Can I Sell My House While In Forbearance

Daniel asked us if we sold our home while it was in forbearance, and the answer was YES. We never missed a payment. At the closing, we had to pay the accrued interest from those months of skipped payments, so we netted less than we would have liked, but we were never late on a payment.

Under the CARES Act, there should be no negative impact to ones credit report as a result of forbearance. I asked Daniel if this was going to mess up our loan, and he assured me that it would not, but it would require more paperwork.

I simply had to upload the documents from my previous lender stating that it was Covid forbearance and not due to any other financial hardship.

Navy Federal Personal Loan Details And Requirements

-

NFCUs APR rating ranges from 7.49% to 18.00%.

-

There is no required credit score for getting a personal loan, but a good or excellent score increases your chances of getting approved and receiving a lower interest rate.

-

Income Requirements

You must have verifiable income to qualify for a NFCU personal loan.

-

Loan Amounts

Navy Federal lets you borrow $250 to $50,000.

-

Loan Terms

Personal loans from Navy Federal have terms of 36 to 72 months.

-

Permitted Uses

NFCU personal loans can be used to finance almost anything from home improvement to personal expenses and debt consolidation.

-

Prohibited Uses

You cant use a Navy Federal personal loan to fund any illegal activity.

-

Time to Receive Funds

You can receive funding the same day that your application is approved.

-

Origination Fees

There is no origination fee.

-

Late Fees

If a payment is missed, Navy Federal charges a $29 late fee.

-

Prepayment Penalty Fees

NFCU does not charge prepayment penalty fees.

-

Co-signers and Co-applicants

NFCU allows both co-signers and co-applicants for personal loans.

-

Perks

Active members and veterans with direct deposits can enjoy a 0.25% autopayment discount rate.

-

Mobile Application

Navy Federal offers a mobile app for Android, iOS and Amazon users.

Show more

Is Navy Federal Right for You?

Other Va Loan Lenders We Considered

While there are many mortgage lenders with outstanding products and features, they dont necessarily have everything that could make them one of our top picks.

We reviewed the following lenders, and while they meet some of our criteria for top VA loan lenders , they ultimately didnt make the cut.

Veterans First

Thanks to its fully online mortgage process, Veterans First is a great choice for military members deployed overseas. Its focus on VA loans also means that the company is better prepared to attend to the specific needs of military members and veterans during the mortgage process.

On the other hand, Veterans Firsts specialization in VA loans means that it offers no other types of loans, which makes it less than ideal for anyone who doesnt qualify for these products. Its higher than average credit score requirement was also a deciding factor in keeping it out of our top list.

North American Savings Bank

North American Savings Bank is dedicated to servicing customers in the Kansas City, MO area, but it extends its mortgage services to individuals all over the U.S. In addition to standard VA loan products , it offers many mortgage options for individuals who are unable to provide traditional credit and income data.

- 12 branch locations limited to Missouri

- VA mortgage rates are higher than average

You May Like: How Much Personal Loan Can I Get On 50000 Salary

Navy Federal Credit Union Transparency

Navy Federals website is easy to use and offers an array of guides that explain the homebuying process and different types of mortgage loans, calculators to help you figure out how much home you can afford, and a blog dedicated to other home-related topics.

The lender lists out the types of mortgages it offers, but doesnt advertise minimum credit score and debt-to-income ratio requirements. It does flag minimum down payments, which vary from 0% to 15% depending on the type of home loan you get. Keep in mind: You still may have to pay a funding fee and an origination fee.

To get a mortgage, you can apply online, over the phone, or in person at one of 344 branches worldwide, including 26 international locations and 184 branches on or near military installations.

Navy Federal has also streamlined the online process with a digital application platform called HomeSquad. Applicants can set up a personalized portal where they can get preapproved, upload documents, connect their bank accounts to verify assets, receive notifications when they reach milestones, work with a personal home loan adviser, and check the status of their loan.

