How Are Federal And Private Loans Different

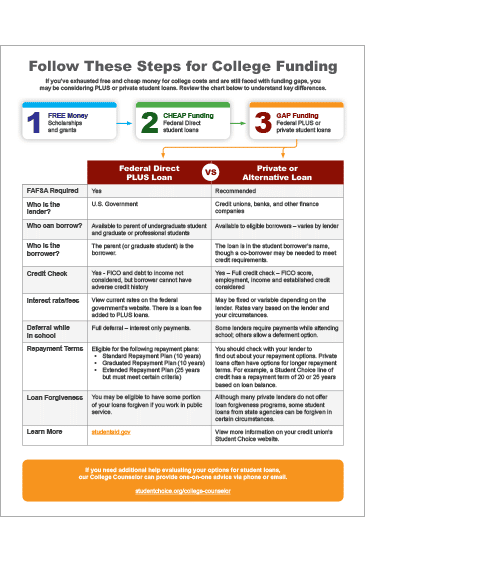

Federal student loans generally have more favorable terms. They offer forgiveness, cancellation and discharge alternatives in addition to the plan announced by the Biden administration.

Private loans can fill a gap when public loans, scholarships, fellowships, subsidies and grants aren’t enough to pay for school, but without the same government payback options like deferral or forgiveness.

If you’re looking for a loan to help fund your education, you have multiple options to pursue. You can easily get started today.

When To Borrow Private Student Loans

The first step in your quest to finance your college education is to fill out the FAFSA. It’s a not a quick process, but it’s your best chance for securing financial aid, including grants, work-study, and federal loans. While you’re waiting to hear back, look into other financial aid resources you can access, such as scholarships or grants. These are available from many state/local governments and private organizations.

The more aid you can cobble together from grants and scholarships, the less student loan debt you’ll need to take on and the less debt you have now, the less you pay later. However, most students need more cash for college than they can get from scholarships and grants.

If that’s the case for you, the next step is federal loans. While they have many benefits, there are borrowing limits on federal student loans. The loan limits per year vary depending on criteria such as what year you are in school, you/your family’s income, and whether you’re a dependent or independent student. If the max you can borrow through federal loans isn’t enough to cover your educational costs, you do have other student loan options.

Most financial institutions can help you fill the so-called tuition gap. To qualify for a private student loan, the lender will evaluate your overall creditworthiness and offer you a loan amount and payment terms based on that. If you don’t have a long credit history you may need to get a co-signer to secure a private loan.

Federal Vs Private Student Loans: 5 Differences

There are several differences between federal vs. private student loans, including interest rates, repayment options, and eligibility requirements.

Edited byAshley HarrisonUpdated December 13, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

With the ever-increasing cost of college, youll likely need to borrow money to pay for your degree. But before you decide between federal vs. private student loans , its important to get familiar with the differences between them.

Heres what you need to know about federal vs. private student loans:

Also Check: How To Get Lowest Interest Rate On Personal Loan

Disadvantages Of Federal Loans

Although federal loans are generally preferable to private ones, they do come with some disadvantages.

Types Of Federal Loans

The William D. Ford Federal Direct Loan program is the largest and best known of all federal student loan programs. These loans are sometimes referred to as Stafford loans, the name of an earlier program. There are four basic types of federal direct loans:

- Direct subsidized loan

- Direct PLUS loan

- Direct consolidation loan

Note that a provision in the American Rescue Plan makes all student loan forgiveness tax-free from Jan. 1, 2021, to Dec. 31, 2025.

Also Check: How To Cancel Your Student Loan

How Is The Federal Government Arguing For Student Debt Relief

The federal government in response has said loan servicers are not guaranteed income from managing student loan debt. They further said states can set and change their tax codes as they see fit.

Prior to this case reaching the Eighth Circuit Court of Appeals, judges have dismissed the legal challenges to the presidents plans, in large part because the plaintiffs were unable to prove they would be harmed on an ongoing basis by debt cancellation.

On Monday, the administration criticized the states for their efforts to block the student debt relief plan. Federal attorneys argued that if the appeals court found it necessary to intervene, that the court narrowly tailor its relief. If the courts ultimately barred citizens from those states from receiving debt relief, about 2.8 million people would be affected.

The states also argued that a partial injunction wouldnt provide the desired relief because MOHELA services loans nationally. Additionally, they argued that barring borrowers from the program in certain states would be ineffective because people and their loans move from state-to-state.

Across the country, about 40 million people are eligible to have some or all of their student loan debt forgiven.

Contact Chris Quintana at 308-9021 or [email protected]. Follow him on Twitter at @CQuintanadc.

