How To Improve Your Chances Of Getting A Loan

Now that you have a good idea about the differences between secured loans vs unsecured loans, as well as whats important in order to get approved for a loan, youre ready for the next step. That is, making sure youre in the best possible position, should you decide to apply for a loan. Improving your business credit and maintaining a good credit score is important to improve your chances of getting approved for a loan.

Here are some ways to help build your business credit score:

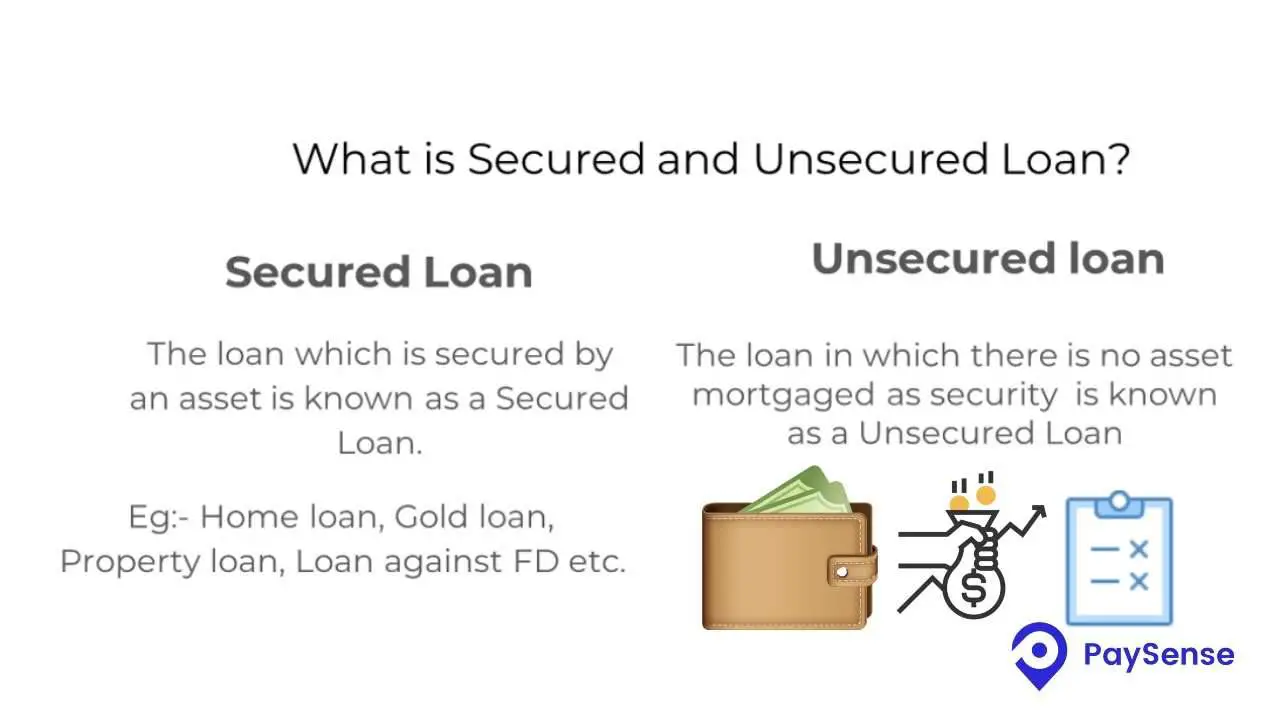

What Is Unsecured Loan

An unsecured type of loan does not require you to provide any Tangible security to the lender when taking a loan from them. These may have comparatively higher interest rates as compared to secured loans due to the absence of security. The creditor grants you the loan mainly by assessing your ability to repay the debt. This is done by analysing your bank account statements and CIBIL score, among other factors. Having a stable source of income can help you procure an unsecured loan with ease. A stable employment history along with references are also considered by banks when reviewing your application for an unsecured loan. Lenders also take into consideration your monthly income in combination with your existing debts. This helps them accurately understand your financial capacity for repaying the loan.

An unsecured loan is a great option for people who need to borrow money but have no collateral to pledge. Thus, even if you do not have assets like a home or jewellery, you can still get the funding that you need.

