Direct Consolidation Loan Interest Rate Calculation Method

Calculating your weighted average interest rate involves the following processes:

- Step 1: Multiply the student loan balance by its current interest rate. Do the same for every loan balance of each student loan you select for consolidation.

- Step 2: Add the results of Step 1.

- Step 3: Divide the results of Step 2 by the Direct Consolidation Loan balance.

- Step 4: Multiply the results of Step 3 by 100.

- Step 5: Round up the results of Step 4 to the nearest one-eighth of a percentage .

Hereâs an example situation with hypothetical loan balances to demonstrate this interest rate calculation method:

Student Loan A: $1,500 loan balance 5% interest rate

Student Loan B: $1,000 loan balance 6.3% interest rate

Direct Consolidation Loan Balance: $2,500 = Student Loan A + Student Loan B

- Step 1: Student Loan A = $75 = $1,500 Ã 5% Student Loan B = $63 = $1,000 Ã 6.3%

- Step 2: $138 = $75 + $63

- Step 3: .0552 = $138 ÷ $2,500

- Step 4: 52 = 0.0552 Ã 100

- Step 5: 63% = 5.52% rounded up to the nearest one-eighth percent

This sample Direct Consolidation Loan will have a new fixed interest rate of 5.63% after consolidating two federal student loans.