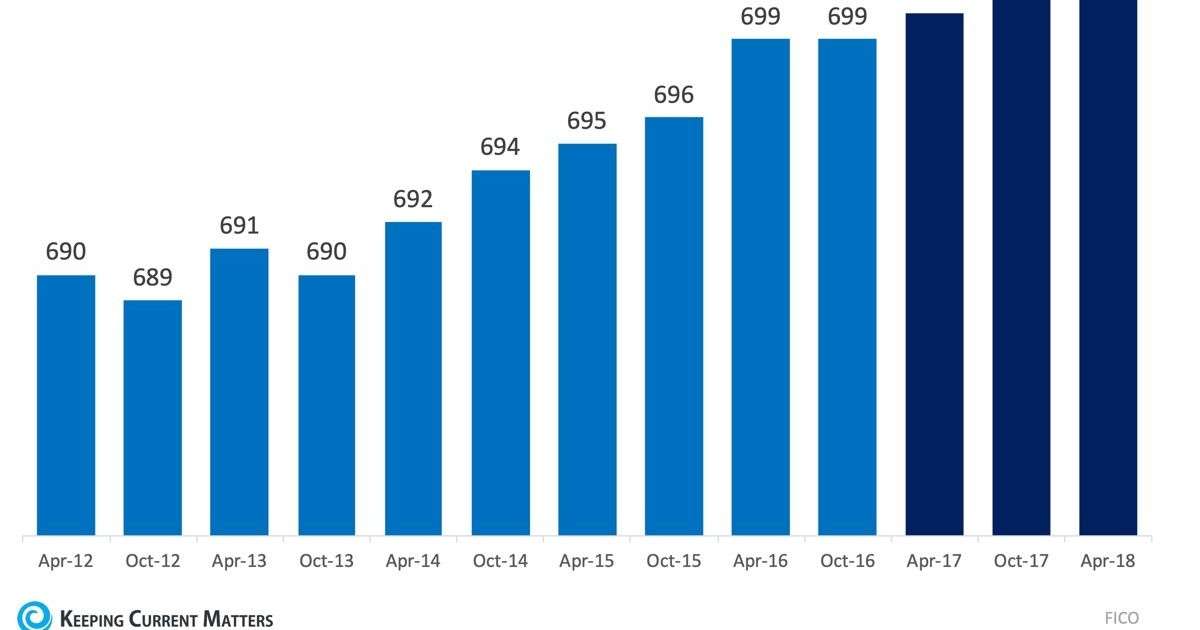

How Can I Improve My Credit Score

A good first step is to look at your credit reports. Each major credit bureauEquifax®, Experian® and TransUnion®compiles information from lenders who have given you credit. The report shows the number and types of credit accounts you use, how long theyve been open and whether you make on-time payments. Your credit report is a summary of open and closed accounts, outstanding balances, recent credit inquiries and negative items .

Currently, you can order 1 free credit report a week from each bureau. Review your reports to identify bad credit behavior or to spot fraudulent activity, evidence of identity theft or errors. And, Navy Federal Credit Unions Mission: Credit Confidence Dashboard is an excellent resource for monitoring your credit score. Youll get monthly updates, notifications on score changes and tips to improve it. This kind of comprehensive view makes improving your credit much easier and can help increase your credit confidence.

Recommended Reading: Va Loan Cash Out Refinance

Re: Fico Score Needed For Navy Federal Credit Union 100% Homebuyers Choice Mortgage

They have their own scoring system…they can pull for each CRA and seem to use TU most of the time, but it just can easily be any of them. They take debt to income seriously and your UTI, most folks that seen to get high $$$ CL have very low UTIs and I have found the best way to get CLI is spend low, PIF and 90+ days before you ask, they will ask about any derogs but it’s a definite no-go if your derogs are less then a year or plenty.

**whoops..I gave the data for CC**

wrote:

They have their own scoring system…they can pull for each CRA and seem to use TU most of the time, but it just can easily be any of them. They take debt to income seriously and your UTI, most folks that seen to get high $$$ CL have very low UTIs and I have found the best way to get CLI is spend low, PIF and 90+ days before you ask, they will ask about any derogs but it’s a definite no-go if your derogs are less then a year or plenty.

This is for mortgage underwriting, not a credit card: they aren’t comparable products nor underwriting.

I would be stunned and amazed if they were doing an internal score for mortgages, even NFCU which is the largest of credit unions by assets. that includes their 100% mortgage which is going to have to be held on the books for a while… they almost certainly wouldn’t pull a single bureau for a mortgage actually at least from around August of last year they did a standard tri-merge pull, and were UW down to around 630-640 ish.

Latest News On Va Loans

To learn more about mortgage loans, we recommend you start with our guide on 9 Types of Morgage Loans. Our guide includes in-depth information on loan types, terms and interest rates.

If youre looking to purchase your first home, you can also read our first-time homebuyer guide about the different programs that can help you achieve your homeownership goals.

