How To Obtain Your Coe In The National Guard

In order to use your VA loan benefit as a member of the National Guard, youll need to obtain your Certificate of Eligibility .

In order to use your VA loan benefit, youll need to obtain your Certificate of Eligibility . For members of the six main military branches, this just requires logging into your eBenefits portal and filing a simple request.

For National Guard members, however, the process may be a bit different. Depending on the nature of your service, you may need additional forms or to work with your commander or personnel officer to get the ball rolling.

Are you a Guard Member hoping to apply for a VA loan? Heres what youll need to do to get your COE.

Family Servicemembers’ Group Life Insurance

- Spouse or dependent child of an active duty Servicemember covered by full-time SGLI, OR

- Spouse or dependent child of a member of the National Guard or Reserve of a uniformed service covered by full-time SGLI

- Member of the uniformed services and have SGLI, OR

- Suffered an injury that resulted in a qualifying loss between October 7, 2001 and November 30, 2005

Eligibility Requirements For Va Home Loans

The eligibility requirements for VA home loans differ from service type to service type. However, all applicants must apply for the COE to validate their eligibility.

You must meet any one of the conditions stated above to qualify for the loan. But, if you cannot meet either of the conditions, there is still a slight possibility that you might qualify if your discharge falls under one of the following categories:

- You were discharged due to hardship, reduction in force, or at the convenience of the government.

- You were discharged due to a service-connected disability.

- You served at least 21 months of the two-year enlistment and were discharged early.

Here are eligibility requirements for different service types.

Read Also: Va Loan On Manufactured Home

Why Did You Wait Until Now To Announce This Change

Even though the law was signed by President Trump on January 5th, 2021, we had to wait for guidance from the VA on how to implement it.

They finally released this guidance on April 15, 2020, as Circular 26-19-33.

Now that we can officially implement these changes, we’re so excited to serve a greater number of veterans.

For those who are or have ever been a member of the National Guard, we know how much our nation asks of you. By reducing the benefits gap between you and active duty servicemembers, your home loan benefits are now a better reflection of your service and sacrifice.

Things Veterans Should Know About Va Loans

Heres what youll want to keep in mind as you go into the process:

You May Like: Jp Morgan Chase Lien Release Department

Expanded Va Loan Eligibility

Tens of thousands of National Guard members have been activated to respond to the coronavirus pandemic since March. They’re playing a critical role during the crisis, doing everything from supporting local testing sites and boosting medical capacity to distributing food and helping with supply chain logistics.

As the pandemic lingers, some of those Guard members are spending months taking care of communities across the country. Until now, many of them weren’t eligible for a VA loan.

In most cases, National Guard members gain VA loan eligibility after six years of service. That time requirement can shrink to just 90 days for Guard members called to active duty federal service under Title 10 of the U.S Code.

During large disasters, such as Hurricane Katrina or the COVID-19 response, Guardsmen have been mobilized under Title 32 of the U.S. Code, which means they’re in a federal pay status but under the command and control of state governors. Governors across all 54 states and U.S. territories have mobilized components of their Army and Air National Guards for the response.

Unlike with Title 10 orders, Guard members serving under Title 32 orders have never been granted early access to the VA loan benefit.

This bill eliminates that discrepancy. Moving forward, Guard members activated under Title 32 will become eligible for a VA loan after serving 90 total days, 30 of which much be consecutive.

Va Home Loan Eligibility For National Guard Members And Reservists

February 14, 2018 By CHamler

Veterans have this awesome financing program called VA home loan which allows them to have an affordable mortgage. This they can use to purchase or refinance a home. It offers great benefits to over 18 million Military Veterans in the United States.

However, Military Veterans arent the only individuals who can benefit from this financing. National Guard Members and Reservists may also qualify.

Also Check: Va Loan Requirements For Mobile Homes

The Complete Guide To Buying A Home With Va Loan For National Guard Members

Serving in the National Guard is a wonderful way to serve your country while still being able to maintain your civilian life, job, and obligations. Though youre not serving in the military as a full-time service-member, youre still entitled to many of the same benefits other veterans and current military members receive. The VA loan program is one of them. Buying a home with a VA loan is somewhat different than buying one with a conventional mortgage. Use this guide to help you get ready for your purchase.

What Is The Best Bank For Va Loans

There are hundreds of mortgage companies and banks across the country that offer VA home loans. But just because a lender offers VA loans doesnt necessarily mean theyre good at making them work.

In fact, many lenders do VA loans only occasionally even as they advertise themselves as VA mortgage lenders. But a VA mortgage is a unique mortgage product, and requires special handling.

For that reason, I narrowed our list down to the five best VA home lenders. Not only are all five well equipped to handle VA home loans, but each operates on a nationwide basis. That will be important, since finding qualified VA home loan lenders can be a bit like panning for gold. Some may even claim to be specialists but are nothing of the sort.

Youll be well advised to go with lenders known for specializing in VA home loans rather than those that offer them mainly as just another line item on their product list.