How Federal Student Loan Interest Rates Work

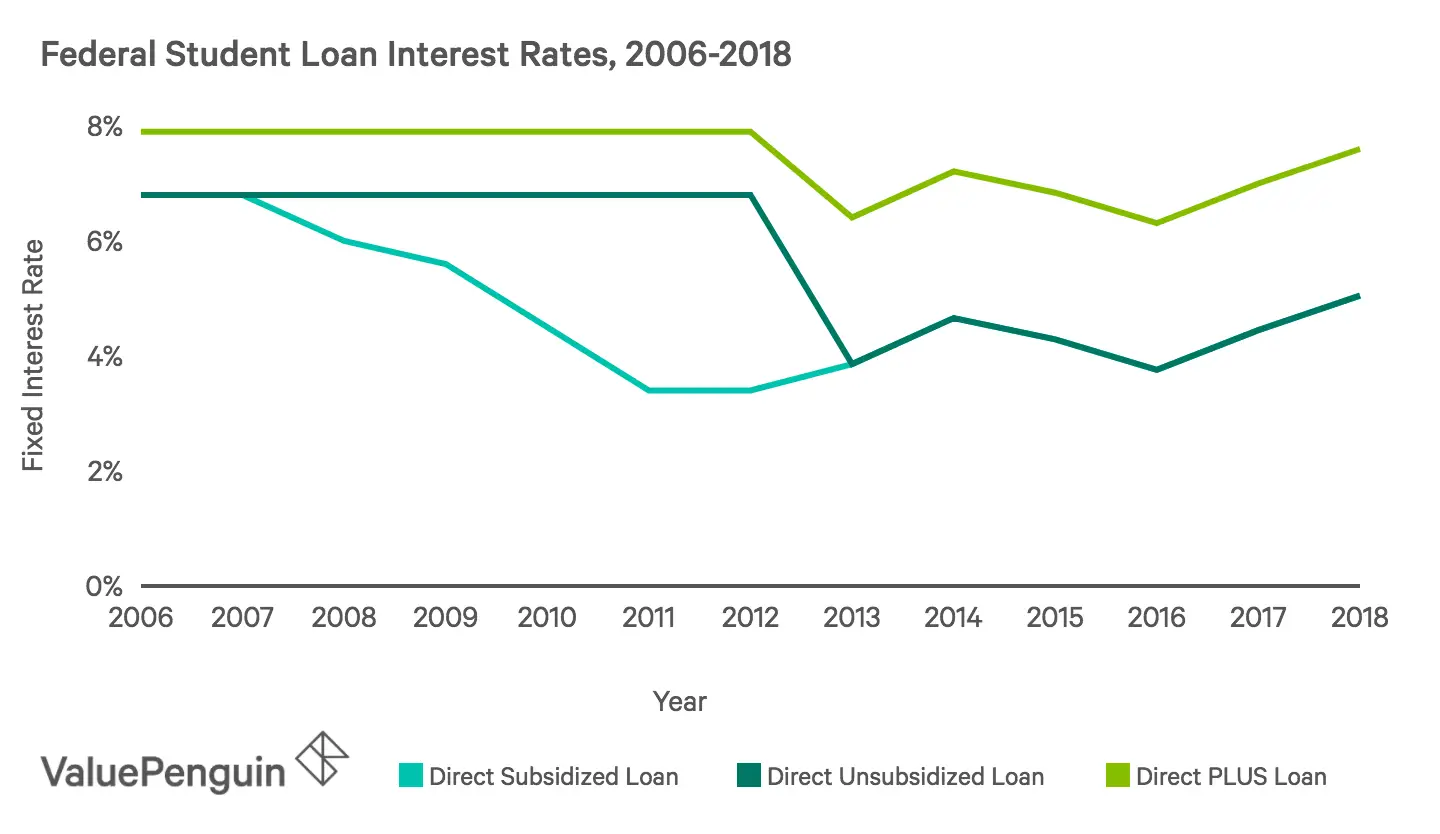

Although the U.S. Department of Education sets the federal loan interest rates for each school year, the numbers are not random. The rates are based on the U.S. Treasury 10-year notes, and then a couple of percentage points are added on as a margin. So if the note is 3% and 2.05% is added, your student loan’s interest rate is 5.05%.

The good news for people who are new to borrowing money or who have damaged credit histories, is all federal loans except the PLUS loans are exempt from a credit check. The requirement is you must be a part- or full-time college studentthere really aren’t any hoops you need to go through. Just complete the Free Application for Federal Student Aid and wait to see what you’re qualified to receive.

Additionally, the interest rates on federal loans are always fixed, so your rate will stay the same for the lifespan of the loanunless you refinance or consolidate the loan .

Is It Smart To Consolidate Your Student Loans

The main advantage of student loan consolidation is simplicity. Instead of making multiple monthly payments, you make just one student loan payment. This reduces the risk that a payment will slip through the cracks and affect your credit score.

A federal direct consolidation loan may be a good option if youre happy with the average of the interest rates on the loans you have, you are planning to use an income-based repayment program such as PSLF, or if you are working towards having good credit for the refinancing application process. The important thing to remember is that while consolidation gives you the option to stretch out your repayment term with a lower monthly paymentdoing so means you may pay more interest on your student debt over time.

You May Like: Usaa Auto Refinance Rates

Reasons Not To Consolidate

- Potential for higher interest cost because consolidation loan is repaid over longer period of time

- If you consolidate Stafford Loans that still have a variable rate and interest rates fall in the future, youll be locked into a higher interest rate

- Loss of any current repayment incentives you are receiving on the loans you plan to consolidate

- Inability to re-consolidate if the variable interest rate on Federal Stafford/Direct Loans borrowed prior to 7/1/06 drops lower in the future

- Possible loss of discharge provisions for certain loans, if consolidated

- Possible loss of interest subsidy during deferment for certain loans, if consolidated

- Some lenders require a minimum loan amount before you can consolidate

- If you and your spouse consolidated when married consolidation was an option, if you divorce, both of you are responsible for repaying the full amount of jointly consolidated loans

Average Student Loan Interest Rates In 2021

BURSAHAGA.COM” alt=”Student Loan Interest Rate > BURSAHAGA.COM”>

BURSAHAGA.COM” alt=”Student Loan Interest Rate > BURSAHAGA.COM”> Edited byAshley HarrisonUpdated October 7, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

