Use Chipper For Lower Payments

Chipper can help you find a student loan repayment plan that actually fits into your budget. You simply fill out your information and link your student loan account for us to generate your options in seconds. We help the average student loan borrower save over $300 a month off their student loan monthly payment. Lowering your monthly payment plan can game changing for your personal finance and can be done in minutes! to get on track with your student loans.

Federal Student Loans May Qualify For Student Loan Forgiveness Down The Line

If you take out federal student loans, you might qualify for partial or full loan forgiveness in some circumstances. Here are the three federal student loan forgiveness programs :

Income-Driven Repayment Plan forgiveness

If you have federal student loans and cant afford your monthly payments, one option is to sign up for an income-driven repayment plan. Under an IDR plan, your monthly payment is based on your discretionary income and family size. Depending on your situation, it could be dramatically reduced.

After 20 to 25 years of making on-time payments , the remaining balance of your loans should be discharged. But keep in mind that the forgiven amount is taxable as income.

Private student loans are not eligible for income-driven repayment plans.

Public Service Loan Forgiveness

If you have federal student loans and your employer is a government agency or nonprofit organization, you might be eligible for Public Service Loan Forgiveness .

To apply for PSLF, you must work for an eligible employer for 10 years and make 120 payments on your qualifying federal student loans. And unlike IDR forgiveness, the forgiven balance with PSLF isnt taxable as income.

Teacher Loan Forgiveness

Teachers might be eligible for $5,000 or $17,500 in loan forgiveness through the Teacher Loan Forgiveness Program, depending on the subject you teach.

What Are The 3 Types Of Student Loans

There are three types of student loans: federal loans, private loans and refinance loans once you leave school.

- Federal loans are provided by the government, while banks, credit unions and states make private loans and refinance loans. …

- The right loan is key to taking on no more student loan debt than is necessary.

Recommended Reading: Refinance Fha Loan To Conventional Calculator

Private Student Loan Forgiveness

Although private student loan forgiveness programs dont exist in the traditional sense, there is help out there for private student loan borrowers in certain circumstances. The key is to talk to your lender if youre struggling to see what options are available and to act fast.

You dont want to fall into delinquency or deferment, which could hurt your credit. So if youre facing difficulties with your student loan payments, take action today.

Caitlin See contributed to this article.

Have you used any of these alternatives to private school loan forgiveness?

Q If So Many Students Are Struggling To Repay Their Loans How Much Are Taxpayers On The Hook For

A. For many years, federal budget forecasters expected the student loan program to earn a profituntil recently. In its latest estimates, the Congressional Budget Office expects the program to cost taxpayers $31 billion for new loans issued over the next decades. And that figure uses an arcane and unrealistic accounting method required by federal law. Using an accounting method that calculates the subsidy to borrowers from getting loans from the government at rates well below those theyd be charged in the private sector, the cost to taxpayers is $307 billion. And that largely excludes the cumulative losses already anticipated on loans issued prior to 2019.

Recommended Reading: Nerdwallet Loans

How Much You Should Borrow In Private Student Loans

In terms of how much you should , borrow only what you think you can afford to pay back later. Think about your future career and how much you may make in your chosen field. To help estimate your future income potential, you can visit the US Department of Labor at bls.gov.

The amount of money you can receive from a private education loan varies by lender. If your lender requires school certification, your school verifies your enrollment and ensures that youre not borrowing more than the cost of attendance .