What Is Student Loan Consolidation

The federal government offers the Direct Consolidation Loan program that allows borrowers to combine all of their federal loans into one consolidated loan.

Loans consolidated in this program receive a new interest rate that is the weighted average of the interest rates of all loans being consolidated rounded up to the nearest one-eighth of a percent. This means that the actual interest rate isnt necessarily reduced when consolidated. If monthly payments are reduced, it is most likely because the repayment term has been lengthened. Additionally, only federal student loans are eligible for consolidation in the Direct Consolidation Loan program.

Read Also: When Does Jackson Hewitt Start The Holiday Loan 2021

Benefits Of Federal Loans

- Affordable monthly payments are available several repayment plans offer payments based on income.

- Flexible repayment terms allow borrowers to change their repayment plan as their financial goals or situation changes.

- Loan forgiveness may be available through programs like Public Service Loan Forgiveness , and Income-Driven Repayment plans.

- Postponing payments during residency and fellowship are possible through grace, deferment, or forbearance options.

- Most federal loans are eligible for consolidation through the Direct Consolidation Loan program.

- A student who is not in default and has not exceeded cumulative loan limits may borrow a Direct Unsubsidized Loan, regardless of credit history.

- Direct PLUS Loans are available to cover any remaining costs . A Direct PLUS Loan DOES require a credit check. If the borrower has adverse credit, an endorser/co-borrower will be needed for approval.

- Interest rates vary by loan type however, once a loan is disbursed, it has a fixed rate. Rates are recalculated for each academic year, which begins on July 1.

What Does Unsubsidized Loan Mean

Unlike subsidized loans, unsubsidized loans start accumulating interest from the instant the money is disbursed. In addition, as the borrower, interest payments are your responsibility. Although you can decide to hold off on making interest payments until youve finished school and passed the six-month grace period, the accumulated interest will be added to your total balance. Therefore, youll be paying interest on interestan unfavorable financing option, especially if youre going through financial hardship.

The good news is unsubsidized loans are available to undergraduate and graduate students, opening the door for further education to more people. Theres also no requirement to prove financial need. Your school will determine your qualifying loan amount based on the cost of attendance and any scholarships and grants you may have received.

How much can you borrow?

The maximum undergraduates can borrow for direct unsubsidized loans ranges from $5,500 to $12,500, depending on dependency status and year in school. Graduate students, as well as professional students, have an annual loan limit of $20,500.

When it comes to unsubsidized student loans, you have several choices:

- Direct Unsubsidized Loans

- Direct PLUS Loans

- PLUS loans from the Federal Family Education Loan Program

Youll need to do your due diligence on each type to figure out which is right for you.

So, what makes you eligible?

Dont Miss: How Banks Determine Mortgage Loan Amounts

You May Like: How Do I Find Out Student Loan Balance

How Do You Borrow College Money Under Federal Loan Programs

To qualify for a federal loan, you will need to complete and submit the Free Application for Federal Student Aid, or FAFSA. Borrowers must answer questions about the student’s and parent’s income and investments, in addition to other relevant matters, such as whether the family has other children in college. Using that information, the FAFSA determines the Expected Family Contribution, which is being rebranded as the Student Aid Index. That figure is used to calculate how much assistance you’re eligible to receive.

Whats The Difference Between A Federal And Private Student Loan

Not all loans are created equal. Heres an overview of some of the main differences in federal vs. private student loans.

| What are the repayment terms? | Standard terms are 10 years. | Terms vary by lender but could range anywhere from five years all the way up to 25 or more years. Talk about a nightmare! |

Read Also: Can You Keep Your Car Loan In Chapter 7

How Is A Federal Loan Different From A Private Loan For Education

To compare these two types of loans even further, we need to look into more specific factors characteristic of each of them.

Repayment

If we compare repayment plans for private vs federal student loans, its clear private loans can take more years to pay off.

Private loans have no set borrowing limit on how much you can borrow. They often cover the full cost of your attendance. As a result, your loans can cost higher or take a longer time to repay if you go to an expensive college or spend more years at school. Most private loans offer 20 to 25 years in loan terms.

Meanwhile, federal student loan limits are around $12,500 annually. They also dont exceed $57,500 in total. The limits can rise to $20,500 annually and $138,500 in total.

Most federal student loans come with 10-year repayment plans plus a grace period of 6 months after graduation. You also have a few repayment options, which well discuss in detail further.

Interest Rates

Another key difference between federal and private student loans is the interest rate you pay. Private student loans often have higher interest rates than federal student loans.

Private lenders charge around 4.29% to 12.49% in fixed rates and 1.8% to 14.8% in variable rates. If you have an excellent credit rating or a cosigner with a good credit score, then you may get a lower interest rate.