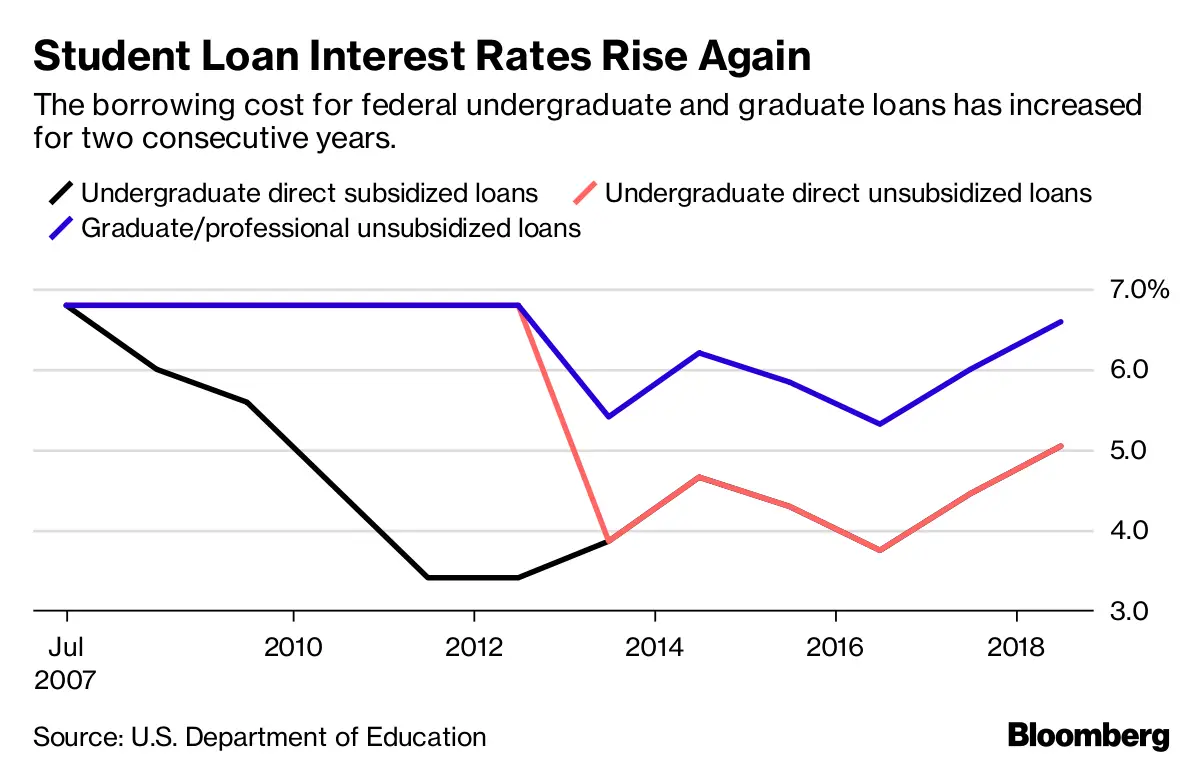

From 2006 through 2021, average federal student loan interest rates were:

- 4.66% for undergraduates

- 7.27% for parents and graduate students taking out PLUS loans

Are your rates higher than average?

See what rates you could get using Credibles rate estimator

*Rates displayed above are estimates based on your self-reported credit score and should only be used for informational purposes.

Read Also: Refinance Parent Student Loans

Benefits Of A Debt Consolidation Loan

Debt consolidation loans may not provide a solution for everyone. However, personal loans do offer several benefits â under the right circumstances. Consolidating debt may even allow you to get out of debt faster while increasing your monthly cash flow. Other benefits of the best debt consolidation loans include:

Why Would The Interest Rate Be Different From The Apr

- Discover Student Loans have zero fees, and no interest capitalization during the deferment period – as a result, the deferment period APR will be less than the interest rate.

- For our student loans, accrued interest capitalizes at the start of the repayment period – since we do not charge fees, and assuming you make all your scheduled payments on time, the repayment period APR will be equal to the interest rate.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Federal Student Loan Interest Rates

