where Can I Find This Information

The contract for the aftermarket product will provide the details of the coverage, including items such as the cost, what is covered and excluded, and how long the coverage lasts . If you have questions about the coverage, contact the dealership or the coverage provider their contact information is listed on the contract. To request a copy of the contract, contact the dealership or call us.

Also Check: How To Pay Off Harley Davidson Loan

When Will I Receive My Title After I Pay Off My Loan

After we receive your final payment and the account balance is satisfied, we will release your title depending on the payoff method, state law requirements, and state motor vehicle department procedures. The title release process can vary in length and depends on if you have a paper, electronic, or customer-holding paper title. If you are unsure of which category applies to you, please contact your local motor vehicle department. If you have additional title-related questions, please call us at 1-888-329-4856.

Paper title maintained by Wells Fargo AutoWe start the title release process in approximately 3 10 calendar days after the payoff posts to your account, to allow enough processing time for your payment to clear through your financial institution, or as otherwise required by state law. To shorten the title release process, payment by guaranteed funds will begin the process within 3 calendar days.

Please note this does not include mail time.

If the payoff amount received does not satisfy the amount owed, the title will not be sent until the balance is settled. If you have additional title-related questions, please call us at 1-888-329-4856.

Electronic title maintained by your stateFor electronic titles, you will not receive a paper title from Wells Fargo Auto. At the time of release, we will electronically cancel our lien with your state. After the lien is released, your state will mail your title in approximately 4 8 weeks.

How Do I File A Claim Or Use My Aftermarket Product

Contact the coverage provider for information on how to file a claim or how to use the product their contact information is listed on the contract. Your coverage provider will let you know if they will reimburse you for expenses or if they will pay the expenses at the time a covered service is performed. They will also explain other conditions, such as requiring that the maintenance be performed at the dealership where you purchased the vehicle.

Read Also: How To Get Low Interest On Car Loan

What Is A Lien Release

A lien release is a notarized document sent after the vehicle has been paid off to show that Wells Fargo Auto is no longer the lien holder. Please note if you already have the paper title in hand or are waiting on the motor vehicle department to mail your paper title, you do not need a lien release. If requested, we will send a lien release for a paper title maintained by a customer. If you have additional title-related questions, please call us at 1-888-329-4856.

Other Products & Services:

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, member FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. . JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

“Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

Also Check: What Are The Qualifications For Rural Development Loan

Go Electric And Drive Away With Big Savings On Your Auto Loan

Getting a car loan doesn’t have to be a major journey. We create a speedy course for you to take, so that you can get on the open road. Take advantage of competitive rates and flexible terms. The roadmap for a car loan doesn’t get easier. Save an additional 0.25% when you make automatic payments from a Bank of the West checking or savings account. There may even be additional benefits for our Premier and Wealth Management customers.1

Have you recently moved to the U.S. to pursue your career? If so, financing a car without established credit history can be challenging. We’re here to help you get behind the wheel. Learn More

Go green with an Electric Vehicle loan discount and save 0.25% off our standard auto rates when you finance a qualified electric vehicle. Learn More

Will I Get A Refund If I Cancel The Aftermarket Product

The contract may say whether you are entitled to a refund. If it does not, contact your coverage provider, as they will determine whether you are entitled to a refund and what amount, if any, is owed. The coverage providers information is listed on the contract. To request a copy of the contract, contact the dealership or call us.

Read Also: How Much Fha Loan Can I Get

How Is Interest Calculated On My Auto Loan

With a simple interest loan, interest accrues daily. As you pay off the principal balance, the daily interest charge will decrease.

To calculate the daily interest charge, first convert the interest rate percentage into a decimal by dividing the interest rate by 100. Multiply that number by your principal balance, and then divide by the number of days in a year . This will give you the daily interest charge.

ExampleIf the loan has a 9% interest rate and a $10,000 principal balance, you convert the interest rate into a decimal: 9 / 100 = .09, and calculate the daily interest charge: .09 x $10,000 / 365 = $2.47 daily interest.

My Car Was Totaled And My Insurance Did Not Cover The Full Loan Amount What Should I Do

You are responsible for making your regular monthly payments until the loan is paid off. If you had Guaranteed Asset Protection insurance on your loan, some or all of the remaining balance may be covered. If there is a remaining balance on the loan after the GAP payout is determined, you are responsible for making regular monthly payments until the loan is paid off. You can also make a lump sum payment, if you prefer.

You May Like: Does The Student Loan Forgiveness Work

How Much Will My Refund Be

For a refund quote, contact the dealership or your coverage provider their contact information is listed on the contract. Factors such as the purchase and cancellation date, vehicle mileage at the time of purchase and cancellation, purchase price, and the state you live in can affect how the refund is calculated. To request a copy of the contract, contact the dealership or call us.

Where Can I Find My Payoff Information

You can review your payoff information for your loan through Online Banking. Once you have signed onto Online Banking:

Don’t Miss: How Long Does It Take To Get Student Loan Money

I Need To Change A Name On My Vehicle Title And My Loan Account Has An Outstanding Balance What Should I Do

Begin by checking with your motor vehicle department to find out what title documentation youll need. When we receive the request, well send the title documentation in the appropriate format.

- If the motor vehicle department asks for a copy of the title, an electronic screen-print, or an authorization letter, you or the motor vehicle department can request that from us.

- If the motor vehicle department needs the original paper title, they will need to request the title from us.

Youll then go to the motor vehicle department to formally request the title change. The motor vehicle department will either send the information to us directly or will provide you with the required document. If you receive the document from the motor vehicle department, you can submit it to Wells Fargo Auto, along with one of the following documents:

- Articles of amendment

Fax

1-844-497-8670

Please allow three to five business days for processing from the date that we receive the required documentation.

Where Can I Find My Vehicle Identification Number

Your Vehicle Identification Number can be found in a number of places: on your most recent billing statement, on your insurance documents, on your contract or purchase agreement or inside the windshield of the vehicle itself. If you can’t find it or you need more assistance, please contact us at 888-895-7578.

For auto financing, your Vehicle Identification Number is 17 digits and can be found in a number of places, including on your most recent billing statement, on your insurance documents, on your contract or purchase agreement or on the inside of the windshield of your vehicle.For trailers, your VIN can also be found stamped on the manufacturerâs plate, which is usually near the front of the driverâs side of the trailer.For boat financing, your Hull ID is 17 digits including leading zeros and can be found in your original contract or on your most recent billing statement.

Recommended Reading: How To Cancel My Student Loan Debt