Don’t Miss: Genisys Loan Calculator

Va Home Loan Eligibility For National Guard And Reserve Members

Learn about VA home loan eligibility requirements for National Guard and Reserve members.

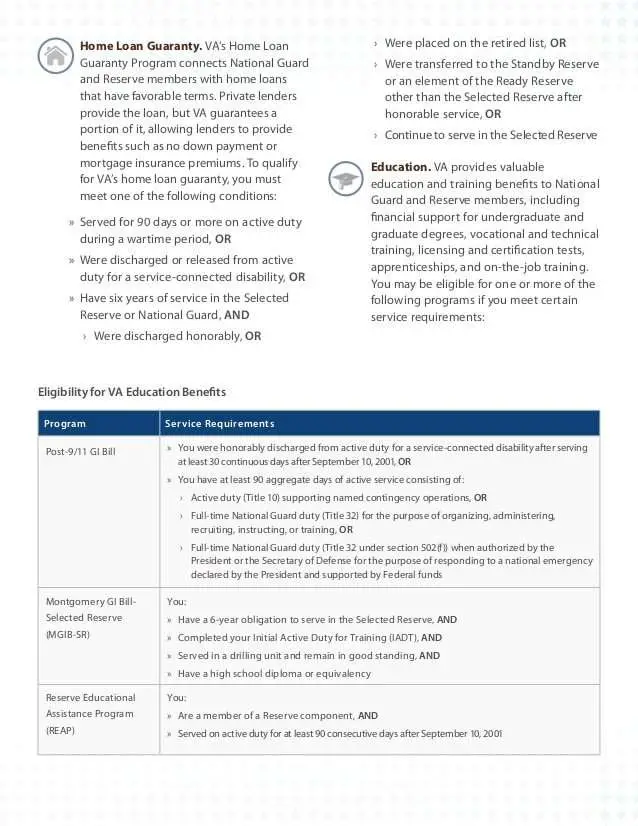

As a member of the National Guard or Reserves, you may qualify for a VA home loan. The VAs Home Loan Guaranty Program allows qualified National Guard Members and Reservists to apply for VA home loans.

To qualify for VAs home loan guaranty, you must meet one of the following eligibility requirements if you served before 1990:

- Served for 90 days or more on active duty during a wartime period, OR

- Were discharged or released from active duty for a service-connected disability, OR

- Have a minimum of six years of service in the Selected Reserve or National Guard, AND

- Were discharged honorably, OR

- Were placed on the retired list, OR

- Were transferred to the Standby Reserve or an element of the Ready Reserve other than the Selected Reserve after honorable service, OR

- Continue to serve in the Selected Reserve

If you served after 1990, you may qualify for a VA loan if you meet one of the following:

NewDay USA Offers a $0 Down VA Home Loan to Eligible National Guard Members and Reservists

If you are an eligible National Guard or Reserve member, you may take advantage of our $0 Down VA Home Loan option.

This VA-guaranteed home loan offers many benefits to Guardsmen and Reservists:

- Zero down payment requirements

- Zero private mortgage insurance requirements

- Competitive interest rates

A Historic Opportunity To Potentially Save Thousands On Your Mortgage

Chances are, interest rates won’t stay put at multi-decade lows for much longer. That’s why taking action today is crucial, whether you’re wanting to refinance and cut your mortgage payment or you’re ready to pull the trigger on a new home purchase.

The Ascent’s in-house mortgages expert recommends this company to find a low rate – and in fact he used them himself to refi . and see your rate. While it doesn’t influence our opinions of products, we do receive compensation from partners whose offers appear here. We’re on your side, always. See The Ascent’s full advertiser disclosure here.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

% Down Payment Required

VA loans offer 100 percent financing. That makes them the only single mortgage program available that allows you to buy or refinance a home with no down payment or equity. Whether youre a first-time homebuyer or a veteran of the housing market, you can tap into this incredible benefit from the VA loan program.

And thats a perfect arrangement for either active duty military personnel or recently discharged members who may be short on cash for a down payment.

What Is The Minimum Credit Score To Qualify For A Va Mortgage

There are no minimum credit score requirements to qualify for a VA loan, but your private lender will require you to have a minimum score of 620.

To improve your credit score, implement the following financial habits:

- Try not to max out your credit cards.

- Make sure to clear any existing debts.

- Pay your bills on time.

Read Also: What Car Loan Can I Afford Calculator

How To Get A Second Va Loan

If you have an existing VA loan, you can still get another in certain cases. You dont need to have full entitlement to qualify for a second loan in this case, youll have remaining entitlement.

There are plenty of situations in which you may need to get a second VA loan. One common situation is when a service member receives orders to a new station. For whatever reason, they choose not to sell their existing homewhich is financed by a VA loanand also want to purchase another property at their new duty station.

Other situations include when youve:

- Paid off the loan but still own the property

- Had a foreclosure and havent paid back the loan

- Refinanced the home with a non-VA loan

When using your remaining entitlement, the amount you can borrow depends on county loan limits. These limits match those set by the Federal Housing Finance Agency and will vary according to the cost of living in each area. The VA will either cover 25% of the loan limit minus the entitlement already used or 25% of the county limit, whichever is less.