Although the VA loan program offers favorable terms like no down payment and no private mortgage insurance to those who qualify, private institutions still issue the loans just like any other mortgage. To make sure you save money and make the most out of your VA loan benefit, weve put together an article on the 5 Tips for Getting the Best VA Loan Rate.

Finally, VA loans don’t require a down payment because the government guarantees the loan. However, putting money down can cut your costs in the long run. Read our latest article to learn more about the advantages of making a down payment on a VA loan.

Read Also: How Much Loan Can I Get Approved For Home

What Is A Usda Loan

A USDA loan is offered through the United States Department of Agriculture and is aimed at individuals who want to purchase a home in a rural area. Best of all, USDA loans require a minimum down payment of 0% in other words, you can use it to buy a rural home without having to make a down payment.

Navy Federal Credit Union

Navy Federal Credit Union can be a smart option for borrowers due to its low interest rates for auto loans and auto refinancing. However, you must be in the armed forces or be a veteran or a close family member to qualify for membership and use any of the credit unions financial products.

In our Navy Federal Credit Union finance review, we at the Home Media reviews team will explore the companys auto loan and refinancing options for borrowers. Well also explain how financing works, the application process and other financing options, including those with the best auto loan rates and best auto refinance rates for 2022.

Recommended Reading: Is It Easy To Get Loan From Credit Union

How Do Mortgages Work

A mortgage is a type of loan you can use to purchase a home. It’s also an agreement between you and the lender that essentially says you can purchase a home without paying for it in full and upfront you’ll just need to put some of the money down usually between 3% and 20% of the home price and pay smaller, fixed monthly payments over a certain number of years, plus interest.

For example, you probably wouldn’t want to fork over $400,000 for a home upfront, though you might be more willing to pay $30,000 upfront. Having a mortgage would allow you to make that $30,000 payment while a lender gives you a loan for the remaining $370,000. You would then agree to repay that amount plus interest to the lender over the course of 15 or 30 years depending on your terms.

Keep in mind that if you choose to put down less than 20%, you’ll be subject to private mortgage insurance payments in addition to your monthly mortgage payments, however you can usually have the PMI waived after you’ve made enough payments to build 20% equity in your home.

Benefits To Using Navy Federal Credit Union

Navy Federal Credit Union offers plenty of perks to eligible members: a variety of mortgage products, several 0% down and no PMI options and unique programs that help the credit union stand out from the crowd.

- 0% down and no PMI. Navy Federal Credit Union offers mortgages with no down payment and no PMI.

- RealtyPlus. Buy or sell a home with a RealtyPlus agent, and you can receive $400 to $8,000 in cash back after you close.

- Rate match guarantee. Navy Federal Credit Union will match a competitors better rate, or itll give you $1,000 after you close with the competing lender.

- Freedom lock. New applicants of purchase and refinance loans have the chance to relock their rate within 60 days at a lower rate and at no additional fee.

- Rate and fee transparency. Navy Federal Credit Union publishes its mortgage rates online and updates them daily. Its publicly available rates and fees sheet can be helpful for borrowers comparing lenders.

- Favorable customer reviews. Out of the thousands of reviews left by customers online, a majority are overwhelmingly positive.

Also Check: Loan Companies That Take Life Insurance As Collateral

Navy Federal Mortgage Loan Types

Members can choose from a wide variety of purchase and refinance loans, including mortgages with no- and low-down-payment requirements. Navy Federal offers the following:

-

15- and 30-year fixed-rate loans.

-

VA loans.

-

Jumbo loans.

The adjustable-rate loan option can be especially useful to families who must relocate every few years. The credit union also offers mortgages for second homes and investment properties.

Navy Federal has two cornerstone loans geared to military members and their families: the HomeBuyers Choice Mortgage and the Military Choice Mortgage.

The HomeBuyers Choice program is for first-time home buyers. It offers fixed-rate loans of 30 years with up to 100% financing and no mortgage insurance premiums. The 1.75% funding fee can be waived in favor of a higher interest rate, which minimizes the amount of cash you need at closing.

The Military Choice program has the same benefits as the HomeBuyers Choice, but with special pricing on mortgage interest rates and origination fees for active-duty and veteran borrowers, according to the lender. Also, Navy Federals standard 1% loan origination fee can be rolled into the loan or waived in exchange for paying a higher mortgage rate, further reducing the amount of cash you need to close.