It’s More Than Just Collateral Requirements

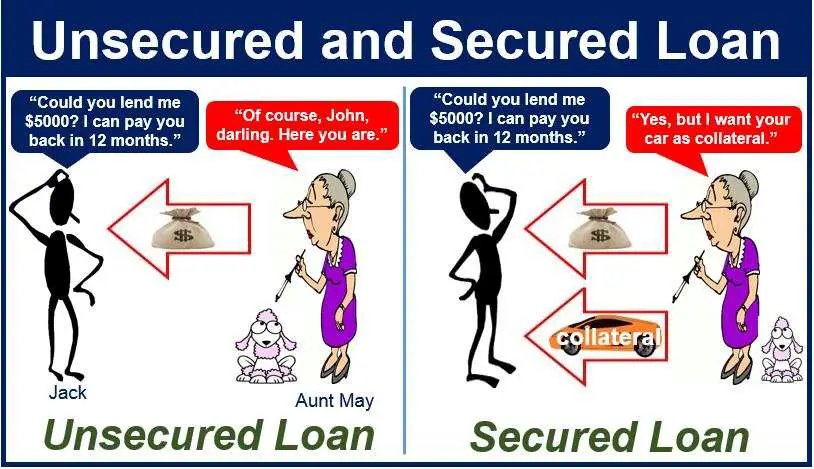

Small business loans come in various forms, providing different options for businesses across industries. Although there are many types, business loans can be categorized as either secured or unsecured loans. One of the main factors that determines whether a loan classifies as secured or unsecured is collateral.

Collateral refers to the assets that are offered to guarantee the loan, such as valuable property owned by the applicant. With the use of collateral, the property can be seized if the borrower is unable to pay the loan. Getting approved for a business loan can essentially put property at risk, so its important to understand the differences between secured and unsecured business loans and how they work.

Recommended Reading: Refinance Options For Fha Loans

Can My Home Be Used As Collateral For More Than One Loan

Your home can be used as collateral for more than one secured loan. For example, if you have a mortgage on your house, you can still take out a home equity loan or aHELOC. Home equity loans and non-standalone HELOCs are also considered to besecond mortgages. You may also even take out a third mortgage through someprivate mortgage lenders.

When you secure a loan against your home, lienholders have a stake on the title of your home. Having more than one lienholder means that there will be a priority in who will be repaid first in the event that you default on your loans.

Your first mortgage is the lien held by the mortgage lender that is first in line should you default. If you take out asecond mortgage, which is often offered byprivate mortgage lenders, then the second mortgage lender will be second in line. If you default, your home will be sold. The amount recovered will first be paid to the primary lien holder until they recover their full amount. Any leftover amount is then paid to the second lienholder, and then other lienholders, until no amount is left or the debt is paid back in full.

An underwater mortgage happens when your outstanding debt on your mortgage is more than the value of the home. This happens if home prices fall, and if your existing home equity is not enough to cover the fall.

Is A Secured Or Unsecured Loan Better

It can be easy to mix up the difference between a secured loan and an unsecured loan. Especially, Y if you are not familiar with the lending industry or if you are just starting out your credit-based life in the world. The keyword here is secure. When you take on a secured loan you are essentially securing the loan with an asset that you already own. When you take on an unsecured loan you are not required to secure the loan with an asset. That is the most basic difference between them but there are a few other details that are important to note based on what kind of borrower you are. Keep reading to learn more.

Quick. Simple. Secure.

You May Like: How Much Do Loan Officers Make In Commission

How Do Lenders Assess Creditworthiness

Both types of credit loanssecured and unsecuredcreate fodder, for better or worse, for your credit score. Financial lenders report your payment history to the credit bureaus. If youre looking to avoid blemishes, beware of late payments and defaults.

If you default on a secured loan, of course, the lender may repossess whatever you bought with the loan , or, if it was a house, foreclose on it. Those dont look good on your credit score, either, by the way. So although the terms of your secured loan might seem generous, especially with interest rates nearing all-time lows, these should still be considered high-risk loans.

There are five criteria, known as the Five Cs, that financial institutions often look for in determining the merit of the borrower on the basis of the persons financial history and resources. Weve covered them in more detail here, but here they are in brief.