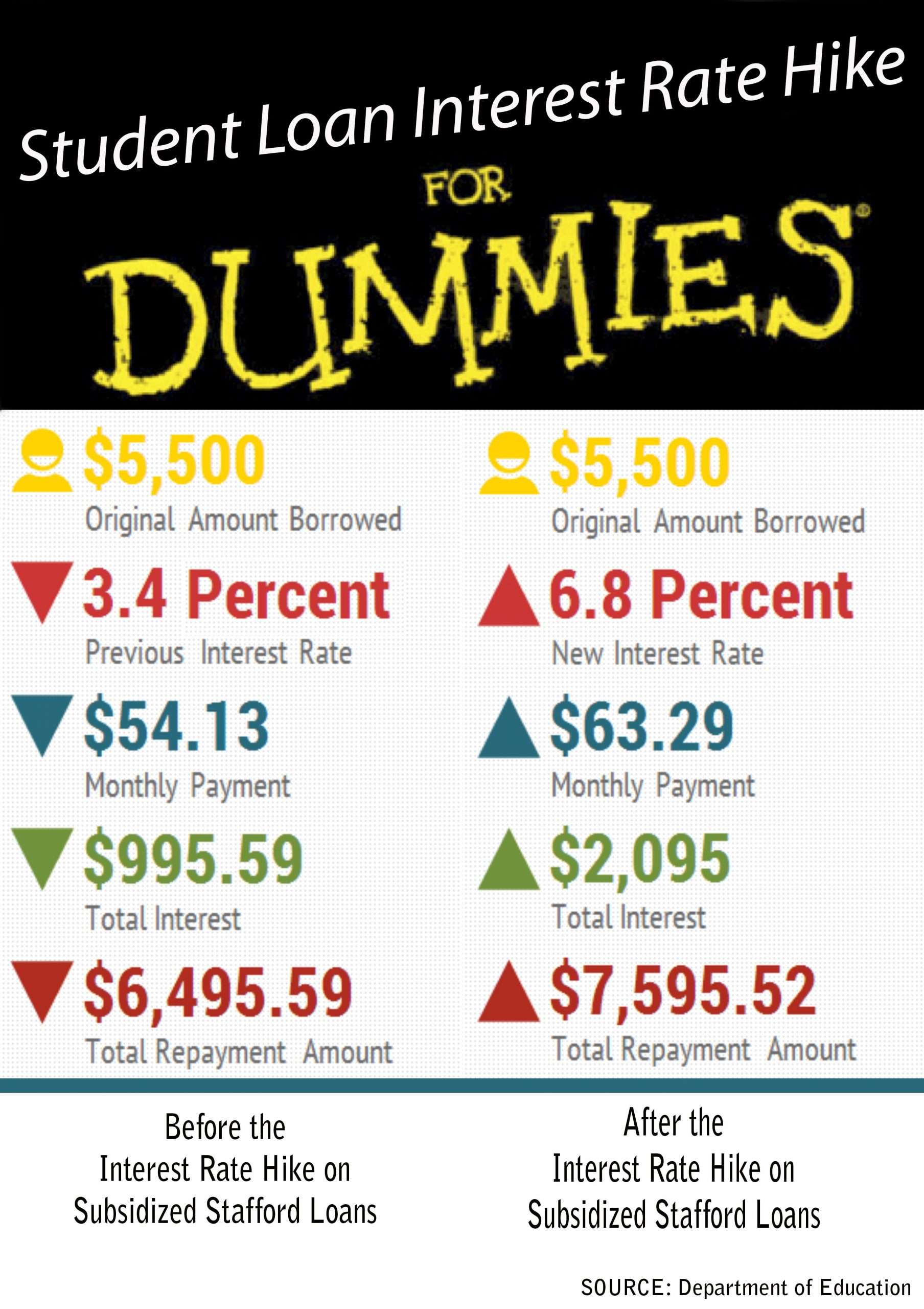

Each spring, student loan interest rates are set by Congress based on the high yield of the last 10-year Treasury note auction in May. New rates apply to student loans disbursed from July 1 to June 30 of the following year. Federal loans are fixed, meaning that the rate will not fluctuate for the life of the loan. The interest rate you receive on a federal student loan is not determined by your credit score or financial history.

Interest charges differ between subsidized and unsubsidized loans. For federal subsidized loans, the government pays your interest charges for you while youre in school at least half time, during your grace period and while youre in deferment. The amount youll owe once your loan is in repayment will include only your original principal balance, loan fees and interest accrued moving forward.

With federal unsubsidized loans, interest charges start accruing immediately after funds are disbursed. If you choose to hold off on making loan payments until later, the accumulated student loan interest gets added to your principal balance when the loan enters repayment.

With that said, interest rates on federal student loans are temporarily set to zero through Jan. 31, 2022, due to impacts of the coronavirus pandemic.

When Does A Variable Interest Rate Based On 3

Discover Student Loans may adjust the variable interest rate quarterly on each January 1, April 1, July 1 and October 1 , based on the 3-Month CME Term SOFR rate available for the day that is 15 days prior to the interest rate change date, rounded up to the nearest one-eighth of one percent , or 0%, whichever is greater. If the 3-Month CME Term SOFR rate is less than zero percent, then the index will be deemed to be zero percent for purposes of calculating your interest rate.

You May Like: Does Va Loan Work For Manufactured Homes

Best For No Fees: Discover Student Loans

- Interest Rate: 1.74%+

Discover doesnt charge any lender fees or late fees. It also offers variable and fixed interest rates.