Subsidized Loans

Cosigner

Digging deeper into federal student loans vs private ones, you sometimes need a cosigner to help you take on a loan.

Penalty Fee

Which Type Of Loan Is Best For You

You shouldnt even consider taking out a private loan to help cover the costs of school unless you are entirely out of other options. The disadvantages are too severe, and if youre not careful, you could find yourself in serious financial trouble.

If you miss payments or go into default on a private student loan, your credit score will plummet, making it nearly impossible for you to buy a car, get a mortgage, or even lease an apartment. And since its nearly impossible to discharge any student loan in bankruptcy, you cant escape your monthly payments, even if making them becomes a severe hardship.

On the other hand, should you ever fall into hard times and become unable to make your monthly payments on a federal loan, you have a variety of repayment options, including completely pausing payments through deferment or qualifying for $0 payments through IBR.

That makes just about any federal loan a better option than private loans, even if you have the credit to qualify for a better interest rate on a private loan. Turn to private loans only after youve maxed out every other option.

Recommended Reading: How To Find Interest On Loan

Youll Need A Credit Check For A Private Student Loan

Most federal student loans dont require a credit check. You can qualify for a student loan even if you have poor credit or no credit history at all. Even with PLUS Loans, the credit check is used to see if you have an adverse credit history it doesnt determine your eligibility or interest rate based on your credit score.

With Credible, you can check private student loan rates with multiple lenders by filling out a single form.

How Do I Know If My Mohela Loans Are Federal

The Department of Education keeps detailed records on all federal student loans.

Borrowers can access these records at studentaid.gov. If your Mohela loans are listed, they are federal. If the loans do not appear, they are private.

A phone call to Mohela can also clarify any confusion about loan status. The Mohela contact information is available here.

Don’t Miss: Why Do Loan Companies Sell Loans

Federal Student Loan Repayment Plans

Every loan comes with terms for how and when you will be required to repay it. The repayment term usually refers to the amount of time you are given to repay your loan. Paying the loan back sooner will result in a lower overall cost but will result in larger monthly payments. Repayment terms can also refer to different options for repayment.

In the case of federal student loans, the Department of Education sets out all terms for repayment. If circumstances make monthly payments difficult to meet, the DOE has programs that can lower or erase your monthly payments, and/or extend your repayment duration.

Private Student Loans Are Safer To Refinance

Student loan refinancing is only available through private companies, which means refinancing a federal loan turns it into a private loan. Youâll lose access to IDR, forgiveness, generous deferment periods and other advantages.

But since private student loans often have fewer protections and higher rates, itâs particularly wise to consider refinancing them once you have a good or excellent credit score and stable income. By refinancing, you have the chance to secure a lower rate, saving you a potentially significant amount of money throughout your repayment term.

Read Also: How Many Affirm Loans Can I Have

Why Consider A Private Student Loan

Federal student loans dont always cover all college costs. According to the U.S. Department of Education, undergraduate dependent students whose parents are eligible for Direct PLUS Loans are allowed a maximum of $31,000 in federal student loans to cover all 4 years of college, and independent students have a maximum borrowing limit of $57,500. When you compare these numbers to actual costs, youll see there could be a gap.

According to collegedata.com, for the 2021 academic year, the average cost of attendance for in-state public colleges averaged $27,330 per year and a moderate budget for private colleges averaged $54,800. That translates to roughly $109,320 for 4 years at an in-state public college and $219,200 for 4 years at a private college.

Estimated cost and federal funding allowed for different colleges| Type |

|---|

: Federal Student Aid, an Office of the U.S. Department of Education, studentaid.ed.gov

Federal Vs Private Student Loans

There are two types of : federal student loans and private student loans. If youre trying to figure out how youre going to pay for school, youve likely thought about both. Federal and private student loans are not the same and its important to know the difference.

Federal student loans are made and funded directly by the federal government. To apply, you need to complete the Free Application for Federal Student Aid .

Sometimes referred to as non-federal or , are made and funded by private lenders, such as banks and online lenders.

But when it comes to paying for college no matter if youre an undergraduate student, a graduate student, or a parent theres more to know about federal vs. private student loans. Lets look at each one in more detail.

Already applied for federal student loans and dont have enough money for college? Apply for a private student loan today.

Also Check: What Does Refinance Auto Loan Mean

Refinancing Federal Loans To Private

In some cases, borrowers might choose to refinance federal loans to private. This option is usually exercised to obtain a lower interest rate or to release a cosigner from their obligation to the loan. However, when you switch from a federal repayment program to a private one, your loan might be subject to the fluctuations of variable interest rates and you will no longer be eligible for the protections and benefits, like income-based-repayment and loan forgiveness.