What Is A Secured Loan

A secured loan requires collateral as security in case you fail to repay your debt. If secured debt is not repaid, the collateral is taken. In addition to seizing collateral, lenders can start debt collection, file negative credit information on your report, and sue you for outstanding debt. This generally makes secured loans more risky for the borrower.

Conversely, collateral decreases the risk for lenders, especially when loaning money to those with little to no or low creditworthiness. Less risk means that lenders may offer some leeway regarding interest rates and borrowing limits. See the list below to review other typical secured loan characteristics.

Characteristics of a Secured Loan:

For borrowers:

- May require a down payment

- May sell property to repay loan

- Generally lower interest rates

- Easier to obtain for those with poor or little credit history

For lenders:

- Lender can take your collateral

- Lender can hold the title to your property until loan is repaid

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Secured Vs Unsecured Loans

If you’re considering applying for a loan or line of credit to help with a major purchase, you have a choice between secured and unsecured lending options. Secured loans and lines of credit are secured against your assets, resulting in higher borrowing amount and lower interest rates. Unsecured loans allow for faster approvals since collateral is not required.

How Do I Get A Secured Or Unsecured Business Loan

The process for applying for secured and unsecured business loans is similar. Both generally require an application that requires identification, personal information, contact information, a credit check, and financial statements, business plans, or other documents. The secured loan will require additional information regarding collateral the unsecured loan may require more financial statements and documents to prove the worth of the business.

Recommended Reading: How Long Does Sba Loan Take To Process

First And Second Charge Mortgages

A first charge mortgage loan involves taking out a loan when you have no existing mortgage.

A second charge mortgage involves setting up a separate agreement from your existing mortgage, either with your existing mortgage lender or by taking out the loan with a different lender.

Find out more in our guide Second charge or second mortgages

Legal/will Guide Step By Step Guide

Trending Now

Popular Categories

Hot on Web

In Case you missed it

Top Calculators

Top Searched Companies

Read Also: Sss Loan Requirements

How Do Secured And Unsecured Loans Affect Your Credit

Despite their differences, secured and unsecured loans can impact your credit in much the same way.

Once you’re approved and begin using the money you borrow, the lender will report your payment history, loan limits, and balance to one or more of the three major credit bureaus: Experian, TransUnion, and Equifax. The information these agencies collect will play a huge role in determining whether you qualify for future loans.

If you make payments on time both types of loans help to build your credit and boost your credit rating. This, in turn, will improve your chances of qualifying for loans and lower interest rates in the future.

On the other hand, if you’re consistently late making payments or you default completely on your loan, both secured and unsecured forms of debt will lower your credit score. Lenders will be less willing to let you borrow money moving forward, and those who do will likely charge higher interest rates.

Secured Vs Unsecured Loan: Which Is Better

Now, you may wonder which is the better option between these two types of loans. Honestly, there is no right or wrong answer as the loan choice depends on your unique needs and capacity as a borrower.

Opting for a secured loan, also known as a collateral loan, is beneficial if you are seeking a relatively lower rate of interest to pay and want to enjoy a longer loan tenure. On the other hand, an unsecured loan is the apt choice for individuals who are looking to borrow money but do not have any tangible security to offer to the lender. If you have a good credit score and a stable source of income, an unsecured loan can be procured quite easily.

Read Also: Usaa Auto Loan Requirements

How To Get The Best Deal

If youve decided a secured loan is the best choice for you, then your first step might be to approach your mortgage lender to see what they offer. Some will offer special loan deals to those borrowers who have a good record repaying their mortgage.

Next, check some comparison websites to see if you can get a better deal with another lender. But remember comparison websites do not always offer a comprehensive selection of deals. As well as researching the cost of borrowing, be sure to compare the terms and conditions of each loan and what could happen if youre unable to repay.

If youre comparing lots of deals, for example, on a comparison site, check whether doing this will show up on your credit file. Some lenders will carry out a full credit check on you before providing a quote, so it can look like youve actually applied for the loan.

If this happens lots of times, it might harm your credit rating. Ask if they offer a quotation search or soft search credit check or eligibility checker instead, which doesnt show up on your credit reference file this can be useful when you are shopping around and not yet ready to apply.

