Applying For A Prosper Personal Loan

Getting a loan through Prosper is simple thanks to a quick and easy online application process. You can apply for a loan directly from Prospers website, and you actually have the option to check your rate before submitting a full application.

This is beneficial because you will not get a hard inquiry on your credit report when you check your rate, so your credit score wont be affected. When you have too many hard inquiries on your credit report, your score can go down, so avoiding an unnecessary inquiry is important.

Why Should I Apply With Prosper

Prosper has lent $16 billion to more than a million people. So it’s a serious player in the personal loans market. But is it right for you? Here’s what you need to know:

With more than a million customers, Prosper is clearly doing many things right.

But this is a personal loan review. And there must be quibbles. Well, you’re going to have to pay an origination fee, which is deducted from the proceeds of your loan. And the company charges late fees if you don’t make payments punctually.

Is There A Minimum Income Or Credit Requirement

Prosper has a few requirements for people who are looking to borrow money. You must meet all of the following requirements to be eligible:

- Have a FICO credit score of 640 or better

- Have a debt-to-income ratio below 50%

- Have a stated annual income greater than $0

- Have not filed bankruptcy in the previous twelve months

- Have fewer than seven credit inquiries on your report in the past six months

- Have at least three open loans on your

If youve borrowed money from Prosper before, you must also meet two additional conditions:

- Have not had a Prosper loan charged off

- Have not been declined for a Prosper loan in the last four months due to delinquency or returned payments on a Prosper loan

If you meet all of those requirements, youll be able to get a loan from Prosper. Your interest rate will vary depending on a variety of factors, such as your credit score and debt-to-income ratio.

Read Also: How To Apply For Direct Loan

How To Qualify For A Lightstream Personal Loan

Personal loan applications are approved or declined based on a number of factors. All lenders have their own unique underwriting requirements, but these typically include information from an applicants credit profile and other factors that demonstrate the ability to repay the loan, such as income. Meeting the requirements below wont guarantee approval, but they can help you decide if a personal loan is the right fit for you.

How To Apply For A Prosper Personal Loan

Applying for a personal loan typically involves prequalifying for a rate, submitting a formal application and awaiting loan approval. Follow these steps to apply for a Prosper personal loan:

Don’t Miss: Are Jumbo Loan Rates Higher Than Conventional

Which Loan Products Does Prosper Offer

Prosper mainly offers personal loans that can be used for many different purposes, such as home improvements, debt consolidation, vehicle financing, weddings and engagement rings, new baby and adoption costs, and even small business expenses. They also now allow HELOCs in Alabama, Arizona, Colorado, Florida, New Mexico, and Texas. Here is a closer look at the two specific loan options from Prosper.

Decide On Your Loan Amount And Terms

Start by determining whether you should get a personal loan, how much money you need to borrow and create a plan for paying it back. The same loan amount might have a lower monthly payment with a longer term, but the amount of time you pay interest leads to a higher overall cost over time. Lenders have varying amounts, but Prosper has loan amounts of between $2,000 and $40,000, and you can choose between terms of three and five years.

Recommended Reading: How To Get Better Interest Rate On Car Loan

Where Prosper Falls Short

Origination and late fees: Borrowers may be charged an origination fee ranging from 2.41% to 5%. Many online lenders charge an origination fee that can skim a few hundred to a few thousand dollars off the loan amount once approved.

There is a late fee for loan payments more than 15 days past due. The fee is 5% of the monthly payment amount or $15, whichever is greater.

Limited term lengths: Borrowers can choose a three- or five-year loan repayment term. Thats somewhat common for online lenders, but it doesnt give you the option to choose a shorter term and pay less interest, or select a longer term to lower your monthly payments.

Funding time: While next-day funding is available, most borrowers receive loan funds in three days upon loan approval, according to the company. This is a longer funding time than competing lenders.

No rate discount for autopay: Unlike some other lenders, Prosper does not offer an additional rate discount for setting up autopay. The discount usually ranges from 0.25 to 0.5 percentage points and helps borrowers to pay on time.

No direct payments to creditors: Prosper does not send your loan proceeds directly to creditors when you consolidate debts with a loan. Instead, borrowers have to keep track of their own repayments.

What Are The Fees On A Prosper Loan

My application was for $3,000. But only $2,850 was deposited into my checking account, exactly $150 less than what I asked for. Why didnt I get the full amount?

Prosper took 5% of my loan as an origination fee . Borrowers will pay an origination fee between 2.4% and 5%, depending on their credit history. Your fee will be displayed on the Terms Page from earlier, so make sure it is to your liking before you agree to your loan.

Note: if you need a very specific amount of money then you should consider this origination fee before you apply. For example, lets say you need a loan of exactly $5,000. If you assume an origination fee of 5% then you should ask Prosper for a $5,264 loan. 5 percent of $5,264 is a fee of $264, leaving you with the desired amount of $5,000.