This means if youre in a low cost-of-living area and you wish to purchase an expensive home, you may need to front your down payment to meet that 25% guarantee for your lender.

Va Loans And Rental Properties

Though the US Department of Veterans Affairs does not provide loans for rental or investment properties, it does provide mortgages for multi-unit properties.

So, if you are planning to live in one unit and rent the others, you can use your VA homes to earn a rental income with up to four total units.

In addition to meeting the departments and lenders requirements, you must also take care of the occupancy requirements if this is the route you want to take.

Some lenders might expect you to prove that youll be living in the house for at least 12 months after the loan closing.

Don’t Miss: Usaa Rv Loan Rates Calculator

Va Loans From Neighbors Bank

Breaking Down the VA Loan

A VA Home Loan is a mortgage product backed by the U.S. Department of Veterans Affairs. It is available to U.S. military Veterans, active duty service members and those serving in a National Guard or Reserve component. Spouses of those who died while on active duty or because of a service-connected disability may be eligible as well. It requires no down payment or mortgage insurance.

Definition Of A Veteran

Legally speaking, a Veteran is someone who served in the active military, naval, or air service, and who was discharged or released therefrom under conditions other than dishonorable.

Service technically means full-time active duty when a member is on-call to report 24/7 for a given period. For most military members, there must be at least 24 months of active duty on record.

Those drafted or enlisted before September 8, 1980, or who have a service-related disability dont need a minimum length of service to be considered a Veteran.

Read Also: Commitment Fee On Mortgage

Ordering Your Own Home Inspection

Though its not required, you could also have your own home inspection performed by a professional of your choice. Its important to remember the appraiser is looking at the property from a value standpoint. More specific inspections will only be required if obvious deficiencies are identified.

But a home inspection is a way for you, as the future owner of the home, to determine all the details of the property. A certified home inspector will examine all the major systems of the property, including structure, and provide you with a written report.

Youll not only know the homes deficiencies. Youll also get an idea of how much youd pay to make repairs. This can be a valuable tool as you negotiate the cost of the repairs within the context of the homes purchase price.

Plus, your own inspection gives you a starting point for repairs you may need in the future and a baseline to compare as your property ages.

Can I Get A Coe In Any Other Situations

You may be able to get a COE if you meet at least one of the requirements listed below.

At least one of these must be true. You:

- Are a U.S. citizen who served in the Armed Forces of a government allied with the United States in World War II, or

- Served as a member in certain organizations, like a:

- Public Health Service officer

- Cadet at the United States Military, Air Force, or Coast Guard Academy

- Midshipman at the United States Naval Academy

- Officer of the National Oceanic & Atmospheric Administration

- Merchant seaman during World War II

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Your Benefits: Traditional & Technician

Traditional and Technician National Guard and Reserve members typically serve one weekend a month and two weeks a year, and are eligible for some VA benefits. Serving on active duty under Title 10 or full-time National Guard duty under Title 32 may qualify you for additional VA benefits.

A state or territory’s governor may activate certain National Guard members for State Active Duty, such as in response to a natural or man-made disaster. State Active Duty is based on state law and funding and does not qualify as active duty for VA benefits. However, National Guard members may also qualify for additional benefits through their state. Contact your state’s Veterans agency office for more information.

VA Home Loan benefits help Servicemembers and Veterans purchase, retain, or adapt a home. National Guard and Reserve members may qualify for a VA-guaranteed home loan by meeting one of the following conditions:

- Six years of service in the Selected Reserve, AND

- Were discharged honorably, OR

- Were placed on the retired list, OR

- Were transferred to the Standby Reserve or an element of the Ready Reserve other than the Selected Reserve after service characterized as honorable, OR

Va Loan Credit Requirements

A VA loan extends your borrowing power. When the federal government backs your mortgage, your bank can afford to help you by:

- Lowering your down payment: You could finance up to 100 percent of your homes value, meaning you dont need a down payment. This is a huge benefit compared to other loans requiring anywhere from 3 to 20 percent down.

- Lowering your interest rate: Mortgage interest rates fluctuate with the market, but VA loans typically offer lower rates than youll find on the broader market.

- Lowering the required credit score: Lenders assess your risk as a borrower based on your credit history. Since the federal government will back your loan, banks can accept more loans from people with lower credit scores.

Despite these advantages, lenders still have standards youll have to meet, and your bank will analyze your credit history just like it would with any other borrower.

Usually, a lender will pull your credit score from Equifax, TransUnion, and Experian, then take your median credit score to use for your application.

Some lenders will make exceptions, but generally, youll need a median to qualify. If you dont yet meet this requirement, you should start working now to improve your credit score. Well get into that below.

However, a score below 620 doesnt automatically disqualify you. Lenders will consider other factors such as your most recent credit history.

Also Check: Refinance Avant