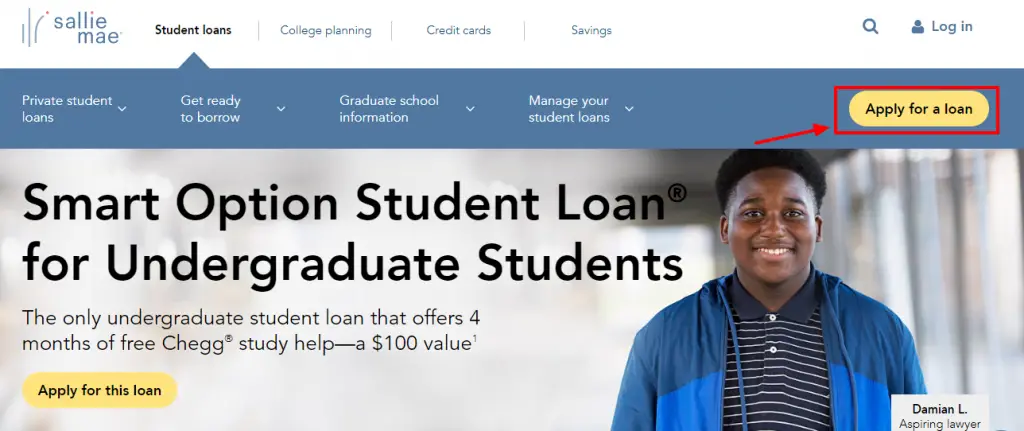

Sallie Mae Student Loans Review

Sallie Mae offers loans for a variety of schooling levels with competitive rates, terms, and benefits. If you are looking for helping paying for college, Sallie Mae may be a great choice.

Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site.

Key points:

- Sallie Mae is one of the largest private student loan companies in the nation, and it offers a broad range of private student loan products.

- Undergraduates, graduates, parents, and professional students can find a loan with Sallie Mae.

- Sallie Mae no longer services federal student loans that service was split off into the company now named Navient.

| $1,000 to 100% of school-certified college costs |

| Repayment Terms |

The information above is for the Sallie Mae Smart Option Student Loan for Undergraduates.

Sallie Mae began as a government-sponsored organization in 1972. In 2004, the lender became fully privatized, and in 2014, Sallie Mae was split into two distinct companies.

The first is the SLM Corporation, which is Sallie Mae. Sallie Mae is a private student loan originator. The other company formed from the split was the Navient Corporation. Navient is a federal and private student loan servicer.

In this review:

WATCH: LendEDU reviews Sallie Mae student loans:

Don’t Miss: Refinancing Fha Loan Calculator

Is Sallie Mae A Federal Or Private Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

What’s The Difference Between Sallie Mae And Navient

Two names that come up often when talking about student loans are Sallie Mae and Navient. Many people get confused over whether they’re the same company or not. Here’s the fast answer: No, but they used to be. These days, they are two separate companies. Sallie Mae is offers private student loans and Navient acts as a servicer for federal and private student loans.

You May Like: Is Prosper A Legit Company

Paying Off Federal Loans Vs Private Loans

Theres no definite answer when it comes to which can be paid off faster, federal student loans or private student loans. It depends on the amount of your loans, how much your payments are, your interest rate, and how much money youre making after school:

- How much is your monthly student loan payment?

- Did you choose a repayment plan where you make payments during school, or did you have a grace period after graduation?

- Is there a cosigner on the loan? Are they helping with payments?

- Are you keeping up with your payments and paying interest that accrues before it capitalizes ?

Is A Sallie Mae Loan The Right Fit For You

College costs have skyrocketed in recent years, and federal direct subsidized and direct unsubsidized loans have strict caps on how much you can borrow. If you need additional money to pay for school, using a private student loan from a lender such as Sallie Mae can be a good option.

On the plus side, Sallie Mae offers a wide range of loans, with multiple repayment options, for students of all types. It also has loan forbearance and discharge programs that compare favorably to federal loan discharge policies, and it allows you to apply for a cosigner release in just 12 months, setting it apart from other lenders. However, on the downside, Sallie Mae doesn’t allow you to get a rate quote before you apply, which means a hard credit inquiry is required to see your rate.

Whether Sallie Maes interest rates are more competitive than those of other lenders, including the federal government, is a more complicated question. Much depends on your financials. While Sallie Maes lowest rates are lower than the feds, youll probably only qualify for them if you have an excellent credit scoreotherwise, youll probably end up paying about the same or even more. The lender does offer variable interest rates on its loansunlike the governmentand that can be an advantage in an environment of declining interest rates.