Also Check: When To Take Home Equity Loan

What Credit Score Do You Need

You’ll need a credit score closer to the higher end of “fair” to qualify for a loan. range between 300 and 850, and you’ll need a minimum credit score of 640 to qualify for a Prosper personal loan.

You can find your credit report for free on annualcreditreport.com from any of the three major credit bureaus weekly through April 20, 2022. While this report won’t give you your credit score, it will show you information about your credit and payment history, which lenders use to decide whether to give you a loan. Reviewing your credit report can help you know what you need to improve.;

You can find your score at no cost on your credit card statement or online account. You can also pay for it from a credit reporting agency.;

Here’s how scores break down, according to FICO:;

- Very poor:;300 to 579

- Fair:;580 to 669

- Very good:;740 to 799;

- Exceptional:;800 to 850

Your credit score won’t be affected if you check your rates through Prosper, because the process only results in a soft credit inquiry.;

Once you accept an offer and officially ask for a loan from Prosper, the company will perform a hard credit inquiry, which will probably impact your credit score. A hard inquiry gives a lender a comprehensive view of your credit history, but might hurt your credit score as a result.

What Types Of Loan Prosper Offer

Prosper offers a wide range of loan.

Loan types include:

- Military Loans

If you are desperately in need of money in the future and dont want to go through the long process of banks. Prosper is here to help you out as long as its not beyond $35,000.

Youll have to go through 3 steps to get a loan.

Also Check: What Is Fha And Conventional Loan

When To Use Lendingclub

LendingClub is best for applicants who:

- Can qualify for its lowest APR

- Have credit scores between 600 and 640

- Need a loan amount below $2,000

- Want to pay their creditors directly

If LendingClub offers you its lowest advertised rate, Prosper might not be able to match it. However, if youre applying with a credit score between 600 and 640, you can expect to have a higher APR if you are approved.

Using LendingClub could also be a better idea if youre taking out a loan to consolidate debt. Thats because paying your creditors directly via a balance transfer loan with LendingClub could help lower your rate and monthly payment. Prosper doesnt provide this option.

Additionally, if your credit score is lower than 640 but at least 600, youll likely have a better chance of qualifying for a personal loan with LendingClub or another lender that has lower credit requirements.

Prosper is best for applicants who:

- Have a DTI ratio above 40% but below 50%

- Qualify for a lower APR than they would with LendingClub

Prosper has a less stringent debt-to-income ratio requirement than LendingClub. You can qualify with a DTI ratio as high as 50%. This means your monthly debt amount could be 50% of your income. Conversely, the maximum DTI ratio for LendingClub is 40% for single applicants and 35% for joint applicants.

Applying for a personal loan with Prosper instead of LendingClub could also be a better decision if it offers you a lower APR.

Complaint #3 The Interest Rate Prosper Offers You Is Too High

Maybe you checked your rate on a Prosper loan, and they said you qualified, but the rate they offered you on the loan was really high . Why was the rate so high? The truth is: nobody knows. The formula for how Prosper calculates the interest rate for each borrower is a company secret. It is likely that each interest rate is the combination of a lot of different variables, maybe even thousands of them, so guessing the exact equation Prosper uses is an impossible task.

What Prosper is probably doing is giving you an interest rate based on how likely you are to pay the loan back. So that means we can probably get better interest rates at Prosper by improving the main things that make all borrowers more likely to repay their loans, specifically by improving our yearly income and our . Lets look at each of these one by one:

Read Also: What Kind Of Loan For Land

Looking For Solutions For Your Money

I joined Wealthy Affiliate in 2016 with zero knowledge about how to build an online business and within a couple of months, I had a website built that was driving traffic and sales daily.

After 18 months of joined WA, I was able to work from home running my very own online business. Wealthy Affiliate is the real deal and works. You can join for free. Come on in and Ill show you how how the platform could be an other way for your money solution.

Prosper Personal Loans Review

- EST. APR Range:

- Min. Credit Score:640

Disclaimer: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Read our Disclaimer Policy for more information.

Prosper is one of the more unusual lending services youll find. Instead of providing funding directly, this peer-to-peer platform allows borrowers to apply to a marketplace of different investors.

Since Prosper was founded in 2005, theyve processed more than $18 billion in personal loans.

Their loans are geared towards individuals with fair credit or better, although borrowers with excellent credit will get the best rates.

Is a Prosper loan the right choice for you? Heres a complete guide, so you can decide for yourself.

Recommended Reading: Is My Loan Fannie Mae

Can I Refinance A Personal Loan With Prosper

Prosper currently doesnt offer personal loan refinancing.

As a peer-to-peer lending platform, you can use Prosper to take out a personal loan thats funded by investors. You need a good credit score to qualify, but you dont need a long credit history. This is helpful for borrowers who are new to credit and dont have much to their name. The ability to change your due date to a day that works best for your budget is also helpful to ensure that you never miss a payment.