-

Different loans for different degrees

-

Bar exam loan

-

Contact for minimum credit score

While some lenders charge origination, application, or late fees, Discover is different. It charges no fees at all, even if you miss a payment. With no added fees, the only charge you have to worry about is the interest that accrues on your loan.

Discover offers the following interest rates for student loan refinancing :

- Variable: 1.74% to 5.74%

- Fixed: 3.49% to 6.99%

You can refinance as little as $5,000 for a term of 10 or 20 years, and you can choose to refinance your loans while you’re still in school. To qualify for a loan, you must be at least 18 years old, pass a credit check, and have verifiable income. With Discover, you may qualify for a loan without a cosigner. However, applying with a creditworthy cosigner will likely earn you a lower interest rate.

Read the full review: Discover Student Loans

Should You Refinance Student Loans During The Coronavirus Pandemic

With many Americans currently experiencing reduced income due to the coronavirus pandemic, student loan refinancing is an attractive option for those struggling to make student loan payments. Interest rates on student loans are at record lows, meaning now could be one of the best times to refinance your private student loans if you’ve been considering it.

It’s likely not a good idea to refinance your federal loans now, since interest and payments are currently waived on federal student loans through Jan. 31, 2022 by refinancing your federal loans, you would be required to make payments with interest and lose the ability to take advantage of any future federal relief programs.

The one exception is SoFi, which is currently offering a program that lets you refinance your federal student loans without interest charges until Dec. 20, 2021. However, it’s still wise to take a look at the other federal benefits you’d lose by refinancing.

If you have private student loans, there is little downside to refinancing if you can qualify for a lower rate. Rates are likely to only rise from here as the economy starts to recover, so locking in a fixed rate now could be a good option.

Learn more:Should you refinance your student loans during the COVID-19 pandemic?

You May Like: Illinois Fha

How Do You Refinance Student Loans

To refinance your student loans, apply for a loan from a private lender for the amount of your existing debt. Once approved, you can use the loan to pay off your old loans. You can refinance both federal and private student loans, consolidating them together. After that, you’ll have just one loan to manage, with only one monthly payment to remember.

Why Consolidate Student Loans

It simplifies repayment and could save you money. It is quite common for people with student loans to deal with 10-12 lending institutions, which means 10-12 payments and 10-12 due dates each month. When you consolidate student loans either federal or private its one payment to one lender, once-a-month. Simple.

Read Also: Genisys Credit Union Auto Loan Calculator

What Repayment Options Are Available On Your Current Loans

Brazos Refinance Loans begin repayment immediately and do not offer repayment options such as graduated repayment schedules or income sensitive repayment options. These options may be available to you through your current lender and will be lost if you refinance your existing loans. If you believe you may want to take advantage of these special repayment options, refinancing may not be right for you.

Also, forbearance and deferment options may be available with your existing loans that are not available with a refinance loan. If you plan on going back to school, for instance, your existing loans may allow you to defer payment on the loans until you are no longer enrolled in school, whereas a Brazos Refinance Loan will not have this deferment option.

What Is A Debt

A debt-consolidation loan merges multiple debts, like credit card balances, into one new loan, with one monthly payment and a potentially lower interest rate.

Some debt-consolidation loans may be secured or unsecured . With secured loans, the borrower is required to provide collateral, like a home or savings account, to secure the debt. The lender can take the asset to satisfy the debt if you stop making payments. But unsecured loans dont require collateral.

Will you save money with a debt-consolidation loan? Maybe. A lower interest rate, a longer loan term or a combination of both could help lower your monthly payment.

But if you extend the loan term and only make minimum payments, you may actually end up paying more in interest over the life of the loan. Also watch out for additional costs and fees that you may need to pay as a part of a debt-consolidation loan.

Read Also: Drb Student Loan Refinance Reviews

Consolidating Private Student Loans

The process for consolidating private student loans is focused around your credit score. If your credit score has improved dramatically since graduation, you may be in line for a lower interest rate. Home equity loans are another way to consolidate a lower interest rate. There also could be a variable interest rate loan that suits your situation. Contact several lenders before making a final decision on consolidating your student loans through a private lender.