Before making a decision, make sure you compare offers from other private student loan lenders.

Read Also: What Percentage Do Loan Officers Make

What Private Loans For College Can Be Used For

Whether you’re studying online or on campus, private school loansas well as federal student loansfor college and grad school can be used to pay for your education expenses, which for full-time and half-time students may include:

- Tuition

- Transportation

- Computer for school

Apply only once with a single credit check and funds will be sent directly to your college or university each term as requested. You can cancel future disbursements as needed with no penalty. No additional interest is charged until money is sent to your school.

Definition And Examples Of Sallie Mae

Sallie Mae is a publicly-traded company that is a major provider of private student loans in the U.S. As of the third quarter of 2021, Sallie Mae held $20.5 billion in private student loans. It held another $703 million in federal student loans issued through the now-defunct Federal Family Education Loan Program.

Other examples of Sallie Mae products include credit cards and online savings accounts.

Also Check: Mountain America Mortgage Rates

You Might Need A Cosigner For Private Student Loans

You can qualify for federal loans on your own, even if you dont have a steady income or good credit. But with private student loans, lenders require applicants to meet certain income and credit requirements.

In general, youll need to have good to excellent credit to qualify for a loan, or youll need to have a creditworthy cosigner apply with you. Keep in mind that if you choose to have a cosigner, theyll be on the hook if youre unable to make your monthly payment for any reason.

Learn More: Student Loan Requirements

What You Need To Know About Navient

Since youre on the borrowing end of the student loan process, you might not be too concerned about the company that is going to service your federal student loan.

More than likely, youre just trying to figure out what your FAFSA status is and how to read your financial aid award letter.

But after graduation, Navient may be the one servicing your student loanswhich means you will be sending your monthly payment to them.

After you start paying on your student loan, they will be able to provide you with information about different income-driven repayment plans that can help make your monthly payments more affordable. And if you experience financial hardship or lose your job, Navient may also be able to assist you with deferment or forbearance.

Want to know more about how private student loans work? Get our free Private Student Loans 101 guide.

You May Like: Usaa Credit Score Range

How To Apply For Federal Student Loans For College

Applying for a federal student loan is free. All you need to do is complete the . In addition to federal student loans, the FAFSA also determines your eligibility for other federal student aid like grants and work-study. You need to submit the FAFSA every year youre enrolled in college to receive federal student aid.

Free money tip

Want to pay less for college? File the FAFSA® to see how much financial aid you can get. Sallie Mae and our partner Frank make applying easy with a faster, simplified process and step-by-step guidanceand it’s free.

The easiest and fastest way to file the FAFSA is online. Your application will be processed within 3-5 days. You can also mail in a paper application, but processing it will take about 7-10 days.

Submitting the FAFSA is totally free. If youre asked to pay, that means youre in the wrong place.

Resources For Student Borrowers

For more information about private student loans, your rights, and local lawyers to help, visit the National Consumer Law Centers Student Borrower Assistance website.

For more information about how to stop collectors from contacting you about private student loans, visit the Consumer Finance Protection Bureaus website.

The Project on Predatory Student Lending

The Project is part of the Legal Services Center of Harvard Law School , a community law office and clinical teaching site of the law school. Clinical students join the Projects staff to litigate cases on behalf of clients, in partnership with community-based organizations and advocacy organizations.

This website is neither a solicitation nor an offer to represent you concerning any legal problem. The information conveyed on this website is not legal advice and is not intended to and does not create an attorney-client relationship between you and our law firm or any attorney with our firm. Please be aware that unsolicited letters, emails, and faxes do not create an attorney-client relationship, and you should not send any confidential information to us unless and until you and our firm enter into a formal agreement establishing an attorney-client relationship. You can read Harvard Law School’s Privacy Statement here.