Nevertheless, Prosper might not be the best option. The various fees could be a turnoff. There are other personal loan lenders who dont charge any fees, so Prospers origination, late, and insufficient funds fees can inflate your loan amount. You might save more money by using a lender that doesnt charge the extra fees.;

Because its a peer-to-peer lending platform, your loan funds could take longer to come through. If you need your money right away, there are other lenders who approve and deposit funds within a day or a couple of days. Compare lenders to make sure a Prosper loan is right for you before completing your application.

How You Get Your Funds

The first step to check your first. You visit the Prosper official site and select your loan amount, answer a few questions and get your lowest eligible rates instantly. Then youll choose your loan and choose the offer with the terms that work best for you. Next, if approved, your money goes straight to your bank account via direct deposit.

Also Check: Can You Refinance Your Car Loan With The Same Company

Pros Of Prosper Loans

- A competitive APR:;Prosper provides loans at reasonable rates for many borrowers. It has an APR range of 6.95% to 35.99%.

- No prepayment penalties:;You dont have to pay a fee if you want to repay your loan early. This gives you the flexibility to become debt-free more quickly.

- You can qualify even if you dont have a perfect credit score: Prospers minimum credit score to apply for a loan is 640, which is considered to be fair credit.

- You have a choice of repayment terms:;You can repay your loan over either 36 or 60 months. While a longer repayment term allows you to keep monthly payments lower so theyre more affordable, youll pay more in interest over time since you pay back interest for longer.

- You can use the funds for almost anything:;While many people take out Prosper;loans as debt consolidation;loans, you can also use the money for a wide variety of other purposes including home improvement, buying a car, paying for school, making big purchases, or paying for your wedding.

Accept The Loans Terms

Were almost done. Here you will be taken to a page that outlines the terms of your loan. This is basically your entire application laid out in a single legal document, so clicking your agreement at bottom of this page is like signing the loan application with your signature.

Did you agree to the terms page? If so, congratulations. Your application is on its way and you should hear back from Prosper shortly about whether your loan is approved.

What is a peer to peer loan?

The afternoon that I applied for my loan, Prosper opened it up for funding from investors. Soon it was 100% funded from a bunch of different people.

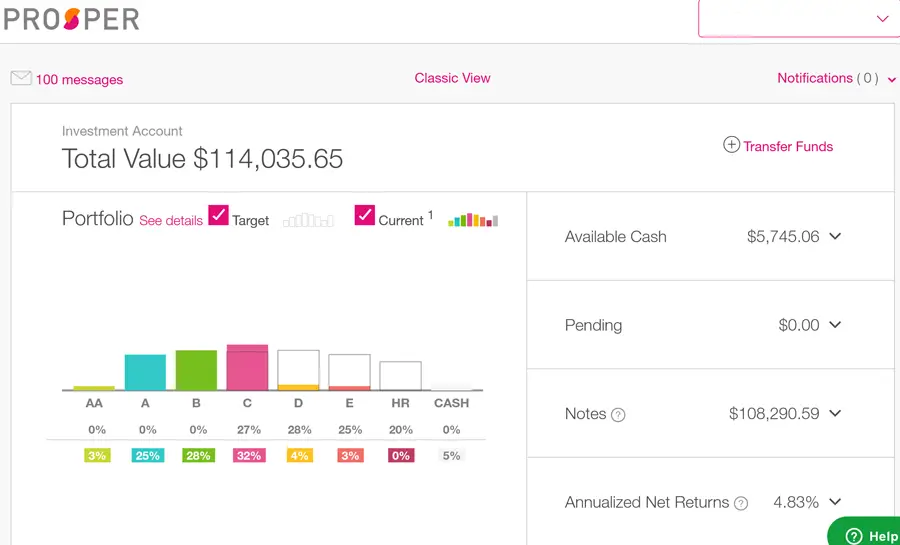

The reason that there are multiple investors of this loan is because Prosper loans are peer to peer loans. Unlike a bank that funds your loan itself, a peer to peer loan can be funded by hundreds of different investors all combining their money together . So Prosper actually has two sides to its website: an investor side and a borrower side. Here is what your loan might look like if you saw it on the investor side:

Pretty interesting, right? Click here to read about becoming an investor at Prosper.

You May Like: Is Jumbo Loan Rates Higher

What Are Your Financing Options

Depending on your funding needs, a personal loan may or may not be the best choice for you. In most cases, theyre best for people who need a large chunk of money and want a few years to pay it off. For short-term financial needs, you may find more flexibility with a credit card.

If you know youll be able to repay your debt in a short amount of time, look for a credit card with a low-interest introductory period. It may not be worth paying the personal loan origination fee so do a side-by-side comparison of costs.

Your credit score, income, and current debt load also affect your best borrowing options. If your application is denied or your rate is extremely high, think about how time-sensitive your financial needs are.

Could you wait another six months or year to use the funds? For something like a home remodeling or vacation, then the answer might be yes.

Take the time to actively repair your credit score or lower your debt so that you can get better loan terms. Once you confirm that youve made some positive changes, redo the pre-approval process to check your new loan offer.