What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Our Favorite Mortgage Lender

There are a lot of companies offering competitive mortgage rates, but theyre difficult to find one by one. Thats why we like , an online marketplace to compare mortgage quotes. Youll simply enter the homes purchase price, your down payment amount, your state, choose your mortgage product type, and your credit score to get mortgage rates and offers from multiple mortgage lenders.

Another service we like is , which also moves the approval process completely online. In just three minutes, Credible offers loans from multiple lenders without revealing your personal data to them. You can even quickly generate a preapproval letter that you can use to start your home-shopping process.

Analyze Your Monthly Expenses

When estimating what you can afford, its also important to have a clear view of your monthly expenses. These can be hard to track and will likely vary based on the size of your household and your spending habits. According to the Bureau of Labor Statistics, the average individual has monthly expenditures that include:

- Food: $644

- Internet: $47

- Cell phone: $120

For an individual, these expenses add up to a monthly total of $2,463. Some of these items are discretionary and will fluctuate based on your lifestyle, city, the size of your home, and the size of your family. The goal is to estimate how much money youll need to spend each month after you pay your mortgage and other debts.

You May Like: Rv Payment Calculator Usaa

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.

Don’t Miss: Usaa Auto Loan Credit Score Requirements

How Much Income Is Needed For A 250k Mortgage +

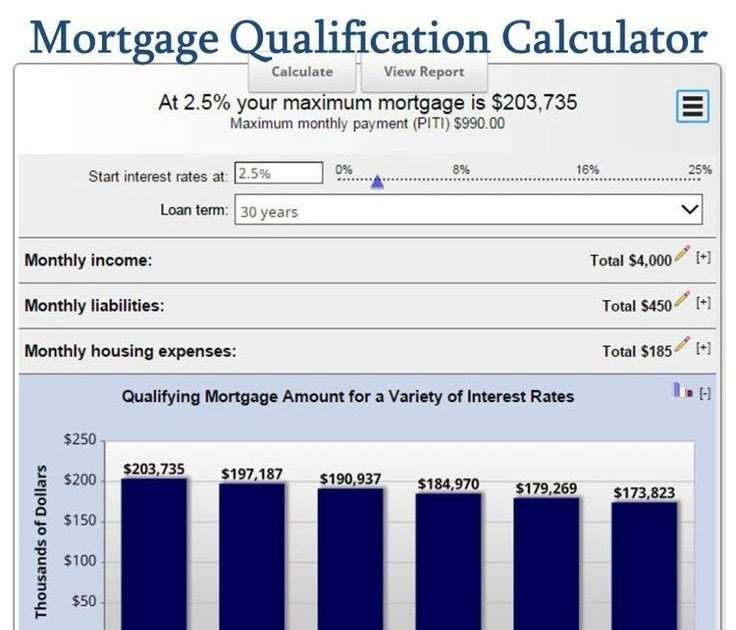

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Shop Around For A Great Pre

Just as youâll see several homes before settling on âthe oneâ, you should shop around for the best mortgage rate. Donât just go to your local bank branch and expect to receive a great deal. Do your research and compare mortgage rates, or use a mortgage broker who will negotiate on your behalf.

Even half a percentage point can make a huge difference in your regular payments and the amount of interest youâll pay over time. To see what we mean, plug in your numbers into our mortgage payment calculator, then change the interest rate in small steps. Youâll very quickly see what we mean!

What happens after your mortgage pre-approval? Generally, youâll have a 90 to 120 day period where your offered rate will be held for you. This is when you should start house hunting!

You May Like: Fha Build On Own Land

Consider Your Mortgage Options

Lastly, it might not be anything you’re doing wrong. It’s important to consider all your mortgage options. Different lenders have different loans available. The also set their own terms and pricing, so it’s important to be aware that you won’t always get the best deal by going to the first lender you see.

One other key thing to look at is the difference between the interest rate and the annual percentage rate associated with the loan. The bigger the difference, the more the lender is charging you in closing costs.

Figure Out How Much Mortgage You Can Afford

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyll also look at your assets and debts, your credit score and your employment history. From all of this, theyll determine how much theyre willing to lend to you.

However, the amount you may qualify to borrow isnt necessarily what you should borrow. Why? Because lenders are only looking at your past and present situation. They dont take into account your future plans.

Are you thinking of a career change? Do you expect a substantial increase in debt or expenses? Use our mortgage affordability calculator to consider multiple scenarios. Or talk with a mortgage loan officer. They can help you figure out a price range that makes sense for the long term.

You May Like: Defaulting On Sba Loan

Why Its Smart To Follow The 28/36% Rule

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as well as things like student loans, car expenses and credit card payments. The 28/36 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

Example: To calculate how much 28 percent of your income is, simply multiply your monthly income by 28. If your monthly income is $6,000, for example, your equation should look like this: 6,000 x 28 = 168,000. Now, divide that total by 100. 168,000 ÷ 100 = 1,680.

Depending on where you live and how much you earn, your annual income could be more than enough to cover a mortgage or it could fall short. Knowing what you can afford can help you take financially sound next steps. The last thing you want to do is jump into a 30-year home loan thats too expensive for your budget, even if you can find a lender willing to underwrite the mortgage.

Homeready And Home Possible

The HomeReady and Home Possible loan programs help income-challenged borrowers qualify for conventional loans.

For example, Fannie Maes HomeReady program lets you document income from your roommate to strengthen your loan application. Or, you could even qualify with income from family members who wont live in the home with you.