You May Like: Why Is My Car Loan Not On My Credit Report

Use Chipper For Public Service Loan Forgiveness

The Public Service Loan Forgiveness program was created to provide relief to borrowers aiding the public sector. Unfortunately, 30% of applicants are denied due to incorrect paperwork. We can help! Chipper was created to solve this issue by assisting borrowers in understanding their options as well as allowing forgiveness eligible users enroll into the best forgiveness program available. to see your student loan forgiveness options and get the forgiveness you deserve.

Few Options For Relief For Student Borrowers

Student borrowers with private loans from for-profit schools have very few, if any, options for relief. Most private student loans have high interest rates, no automatic forbearances or income driven plans. Students are at the mercy of their lenders to provide payment reductions or forbearances.

Student borrowers are locked into contracts with private loan lenders, often including mandatory arbitration clauses, which are unfair and favor schools.

Private student loans have many negative consequences for student borrowers. Student borrowers have ruined credit, cannot buy homes or cars, cannot get access to credit cards and cannot pursue their education further. These loans have impacted their personal lives and relationships and cause a huge amount of stress.

Although not impossible, it is difficult to get any student loans, including private loans discharged in a personal bankruptcy, where students must prove a very high bar of undue hardship. Despite widespread support, even from those in the industry, Congress has still not restored bankruptcy rights to student borrowers. In contrast, for-profit schools are allowed to file for bankruptcy and walk away fairly unscathed, leaving in their wake students with mounting, bogus debt and useless degrees.

Recommended Reading: Can You Buy An Auction Home With A Fha Loan

Defer Your Student Loans

If youre looking for private student loan forgiveness, its likely that youre struggling with your loan payments after paying for college.

Unlike with federal student loans, private lenders dont offer an income-driven repayment program to make your student loan payments more manageable and affordable. But you may be able to apply for deferment.

Lets say youre looking for Sallie Mae student loan forgiveness. While there is no available option for Sallie Mae loan forgiveness, they do offer deferment for student loan borrowers. When you defer your student loans, you can reduce or pause payments temporarily.

Am I Eligible For A Sallie Mae Student Loan

If you are pursuing a Federal loan, you will need to meet certain minimum requirements. All students applying to a Federal loan program must have a minimum GPA , they must be a U.S. Citizen or legal resident, they must fall within the required income bracket and they must be able to prove that they have not defaulted on any prior loans.

If you are pursuing a private loan for college your academic performance will not matter as much as your credit score. This can be problematic for many students as most college bound seniors have built up little or no credit history. For students looking to borrow from private lenders Sallie Mae offers cosigner options for applicants with little or no credit. With a cosigner you can get the money you need for college while building up credit that will serve you in good stead in later life.

One major benefit of securing a private loan through Sallie Mae is that you can apply for larger sums of money. Assuming you have not qualified for a Federal loan program and you are stuck paying for college out of your own pocket, a Sallie Mae private loan can get you the finances you need to cover your tuition costs while offering competitive rates and manageable terms.

Read Also: Usaa Refinance Rates Auto

Sallie Mae Interest Rates

As a private lender, Sallie Mae is allowed to decide their own terms of lending. This means that Sallie Mae can choose what interest rates it wishes to choose, regardless of the rates that Congress sets for federal student loans. Exactly what interest rate you might qualify for will depend on a number of factors, including:

- Your credit history: Do you have a credit history? What is your credit score? This number is designed to tell a lender how risky it will be to lend you money. If you have a higher score, you may qualify for lower interest rates.

- Your income: Whether or not you have a current source of income, and what that income is, may impact your interest rate.

- Whether or not you apply with a cosigner: Because applying for a loan with a cosigner makes you less risky, it also typically means that you can qualify for a lower interest rate.

- The type of loan you are applying for: Loans for degrees that typically lead to higher salaries often come with lower interest rates.

When evaluating the interest rates offered by Sallie Mae, bear in mind that private lenders often advertise the lowest rates possible. These rates are typically reserved for borrowers with excellent credit scores, and/or are tied to variable rate loans which may change over time.