Is Now A Good Time

Most mortgage experts agree, with rates expected to rise in the coming years, now is still a good time to lock in relatively low mortgage rates.

Mortgage rates are near 40-year lows. If youre thinking of buying a home, or looking to refinance an existing mortgage to lock in a lower rate, experts agree: now is a great time.

Realistically, mortgage rates are forecasted to rise. Experts recommend locking in rates now while theyre still low.

For 2022, New American Funding is our top-rated choice for all of your mortgage needs.

Also Check: How Does Usda Mortgage Work

Read Also: What Is The Best Car Loan Length

Getting A Quicken Loans Preapproval

It took about one hour total, and we were able to receive a preapproval for an FHA loan, requiring 3.5% down, at an interest rate of 2.875%. The preapproval amount? $320,000! A conventional loan would have required at least 5% down and the interest rate was 3.5%.

There were questions, such as Did we have a mortgage in forbearance during Covid?.

When we listed our home for sale on March 6, 2020, in Illinois, we had no idea that the idiot governor was going to shut the entire state down for months.

People just werent comfortable buying a home from a virtual walk through. So our home sat on the market for several months, and instead of paying for 3 homes , we put it in forbearance.

Money was tight, and this was before we had paid off our debt.

What To Do If You Are Rejected From Navy Federal

If you’ve been denied a personal loan, don’t feel discouraged. There are numerous other lenders from which to pick. It’s likely that your application was turned down because you didn’t meet certain requirements. Lenders may reject applications due to low credit ratings, insufficient documentation, a lack of credit history and other reasons.

If denied, the best course of action is to inquire as to the reason for denial of your application. Perhaps you can make changes to your application, such as the loan amount or payment terms. If not, then at least you know how to improve your application. You can always seek a personal loan from a different provider.

You May Like: Which Bank Is Good For Mortgage Loan

Navy Federal Rate Match

Navy Federals rate match guarantee does come with some requirements: You must lock your rate with Navy Federal before submitting a rate match for the credit union to beat. You must get a loan estimate from the competing lender thats dated within three calendar days of you locking your rate with Navy Federal.

What Mortgage Rates Does Navy Federal Credit Union Offer

Mortgage rates change daily based on market conditions and vary significantly depending on the loan type and the length of the term. For instance, fixed rate mortgages will typically have a higher interest rate than mortgages with variable rates, and jumbo loans usually have higher mortgage rates than conforming conventional loans. Find the best interest rate available to you by getting quotes from three or more mortgage lenders before choosing a home loan.

Navy Federal mortgage offers home loans with APRs starting at 2.338% .

Recommended Reading: How To Apply For Pre Approved Home Loan

Lender Reviews Are Positive

Member reviews for Navy Federal Credit Union on Trustpilot are overwhelmingly positive. Reviewers there have rated the credit union 4.7 out of 5 stars based on 10,426 reviews as of June 2022.

Most customers commend the credit union for its empathetic, respectful and first-class customer service. Others say they received loans through Navy Federal that they wouldnt have been approved for elsewhere.

Over on the Better Business Bureau , its a slightly different story. Navy Federal Credit Union isnt BBB-accredited, and its rated 1.42 out of 5 stars based on 145 reviews.

In the last three years, the credit union closed 1,030 complaints. Negative reviews range from complaints about rejection for personal loans and closing credit cards without notice, to long approval processes.

All things considered, Navy Federal Credit Union comes out near the top when compared to other lenders. Its customer reviews are overwhelmingly positive, which is more than you can say about some other lenders on the market.

How Navy Federal Credit Union Stacks Up

As the largest credit union in the U.S., Navy Federal Credit Union has built a decades-long legacy of serving active members of the military, their families, veterans and employees of the Department of Defense. Navy Federal Credit Union offers a variety of loan types that enable buyers to purchase their new homes without a down payment or private mortgage insurance. The latter sets Navy Federal Credit Union apart from other traditional mortgage lenders. However, members of the general public are not eligible for home loans from Navy Federal, only those who belong to the credit union can get a mortgage through it.

According to the Navy Federal Credit Union website, it typically takes 30 days to close on your mortgage once youve submitted your completed application. But closing times can vary and delays caused by COVID-19 have resulted in home purchase mortgages averaging 35 days to close. Those planning to refinance their home should anticipate the process taking between 60 and 75 days, according to the credit union.

Recommended Reading: How Does Refinancing Your Home Loan Work