Home Possible, from Freddie Mac, can help you turn sweat equity into a larger down payment.

Any of these advantages can end up lowering your monthly payment, making it easier to afford the same home on the same income.

Recommended Reading: Usaa Refinance Auto Loan Rates

How Much Do I Need For A Down Payment

It looks like you may be able to afford a home worth about 386,405 for a payment of about1,300per month/mo.

$376,405 loan amount

10,000 |2.6%

Down payment

Information and interactive calculators are made available as self-help tools for your independent use and are intended for educational purposes only. Any results are estimates and we do not guarantee their applicability or accuracy to your specific circumstances

Who Is This Calculator For

The Maximum Mortgage Calculator is most useful if you:

- Want to know exactly how much you can safely borrow from your mortgage lender

- Are assessing your financial stability ahead of purchasing a property

- Would like to compare the impact of different interest rates on the amount you can feasibly borrow.

Also Check: Does Usaa Do Student Loans

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers

Recommended Reading: How To Get Approved For Capital One Auto Loan

My Result Came Out Higher Than The Amount I Wish To Borrow What Now

Now that you have ascertained that you are in a strong enough financial situation to sustain the purchase of your desired property, you need to set about getting in touch with some mortgage providers.

Fortunately, we have made this process very easy for you. Simply click the Get FREE Quote button and you will be taken through a very brief set of questions. We will then ask our carefully selected lenders to contact you directly with the very best quotations they can provide. By reaching out to lenders this way, you get the best deal possible and are saved the effort of contacting them yourself it couldnt be simpler!

Apply For A Mortgage Pre

Most Canadians think the first step in the home-buying process is to contact a realtor and start looking at homes. This isnât correct. The first thing you should do is apply for a mortgage pre-approval. After all, if you find a home you like, youâll want to move quickly. Being pre-approved for a mortgage removes an extra step in the process.

Being pre-approved also helps you know how much you can afford to spend. You can get a good estimate of how much you can afford with our mortgage affordability calculator. However, the hard limit will always be how much the bank will approve you for â a mortgage pre-approval gives you that.

How long does it take to get a mortgage pre-approval? It can be done within an hour if you have your documentation together. Get in touch with a mortgage broker near you to get started.

Don’t Miss: How Much Do Loan Officers Make In Commission

Consider The Ongoing Costs

Now you own your home. You love it. You never want to leave it, and then the roof begins to leak. When youre deciding how much home you can afford, dont forget about ongoing repairs and maintenance.

A good rule of thumb is to set aside at least 1% of your homes value every year for repairs and maintenance. So, to keep a $250,000 home in great shape, that means you should plan to save $2,500 per year.

Also keep in mind that prices for everything tend to go up, not down. Property taxes, homeowners insurance and utilities these are expenses that will continue as long as you own your home.

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

You May Like: How To Get Approved For Capital One Auto Loan

What Is The 28 36 Rule

A Critical Number For Homebuyers

One way to decide how much of your income should go toward your mortgage is to use the 28/36 rule. According to this rule, your mortgage payment shouldnt be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income ratio.

Can I get a mortgage on 20k a year? How Much Mortgage Do I Qualify for If I Make $20,000 a Year? As discussed above, a home loan lender does not want your monthly mortgage to surpass 28% of your monthly income, which means if you make $20,000 a year or $1,676 a month, your monthly mortgage payment should not exceed $469.

What salary do I need for a 300k mortgage UK?

Most providers are prepared to lend up to 4 4.5x your annual income, which in this instance means that you will need to bring home a minimum of £66,667 £75,000 a year .

What happens after 5 years of help to buy? Then after five years youll start paying interest on the equity loan, until you pay it back. If you dont repay your equity loan within five years, youll start being charged interest on it.

How To Get Your Finances Ready To Buy A House

Take stock of your finances to see if youre ready to apply for a mortgage. Make sure that you can provide evidence of at least two years worth of regular income, and figure out your total assets, debt and monthly expenses.

Check your credit reports. If you want to apply for new credit cards or other loans, keep in mind that these applications may add inquiries to your credit history and could lower your scores. Plan to apply for other types of credit well in advance of applying for a mortgage or wait until after youve closed on your home loan.Home affordability calculator

Ask lenders what information they need from you to issue a mortgage preapproval letter, and confirm that you have the documents on hand.

Don’t Miss: How To Get Approved For Capital One Auto Loan

Where Do I Get A Mortgage

Finding a good mortgage lender is a lot like finding a good marriage partner with one notable exception: the mortgage vows shouldnt last more than 30 years.

Otherwise, the process is largely the same. You have your pick from suitors that include local and national banks local and national credit unions mortgage brokers and online lenders. Each of them offer inviting promises and each has faults that you must accept for better or worse.

The most important rule in choosing a lender is look around. Apply in at least three places and compare costs. An astonishing 71% of homeowners only apply for a loan in one place. A 2016 study by J.D. Power found 27 percent of first-time homebuyers more than one out of four! regret the choice of lender they made for a mortgage.

Most of their dissatisfaction stemmed from lack of communication and unmet promises. That could be because buyers dont realize all that goes into a mortgage loan.

The list of questions you need answered goes far beyond: Whats my interest rate and is this a 30-year or 15-year mortgage? There is a long list of fees involved and each one has a cost.

Some of the fees you could be charged at closing include:

- Loan origination or application

- Title insurance

Ask the lender to give you a dollar-figure for each of the fees, or at least an educated estimate. You are allowed to bargain between lenders over fees. Thats how you find out who really wants you as a customer.