Consolidating Student Loans With Bad Credit

Federal student loan consolidation doesnt require a credit check, so even if you have bad credit you will qualify. A federal Direct Consolidation Loan can even rehabilitate your student loans if you are in default.

Consolidating private student loans is more complicated. If your score is under 650, It is unlikely you will qualify for consolidation from private lenders by yourself. Youll need to find a co-signer with good credit and continue to pay bills on time until your credit score improves.

Things get more difficult without a co-signer. Local credit unions usually have softer requirements than traditional lending services. They might be willing take a chance.

Maxing-out credit cards tanks a credit score because credit utilization , makes up 30% of your credit score. A quick way to boost your score is to lower your utilization by paying down your credit cards to at least 30% of your limit. Wait a couple of months, and then apply for student loan consolidation.

Also Check: Penfed Exotic Car Financing

The 7 Best Student Loan Calculators

Editorial Note: This content is based solely on the author’s opinions and is not provided, approved, endorsed or reviewed by any financial institution or partner.

When it comes to student loan repayment, its critical to have the best student loan payment calculator. A student loan payment calculator helps you calculate automatically how much money you owe for student loans each month and overall. Whether its a student loan refinance calculator or a student loan monthly payment calculator, make sure you understand your monthly payment, principal balance, interest and total payments.

Heres our review of the 7 best student loan calculators.

Age Differences In Student Loan Debt

According to an analysis by CNBC, when broken down by age, the highest student debt loads are carried by adults between the ages of 25 and 49, with the lowest debt loads carried by adults aged 62 and older.

As of 2021 approximately 7.8 million Americans below the age of 25 carry student loan debt, with an average balance of almost $15,000. Within the group with the largest amount of student debt, adults between the ages of 35 and 49, the average individual balance owed exceeds $42,000, with the average debt load for adults between the ages of 50 to 61 being only slightly lower. These balances are composed of the balance of the debt that adults owe for their own education, and additional amounts they borrow in order to finance their children’s college educations.

Also Check: Can You Buy A Mobile Home With A Va Loan

How Do You Get A Debt Consolidation Loan With Bad Credit

If you believe your bad credit score will prevent you from getting a debt consolidation loan, think again. Some credit unions specialize in loans for those with low credit scores. Rather than simply reviewing your credit report and making a decision based on your credit history, they consider your employment status, education, income, and other factors.

You can also improve your approval chances by:

- Getting a co-signer

- Checking your credit report for mistakes

- Prequalifying for loans

- Comparing rates and loan terms

Marcus By Goldman Sachs: Best For Longer

Last but certainly not least, Marcus by Goldman Sachs rounds out the top 10 best debt consolidation loan providers. The online banking and lending branch of Goldman Sachs provides unsecured loans with competitive interest rates to borrowers with credit scores above 660.

The lending service offers a wide range of advantages, too. Marcus by Goldman Sachs provides rate discounts for users who register for automatic payments and doesn’t add any processing charges. That means you won’t have to pay an origination fee if you opt for a loan through Marcus.

Alongside easy online application and approval processes, Marcus usually provides funding for borrowers throughout the United States within a week. To ensure you get the best rate, you can prequalify using a soft credit check. Then you can compare rates, repayment plans, and customer service offerings before making a decision.

After you accept the loan terms, Marcus will transfer the funds to your bank account or pay your creditors directly, making it easier than ever to consolidate high-interest bills. You can pay off your loans as quickly as you want, too, without running into any prepayment penalties.

- Loan Amounts: $3,500 to $40,000

- 6.99% to 19.99%

- Minimum Credit Score: 660

Recommended Reading: Typical Origination Fee

Which Are Eligible Loans For Private Consolidation

You can refinance and consolidate both federal and private student loans. This includes all types of federal loans, including Direct Loans, Stafford Loans, Parent PLUS Loans, as well as private loans.

Its important to note that when you refinance and consolidate, you can decide in your loan application which loans you want to refinance and which, if any, youre happy to keep at their current terms. Some people may want to refinance all their loans, and for others it may make sense to only refinance some of them.

When you refinance federal loans and private loans into a one new private loan you will no longer be eligible to use repayment options included in the governments income-based repayment programs or forgiveness programs like public service loan forgiveness.

To decide, you should look at the loan repayment terms for each of your current loansand whether refinancing can help you do better. You can get an estimated rate from Earnest in just two minutes.