Secured And Unsecured Borrowing Explained

A secured loan is money you borrow secured against an asset you own, usually your home. Interest rates on secured loans tend to be lower than what you would be charged on unsecured loans, but they can be a much riskier option. If you fall behind with payments, your asset might be repossessed, so its important to understand how secured loans work and what could happen if you cant keep up with your payments.

Don’t Miss: Stilt Loan Processing Time

Can You Get A Personal Loan With A Credit Score Of 550

Yes, you can get a personal loan with a credit score of 550. You could consider getting a secured personal loan, applying for an unsecured personal loan with a co-signer, borrowing from family and friends, and checking with local credit unions which usually have a lower requirement over credit score.

Advantages And Disadvantages Of Unsecured Loans

The biggest advantage of an unsecured loan is that you don’t have to put up collateral. So if you default on the loan, the lender can’t take any of your assets.

Of course, this “freedom” comes with a price. Unsecured loans usually have higher interest rates than secured loans, and the amount you can borrow is limited by your credit history and income.

When considering an unsecured loan, keep these advantages and disadvantages in mind:

| Pros | |

|---|---|

| Money can be used for nearly anything | Shorter repayment periods |

Read Also: Usaa Used Cars

Secured Vs Unsecured Loans: Which Loan Should I Pay Down First

If youve got both a secured loan and an unsecured loan, and youre wondering which to pay down first, the secured loan, if often the better choice since it is tied to your property. If you dont make the payment on your businesss delivery truck, for example, someone is going to come for the keys.

That said, the interest rates on an unsecured loan can be quite high. Sometimes, giving up the secured assets to keep from going bankrupt is simply the better option if you dont have an alternative. If you have multiple loans and are uncertain about how to proceed, your business accountant or financial advisor may be able to help.

Personal Lines Of Credit

With a personal line of credit, a lender approves you for a certain amount that you can tap into and pay back as needed over time rather than taking the full amount at once. You’re only charged interest on the portion of the loan you use, and the line of credit becomes available again as you pay down the balance.

Recommended Reading: Carmax Pre Approval Hard Pull

Whats The Difference Between Secured And Unsecured Loans

The main difference between a secured loan and an unsecured loan is whether the lender requires security.

A secured loan for your business requires security. This may be property, inventory, accounts receivables or other assets. If the loan canât be met, the lender may rely upon these assets to clear the outstanding balance, interest or fees.

An unsecured loan for your business doesnât require physical assets as security. Instead, your lender will often look at the strength and cash flow of your business as security.

Secured Vs Unsecured Loans: Which Is Right For You

Which type of loan is right for you depends largely on the circumstances youre in and what your goals are. Keep in mind that a secured loan is normally easier to get, as its a safer venture for the lender. This is especially true if you have a poor credit history or no credit history. If thats the case, lenders justifiably want some kind of reassurance that theyre not just gambling with their money .

A secured loan will tend to include better terms, such as lower interest rates, higher borrowing limits, and, as discussed above, longer repayment schedules. A secured loan is often the only option in some situations, such as applying for a mortgage or making a purchase far beyond your normal borrowing limit.

Then again, maybe you dont have or want to provide collateral. Perhaps youre more concerned with just weathering a storm, and youre not worried about paying a higher interest rate. Or maybe you plan to pay back the money immediately, in which case, youre not concerned about interest or a lengthy payment plan. And assuming you dont need a small fortune, the higher borrowing limit might not be a feature that you care about. In these cases, you might prefer an unsecured loan.

How Do I Get a Secured Loan? How do I Get an Unsecured Loan?

For borrowers with a lower credit rating who do manage to get a loan, they can expect to pay higher-than-normal interest rates and premiums and get stricter payment terms than those borrowers with high credit scores.

Recommended Reading: Max Fha Loan Amount Texas 2020

Home Equity Or Homeowner Loans Borrowing More From Your Mortgage Lender

You may be able to get a further advance on your mortgage you borrow an additional amount of money against your home from your current mortgage lender.

This might be a useful option if youre looking to pay for some major home improvements or to raise a deposit to buy a second home.

Read our guide Increasing your mortgage getting a further advance